Alan Simpson Calls Bullshit on Social Security

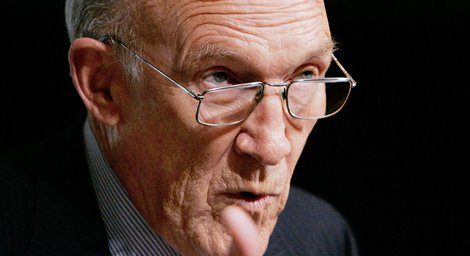

Alex Lawson of Social Security Works has apparently been stalking the White House Debt Commission with a video camera. He got an earful from co-chairman Alan Simpson.

The more interesting parts of a long exchange:

ALAN SIMPSON: We’re really working on solvency… the key is solvency

ALEX LAWSON: What about adequacy? Are you focusing on adequacy as well?

SIMPSON: Where do you come up with all the crap you come up with?

SIMPSON: We’re trying to take care of the lesser people in society and do that in a way without getting into all the flash words you love dig up, like cutting Social Security, which is bullshit. We’re not cutting anything, we’re trying to make it solvent.

SIMPSON: It’ll go broke in the year 2037.

LAWSON: What do you mean by ‘broke’? Do you mean the surplus will go out and then it will only be able to pay 75% of its benefits?

SIMPSON: Just listen, will you listen to me instead of babbling? In the year 2037, instead of getting 100% of your check, you are going to get about 75% of your check. That’s if you touch nothing. If you like that, fine. You’ll be picking with the chickens yourself when you’re 65.

So we want to take care, we’re not cutting, we’re not balancing the budget on the backs of senior citizens. That’s bullshit. So you’ve got that one down. So as long as you’ve got those two things down, you can’t play with anymore, that we’re not balancing the budget of the United States on the backs of poor old seniors and we’re not cutting anything, we’re stabilizing the system.

It goes on like this for quite some time, with Simpson doing an excellent job of explaining the intricacies of the problem and Lawson seemingly not understanding any of it.

FDL’s Jane Hamsher, who has the full transcript, is with Lawson:

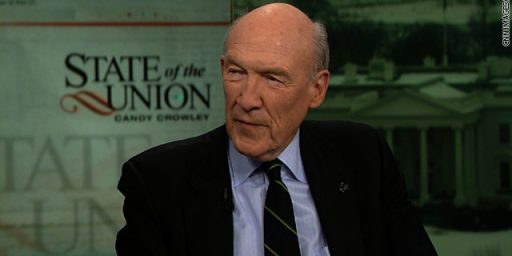

Simpson is apparently a graduate of the Bobby Etheridge school of charm. Alex Lawson was incredibly respectful and polite as the crankly Simpson berated, interrupted and cussed him. Simpson has been a long-time supporter of rolling back the New Deal, and when asked about cuts he would recommend to the President and Congress on CNBC, Simpson said “We are going to stick to the big three,” meaning Social Security, Medicare and Medicaid. His sentiments haven’t changed.

CJR’s Trudy Lieberman recently ran down Simpson’s history of delicate statements on the subject of Social Security. He is equally decorous on camera with Alex, who clearly knows a great deal more about the subject than he does. Simpson starts from the premise that the Treasury will default on the bonds issued to the Social Security trust fund, because all the best people apparently know that it’s better to default on America’s senior citizens and plunge them into poverty than it is to default on, say, the Chinese.

Despite Simpson’s assertions, raising the retirement age to 70 IS a benefit cut. It would put an estimated 1.5 million senior citizens into poverty. After two years of watching billions of dollars in taxpayer money being paid out to Wall Street CEOs in lavish bonuses while the White House breaks every promise they’ve made to rein them in, that takes a fat load of nerve.

Ditto HuffPo’s Jason Linkins, who terms it a “profanity-laced confrontation.”

Over at BreitbartTV, though, they describe it as “a full and frank engagement with an activist questioning him on the proposed reforms of the Social Security system. He doesn’t duck. He doesn’t hide. He doesn’t grab the guy around the wrist or neck.”

I’m frankly amazed that Simpson spent 8 minutes, 20 seconds talking to some yahoo with a video camera. Regardless, the problems he describes are real. Social Security and Medicare are massive structural burdens, even compared to the spectacular cost of the wars in Afghanistan and Iraq. Those will soon go away whereas the entitlement demands will continue to skyrocket.

Now, Hamsher and Lawson are right: Simply raising the retirement ago to 70 won’t work, either. There are many occupations that are too physically demanding to work that long. And many people’s health declines much sooner than that. The ultimate solution is going to have to be some combination of means testing and raising the ceiling on the FICA tax. But that’s going to require an admission that Social Security and Medicare are subsidies for the less fortunate elderly rather than “insurance” programs wherein we fund our our retirement during our working years.

But that was always the intent! They were poverty relief programs, designed to provide a safety net for people who couldn’t support themselves one they were no longer able to earn a steady paycheck. Most jobs didn’t provide retirement annuities and many people don’t earn enough to save for retirement, much less for fifteen years of retirement. I’m willing to kick in some money to help those people get by.

