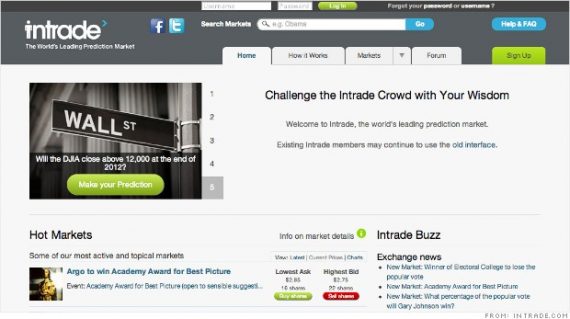

Americans Shut Out Of Intrade

Thanks to the CFTC, Americans will no longer be able to participate in Intrade's predictions markets.

Thanks to Federal regulatory authorities, Americans will no longer be able to participate at the political “betting” site Intrade:

Online prediction market Intrade, hugely popular among political bloggers and pundits, will no longer allow U.S. residents to participate after running into regulatory and legal trouble Monday.

The company alerted American customers on its website that they must close their accounts by Dec. 23, or else the company will do so itself, after determining a fair market value. Funds must be withdrawn by Dec. 31.

Intrade, which is operated by the Irish firm Trade Exchange Network Ltd. was a favorite reference point for political prognosticators, who pointed to futures being traded on the outcome of the presidential election as a reflection of the odds facing each campaign.

The Commodities Futures Trading Commission sued Intrade and TEN on Monday for offering commodity options contracts between September 2007 and June 2012 in violation of the agency’s ban on off-exchange trading.

According to the suit, the CFTC claimed the firm filed false certification forms stating that Intrade limited its offerings to eligible market participants. The agency also claimed that TEN violated a cease-and-desist order, signed in 2005, covering similar conduct.

“It is against the law to solicit U.S. persons to buy and sell commodity options, even if they are called ‘prediction’ contracts, unless they are listed for trading and traded on a CFTC-registered exchange or unless legally exempt,” said David Meister, director of the CFTC’s Division of Enforcement.

The CFTC’s complaint isn’t based so much in the fact that Intrade allows people to place wagers on the outcome political contests, the Academy Awards, or the likelihood of military conflict with Iran, but also on the future price of oil, gasoline, gold and other commodities commonly traded on exchanges regulated by the agency. Given this, it’s possible that the CFTC and Intrade could resolve their dispute by, say forbidding American citizens from participating in contracts related to those commodities. At the same time, though, it’s unclear whether the CFTC would be satisfied with this result. Not too long ago, after all, the agency shot down an attempt by a company in Chicago to create a more formal “political futures” market. So, it’s possible that there may be no possible resolution.

Economist Bryan Caplan thinks this lawsuit is an apt demonstration of the CFTC’s real motives here.

The CFTC’s real complaint is that consumers eagerly bet on Intrade because the company exemplifies market integrity: “I trust Intrade with my money because of their reputation, not government regulation.” Reputation: That’s the same mechanism, of course, that underlies eBay, Amazon Marketplace, and the whole cornucopia of internet commerce that the mainstream information economist of 1990 would have dismissed as free-market Fantasy Island.

If the CFTC really wants to protect market integrity, it should start by publicly admitting that if the CFTC ever served a useful function, that time has long since passed. Americans send money to Intrade because Intrade delivers the goods (and produces the positive externality of accurate forecasts in the process!).

In the information age, firms’ reputations are just a click away. That’s all the protection any consumer needs. The only people the CFTC is “protecting” are their own obsolete employees.

As Brad Plummer points out, this isn’t likely to do great harm to Intrade itself. The company is located in Ireland, and the vast majority of its users appear to be based overseas. Indeed, the site is already fairly inconvenient for Americans to use because Intrade will not accept American credit cards, meaning that the only way that an American Intrade user can fund or withdraw from their account is to use bank transfers, which tend to be rather costly even for small transactions. The only people who will be inconvenienced here are the Americans who voluntarily chose to participate in Intrade. And it’s all being done in the name of “consumer protection.” If people want to participate in something like Intrade and they go into it with their eyes open, and there’s every reason to believe that they do, then I fail to see what the CFTC is accomplishing by making it illegal.

There’s no reason why people who supposedly love Freedom (TM) shouldn’t have supported Barney Frank’s bill to legalize online gambling.

I agree with you on this Doug. Not much else to say.

Honestly, I don’t think this is about “consumer” protection than it is about “market” protection – OUR markets, not a company in Ireland’s – but honestly, I find the whole business of speculation to be shady in the first place. Six of one, half a dozen of the other.

Of course, I also think online gambling should have been legalized, even with the house-weighing (even more than regular casinos) that could go on there, and the security issues therein.

Well, is this because the CFTC was uncompromising or because Intrade didn’t want to invest in the appropriate control functions?

This facile notion died with the financial crisis. Seriously, how many times do people need to get bent over before it occurs to them that the promised reach-around is not to be entirely relied-upon?

Some random company says they’re not ripping anyone off, and hey, the CEO looks good on the cover of Forbes and they haven’t been caught . . . yet. . . so what’s the worry? Was Caplan alive at any point in the last decade or so?

