Americans Losing Money to Spite Uncle Sam

In “Upper-Income Taxpayers Look for Ways to Sidestep Obama Tax-Hike Plan,” ABC’s Emily Friedman reports on a disturbing trend:

President Barack Obama’s tax proposal — which promises to increase taxes for those families with incomes of $250,000 or more — has some Americans brainstorming ways to decrease their pay, even if it’s just by a dollar.

A 63-year-old attorney based in Lafayette, La., who asked not to be named, told ABCNews.com that she plans to cut back on her business to get her annual income under the quarter million mark should the Obama tax plan be passed by Congress and become law. […] “We are going to try to figure out how to make our income $249,999.00,” she said. “We have to find a way out where we can make just what we need to just under the line so we can benefit from Obama’s tax plan,” she added. “Why kill yourself working if you’re going to give it all away to people who aren’t working as hard?”

Granted, so far the trend consists of just two people plus some speculation about others following.

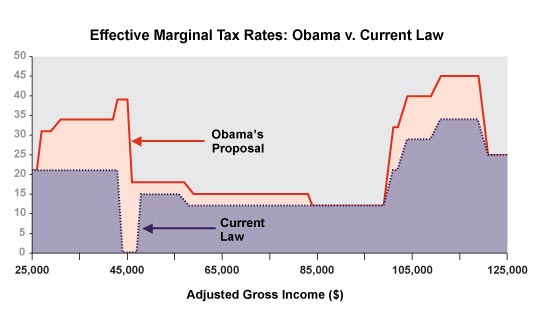

Two people, incidentally, who seem to be clueless about how our tax system works despite being successful at generating income. We don’t tax people earning the trigger point for a new bracket at one rate and those a dollar below it at a different rate. Rather, we tax income incrementally so that everyone pays the same rate on the first X income, the same rate on the next bracket, the same rate on the next bracket, and so on. So, all things being equal, earning the next dollar still results in a net gain of income to the individual; it’s just less than the net on the previous dollar.

Mind you, I’m not in favor of raising taxes on high earners. It actually does create disincentives to work. But I do get the sense that many of the people talking about — and even reporting on — the issue don’t understand it.

Hat tip: Jawa Report

While I think the recession will make the issue moot for us, I can sympathize with the issues. Part of this is uncertainty on what exactly the tax rules will work out to be. For example, the proposal for limiting charitable deductions for those making over $250,000 could make hitting the trigger point a huge cost.

At the same time, excess income for small business owners can also cause reevaluation of perks and benefits. The bottom line is the more you tax the financially successful, the more they will have motivation to avoid those taxes.

It’s even more amusing that people are cutting back NOW when the tax rates don’t go back up until 2011. Until then, all those high earners are going to see net tax DECREASES…

I made a dumb hyper-generalized comment about conservatives a week ago (in response to a dumb hyper-generalized comment about liberals), and this attorney in Louisiana is proving me right: conservatives think that anybody earning a dollar less than them are “unproductive members of society.” This lawyer needs to get a grip if he thinks only millionaire ambulance chasers are hard-working Americans.

Geez Louise, you are right James, they quoted someone so dumb they don’t know how marginal rates work? If you make more than $250K, you take home more than someone making $250K.

Good Lord, how could anyone with that grasp of math make $250K in the first place?

(BTW, the bigger problem for the tax collector’s bottom line is that so many folks over $250K have opportunities for tax loss harvesting in the stock markets these days. I’m not sure TLH isn’t often zero-sum over the long run, but it can certainly cut tax revenues in a down market.)

I’m not sure why this would be surprising, I know people of whom it might be said, will plan their deaths around the repeal of the estate tax.

A proprietorship, like the one referenced, has a lot of options to move income around, raise expenses/benefits, shift income into capital, etc.

Hmmm… Jane Galt, perhaps?

Portion of comment in violation of site policies deleted. If you wish to buy advertising for your pet agenda, contact me for rates.

While gaming the tax system like this is generally futile, clearly many of the commenters have never received a $0.25/hr raise and seen your net take home pay decrease. I and many others working near minimum wage jobs back in the ’80s have seen that. It is quite the disincentive to keep your hours up. Admittedly, back in high school and college, I didn’t embrace the take-home and tax return as total pay so perhaps it was an advantage on whole but seeing your take-home go down while you supposedly got a raise is quite an immediate experience.

If you’re a small business owner, it’s not uncommon to change how much you pay yourself when taxes go up, to avoid hitting trigger points (whether the new 250K for charitable deductions, the AMT, IRA limits, deductions for student loans, or any of the other triggers that make the big picture tax bracket discussion deceptive).

As “yetanotherjohn” hints at, above, and as some folks seem to miss, you don’t in fact have more money that you control if you’re just above a trigger point. Sure, I’d rather have a salary of 300K vs. 249K, but 250K vs. 249K? I’d have to run the numbers. (I wish I were making anything in this range, of course).

If I were a small business owner – possibly including a partner in a law firm – I could see reducing my income while increasing the number of low-paid employees I had, cutting back my own hours because the value of each extra hour vs. the cost of another employee. I don’t see why that’s a surprise, it’s nothing new. It’s just math. And yes, this may not be a change that hits for another year and change, but that doesn’t mean that small business owners don’t have to start hiring people now if they’re cutting back later.

I guess everyone sees different stories gawaine, but for what it’s worth I’ve filed as a sole proprietorship most of my years. In that time I’ve seen my peers take various tax strategies. There are some things we can reasonably do. In my opinion, the people who get too fancy, trying to avoid taxable income, end up avoiding income itself.

So there is a balance. When I hear the lady above, I hear echoes of those who got too fancy.

I predict we will begin to see a rise in divorce, not because of the couple no longer desiring to be married to each other, but because of the tax advantage of alimony on taxes.

For example, right now a couple earning $300,000 with two kids pays about $72,592 in federal taxes (using just standard deduction rather than getting complicated with itemized deduction to keep this easy).

That means they take home (after we consider medicare and social security) $216,437.

With the coming proposed changes, if they remain married, their tax burden increases to $82,023 and all else remaining the same, they now have $207,006 they take home – or $9,431 less after the tax increase.

If they instead divorce and split their income into two returns, one single and one single + 2, their after-tax situation changes dramatically…where for the same couple, they now have $234,036 instead of $207,006….or will take home $27,030 MORE despite the tax increase…so that’s why I think we’ll see more divorces – quick, down and dirty way to capture and increase take-home for the couple.

This isn’t surprising at all. The attorney above is realizing that a certain fraction of the (finite) number of hours in the week is better spent doing things other than working, once the marginal rate gets to a certain level. If you work for reasons other than the joy of the work – and let’s be honest, that’s why most people work – pursuing hobbies and spending more time with your family translates to a dollar value.

One thing that will happen on a significant basis, I assure you – high income earners with college-age and adult children will begin transferring wealth to them by creating sinecure employment for them. If they take a dollar of gross revenue and their options are to pay themselves at e.g. 50% tax, and give it to their college age son for non-deductible living expenses, or put him on the payroll and let him pay 20%, guess which they’ll do?