Tax Increases For the Middle Class–Nope

According to this story President Obama is planning on letting the Bush tax cuts and the ATM.

In the 2010 budget tabled by President Barack Obama on Monday, the White House wants to let billions of dollars in tax breaks expire by the end of the year — effectively a tax hike by stealth.

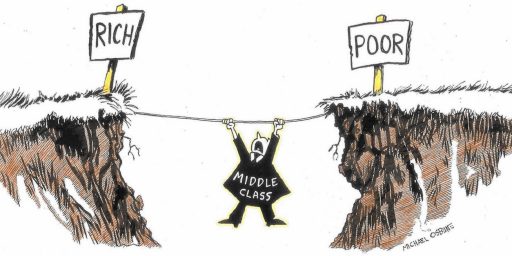

While the administration is focusing its proposal on eliminating tax breaks for individuals who earn $250,000 a year or more, middle-class families will face a slew of these backdoor increases.

[…]

If the provisions are allowed to expire on December 31, the top-tier personal income tax rate will rise to 39.6 percent from 35 percent. But lower-income families will pay more as well: the 25 percent tax bracket will revert back to 28 percent; the 28 percent bracket will increase to 31 percent; and the 33 percent bracket will increase to 36 percent. The special 10 percent bracket is eliminated.

Investors will pay more on their earnings next year as well, with the tax on dividends jumping to 39.6 percent from 15 percent and the capital-gains tax increasing to 20 percent from 15 percent. The estate tax is eliminated this year, but it will return in 2011 — though there has been talk about reinstating the death tax sooner.

[…]

Without annual legislation to renew the patch this year, the AMT could affect an estimated 25 million taxpayers with incomes as low as $33,750 (or $45,000 for joint filers). Even if the patch is extended to last year’s levels, the tax will hit American families that can hardly be considered wealthy — the AMT exemption for 2009 was $46,700 for singles and $70,950 for married couples filing jointly.

I don’t see how this wont be a campaign issue and it could be an expensive one for the Democrats.

Update: Reuters has pulled the story.

Update II: And this one notes that Obama’s budget will extend Bush’s tax cuts for the middle class.

Update III: And here is part of the 2011 budget that addresses the Bush tax cuts (pages 39-40).

Allow the Bush Tax Cuts for Households Earning More Than $250,000 to Expire. In the last Administration, those at the very top enjoyed large tax breaks and income gains while almost everyone else struggled and real income for the middle class declined. Our Nation cannot afford to continue these tax cuts, which is why the President supports allowing those tax cuts that affect families earning more than $250,000 a year to expire and committing these resources to reducing the deficit instead. This step will have no effect on the 98 percent of all households who make less than $250,000.

This is what I thought the Obama Administration would likely do. Still, from a fiscal standpoint it is going to make the situation worse than better. Of course, considering the weak nature of the economy allowing the tax cuts to expire for everyone probably is not the best course either.

The deficit numbers projected by the CBO and that we’ve been bandying about for the last couple of days assume that the tax cuts will be allowed to expire. Without that the deficit for the 2011 budget would be substantially higher.

I saw Grover Nordquist on a PBS interview once. I think it was around the middle of the GWB span. Grover made a bit of a game by answering a number of questions with “I don’t care, as long as I get my tax cut.”

That interview made Nordquist my poster-boy for right-wing stupidity. He really didn’t care what wrack and ruin the GWB policies produced … as long as he got his tax cut.

Looking back now at GWB spending we absolutely know those tax cuts were unsustainable. Even in an economy with nominal growth, with a Republican President and a Republican Congress, spending could not be brought in line with the “temporary” tax cuts – tax cuts set with an expiration date.

Now Steve V is writing a series of laments that the temporary tax cuts should never go? Grover would be proud.

Steve, I think you’re getting whipsawed by a simple political calculation. The CBO deficit report was released on Monday with Orszag doing wall to wall defense on the cable news networks to mollify budget concerns. Nobody was supposed to look too closely at the CBO’s assumption that the Bush tax cuts would expire.

Some day in the future, when deficits are not front in center, we’re going to have a bunch of tax breaks for the middle class, in addition to making the Bush tax cuts permanent for those under $250k.

Your conclusion is vague. Should we have kept the tax cuts for everyone?

Steve

So PD, you actually have an expectation that our society will cut its national spending to make it in-line with those Bush-level taxes? Isn’t that a big gap to close?

Oh, :-), maybe you mean “someday” when $250K is median.

I’ve offered no opinion, other than I think Obama will essentially keep the Bush tax cuts (plus more) for those under $250k; his administration simply didn’t want this to be clear at the time deficits were being talked about.

I seem to remember that raising taxes on $250K and over and keeping everyone else where they are was what he has been stating his plan was since at least March ’08. Why is this a surprise?

Yes the deficits are bad, but, believe it or not, Obama seems to be getting some work done on getting them under control. Eliminating supplemental/emergency expenditures for Iraq and Afghanistan (and, possibly, Haiti) will be huge, if he can manage it.

It took eight years of gross mismanagement to get ourselves into this mess of overspending, it will take more than a year to get out of it. (Particularly with Congressional Republicans currently acting like six year old that didn’t get a piece of candy at the store.)

No, I’m saying that due to fiscal mismanagement for the past 30 years and the current economy we really don’t have much room to do much of anything.

Raise taxes? You might very well kill the fragile recovery. Leave tax rates unchanged? You’ll let the debt levels rise to levels that are often linked to lower growth. Cut spending? Same problems. We’ve let our public sector become such a large part of economy that we can’t really cut it and expect no downside regarding the economy.

We’ve boxed ourselves in. What are we to do? There is no easy painless answer. And politicians don’t like pain, because they tend to get fired for it. So they’ll go on pretending there is no problem till the problem becomes so severe that things start to try to right themselves anyways. That will be really painful for all of us, IMO.

No, not really. When we go over 100% debt-to-GDP ratio, I’ll put up a post for you to comment in then.

Uhhmmm, no. It took about a year really. Sure Bush ran deficits, but there was a recession. So cut taxes (or increase spending) what politician wouldn’t do that. Sure, we can point the rhetoric and that Bush was going to do it anyways, but the timing, in the end, was fortuitous. And deficits were getting smaller. Then economy tanked and here we are. In about a year we went from about 60% debt-to-GDP to 80% and rising.

I want to be clear, I’m not being partisan here, I’m looking at the numbers and while debt rose under Bush, the rate has accelerated tremendously in the last 2 years.

Given that Team Obama is likely going to keep the Bush tax cuts for people under $250k/year it will make the CBO’s deficit/debt numbers look even worse.