A Question About Bonuses and Bailouts

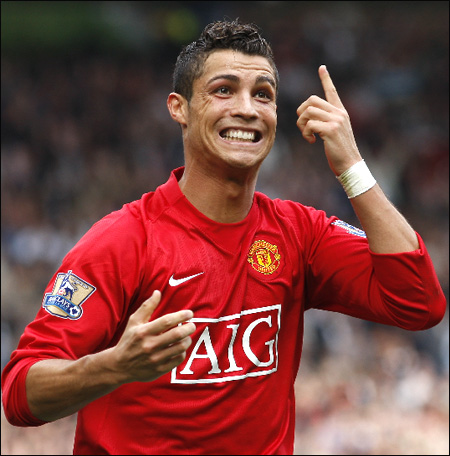

I was reading this Megan McArdle post about the federal government restricting bonuses to AIG employees. As I was reading, I came across this sentence:

I was reading this Megan McArdle post about the federal government restricting bonuses to AIG employees. As I was reading, I came across this sentence:

To wit: the traders at AIG are threatening to walk if Ken Feinberg pays them what he says he’s going to pay them, particularly if the company tries too hard to withhold the retention bonuses they were promised in order to stay on board and clean up the mess.

One of the common criticisms about the federal government intervening in the payment of bonuses to employees of bailed-out firms is that if those employees don’t get those bonuses, they’ll leave and go elsewhere.

I have a question about this, and I mean this with all sincerity: where will they go to work? Is there a lot of demand for trading jobs right now? I would think that from the general state of the economy, the answers to the above questions are pretty much “nowhere” and “no.” But I can’t find any data one way or the other.

If there isn’t much demand for traders at the moment, then is retention of those traders that big of a concern? After all, if there’s not much demand, there’s probably people who would take any job, even with income restrictions, because $500,000 a year is a lot better than $0 a year.

Does anybody out there know the state of the job market for traders right now?

Are you suggesting that it is okay to withhold the bonuses because they have nowhere else to go? Seems a bit heavy handed to me and they did have a contract (even if it was just a verbal one); I guess principles never enter into the equation.

No. I’m asking whether there’s any empirical support for a particular argument against a particular policy.

Alex, they will go Galt, and build a paradise in the mountains. There men are not “traders,” they are builders. Men of vision and genius. Prime movers. To even question their compensation marks you to be lowest of the low. You’re a looter.

Remember: Writing a contract that you have no ability to pay off is the work of a genius.

Questioning a contract to such a genius is socialism.

But the job market is supposed to open wide up in the next few months, according to reports out just tody. I’m sure that means ‘top’ paying jobs first and trickle down slowly to the jobs at bottom. If people like this ‘walk’ they will have offers out of principle only.

Depends a lot on who they are and what their track record is. If they are good* and presumably some of them are there are likely opportunities. There are darn few jobs for newly minted would-be traders, but at the more senior level it depends a lot on the individual candidate. My understanding is that such employees make up the bulk of the AIGFP employees under discussion.

Also, if they’ve made good money in the past and saved it, they might well not need to work at all. In any event since one proposal seems to be to cut their salaries to $1, they could tend bar or whatever for more than that. The notion that these people will put up with anything just to keep their jobs is frankly bizarre.

*Since someone is sure to say, it, the guys who are left are not the same ones who ran the CDS business and lost a lot of money. The groups being wound down actually were generally pretty profitable.

MichaelB –

Thanks for that. Do you know any good links/publications about this? I posted this question here because I had a really rough time finding an answer.

Unfortunately I mostly know about this from recently working on a job search myself. From what I saw when I was looking though, there is still hiring going on, it’s just very specific and selective. Obviously there are a lot of people looking,so firms can afford to wait for someone who fits their needs exactly. But there is still some attrition, and even some organic growth.

A trader with a long track record of making money has some fairly marketable experience. I don’t know the specifics of the AIGFP employees, but I would be surprised if there weren’t a few who could find a new job pretty quickly. That would probably still be only a small proportion of the group, but if you stretch it out over 6 months or a year a lot more would be able to do so.

It’s like unemployment generally. More jobs are being lost these days than created, which shows up in rising unemployment – but there are still jobs being created pretty steadily.

Alex –

Trading, like any other profession, has a hierarchy. There is always a market for the best traders, just like there is a market for the best quarterbacks, shortstops, bank lenders, master marketers, salesman/women, engineers, scientists, staff executives, CEO’s, etc etc in any other endeavor.

Please don’t fall into the trap of the monolithic hiring profile. Further, please don’t fall into the juvenile trap of Bernard Finel’s “na-na-na-na-na” employment potential assessment. It says so much about Bernard.

Alex, I’m kind of surprised that you are asking this question. Do you really think that the mega banks are the only jobs open for people with these skills or that their skills and knowledge won’t translate well in a global market to other related positions? Or that they won’t go Galt and just say to hell with it by becoming day traders for their own benefit? I’m curious, but how exactly do you think a reduction in the liquidity of assets — which might be the result of these traders leaving, or at least being less motivated — will help the economy? Is this the kind of treatment and moving of goal posts that the medical industry has to look forward to with so-called health care reform?

Beyond that, your apparent willingness to violate the sanctitiy of contracts for a populist spike in the polling data is a little shocking. And if it isn’t the sanctity of contracts at the very least it is challenging the integrity of a man’s word and the need to honor his commitments. No doubt you still wonder why us evil businessmen are feeling a little put upon and nervous these days.

