Alcohol Tax Weirdness

Taxes on wine, beer, and spirits vary wildly from state-to-state and even within each state.

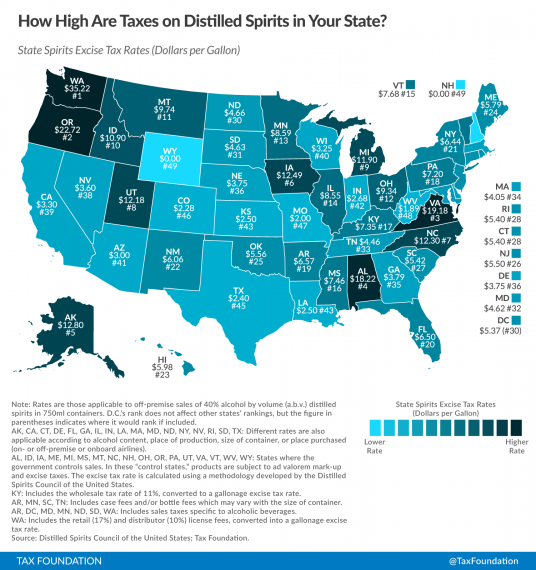

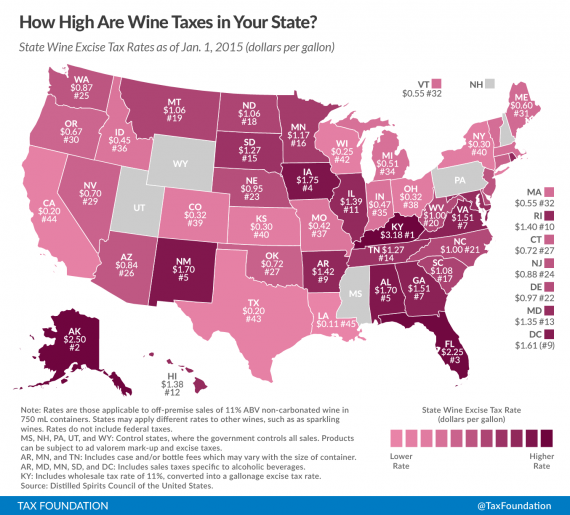

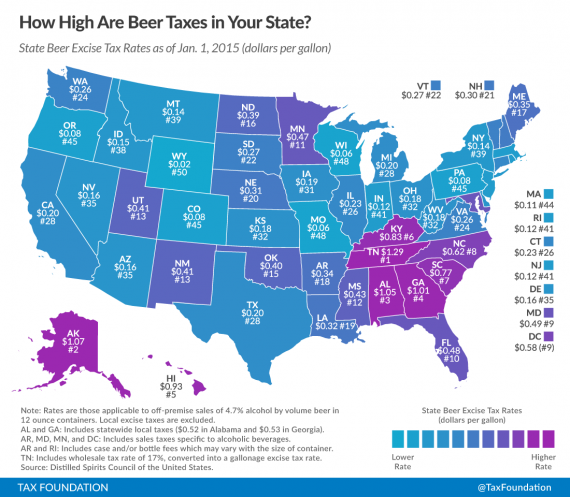

The gang at the Tax Foundation have produced maps showing how each of the 50 states tax wine, beer, and spirits. There is no obvious rhyme or reason:

Not only do wine, beer, and liquor face different tax rates within each state, but there is also a large disparity in the tax rates between different states. These rates can range from $0.02 per gallon on beer in Wyoming, to $35.22 per gallon on distilled spirits in Washington. Some states (like Alabama) tax all alcoholic beverages with relatively higher rates than other states, but some states tax the three products very differently. For instance, Idaho 6th highest tax rate on distilled spirits and the 4th highest rate on wine, but it has only the 31st highest rate on beer.

My home state of Virginia, for example, has the third highest rate on spirits, a whopping $19.18 per gallon in the state-monopoly ABC stores.

These calculations, they admit, are a bit challenging because of lack of transparency. But they use external sources.

Data for this map comes from the Distilled Spirits Council of the United States. To allow for comparability across states, they use a methodology that calculates implied excise tax rates in those states with government monopoly sales.

