Some Information on Mortgage Backed Securities

Alex’s post has prompted me to write this one.

First things first, how long have Mortgage Backed Securities (MBSs) been around? If we believe Wikipedia About 70 years or so.

In 1938, a governmental agency named the National Mortgage Association of Washington was formed and soon was renamed Federal National Mortgage Association (FNMA or Fannie Mae). It was chartered by the US government as a corporation which buys Federal Housing Administration (FHA) and Veterans Administration (VA) mortgages on the secondary market, pools them, and sells them as “mortgage-backed securities” to investors on the open market. FNMA was later privatized.

Lawrence White of the Stern School of Business at NYU says 1970 is when the first MSB was sold.

From its beginning, the issuance of MBS in the U.S. has been dominated by governmental and quasi-governmental entities, although “private label” MBS have been growing in relative importance after a late and slow start. The experience of MBS in the U.S. began in 1970, with MBS issued by Ginnie Mae.37 Freddie Mac, newly created in 1970, issued its first MBS in 1971. Fannie Mae, though in existence since 1938, issued its first MBS in 1981. Finally, the first “private label” MBS was issued in 1977, by Bank of America.

Lets go with the 1970 number, that means that MSBs have been around for 38 years

Did the government create MBSs?

MBSs are a result of government monkeying around in the home loan market. Ginnie Mae stands for the Government National Mortgage and is a government Agency. Fannie Mae was a government agency that was created in 1938 and was later turned into a government sponsored entity and Freddie Mac was a later comer to the game but is similar in nature to Fannie Mae. As we can see from Prof. White’s paper the first one was sold by a government agency, Ginnie Mae.

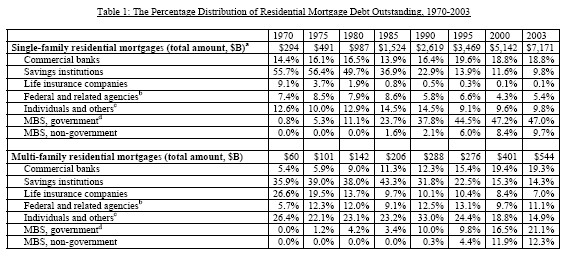

Second the government, through Ginnie Mae, and and also implicitly through Fannie Mae and Freddie Mac gauarntee home loan payments. Professor White also has a nice table showing the percentage of mortgages that MBSs comprised that are government and non-government.

In 2003 government MBSs were almost 5 times that of non-government MBSs.

The bottom line is that the government has its dirty paw prints all over this. Why this is so hard to understand I just don’t get it. Was government the sole/root cause? I wouldn’t go that far, but it was definitely an important factor.

(Quiet nod)

Asset backed securities are not a bad thing. They give people a way to invest in things like mortgages, tons of wheat or corn, piles of money, herds of cattle and sheep, forests of lumber, or just about anything else you can think of without having to buy the whole shipload.

They are rated so that investors know how much they are gambling. A security created from a pile of sub-prime loans would, according to the rules, have a lower rating than one created from normal loans requiring down payments and higher wages.

The problem was created by derivatives which are nothing more than promises to sell or buy assets at a certain price, normally by a certain date. You do not actually have to own anything to offer a derivative for sale. Since the booming market was the housing market, derivatives based on mortgage backed securities became the hot seller. Wall Street and banks pressured the mortgage industry so much for more that lenders began to violate their rules and many bad loans got mixed up with the good loans.

As lenders raised the rates on their ARMs and borrowers began to default and investors, seeing what happened, stopped buying and lenders stopped creating mortgage backed securities. Many investors who had secretly sold derivatives now had nothing to buy and sell. This had an adverse effect on all the other asset backed securities and the derivatives that were based on them. Since the derivatives are mostly unregulated and often sold in secret, no one knows who got left holding the bag and no bank trusts any other bank so, they stopped loaning money.

The problem.

You don’t get it Steve because you routinely cherry [pick the facts that go along with your rather narrow economic ideology. This crisis was the result of a lot of factors and government hold much of the blame. But remember that government involvement in our economy crafted largely by huge moneyed special interests (the people with the cash to fund campaigns) and the banks and wall street barons who have been crafting legislation since the 70’s.