Well I wonder if the scencario is along the following lines:

AIG needs to wind down a unit. But many of their traders have bailed as the company was in trouble. Gov’t breaths temporary new life into AIG so they go looking for traders to help them unwind the unit. The hiring process goes something like this:

Trader: Hmmmm, yeah but I have a good job, and frankly, your name isn’t all that great.

AIG: Good point, we can possibly work out some sort of bonus deal….

Trader: Hmmm, yeah…still, I don’t know I’d be taking a chance here.

AIG: Well do a bonus that is…..mmm…x% over your current bonus.

Trader: Okay, we got a deal.

Now the government wants to void that agreement and the traders are looking around and seeing what is out there. Or if Michael is right, maybe thinking “Why I should I work this hard and take this grief for a fraction of what I was supposed to be paid. Fuck it I got some pretty decent savings, I quit. Heading to someplace warm to drink mojitos in the sun.”

That might not apply to all of them, but if enough of them have those kind of options it could be very bad for winding down those units, getting taxpayer money back (at least some portion of it) and maybe make the situation worse. But I’m just guessing.

Exactly. These men are the very engines of economic growth. How do we know? Well, they were/are well paid, and the market is a perfectly efficient allocator of resources. QED.

Actually, I didn’t say anything about their employment potential Drew… I was just being preemptively snarky about the main line of arguments we’ve seen in the thread. And bless them, both Steve and Charles obliged by making me look prescient. In reality, a lot of the experienced folks would certainly get jobs, if only because there are still plenty of people like Drew who genuinely do believe that that these guys are geniuses. Which, as Drew might say, says a lot about Drew.

Bernard, I’m perfectly content to let Steve and Drew defend themselves, but what are you talking about? Do you imagine that liquidity isn’t important to economic growth? Do you imagine that I said these traders are the be and end all to economic growth? Do you imagine that I said these traders are geniuses, as opposed to just being very good at something someone considers to be valuable? Oh, your sexism is showing as you seem to assume they are all guys. But I digress.

The service they provide is a component of the economic engine, no more or less important than a lot of others. The fact that you don’t understand the value they add does not detract from their value. Nonetheless, no matter how much you want to pretend that any of us said the economy will collapse without them, well, none of us ever said that. I did say the economy won’t function as well if you make assets less liquid. Honestly, that’s not even a subtle difference. So stop being an ass and putting words into my mouth so you can burn down your little strawmen.

Someone’s labor is worth what someone else is willing to pay for it in a free market. But I guess it is that whole “free” thing that has your panties in a bunch. Much better to just tell people what to do and what can be paid for it, well, unless some populist idiot changes his mind and decides after the fact that it is worth less. Anyway, if Drew thinks any of these traders can make him a buck and ends up paying them too much, how exactly is that your problem or one that just begs for the government to step in and make it right?

Drew,

I don’t doubt that. I just wanted to know if there was any actual data about the state of the job market in that field at the moment.

Charles,

What I’m asking is, is there any data to support these arguments.

Did I make the argument that it would? Because I don’t remember doing so.

That’s an empirical question that’s impossible to determine given the current data as I understand it.

Am I willing to do so? I don’t remember saying that.

Once again (a) I don’t believe I stated that I support this policy.

And (b) what data do you have to support that there is a commitment? Are the majority of traders affected by this policy under written contract? Or are they at-will employees? If they’re at-will employees, then they’re subject to pay cuts, bonus cuts, or whatever whenever their employer feels like it, whether the government butts in or not. There is no contract in an at-will employment relationship. (Which is not to say that government should butt in–merely that they may not be violating any contract when they do so.)

Steve,

I understand the argument. I just wondered if there’s any data to support it.

I don’t think any part of that is quite true. I think I do understand their role in the economy, and I don’t think your assumptions about the creation of “liquidity” hold.

What AIGFP did was create the illusion of liquidity, by fraudulently disguising risks of various financial instruments. This did, indeed, allow people to leverage position beyond any reasonable risk-reward calculation.

In a narrow sense, yes, they did create the impression of liquidity. And yes, in response to that impression, there was some additional economic activity. But it was not real — and when AIG collapsed, it was the government which provided the liquidity to the system. Had the government not stepped in and used AIG as a pass through to recapitalize various financial institutions, I think the flaws with this approach would be more visible. But they have been disguised.

I’d argue that in a net sense, this was not a beneficial situation, and that on the whole, we’d have had more net wealth in the country had AIGFP never existed. And I think furthermore, there is compelling evidence that all this financial wizardry on Wall Street is ultimately a drag on the economy, as massive amounts of resources and talent get sucked into the creation and recreation of what are essential Ponzi schemes.

Well, it is late and I’m too tired to bandy about hypotheticals any further, but if the traders are willing to walk, it sure sounds to me as though they think they have better options, regardless of whatever you or I think or any data someone might dig up about the past. Anything in the future is necessarily conjecture, no matter how well founded.

At this point all we know is that they are willing to say they will walk if this happens. How many would actually follow through is an open question. My guess would be less than 10%, but we’ll see.

One place they need not look is Louisiana. They have a senator there who could beat them all. She just traded the dignity of her office and the American people for a measley $300 million, plus a job to be named later -say after the next election?.

Alex,

I don’t think such data is even possible. How do you collect data on people’s job opportunities? So the question is how lucky do you feel (assuming you are in position of negotiating with these traders)?

No, you are just being a petulant prick.

the senior traders will get hired in an instant.

They know AIG ‘s”book.”

that is, they know what AIG holds and what AIG has to sell to keep their government masters happy. Which means who ever is on the buying side of those required trades is going to get a *great* price.

knowledge is power.