An Excerpt From A Real Conversation

Other Person: “I’m really sick and tired of people getting rich because they get special favors from the government.”

Me: “Maybe it’s a good idea to raise income taxes, then, because if people are getting rich off of the government, it only makes sense that we take some of that back to help close the deficit.”

Other Person: “We can’t raise taxes! All that does is punish success!”

Yes, this is verbatim. Well, at least as verbatim as my recollection allows, but it’s a pretty fresh conversation.

I can see that. The consistency is in “the government shouldn’t be so active in either case — either rewarding or punishing.” Sometimes, the correction for something is not its opposite. Saying “the government shouldn’t do X” is not the same as saying “the government should do Y instead,” but “the government shouldn’t do X, Y, or Z.”

J.

Jay, I wonder if the logic holds if Y is entirely intended to be the effective negation of X. If you say “the government shouldn’t do X” then should you endorse Y as a way of undoing X?

I think Other Person’s internal consistency lies in the fact that presumably, OP sees “people getting rich off the government” as a subset of “rich people”. So I assume that OP sees taxes-as-clawbacks, consistently, as an unfairly blunt instrument.

Or maybe we’re just giving OP too much credit. The fact that Limbaugh asserts both X and Y, hence OP asserts both X and Y, doesn’t mean they necessarily have any logical relationship to each other.

Andy, how about this: Other Person complained about specific individuals benefiting from government intervention. Alex’s “solution” was to punish everyone equally, whether or not they benefited from government’s blessing. Kind of like a teacher saying “some of you cheated on this test, so I’m deducting 10 points from everyone’s grade!”

Doesn’t quite work out there…

J.

“I can see that. The consistency is in “the government shouldn’t be so active in either case — either rewarding or punishing.””

Except for the whole thing about taxes NOT being punishment. I can’t decide if this prevalent right-wing attitude of “taxes=punishment” is no more complicated than selfishness or if it signifies that Libertarianism is sliding into classical Anarchism.

Mike

Mike, in this particular case, it is. Alex didn’t make an argument that the government needed more money, or that people were undertaxed, but that “if people are getting rich, we should take more from them.”

And I don’t recall the last time a “targeted’ tax actually went for its stated purpose for very long. It all ends up in the slush pile…

J.

Jay,

The joke is in the definition of success.

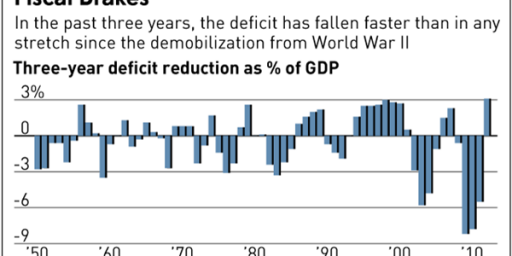

Generally applied income taxes, however, are not a punishment in any sense of the word. With taxes at their lowest point post-World War II, and deficits at an all time high, taking revenue increases out of the equation as part of a deficit reduction measure makes no sense.

“Kind of like a teacher saying “some of you cheated on this test, so I’m deducting 10 points from everyone’s grade!””

There are an awful lot of honor codes which work on that exact same principle.

But let’s look at this another way. What does “special favors from the government” mean? Who gets them? How do they get them? Who provides them? Why do some get them and not others? What makes something a favor and what makes it not so? Are we going to empower the government to aggressively and intrusively seek out those answers and take the actions that logically follow? Or is rich people paying a bit more in taxes actually a better way to deal with the issue?

Mike

““if people are getting rich, we should take more from them.””

He said if people are getting rich “off the government”, we should take more from them. The other person then branded that punishing success. The point of Alex’s post NOT being that he thinks we should punish the rich by raising their taxes, but the other person could resent what he sees as other people getting rich unfairly but is so brainwashed on the subject of taxation that he automatically rejects tax increases even on people who get “rich because they get special favors from the government”.

Mike

Reminds me, tangentially I will grant, of a conversation with a grad student who was upset with the size and scope of government including the notion that government is too much in our lives who then, a few minutes later, was griping about how lousy his student loan was.

Mike, if Alex had said “raise taxes on THOSE people,” I’d agree with you. But Other Person’s complaint was about a specific group (I’d point the finger at GE, the UAW, SEIU, and a few others), while Alex’s response was general.

And on a related note, I’ve noticed that those who are direct beneficiaries of government largesse (the above, plus government employees) tend to mind higher taxes a lot less, as they see that they will get a “refund” in the form of increased government spending.

Ask a teacher or a cop or a firefighter if they mind a higher property tax in order to increase their salary.

J.

Reminds me of “keep you’re damn socialist government hands off my medicare”.

damn…scott o. beat me to it.

…and my social security and my farm subsidies and my mortgage interest deduction and my health care subsidies…

So why increase income taxes on all persons to punish those who get special favors? Why not simply try to eliminate those favors, which, as many are via the tax code, would increase the income tax on those individuals.

We should also apply a special tax to minority and women-owned businesses that get special favors in government contracting.

Or we could look at taxing non-profits and university endowments who become very rich by the special government favor of not being subject to taxes. That would certainly bring in more than increasing the income taxes that would cause individuals to reduce their wealth creation since no use working for the Man.

Yes, let’s increase government revenue so the politicians can increase the amount of special favors that it gives out.

JKB,

I have stated, several times, that all deductions and credits should be eliminated from the individual income tax code (except for business deductions for the self-emploiyed who are taxed as individuals).

As for the rest of you, the more times you explain a joke, the less funny it gets. I already explained it once, up above. So did MBunge. Good lord, people…

Interesting that your list of possible solutions doesn’t include removing the power of government to redistribute wealth. Very telling, this.