Instead, though, we’ve created a bizarre system where I’m paying a pretty nice chunk of change every month and being told that I’m paying for my own retirement. Yet, even if we were able to sustain the current setup, my return from Social Security will be so modest that, barring unforeseen circumstances, it’ll be a tiny portion of my income. And we’re bankrupting the system to keep up the illusion.

![Morgan Freeman Does Television Voice-Over For North Carolina GOP Candidate [UPDATED: Morgan Freeman Denies It's Him]](https://otb.cachefly.net/wp-content/uploads/2012/03/us-politics-512x256.jpg)

The SSA Planner is pleased to tell us:

“No one pays federal income tax on more than 85 percent of his or her Social Security benefits based on Internal Revenue Service (IRS) rules”

This strikes me as a pretty easy shell game. They can easily keep paying full benefits. They don’t need means testing. They can do that by increasing taxes on Social Security benefits.

I’d say ignore the grandstanding and watch for changes in Social Security tax rates.

http://www.socialsecurity.gov/planners/taxes.htm

I’d like to see some means testing myself. When I heard John McCain was receiving Social Security checks I about flipped. “What do you mean he’s cashing Social Security checks? He’s rich!” (Indeed, McCain’s defense was that he paid into the system and was entitled to it, which, yeah…..is kind of the problem.)

Sadly, I have no confidence that we’re capable of having an honest debate about this subject. All I know is that, as a young guy in his early 30s, I’m not planning on Social Security being around in its current form.

“But that was always the intent! They were poverty relief programs, designed to provide a safety net for people who couldn’t support themselves one they were no longer able to earn a steady paycheck. ”

If this was, indeed, the intent of Social Security, why wasn’t it means-tested from the beginning?

In my opinion, calls for means testing is mostly a way to turn Social Security into a welfare program that will then be easy to eliminate entirely.

Just remove the income cap on FICA taxes.

If this was, indeed, the intent of Social Security, why wasn’t it means-tested from the beginning?

Politics. People didn’t want to think of themselves as taking welfare.

Just remove the income cap on FICA taxes.

Wouldn’t solve the problem. But, unless we’re going to massively increase payouts to wealthy retires, it would also make it just another welfare program. So why have a FICA tax at all? Just lump it in with general income taxes?

Entitlements and defense are where you will find the money to reduce our deficits. Means testing +/- raising the income limit would seem the way to go, but it will be a political decision influenced by the old folks lobby. That makes raising the pay cap more likely.

Steve

…I fail to see the merit of any talk that claims it is welfare…for regular SS benefits taxpayers paid in. How is that welfare?

No numbers here to prove anything. Now the general fund has a problem. Up until the Great Recession, spending was a Republican dynamic big time. Tax cuts created the deficits since spending responsibility was off the table in the last decade.

If the gang on the hill would stop raiding the social security “trust fund” I expect at least part of the problem would go away.

BTW James, since you claim a pretty chunk of change you pay, you pay about 6% of up to about about $106,000. So what amount don’t you pay on? Don’t worry, you will get your money back. And more so if you are unlucky and can’t keep working. SS was created in a fiscally responsible manner that accounts for a lot of possibilities, in an ‘honor thy father and mother’ sort of way, which I have done….but then, they paid their own money too, so no welfare for them either. Honorable way to live I believe.

****Entitlements and defense are where you will find the money to reduce our deficits*** and the speakers new office?

I say we start with the push one for English system.

“it would also make it just another welfare program”

The plan has worked as a mandatory annuity given the previous pay-in/out rates and demographics. It is breaking now, on changing demographics(*), isn’t it? It is overcommitted based on changing demographics(*).

* – including rates of unemployment

It does not work like an annuity john. But to explain why not takes a post or two.

The worker to retiree ignores the increases in productivity.among several other things. And the demographic item was planned for and the program works as planned.

Ignoring for now the strawman of ‘bankrupt’, the tax increase to take care of the whole thing amounts a couple dollars a week in order to take care of things according to the structure Peterson employs. The increase could be eliminated if the economy picks up…hence the trust fund was to be a ‘bridge’ for hard times, but it did balloon the last 12 years or so.

Say if we stay at 10% unemployment and another 5-10% underemployment for 10 years and wages stay flat like the last 20 years, there could be a problem. But then again if the trust fund is gone payments STILL can be maintained at 75%…however, I would suggest we would have far more serious problems if that were the case.

Please give me the short-hand Rdan. I could see starting a private annuity, taking people’s monthly payments, investing in t-bills, and then paying out based on actuarial data. Didn’t I just describe Social Security? Monthly payments. Trust fund invested in t-bills. Payout based on (50 year old) actuarial data.

How nice of all these multi-milliionaire politicians and pundits to decide that the only way to rescuse social security is to slash benefits. Those who suffer will find it’s good for their souls. And God forbid we raise taxes on those same multi-millionaire politicians and pundits. That kind of suffering is just bad.