Washington has the highest spirit excise tax rate at $35.22 per gallon, followed by Oregon ($22.72), Virginia ($19.18), Alabama ($18.22), and Alaska ($12.80). Spirits are taxed the least in Wyoming and New Hampshire, where government-run stores have set prices low enough that they are comparable to having no taxes on spirits. Following Wyoming and New Hampshire are West Virginia ($1.89), Missouri ($2.00), Colorado ($2.28) and Texas ($2.40).

Like many excise taxes, the treatment of spirits varies widely across the states because of various factors. Spirit excise rates may include a wholesale tax rate converted to a gallonage excise tax rate; case and/or bottle fees, which can vary based on size of container; retail and distributer license fees, converted into a gallonage excise tax rate; as well as additional sales taxes (note that this measure does not include general sales tax, only those in excess of the general rate). Rates may also differ within states according to alcohol content, place of production, or place purchased (such as on- or off-premise or onboard airlines).

What’s odd to me is that one would think that heavy producer states, such as Kentucky and Tennessee, would have the lowest taxes. They don’t. Nor, interestingly, do states who only allow spirits to be sold in state-run stores charge the highest rates.

Virginia comes in 7th in wine taxes, coming in at $1.51 a gallon.

Again, the calculation is a bit muddy because of differences in the way the taxes operate:

Kentucky has the highest wine excise tax rate at $3.18 per gallon, followed by Alaska ($2.50), Florida ($2.25), Iowa ($1.75), and New Mexico ($1.70). The five states with the lowest wine excise rates are Louisiana ($0.11), California ($0.20), Texas ($0.20), Wisconsin ($0.25), and Kansas and New York (tied at $0.30). Notably, these rankings do not include states that control all sales.

Wine excise rates can include case or bottle fees dependent on the size of the container, as in states such as Arkansas, Minnesota and Tennessee. Additionally, rates may include sales taxes specific to alcoholic beverages and wholesale tax rates, as in Arkansas, Maryland, Minnesota, South Dakota, and the District of Columbia.

It should also be noted that many states apply varying rates based on wine type, and wines with a higher alcohol content are often subject to higher excise tax rates. Federal rates also differ by type and alcohol content, with wines up to 14 percent alcohol by volume (ABV) being taxed at $1.07 per gallon, wines between 14 and 21 percent ABV at $1.57 percent per gallon, and wines between 21 and 24 percent ABV at $3.15 per gallon. Sparkling wine gets its own category in the federal code, and is taxed at $3.40 per gallon regardless of alcohol content.

Virginia comes in middle of the pack in beer taxes, at a mere 26 cents a gallon, 24th in the nation.

State and local governments use a variety of formulas to tax beer. The rates can include fixed per-volume taxes; wholesale taxes that are often a percentage of a product’s wholesale price; distributor taxes (sometimes structured as license fees as a percentage of revenues); case or bottle fees (which can vary based on size of container); and additional sales taxes (note that this measure does not include general sales tax, only those in excess of the general rate).

They also cite a Beer Institute study claiming that ”taxes are the single most expensive ingredient in beer, costing more than labor and raw materials combined” and that ”if all the taxes levied on the production, distribution, and retailing of beer are added up, they amount to more than 40% of the retail price.” Remarkable, if true.

Which is why it’s sometimes worth it for residents of Northern VA to make the drive into #30 DC or #32 Maryland, especially if looking to buy multiple bottles.

I can still shop at the military Class Six store but their selection tends to be poor.

@Mikey:

I’ve done that some but you really have to work hard to ferret out the stores with good deals. Prices in downtown DC, especially, are often higher than they are in Virginia. You have to go into the seedier and harder-to-get-to neighborhoods to get good deals. (Although there’s now a Costco in DC that sells spirits. I need to check that out.)

I used to travel to Japan on business a lot. When travelling to Japan it is customary to bring gifts for your contacts. The first time I went I bought several bottles of Scotch before I left only to discover that the same Scotch was much cheaper in Japan. The reason is Japan taxes all alcoholic beverages at the same per volume rate making spirits a bargain and beer not so much.

Conjecture: All the states with $12+ taxes on distilled spirits also have a thriving black market in moonshine. VA, NC, OH, AL because of settlement in backcountry by Scots-Irish who brought the practice with them from Britain; IA, UT, ID, MT due to pioneers bringing the practice with them through the 19th century; and Washington and Oregon got both the moonshiniest of those pioneers plus a “hipster” movement looking for authentic ways to get blitzed.

