Stock Market Roller Coaster

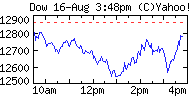

The stock market provided quite a roller coaster ride today.

The Dow Jones Industrial Average dropped 300 points, recouped a large portion of that loss, then lost what was recouped, only to rally at the end of the day and close down about 55 points.

I’m sure that part of the reason for todays wild ride was the news that Countrywide is facing some growing and serious problems.

NEW YORK (CNNMoney.com) — Embattled Countrywide Financial, the nation’s No. 1 mortgage lender, was forced to tap an $11.5 billion line of credit Thursday to run its business during the credit crunch, and said it’s toughening underwriting standards on home loans.

At the same time, SEC filings show the company’s chairman has made a $13 million profit in the past month selling Countrywide stock on the decline.

The unusual step taken by Countrywide (Charts, Fortune 500) aggravated fears about the problems facing the key lender.

And the problems at Countrywide are part of a larger problem, the continuing and growing weakness in the housing sector.

NEW YORK (CNNMoney.com) — Housing starts and permits both fell to their lowest levels in more than a decade, as the latest readings on the battered housing and homebuilding markets came in below expectations Thursday.

Housing starts fell 6.1 percent to an annual rate of 1.38 million in July from a revised 1.47 million rate in June. Economists surveyed by Briefing.com had forecast starts would fall to a 1.41 million pace in June.

[…]

The report comes the day after a survey of members by the National Association of Home Builders showed builders’ confidence in the market at a 16-year low.

[…]

“There is no conceivable way the economy will escape the housing slowdown completely, at this point,” said Adam York an economist with Wachovia.

And the problems on the Dow Jones are also seen in other markets as well.

PARIS/NEW YORK (Reuters) – Shares plummeted worldwide on Thursday and politicians weighed in behind central bank attempts to calm financial markets swept by fears that years of runaway credit growth will end with a big blowout.

The largest U.S. mortgage lender, Countrywide Financial Corp., tapped out an $11.5 billion credit line and another lender stopped funding home loans as companies scrambled for cash and credit markets seized up. At one point, Countrywide’s shares were down as much as 30 percent.

“It’s fear and panic,” said David Bianco, chief U.S. equity strategist at UBS in New York. “People are beginning to lean toward outlooks now of all the dominoes falling, that the U.S. economy slides into recession because of this credit crunch, and it has an adverse impact on the global economy and even the globally exposed sectors.”

Steve V.

What influence could the rise of hedge funds have on market volatility? It seems like markets swing more wildly than ever and I have heard these funds thrive in unstable markets using their more sophisticated nature to take advantage of less savvy investors and fund managers.

I’ve heard this yet wonder what your take on it is. Thanks.

I haven’t looked into the effect of hedge funds on the market. Your “story” sounds good, and that might indeed be the effect, but I don’t know. Of course, now that you brought it up, I’ll probably google around tonight and see if anything has been written on it.