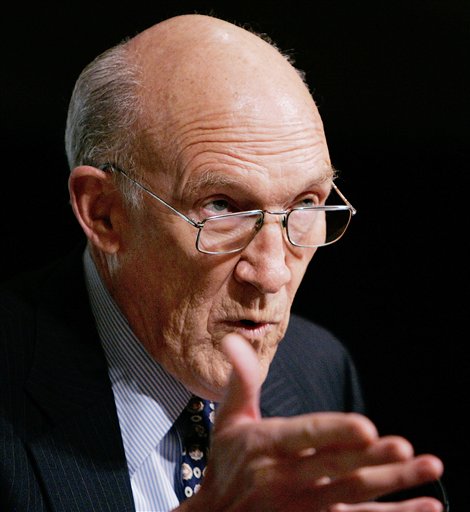

Alan Simpson: Best Damn Record of No Taxes of any Son-of-a-Bitch

Alan Simpson’s wit, candor, and integrity made him one of my favorite senators of all time. And now he’s fighting back against the interest groups that are killing our party.

Alan Simpson’s wit, candor, and integrity made him one of my favorite senators of all time. And now he’s fighting back against the interest groups that are killing our party.

Former Sen. Alan Simpson is none too pleased with conservatives who say he lacks sufficient antitax fervor. “I got the best damn record on no taxes of any son-of-a-bitch in the Senate,” says the blunt-speaking Wyoming Republican, the co-chairman of a new presidentially created deficit-reduction commission. In a prepared statement, Simpson adds, “I don’t intend to allow folks to distort who I am without responding with the facts. This `Mr. Tax Hike’ business is garbage.”

Americans for Tax Reform, a group headed by longtime conservative activist Grover Norquist, said after Simpson’s appointment in February that he voted for two bipartisan budget deals that contained real tax increases but phony spending cuts. One was in 1982 and the other was in 1990. “There is no reason to believe that things would be different this time around,” Norquist said in his statement. “When you put everything on the table, including damaging tax hikes, taxpayers will more than likely be sold out.”

In his counter-statement, Simpson notes that he earned consistently high ratings — often very high ratings — from various conservative groups for his voting record in the 1980s and 1990s, including the National Taxpayers Union Foundation and the American Conservative Union. Simpson chose not to seek re-election in 1996 after losing a leadership election to former Sen. Trent Lott of Mississippi.

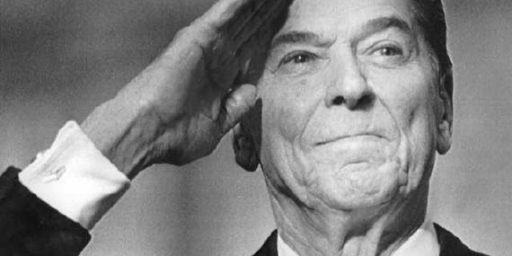

Simpson now seeks to explode the myth that President Ronald Reagan was an antitax paragon, and suggests that Reagan would have supported the deficit panel’s work.

“President Reagan was no fanatic or purist,” Simpson says. “There were several occasions during his eight years of real stewardship where taxes (however you define them) were raised….Whatever Ronald Reagan did, and whatever policies he embraced, he did for the good of the American people and for future generations of Americans. As co-chair of the President’s Commission, I would hunch that if President Reagan were alive and active, he would be supportive of the hard work and hard decisions which lie ahead for our Commission.”

As the formative figure at the time of my political awakening, Reagan was my political hero. He was an incredibly articulate spokesman for the political philosophy I held and, indeed, he helped shape. But Simpson is right: the Mythical Ronald Reagan differs radically from the Real Ronald Reagan.