I recall the time when the VA tax folk would have an informer sitting outside liquor stores in Georgetown, ready to call in the license plate numbers of VA drivers buying large quantities of booze. There was a payphone right next to Dixie Liquors, on the approach to Key Bridge.

Amazingly, those cars would be pulled over once they got back to VA, the booze was confiscated, and fines were levied. A bottle or two might go unreported, but case lots drew attention.

@Tillman:

That’s interesting and probably true. Alas, I much prefer my whiskey barrel aged. (And, thankfully, spirits are a bargain compared to beer and, especially, wine despite the higher tax rates.)

A few years back Washington eliminated the state-run liquor cabal, but imposed amazingly high taxes in order to keep the infrastructure running – and the beer & wine distributors happy.

It was a smart move by the sponsors of the initiative after the first attempt failed, largely thanks to those beer & wine folks teaming up with Liquor Control Board employees and the ‘fear constituency’ – law enforcement/uber religious.

Now the discussion in Washington State is no longer about whether the state should be selling liquor – it’s just about tax rates.

I never understood how this is compatible with the free trade between the states. But then, you need a special mind to read the constitution.

Most of the cars in the New Hampshire State Liquor Store parking lots have Massachusetts plates on them.

The Tennessee Beer tax seems to explain why there’s hardly any breweries on my side of Appalachia vs. NC, where the tax rate is halved (and has many tasty beers).

“What’s odd to me is that one would think that heavy producer states, such as Kentucky and Tennessee, would have the lowest taxes.”

OTOH, these states have a lot of dry counties. The Jack Daniels plant is in a dry county, the Bourbon trail snakes through some dry counties. So I assume strong support for sin taxes, but it’s interesting that Kentucky is #1 in taxing wine and Tennessee is #1 in taxing beer, but both drop to the middle for taxing spirits.

Also, with the success of the bourbon trail, Kentucky probably sees a lot of benefits from taxing out-of-state tourists. And bourbon isn’t bourbon if it’s not from Kentucky.

Very interesting. On so many social- and political-issue maps the Mason-Dixon lines jumps right off the page. The beer tax map is the only one that comes close.

@James Joyner: :Yes, it’s still necessary to shop around. The best deals I’ve seen in MD are well away from the DC metro area and closer to the Delaware state line, so they’re not worth burning gasoline for on their own, but we have friends up that way so if we’re visiting I’ll swing by the liquor store.

I haven’t been to that DC Costco yet either. I’ve heard the Kirkland-branded single malt scotch is pretty decent and really cheap (as in $38 for an 18-year). If that’s available in DC it would certainly be worth picking up!

To those who ask, “How can you stand a 13% marginal rate on state income taxes in California?” I say, “By drinking plenty of low-tax booze.”

When I was in Auburn we’d often drive to Columbus GA and come back with a trunk full of liquor because of the big price difference.

@Lit3Bolt:

It’s not so much the tax rate but rather the real trouble that starts if the beer leaves the premises. A brew pub can’t even move beer to a second pub location without a distributor.

Now this is interesting. Dayton, TN, mostly known for the Scopes Monkey Trial, is getting their own brew pub

Our town is one of those peculiar places that does not allow alcohol sales. If you want a drink, you have to drive about 15 minutes one way.

@Tyrell: Love those ‘dry’ areas, not sure what city/county councils think they are accomplishing, but more power to ’em redirecting the money to the neighboring area.

@Tony W: I don’t know what the people here were thinking but they voted about ten years ago. About 80% against allowing alcohol sales (beer and wine only).

It is a church thing.

@Tyrell: Well, the Christians allied with the bootleggers. When I was in college in west Tennessee in the 68-69-70 era, I’d make a liquor run to Dyersburg TN and come back with a trunk full of booze. Rather a small load since it was an MG-B! But the liquor store guy would give me a business card with the day and date on it (with his initials) that he said would give me a free pass through the two counties I had to drive the contraband through to get back to Jackson County.

Just remembering this gives me a fraternal feeling to Bo and Luke Duke.

@Mu: Why should free trade between the states require a common tax code between the states? If Virginia were charging Marylanders more, that would be different.