The government does nothing on the financial front that financial industry doesn’t explicitly want. If there was any failure of government policy it’s because the financial industry wanted those regulations on the the books for whatever reason. Why is it so hard for you to understand that government does the bidding of industry, not the other way around.

Rick,

WTF? This is quite similar to what I’ve written, yet you accuse me of cherry picking the data?

Sure, my last post on this mention special interest groups. However, even people with only modest means can often join groups that can have an impact. The idea it is all rich fat cats is just silly. All pressure groups get money, look Obama has raised over $600 million, lots of that money didn’t come from rich people.

Man you are preaching to the choir here. My beef is that the regulations are often wrong irrespective of which way they go. Either too, much, too little, or in complex cases both. Rarely is it ever neither–i.e. just right. Add in the bailing out done by the government and you have a real mess.

What don’t you get about this?

You know, considering you aren’t at all familiar with my overall position on this you are clearly talking out of your nethermost orifice.

Uhhhmmm, I don’t think so. That sound suspiciously like a futures contract not a derivative. Derivatives can be futures, but there are other forms as well such as options and swaps. You really want us to believe that we’d be better off without a futures market?

And Ginnie Mae, Fannie Mae, and Freddie Mac. The latter two were huge players in the Mortgage Backed Securities market.

Okay, I pretty much agree here, but it also leaves out the issue of sub-prime and Alt-A loans that Fannie and Freddie got into as well as other private institutions.

You’ve only painted part of the picture, and sorry a futures market is a good thing.

If you caught the Waxman hearings today, Mssrs. Greenspan, Cox, and Snow stated clearly that the GSEs were a factor but not the main factor.

MBS of good loans are perfectly fine investments. Derivatives thereof bought with leveraged money, not so much. MBS of bad subprime loans are hopeless. Most of the bad loans were not through the GSEs, but their more aggressive, profit-driven business model did expose them to excessive risk not unlike various other firms like Lehman, AIG, Bear Sterns.

In 2003, most mortgages were sound, so who cares if most of the MBS were government. When interest rates got super low and lots of bad loans and cash-out refis started getting written, that’s when government inaction let the bubble grow and burst, and surely the semi-corporate Fannie and Freddie were part of that.

I don’t think this is all that controversial, but those ideologues trying to spin this angle into blaming the bulk of the crisis on long term public policies that facilitated home ownership for millions of credit worthy families over many decades just sound ridiculous. I know this post stops short of that but it still reeks of desperation. It sounded like Greenspan was moving onto acceptance — acceptance that his worldview about markets self-correcting was flawed.

That isn’t to say that the government isn’t part of the mess. Our policy mix was atrocious. Time for a paradigm shift. Blaming mid 20th century liberalism is a non starter.

Steve,

My point is simply that nobody forced investors to buy MBS’s, and nobody forced credit raters to give them undeservedly high ratings.

I’m not saying that government didn’t have A role, just that most of the cause lies on Wall Street, not D.C.

This is only true to a point, and even then not enough to actually effect anything. The lobbing groups for consumers, the poor, working people, and those whose investments are limited to retirement funds are woefully underrepresented and never get to craft legislation the way the banking industry or the energy industry has done in the past. You confuse what is theoretically possible with what is.

My point what that government holds much of the blame for abdicating it’s responsibility for crafting legislation that does the most good for the most people to those interest groups who would craft policy to primarily benefit themselves. The notion that money grubbing poor people are forcing anyone to craft policy on there behalf in order to rob the defenseless wall street barons of their hard earned cash is moronic to the extreme (not that you personally have ever said anything like that, but some use the things you do say to try and make that point).

Correct but onl;y in the abstract. Obama is exciting to a lot of people, so they donate, but you like to make it sound like this sort of thing is not unusual and easy to replicate. It’s not and may be a once in a generation thing. So it’s not your are wrong on the basic premise, it’s just that it’s wrong that it can be an effective check on high money, well organized industry lobbies. Everything possible is not probable.