The 1982 tax hike (formally, “Tax Equity and Fiscal Responsibility Act of 1982” or TEFRA) that Simpson voted for was in Reagan’s second year in office. It was an adjustment to the Kemp-Roth tax cuts of the previous year and was part of a compromise package championed by Reagan to control runaway deficits. As it turned out, it didn’t work out so well. Analysts differ on who’s to blame. Wikipedia:

The scheduled increases in accelerated depreciation deductions were repealed, a 10 percent withholding on dividends and interest paid to individuals was instituted, and the Federal Unemployment Tax Act wage base and tax rate were increased. Excise taxes on cigarettes were temporarily doubled, and excise taxes on telephone service temporarily tripled, in TEFRA.

President of the United States Ronald Reagan agreed to the tax hikes on the promise from Congress of a $3 reduction in spending for every $1 increase in taxes. Some conservatives, led by then-Congressman Jack Kemp, claim that the promised spending reductions never occurred. One week after TEFRA was signed, H.R. 6863 – the Supplemental Appropriations Act of 1982 which Ronald Reagan claimed would “bust the budget” was passed by both houses of Congress over his veto. Four years later, then-budget director David Stockman, however, stated that Congress substantially upheld its end of the bargain, and cites the Administration’s failure to identify management savings and its resistance to defense spending cuts as the key impediments to greater outlay savings.

The 1990 tax cuts were agreed to by President George H.W. Bush in violation of his “Read my lips: No new taxes” pledge and quite likely cost him re-election. Again, however, it was part of a compromise with a Democratic Congress in a failed attempt to bring the deficit under control.

In fairness, both tax hikes were unpopular with Movement Conservatives even at the time. This was especially true of the Bush hike, since he lacked Reagan’s street cred with conservatives. Regardless, they both received substantial Republican support and were signed into law by Republican presidents.

Did Simpson really have “best damn record on no taxes of any son-of-a-bitch in the Senate”? Well, I’m sure there were sons-of-bitches who voted No more consistently. But that only gives them a better record than Simpson if they also voted to drastically cut spending. And maybe not even then, given that such votes would have been token. Simpson, on the other hand, worked to achieve compromises and then voted for the deal that both best achieved his goals and could get through Congress.

Simpson was a small-C conservative of the type frequently found out West. He believed in low taxes, yes, but also fiscal responsibility. And, absent the appetite to control spending — which Republicans make difficult by deifying the Defense budget — that sometimes means increasing taxes. But, Grover Norquist’s desires to the contrary, constantly cutting taxes while piling up debt isn’t conservative at all.

AP Photo/Ed Andrieski

Though I have always admired Simpson, who is from a neighboring state, I think he was chosen exactly for his penchant to want to do “good” government deals.

I know the OTB boys don’t agree, but when the Democratic government has operated in poor faith thus far…do I have to list them, or will you agree? No taxes under $250,000 per year “…not one dime!” “This isn’t a government take over of health care” “You can keep you existing doctors and insurance” on and on and on.

So, I think if the government is not operating in good faith to begin with, Simpson only offers up his revered name for chump change and a slap on the back. I guess that was all right for John Lewis, too.

BTW, OT, and speaking of tax cuts…how many folks know that the vast majority of federal taxpayers are eligible for the Making Work Pay tax credit that is part of the stimulus bill (up to $400 for a single filer, $800 for joint filers)? Check it out if you haven’t filed your taxes yet. Go to this page for the details.

If you’ve already filed and didn’t take advantage, not to worry. I wasn’t aware of it, and the evil IRS computed the credit for us and increased our refund accordingly.

Of course, if you’re opposed to the socialist stimulus bill, you can skip it.

Snark, Snark, but I’d put that Obama payoff in the bank, save it for Simpson’s VAT or some other wonderful tax. Gamblers usually only count the winnings, but forget the losses, too.

“Obama payoff,” huh. No wonder you guys are losers.

There are two ways, and no more, that you can address the deficit on the spending side: restructure Medicare and/or renegotiate our overseas military commitments. That’s it. I’d be curious as to which of those two measures Norquist favors: military spending has long been regarded as untouchable by the right, and the TEA partiers made clear that any attempt to reign in Medicare costs was equally unacceptable to them. But since Norquist has an in with that set, maybe he can persuade them to take a fresh look at both.