SS is a kind of defined benefit plan, but oh so much more. you have to understand that SS protects you from inflation, which is something not even I bonds really do. a defined benefit plan could, if the guarantor didn’t go bankrupt. but SS also insures you against death disability, and your own failure to thrive or be able to or remember to make your monthly contribution.

the payout doesn’t need to be based on any “actuarial data.” current experience might suggest a need to change either the tax rate or the benefit schedule. you don’t need to guess. just decide which makes more sense. and the amount of change in tax level is likely to be less than a tenth of a percent every four years while holding benefit levels constant as a monthly “replacement rate.”

Rdan, the inflation adjustment was congress’ tinkering with the actuarial payout, but it was originally, definitely, based on average lifespan. It isn’t just a return of pay-in. If you live to 110, you keep getting payments. You get them because not everyone lives to 110.

If this were a “savings plan” as some people claim, your payout would stop when your savings ran out. That’s not true, it is based on a annuity pool.

Now I also read your paragraphs as ways to improve that pool and system. Absolutely there is room for improvement. Adjustments to for actuarial data are a little late though (contributions have not increased to match lifespans, retirement spans). I think reducing, or even means-testing, benefits are a political no-go. That leaves moving the retirement age and (as I said) increasingly taxing payouts, and routing those reclaimed taxes back through the system.

Of course it is not just a return of pay in. Those on the low end of pay in get a better return than those consistently on the high end of pay in. The rate is adjustable according to longevity overall, and the longevity of payers has steadiliy increased over decades, so the tables account for the fact already. Beautiful, isn’t it?

Adjustments are just fine…longer life spans are accounted for. An adjustment of about a tenth of a percent takes care of this ‘crisis’ over the opaque sounding 75 year event horizon….frankly, I think we are lucky to get a ten year event horizon correct when it comes to predicting economic data. If you want the spreadsheets I can send them.

SS has paid out of its dedicated funding for over seventy years with only “3?’ minor times into negative territory.

Discussing the real problems of ss needs numbers to back up claims….Andrew Biggs is about the only one who does…most crisis debates do not use readily available numbers, which actually make arguing philosophical points moot. It is like discussing bottom line at a actuary meeting without numbers.

The real problem is the general fund. I do believe no one is serious about the general fund drficits except to protect their piece of the action. Taking the military budget off the table (F-22 as an example, or the F-35) as a jobs program does not seem to bother the debt commission, but the noise around jobs programs in other circumstances makes for a lot of negative fuss.

George Bush and company cut taxes to the tune of over 1 trillion so far while beginning two wars costing 1 trillion. Tax cuts did not produce a revenue to even remotely cover the deficit created. Where Obama takes us is also of concern.

But SS is running just as it should within the numbers…why change something working well or if a small adjustment of one tenth of one per cent fixes it, why the growly Simpson face??? Pete Peterson has spent millions and millions on the project out of a philosophical belief, not a numbers and reality belief.

Raising the cap is a good idea. SSA problems are not substantial and it behooves to preserve it as a majority of seniors rely on it as their sole source of income. From what I read- the actuaries would project evenly out seventy five years with a 1% annual compensation reduction and 1% increase in revenue. Part of the problem is the distrust that eighties compromise yielded where in strict macro terms, tax cuts for the wealthy were supported by tax increases in the working population. SSA can be fit economically rather easily; Medicare is another problem altogether and I have yet seen an economic solution.

The actuaries of SSA and the CBO come pretty close in numbers for the layman. But dire shortfall has been predicted before not so long ago and never happened. 25 year projection seems more appropriate…75 year projections are used for simple purposes of looking at posibilities, but certainly not probabilities.

Longevity may go down…the economy may pick up…legal immigrants may help with the the worker to retiree ratios…

Raising the cap does work, but the beauty of the system is that it is paid for by workers for their own retirement protection against destitution, no welfare involved at all, with remarkable benefits if you need them and if your 401k crashes, which of course never happens.

rdan is right

but i can see how it would be hard to understand without taking the time to think it through. and from what i have seen most people won’t take the time. they are too in love with the lies they have been taught to believe.

first: social security has nothing to do with the deficit, now or forever. it pays for itself. it is not welfare. it is workers paying for their own retirement (insurance),

the cost of the expected increase in longevity can be met with an increase in payroll taxes that amounts to twenty cents per week per year.

i am glad that john mccain collects his SS check. it is the contributions of those who END UP wealth that make it possible to supplement the checks of those who END UP poorer. it’s like fire insurance: you don’t get your money back because you didn’t have a fire. contrariwise you don’t refuse to pay the claim for someone who does have a fire because “he can afford to” pay for it himself.

joyner, ph.d. and all, is pretty much of an idiot. he is willing to make authoritative soundig statements about SS when he knows nothing about it at all. that 20 cents per week per year increase in the tax will guarantee that even joyner gets his full SS benefit, with a real value about 160% of today’s… keeping up with the general rise in standards of living… over a longer life in retirement. without the 20 cent raise, SS would still be able to write him a check which, while 25% less in “replacement value” is 20% greater in “real” value. but these are are details you wouldn’t expect a ph.d. to understand.

if you want to learn more write co*****@pe**.org