Obama Joins in on Burdensome Transparency Act

Senator Obama has joined Senators Norm Coleman (R-Neb Minn) and Carl Levin (D-Mich) to introduce the “Incorporation Transparency and Law Enforcement Assistance Act”.

Today Senator Carl Levin (D-Mich.), Senator Norm Coleman (R-Minn.), and Senator Barack Obama (D-Ill.), Chairman, Ranking Minority Member, and Member of the U.S. Senate Permanent Subcommittee on Investigations, introduced the Incorporation Transparency and Law Enforcement Assistance Act to help law enforcement stop the misuse of U.S. corporations.

Currently, nearly two million corporations and limited liability companies (LLCs) are formed within the United States each year. The States generally form these corporations without asking for the identity of the corporation’s beneficial owners, and numerous law enforcement problems have resulted when some of these corporations have become involved with money laundering, tax evasion, or other misconduct. The bill being introduced would require the States to obtain beneficial ownership information for the corporations formed under their laws and to provide access to this information to law enforcement upon receipt of a subpoena or summons.

Stephen Bainbridge explains the problems with this bill, and the one that caught my eye was this:

2. It increases the paperwork burden on small businesses, as all corporations and limited liability companies – even very small mom and pop businesses that are only engaged in interstate commerce by virtue of the sweeping definition given that term in Wickard v. Filburn – are subject to a new annual reporting requirement. Although the bill apparently will exempt firms subject to SEC registration, there are a substantial number of firms with a large number of shareholders and a somewhat active market (such as those traded on the pink sheets). Their costs of keeping track of their beneficial owners will go up.

I’d encourage you to read all of Bainbridge’s commentary. The bottom line, though, is that this is a bill that is going to put even more burdens on small companies, barely affect large ones at all, and will do absolutely nothing to solve the problem for which it is ostensibly being introduced to solve. Ugh.

UPDATE: This is not my day for correctly identifying the parties and/or states of members of Congress. As Sam rightly points out in the comments, Norm Coleman is Senator of Minnesota, not Nebraska. I’ve corrected it above.

Wait, are you telling me that companies don’t currently keep track of shareholders and beneficial owners?

I’m always skeptical about criticism of a policy simply because it would “increase paperwork”. If the policy is requiring the creation of new information, than this is a legitimate problem, but if the information already exists in some form, then a one-off cost of automating the conversion is all that is required.

I’m sure SMB accounting software could quickly find a way to track and report all changes in shareholder information, the way they can track income/expenses and taxes.

You’re assuming that mom-and-pop LLCs have automated paperwork. I assure you that a lot of them don’t.

How can you run any business without some kind of computer system in 2008? Are there actually still people who determine how much to pay in taxes by referring to their two column ledger?

A lot of small business owners that I know, especially side businesses, just use Excel or equivalent.

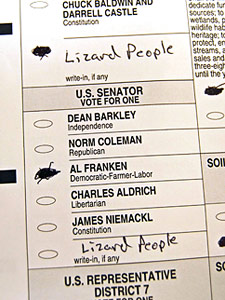

Norm Coleman

(R-Neb)(R-MN)That’s still existing information in electronic form, so again you just have a one-off expense to create a conversion routine and that’s it.

Also, people who use Excel for anything but spreadsheets should be hit with large amounts of paperwork, just on principle.

Regardless, how you convert that to the required forms is an outstanding question, Mike.

The reason you’re not concerned about increased paperwork, I take to be because you’re not a small business owner.

With a converter? Once the information is in structured electronic data, making copies is free, and conversions are a one time expense.

In the case of Excel, a macro of VBA script could do it. For actual accounting packages, they would include converters for you, so it’s just a click of a button.

If you really wanted to avoid burden, the government would provide a web service where the software can automatically submit the signed information on a scheduled basis. Then nobody would have to do anything but keep their accounting data up-to-date, which they should be doing anyway, right?

Presumably Mom & Pop LLCs wouldn’t have any trouble keeping track of their owners, to wit:

1. Mom

2. Pop

Michael, I generally find some value in your comments but here you’re showing your elitist side.

Many, MANY small businesses don’t use or keep much information in electronic form. Anecdotes (not data! ;)): My wife is a groomer, and regularly attends small workshops and such, interacting with nearly every other groomer, dog/cat sitter, etc that serves that business niche between Tampa and Orlando (so not that small a pool). Nearly none of them rely on computers for much more than some appointment setting. We’re talking an interconnected group of small businesses that use paper receipts, date books, etc because it’s EASIER than entering this stuff in a computer, and their margins are slim enough that the applications (which mostly suck) for their environment aren’t worth the cost. They spend enough on other equipment that the digital side doesn’t offer enough benefit to spend on that.

More than just pet related stuff, you’ve also got the people who sell the incidentals that these businesses use, the shampoo vendors, knife/scissor sharpener guys who travel around, independent dog/cat food people (they generally sell homemade treats). Most of these people don’t have much in the way of electronic invoicing either. Add in the time over what they spent just performing the trade that generates income on what they spend keeping track of receipts, travel expenses, and everything else, adding more paperwork or regulations to create the same info in another form and you’re looking at more hours spent NOT generating income.

Further, your comment

really indicates a lack of understanding on how many people just are not that computer proficient. Basic excel is easy enough and allows people to use the computer successfully. More complicated stuff confuses them enough and benefits them little enough that they don’t want to spend the time to learn it. They already HAVE a job and skills…these aren’t worth their time to learn.

Correction: I’m showing my engineering side.

How do they calculate their business tax burdens? Do they have to go through all their receipts from the past year, calculate their income and expenses, find the right tax rate, etc?

Ok, now I’ll show my elitism: GnuCash. It’s not Peachtree, but it’s better than Excel or dead trees.

On the contrary, that comment indicates that I am _painfully_ aware of how most people use Excel.

Well, it appears that the reason this legislation exists is that ‘big’ corporations and/or wealthy individuals are creating things that ‘look’ like mom & pop LLCs in order to engage in “money laundering, tax evasion, or other misconduct.”

If this increase in reporting & record-keeping is too onerous, what _would_ be a good way to detect this kind of fraud?

I have read that Sarbanes Oxley resulted in many corporations moving their headquarters offshore. The law of unintended consequences.

The Pols seem to have hit the right market this time. Where will the Mom and Pops go?

As with Sarbanes Oxley and immigration – aren’t there laws on the books already.

Maybe this is just another Federal land grab.

And now if we could just get a Politician’s Transparency Act through, we might be able to ressurrect the Constitution and get those likability polls for congress about 30%.

BWahahahhahahahhaaaa..

Um… You’ve never programmed automation to a federal form, have you?

Yeah, if only we could fix the government forms to make this easier, but that would take an act of Congress! Ha ha…oh wait.

“”The bottom line, though, is that this is a bill that is going to put even more burdens on small companies, barely affect large ones at all, and will do absolutely nothing to solve the problem for which it is ostensibly being introduced to solve. Ugh.””

“”””””””””””””””””””””””””””””””””””””””””””””””””

The very purpose for which your legislator was born!