Thank you for this post, James. I’ve often felt that Simpson was a Senator whom I largely disagreed with, but at least felt he was sane and interested in governing rather than winning elections. It’s a shame that the current crop of Republicans in Congress feel these are vices, not virtues.

Man, I will pick Simpson over Nordquist any day.

(That Nordquist is a comic villain make it pretty easy, actually.)

(Sam, my tax software (CompleteTax, recommended) took the Making Work Pay tax credit for me. I was surprised.)

Well, okay, I see you are all well-versed on the THEORY side of the economy, but the fact is the issues are being played out in REALITY. The reality is I run a small business and things have been tight, but manageable until they passed health care reform.

Now, I know this is difficult, because it doesn’t reside in some text book somewhere, but psychology plays a huge part in the market. Unless you are the government and can pass laws to make people buy government produced cars, you can’t just force people to buy things. My business depends on their “willingness” (a word Marxists don’t understand)to buy things, to do things, etc

When you start talking about new taxes, people’s sphincters tighten and they don’t spend money and the net result of that is that I just had to lay off two people because the work I had ahead of me for two months disappeared right after March 22nd.

Oh, I know, it’s just a coincidence that this is only the second time since I started this business that people pulled their jobs off the board, the other time was about July of ’08.

But, okay, you’re right, I’m wrong. Feel better? It won’t change the unemployment, and it won’t revive the economy, and it won’t make things better. But, you’re right, we better tax everybody more on the understanding that it’s just “good government” to do so.

Cripes!

Good to see some fighting spirit in rational Republicans like Simpson (and Joyner).

I’mn a liberal but I recognize the need for a healthy and rational opposition in our political system.

Dude, that’s what’s known in the trade as post hoc, ergo propter hoc. Can give us any concrete proof that the falloff in your business was a direct result of HCR?

Tim:

What in God’s name are you prattling about? You had to lay people off because of a tax increase that hasn’t occurred? A tax increase that exists only in your imagination?

Dude: biggest recession since the Great Depression. Said recession began under Mr. Bush and despite his tax cutting. You think maybe that’s why business is tight?

So what are you talking about? It’s Obama’s fault your business is doing poorly because the psychology of the market thinks taxes might be increased some day so you have to fire two guys? What?

I assume you’re a tea partier. You have the “thought process” down perfectly.

Simpson was a small-C conservative of the type frequently found out West. He believed in low taxes, yes, but also fiscal responsibility.

Just like Governor Sarah Palin.

I told you, you don’t have to believe me Michael and Sam. You can believe whatever your little hearts desire. The truth and the facts are exactly what they are and while you spend your time trying to divert responsibility from the causes which you championed, real people get hurt.

I’m telling you, not cajoling you, not trying to impress upon you, not trying to gain your acceptance, I am telling you that even threats of increased taxes have an economic impact and statements like Volcker made today will have a significant impact on the economy.

The point, should you choose to consider it, rather than go off on a rant with no purpose except to make yourself feel intelligent, is that a person who has a job, who sees his work load decrease over time doesn’t have to wait until he is fired before he reconsiders the new car he was going to buy when he couldn’t keep up with the work load.

Or, are you just “government-controlled” economy kinds of guys?

And, btw, I never said it happened under Obama’s watch, what a bunch of ideologues you guys are. It doesn’t matter to me who was in office TWO years ago, SOMEONE was elected to fix, it, right? Or, were they simply elected to blame it on someone else? For myself, I don’t blame anyone. It happened, it just IS. My problem is trying to hold on to my business on a fraction of the income it once produced.

That’s all. I don’t have to be right. I don’t have to find some way to blame it on Obama, that ain’t my gig. That’s yours, you have to find a way to blame it on Bush.

All I am saying is that taxes and the threat of further taxation have a psychological impact. If you want to argue that people only fiscally respond to real time stimuli, and do not plan, or budget, go right the hell ahead.