1/3 of Flagged 501(c)(3)&(4) Applications were from Non-Conservative Groups

Tax analyst Martin A. Sullivan finds that 1/3rd of "potentially political applications" approved by the IRS were from non-conservative groups.

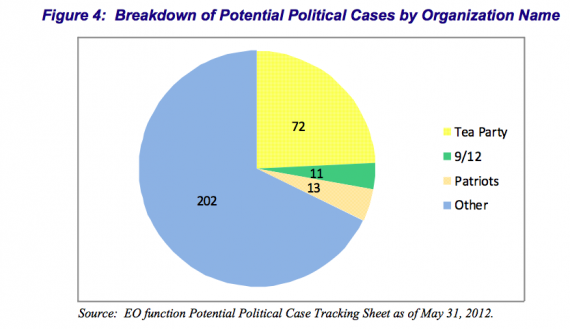

On May 30th, the site Tax Analysts published a more in-depth analysis of IRS data on tax exemption applications that were flagged for specialist “potential political” review. Martin A. Sullivan, working from a number of documents released by the IRS, estimates that approximately 1/3rd of flagged applications were submitted by either liberal or apparently politically neutral organizations.

Much of his post is taken up with an explanation of how the numbers were reached. Essentially Sullivan worked backwards from a list of approved 501(c)(3) and 501(c)(4) recently released by the IRS. Using data included in the TIGTA audit and outside references, Sullivan and team worked through that list to determine what political lean — if any — these organizations had.

Here are the results:

- 122 Conservative groups

- 46 of these groups names contained BOLO terms (Tea Party, Patriots, or 9/12) and were automatically flagged

- 48 non-conservative organizations

- 11 of these group are involved in self-described “progressive” causes

- Another 17 are formed around traditionally liberal themes (social or environmental justice, anti-corporations, outreach to dispossessed and marginalized communities.

- 6 organizations about which Tax Analysts can make no determination — they might or might not be aligned with a political cause

The Tax Analysts post contains an annotated breakdown of the 48 non-conservative groups whose applications were held for review and ultimately approved. Its clear from the list that many of these groups have a liberal agenda. For example:

- Progress Missouri Education Fund

“A multi-issue progressive advocacy organization” focused on state and local policy. - Alliance for a Better Utah, Inc.

Multi-issue education and advocacy organization promoting progressive ideas and causes. - Coffee Party USA

Founded on the underlying principle that the government “is not the enemy of thev people.” Seeks to remove corporate influence from politics. - Louisiana Progress Action Fund Inc.

Advances progressive state policy solutions. - Progress Texas

Organizes rapid response communications in opposition to conservative groups.

There are a couple important caveats to over-interpreting the results of this list.

- The list only tells us about the make-up of approved organizations. There are still a number of groups awaiting approval. Other groups withdrew their applications. And some may have been denied. Thus this should not be taken as necessarily representative of the makeup of the total list of 298 organizations that were flagged as “potential political cases.”

- As Sullivan notes, this simply gives us a cleared view of the makeup of the list of “potential political cases.” It doesn’t tell us anything more about the case selection process. Nor does it speak to whether or not intentional bias took place.

On this second point Sullivan writes the following:Ultimately, to address the question whether the IRS’s review of applications for tax-exempt status has had a disparate impact on one side of the political spectrum or the other, we will need to know more about the overall pool of advocacy groups applying for tax exemption. For example, if there were a surge in the creation of potentially political conservative organizations in the last few years (that was disproportionate to the creation of non-conservative organizations), more conservative groups would be targeted than non-conservative groups even if there were no political bias among IRS officials. Looking at the makeup of exemption-approved groups tells us nothing about bias unless we know the makeup of the group from which they were selected. (Sullivan — Emphasis Mine in order to highlight an important point)

[H/T to the Atlantic’s Garance Franke-Ruta for the link to Sullivan’s piece]

Like all of these non-scandals…the more you look…the less there is.

And not mentioned above…none of these groups…conservative or not…were prevented from operating as they desired.

What a waste of time and money…at the hands of so-called fiscal conservatives.

So, so… it wasn’t a vicious attempt orchestrated by the White house to target ONLY 100 per cent conservative, God fearing “Real ‘Murican” groups?

I bet this analysis never makes it onto Fox News, right wing talk radio and other truth telling media outlets. In fact, I’m sure Mr. Sullivan is effeminate and a socialist to boot. Unskew that analysis!!

So… based on this analysis, being seen as “conservative” only doubled your odds of getting extra scrutiny from the IRS?

@Jenos Idanian:

Come now Jenos, I’m sure you are smart enough to realize that you can’t make that statement without knowing the breakdown of the total number of applications.

If, for example, it turns out that double the number of conservative organizations applied for approval during this time period, then the odds of getting extra scrutiny turn out to be the same for both groups.

@Jenos Idanian: Depends on the universe of applications. If conservatives were 2/3s of applications, then the odds are 50-50.

Jay Tea/Jenos simply ignores or denies the existence of any information that does not confirm his pre-established opinions.

The IRS so called scandal is a bunch of crap! Republicans have nothing else to talk about as they sure as hell are not doing anything to help move the country forward. Lost in the wilderness of sheer idiocy, that is where they reside. Hey Boehner, where are the jobs? He couldn’t stop asking that for the last four years! He just wants someone put in jail! How about we put all the waste of space Congress people in jail? If anyone deserves to do time it is them.

@Matt Bernius: But as we have seen math has a liberal bias, so it is conservative targeting!

Just one more example of why you should never believe anything the right wing says. Literally. All you have to do is assume the GOP/wingnuts are spewing BS, and you’ll be on the correct side of the issue 99% of the time.