A Futures Market In Election Results?

Could traders soon be betting on the outcome of the Presidential elections? Should they be?

A Chicago firm is seeking permission from Federal regulators to start what amounts to a Futures Market in Presidential elections:

More Americans may soon be able to openly wager in the markets about whether President Barack Obama wins re-election or Republicans gain control of the Senate.

Political junkies have previously placed “bets” on the presidential race through the Iowa Electronic Markets and the Irish exchange Intrade. But the federally regulated market being set up by Chicago-based Nadex has a major difference – they could cash in.

Nadex said it plans to file a request Monday with the Commodity Futures Trading Commission to list contracts on the victor of the 2012 presidential race and the majority parties in the House and Senate.

If the federal regulator has no objections, trading could start as early as January 4, the day after the Iowa caucuses, Nadex executives said. The CFTC — which could hold up the listing for further analysis — declined comment on its procedures.

Introducing these so-called “prediction markets” to the broader public could end up giving a better read of the horse race than traditional polls.

“We believe when someone puts his money where his mouth is, it will be more accurate,” said Nadex chief executive Yossi Beinart. “It’s not just a game necessarily.”

Similar prediction markets are already valued tools for political observers.

Forecasts from the Iowa Electronic Markets in the last week of four presidential elections have proven to be more accurate than the final Gallup polls.

Intrade volume on the Republican presidential nominee has already topped 3.2 million shares this cycle, compared to just 1.9 million in 2008, according to Carl Wolfenden, the exchange’s operations manager.

The Nadex contracts would be valued on a scale of 0 to 100, which lets the market determine the percentage likelihood of, say, Obama winning.

If the contract on Obama costs $51—meaning a 51 percent chance of a November 6 triumph for the president—and he cruises to victory, the owner would earn a $49 profit, minus a transaction fee. The person betting against Obama would be out $49.

Or, if a fan of the new Newt Gingrich Civil War novel “The Battle of the Crater” buys shares in the former House speaker at $10 and sells him for $40, he pockets a $30 profit—and covers the sticker price of the book.

As the article notes, these kinds of betting markets have been around for many years, although they seem to be receiving much more attention from mainstream political pundits during this election cycle. The argument behind these types of “markets” has always been the idea who are putting their money behind a particular Presidential selection, or the outcome of some other domestic or international political event, is going to have some kind of special guidance that leads them to that choice, and that the “market price” that results from the decisions of these various “investors” will somehow lead to a better guide to how the race is going, and how it’s likely to end, than mere polling and political punditry.

Intrade and the IEM are small examples of what Nadex has in mind. While the people who participate at both sites do put up real money for the predictions they are making, the amounts are relatively small ($500 at most at IEM and $10 at InTrade) and since both are still technically part of research projects they are not regulated by the Federal Government they don’t have the same features that a real futures market has. Nadex would change all that and have investors betting on “Newt Gingrich” futures in the same manner in which they bet on Pork Bellies. The difference, of course, is that futures markets in commodities serve a useful purpose in the economy, and particularly in industries like farming where they have served as the clearing markets for buyers and sellers for a century, a practice that has its roots in thousands of years of international trade. What’s unclear, though, is what purpose a market in Presidential purpose would serve beyond the merely academic.

I’ve found these electronic futures markets interesting for awhile now, mostly using them as just another tool to watch various races over the years. I’ve been skeptical, though, of their ability to provide any special insight that one cannot garner from watching the polls and, since 2008, the poll averages compiled by RealClearPolitics and other entities. After all, the people who invest in these markets generally are acting on the same information that all the rest of us have access to. Granted they may be paying more attention to it because they have a (small) financial stake in the outcome, but it’s not clear that this provides the electronic markets with any more predictive value than any other indicator.

For an example of what I mean, let’s take a look a few Intrade charts.

First, here’s Mitt Romney’s chart over the past 90 days:

Is what we see here really any different than what you can garner from looking at your average polling graph? Coming off a September in which he was beating off a challenge from Rick Perry, Romney once again rises to the level of presumptive nominee (notwithstanding the rise of Herman Cain, who nobody viewed as a serious contender of the nomination). Then, when Newt Gingrich rises in late November, Romney plummets only to rise again when the Gingrich bubble bursts. As we stand now, Intrade is giving Romney a 70+% chance at being the Republican nominee. If anything, that seems conservative.