An example is when the bankruptcy rules were changed. Most people didn’t understand what was happening or how it might effect them. All they got were stories about dead beats who skived off on their responsibilities. What they didn’t understand is that the lax bankruptcy rules forced lenders to have “skin in the game” and made them be more responsible lenders which was a good thing. But that notion was lost one a public that only got one side of the story. I could go on all day citing smiler examples.

But there are no “free markets” Steve. It’s a myth. Regulations create markets. Without the government sanction of the notion of a cooperation there would be not stocks and no market for stocks. With out rules and regulations that stock market would grind to a halt by someone bringing in the OJ jury every time a price was misquoted. The idea that markets are a better way of allocating resources is a complete joke unless you are talking about goods and services that are pure commodities. The foundation of this notion is that the more profitable the activity is the more deserving it is of resources. This has been proven time and time again to be pure moonshine (and it’s why we can;t discuss it because to do so would take a book not a blog comment.)

The basic notion I question is the idea that government runs industries that are beholden to it’s fickle political whims when the truth is that it’s the other way around.

oh very nice , and Steve you write like shit so most of us don’t know what you are talking about half the time anyway. But what I understand is that, most of the time, you can’t differentiate between who things work on a spreadsheet from how thing work in the real world (hence the moronic argument about how poor people can band together to take on powerful lobbies). If you can’t put it in to a model or a metric you can’t understand it.

Fact is that you an I agree on a lot of things, far more things then I agree with most libertarian types but you would rather engage people on a pissing contest level then an actual exchange. I expect it out of guys like Bithead, you I keep holding out more hope. 🙂

I find Alex’s inconsistency amusing. Observes Alex:

“My point is simply that nobody forced investors to buy MBS’s, and nobody forced credit raters to give them undeservedly high ratings.”

Drew: Truer words were never spoken. Similarly, nobody “forced” uncreditworthy borrowers to take on mortgages they could not afford, and upon which later they defaulted.

“I’m not saying that government didn’t have A role, just that most of the cause lies on Wall Street, not D.C.”

Drew: Wall Street? Since the core issue is defaulted mortgages, it is the borrowers who are to blame. And how, aside from borrower’s poor judgement, did this happen?

“Wall Street” is a favorite whipping boy, and many are wont to blame the banks for “predatory” lending practices. But one cannot escape the fact that the mid-90’s push (dare I say HUD threats) to provide uncreditworthy borrowers with mortgage credit lies at the core of the problem. The last time I looked, HUD was a government agency. Further, perhaps Steve Verdon knows, I don’t believe “Wall Street” has originated a single mortgage loan in its history. They were a syndication conduit for the sale of mortgage loan packages. As Alex observed, nobody “forced” investors to buy MBS’s. Indeed. And I must say I guess I missed the epidemic of hostage takings by Wall Streeters “forcing” loan originators to underwrite those mortgages………….

Alex,

Your…view point is most curious. You claim it wasn’t government when government first created MBSs. You claim government has no role when government either explicitly or implicitly guaranteed the home loans. You claim government has no role when Fannie Mae and Freddie Mac were snapping up any and all mortgages near the end of the bubble and securitizing them and both are government sponsored entities.

Sure there was a disconnect between the suits and the geeks in many financial institutions when it came to determining/evaluating risk, but that isn’t the root cause. Like any tree this poisonous bush has several roots some of which go to the government.

And this doesn’t get into my issue with dynamic inconsistency (time inconsistency) of government policy which may have also been a factor.

Government did not guarantee the home loans. There was an explicit guarantee of the paper issued by Fannie May and Freddie Mac but government never guaranteed the individual loans.

The private credit institution that bought the individual and/or “packaged mortgages” were basing their strategy on the premise that home prices never fall and that the “packaged mortgages” were high quality credits paying higher rates than the ranking assigned them by the private credit agencies. Government had nothing to do with it.

This was the root cause not the government backing of freddie mac and fannie may paper that allowed them to borrow at a lower rate than they otherwise could have.

Your entire argument is based on points that have no basis in reality.