Major accounting firms have been shown up as absolute damned liars and frauds, ditto banks, ditto mortgage lenders, ditto on and on and on, but we should leap to place our trust in an Irish betting company? I mean, if you can’t place automatic, unquestioning faith in people you’ve never met who carry on opaque business transactions in a foreign country and promptly run for cover the minute someone mentions regulation or oversight, who can you trust? After all, they don’t have that many negative reviews on Yelp, right?

Isn’t the CFTC just doing it’s job of enforcing the laws on the books? Shouldn’t your ire be directed at the people responsible for promoting the creation of laws to protect commodities trading? You know…. those..what are they called again? job creators?

@Matt

*BING* *BING* *BING*

Give that man a cigar.

They’re accomplishing nothing, really, except for trying to justify their own taxpayer-funded budgets, salaries, benefits, etc.

Speaking of which, you can take the above quote and juxtapose it pretty much to all regulations by the entire universe of alphabet soup federal agencies empowered by Congressional edicts.

For example:

So on, so forth.

Government regulation is the hobglobin of stunted capital markets and of selective democracy.

@Tsar – except the CTFC and FCC aren’t the bodies that made them illegal. Do we need to have a civics class here? Seriously? You people forget how our government works? Congress creates the laws. The executive (CTFT, FCC, FDA, EPA) ENFORCE the laws. They don’t just make shit up short of being given the authority by CONGRESS to make shit up. And guess who are the ones pushing for barriers to entry for their markets ? I’ll give you a hint – it’s not the government.

@michael reynolds:

Hmm. So maybe I shouldn’t have given my bank account info to this corrupt Nigerian official who needs help in transferring a few billon to America?

No matter. At least I can trust that beautiful Russian woman who needs some bribe money to come here and make love ot me.

@Tsar Nicholas: Y’know, I sort of like being more or less certain that I don’t have to inspect my just-purchased jar of peanut butter to see if it has rat turds in it or not.

And I like being able to drink water from the tap without worrying about it being contaminated with benzene.

And I like getting on an airplane and knowing I have a very good chance of reaching my final destination without dying in a mid-air collision.

Read the history of our government agencies and you will know why they were created. If your so-called “free market” had been so fantastic and had regulated itself the way you libertarians keep claiming it would–there wouldn’t have been any reason for those government agencies to have been created, right?

Face it, what the government agencies do is create trust via standards and policing of those standards. You private marketers had your chance–and you blew it. Drastically.

Bernard L. Madoff Investment Securities. Lehman Brothers. Bear Sterns. AIG. Countrywide. Enron. Need I go on?

Alright, serious question: If this is an Irish company doing business in Ireland, how does the CFTC have any authority over them?

I’ll be delighted if this means the CFTC will now direct resources at the other market corrupting Gresham’s Law examples infesting its bailiwick.

@John D’Geek:

Because it’s doing business over the Internet in the US, with US customers. By accepting accounts from American customers, it has entered the American market, and therefore the CFTC has jurisdiction. Intrade’s notice to its customers that it will no longer accept American accounts is its attempt to escape from that jurisdiction.

@Rafer Janders: Same reason why a lot of foreign companies won’t accept US citizens owning their shares. SEC regs have lurched from one side to the other as to how much info needs to be revealed to the share-holder.

There’s also the international dividend tax. Yet another reason to own ADRs instead….

@Matt: You are aware of administrative law, right? Yes, Congress is supposed to make the laws, but often they delegate that function to regulatory agencies, which often have their own courts.

Indeed. There are no laws at all that govern commerce. It’s reputation all the way down.

@Jeremy: which is what I said:

So when congress says “make regulations to meet this goal” and the regulators make regulations that meet that goal and then enforce them – you blame the regulators?

If there’s a fight to be had here (and I’m not sure that there is – it just looks like another right-wing mole hill) it begins with congress and the law creation process, not the executive branch. Maybe if you started leaning in the right places (on your senators and congresspeople) something would actually get accomplished.

@Rafer Janders:

IANAL, but isn’t that backwards? US customers are doing business over the internet in Ireland. It’s one thing to prohibit US customers from doing business over the internet in Ireland; it’s a completely different thing to tell another sovereign nation how to run their businesses.

If they have no physical presence here* in the US, how can the US regulate them?

* Don’t know that they do or don’t, but that’s a key.

@John D’Geek:

No, not backwards. If you actively solicit US customers, and open accounts for American customers, you are generally considered by the US government to be engaged in commerce “within” the US, even if it takes place entirely over the Internet. If you don’t want to be regulated by the US government, don’t take American customers, is basically the rule. (Vastly simplified, but this is the general idea).

Other sovereign nations can run their businesses entirely how they want — assuming, that is, that they don’t want access to American money. But if they want American money, they get American regulation. The US government at any time has the power to prohibit American banks and other financial institutions from doing business with a foreign company which it considers in violation of US law.

This was affirmed in our last election: the government has an obligation to protect some Americans from making bad decisions — by keeping all Americans from being able to make those choices. We are only as dumb as our stupidest members, and the law must reflect that by catering to those stupidest ones.