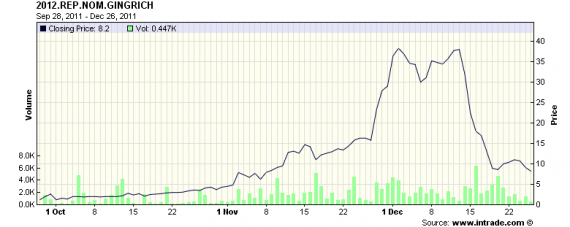

Now, look at Gingrich’s chart for the past 90 days:

And Perry’s for the past 120 days:

And Perry’s for the past 120 days:

Again, what do either of these charts tell us that polling didn’t at the time? As one blogger noted back in 2008, it’s fairly obvious that these electronic markets don’t provide any special insight into political races, or into the various news events that they also “bet” on. All they really are is information aggregators:

Prediction markets are just an information aggregation mechanism (and also a collective anticipation mechanism), which highly depends on what the experts on the ground can discover. Prediction markets are not a magical tool. Event derivative traders are like bees; they harvest information and the expert consensus out there.

Precisely. For the most part, these “investors” are looking at the same information that anyone else who follows the news closely is looking at. Perhaps the “closing price” one gets from such a system is helpful in getting an overall picture of where a particular race stands, but it’s hardly a substitute for real analysis.

As for Nadex’s proposal for a real futures market in this sort of thing, I’ve really only got one question. How exactly would a futures market that bets on the outcome of elections or news events be any different from sports betting? Quite frankly, I don’t see the difference.

I agree. Looks just like Wall Street to me too.

Wall Street at least serves a viable economic purpose

@Doug Mataconis: Well Doug, it certainly used to, and I suppose at some level it still does, but the financial crises was a very elaborate game of musical chairs, and computer aided trading has absolutely no viable economic purpose. It serves only to make the big trading houses enormous profits at the expense market stability.

@OzarkHillbilly: I know a lot of middle class people, some retired, who have made some money by investing over the internet. Not a lot of money, but enough to pay bills, go on a trip, fix up the house, and enjoy some things that they could not have bought otherwise. This was done in a matter of a few hours work per week. These people are not stock experts or someone like that. They have done well with the stock market because they have it work for them. The “computer aided trading” that you mention has put some money in a lot of people’s pockets that would not have had that money. They go out and spend it, and that does help the economy.

The first time around Obama managed to hoodwink enough people that he was a free trade capitalist instead of a marxist/socialist. That won’t happen again.

And the record profits corporations have been making during Obama’s first term can be explained…how, exactly, Delmar?

@McKeever: Investment banks use computers to make thousands of trades a minute, often making vast profits just following (or setting) the trends in the market with no regard for the viability of the business or funds whose stock they are trading.

I suspect this is what Ozark was referring to rather than online investing.

This is not a market, this is just gambling. It should be part of the sports book at a casino. There is nothing you are buying here. It is a betting ticket.

If there was some way you could buy stock in a candidate. I dont know, maybe the candidate would pay out a chunk of their pay as divided and a share would reflect a claim on that income stream. Then you would have a market. Although most of these people, like Cain or Palin, would actually make more money NOT as president but as talking head / inspirational speaker so I am not sure that the market would reflect chances of any one winning the election.

Sports book, that is all this is. And yes, if you look around, you may will find the same thing is going on in lots of ‘markets’. WTF is an ETF anyway? What do actually own?

There is no difference between betting on the collapse of the housing market (or any other market) via credit default swaps and betting on baseball games either.

So much for the “Wall Street at least serves a viable economic purpose “.

‘As the U.S. becomes a one party state will there be anyting to “hedge” against. How does one bet on who will be the clount in any administration? How does one wager on who is in favor and who is out of favor in the one party state? How does one gamble on who will be the choosen successor?

Prediction markets had special interest to economists who, alternately, believed or contested the Efficient Market Hypothesis (EMH). The idea being that markets can, or cannot, in aggregate correctly value a thing.

That the first two comments by OzarkHillbilly and Doug tie that back to Wall Street in broader context is not a coincidence.

FWIW, people who believe in the EMH should believe in inTrade, etc. They should complain that if they fail to predict, it is only because the market is too thin, etc.

Of course, those of us who (correctly) believe the EMH is dead will have less fascination with these future markets AND the latest Wall Street gimmicks.

Remember Doug (and friends) the role of a financial sector is to correctly allocate resources. To the extent that they demonstrate failure at that .. they demonstrate failure at what should be their core purpose.

“Quick, everybody run from real estate to social media” is not efficient allocation.

(FWIW, I take inTrade as a reasonable measure of “current thinking” but in no way truly “predictive.” Because, as I say, the EMH is dead.)

@McKeever:

I wonder how many of those winners know how to correctly calculate their returns. Too many people I know just talk to me about their winners, while discounting their losers.

IMO year-to-year growth of total net worth is the only reasonable measure.

Speaking of markets, the DJIA is looking good the first day of post-Christmas trading. Something tells me no one on the right wants to talk about this, sort of like when the biggest Black Friday in history was a non-event in right wing blogging circles.

anjin,

I’m sure the Dow is looking fabulous today since the markets are closed.

Ah ha! Obama has finally closed the markets! I knew he was a commie.

At any rate, this is what I get for power skimming through websites.

I still think its quite odd there were no posts about Black Friday. I have a feeling a bad showing would have received some attention. It will be interesting to see what the final holiday shopping numbers look like and how they will be spun.

@McKeever:

And I know a whole lot of people who were day-trading during the dot.com bubble, they kept telling me how much money they were making, and they were, until it all crashed. After that they were broke. They not only lost all their paper investments, they lost everything they had ever owned…. including their dreams.

I never made massive profits investing over the internets. I also never lost any money trading over the internets. I have made investments in real things, like 12&1/2 acres of Washington county. No, I won’t be the next Warren Buffet, or even the next Bill Gates, what I will be is just another guy hoping they can’t take it away from me or my wife after I am gone.

@Graham: Exactly.

@OzarkHilbilly: Not to mention the 401k fiasco of the last 10+ years. Most employees are trapped in restrictive 401k plans that limit your investment choices to a few index funds. The S&P, in real terms, is trading the same place it was in the mid-90’s meaning that if you invested in a S&P 500 fund around 1996 and left your money there for the duration, you would have made $0. Of course you would have had to pay fees so you would have actually lost money.

Company matching covers this up, hiding how inefficient most 401ks are as a retirement fund. But dont worry, most people wealth is in their homes anyway. They will just sell the homestead, move to a cheaper location and live off the money they made in real estate instead of 401k money

wooops…….

@Jib:

I have to say Jib, it was not a fiasco for our Galtian overlords. I remember in late ’07, early ’08, telling my wife to get her 401K out of the stock market (no, I am not some kind of savant, just some times it is so OBVIOUS….) I said, “Put it into some nice safe Certificates of Deposits” and she said she couldn’t…… I was in disbelief.

6(10?) months later, her 401K was decimated. She had lost damn near 1/2 of everything.

3 years ago, I married her so she would get my defined benefit pension (I won’t live that long). Lord knows, she has earned it. I am just waiting for our Galtian overlords to find a way to take that from her too.

@OzarkHilbilly: @OzarkHilbilly:

The S&P 500 hit its recent low in March 2009 at below 700 and was back to 1200 a year later. The only people who lost 50% are the people who cashed out at the bottom of the market. And if anyone is doing to need their 401K in the next few years should have a large portion of it in bonds/cash and not in the stock market.

However, a private business that offers a defined benefit pension plan faces the same investment options as everyone else. The only organizations who do not worry about the stock market are the public sector unions who know that the local, state, and federal governments do not have to put aside the money to fund their pensions but just plan on raising taxes in the future to fund them.

@Jib:

I believe that’s called lobbying. ;>