The End of the Euro Will Be Blogged

We haven’t posted much about it here but it’s certainly receiving a lot of attention on the other side of the pond. The ongoing fiscal problems of a number of the members of the European Union—Portugal, Ireland, Italy, Greece, and Spain, not so affectionately being referred to as “the PIIGS”—appear to be reaching the boiling point. Here’s a snippet from an op-ed from today’s Spiegel Online:

We haven’t posted much about it here but it’s certainly receiving a lot of attention on the other side of the pond. The ongoing fiscal problems of a number of the members of the European Union—Portugal, Ireland, Italy, Greece, and Spain, not so affectionately being referred to as “the PIIGS”—appear to be reaching the boiling point. Here’s a snippet from an op-ed from today’s Spiegel Online:

Europe is in the worst crisis of the postwar era. For months, the governments of the European Union member states have proven to be incapable of developing a convincing solution for the serious debt problems of individual countries, as well as for the reduction of imbalances within the monetary union. Uncertainty among investors has grown in recent weeks, which is primarily attributable to the helplessness of political leaders, and only secondarily to the influence of speculators.

The jeremiad concludes:

To ensure sound fiscal policy in all member states in the long term, an additional sanction mechanism would have to be incorporated into the Stability and Growth Pact. For countries that show an “excessive deficit,” the community would have to be granted, in national constitutions, the possibility of adding a surcharge to the national income tax or value-added tax. The advantage of such a measure, as opposed to the sanctions currently provided for under the Stability and Growth Pact, is that it would reduce, rather than increase, an individual country’s problems.

The future of the monetary union, however, depends on more than just solving the current debt crisis. An improved balance of growth is also needed, and Germany plays an important part in that respect. The fact that domestic consumption in the largest euro-zone member has been stagnant for more than a decade is a state of affairs that is unacceptable for the entire system. Anyone who sees this as a virtue must ask themselves whether Germany’s export successes would have been possible if other countries had behaved as “virtuously” as we have. It says a lot about the level of the debate that such simple and fundamental insights are apparently difficult to get across in Berlin. There is no other way to explain the current approach of waiting for an upturn in exports, in the hope that that will revive our economy again. Without massive efforts on our part to create a more dynamic domestic economy in Germany, the euro zone has no future.

The author provides no hints on how or whether Greece would enforce such a tax surcharge or whether increasing revenues alone will solve Greece’s fiscal problems. There are good reasons to believe that Greece would not be successful in enforcing such a tax increase:

Tax dodging in Greece is so rampant that the Bank of Greece estimates the country could be losing as much as five billion euros a year. While that’s a far cry from the €54 billion needed for 2010, it could result in much harsher cuts as the country tries to get out from under its crushing debts.

and to believe that Greece’s problem is not too little revenue but too much spending:

For Greece the historical precedent suggest that a fiscal adjustment of 10 percentage points of GDP ought to be possible. But it might be based only on tax increases without reductions in expenditure and it is likely to leave the debt to GDP ratio at such a high level (150% of GDP) that the country would likely be excluded from financial markets for a long time.

See also here.

It is unlikely that Greece will be able to grow its way out of its problems. Its primary industry is tourism and it is doubtful that can be further potentialized without changes in the world situation that are simply beyond prediction and beyond Greece’s ability to control.

Nouriel Roubini, fondly known as “Dr. Doom”, is predictably gloomy about Greece’s prospects:

Nouriel, of course, takes that kind of thinking to its logical conclusion, and kicked off the panel by announcing that it was just in time: “in a few days,” he said, “there might not be a eurozone for us to discuss.” There’s no way that Greece can implement the 10% spending cut it needs to do in order to stop its debt spiralling out of control at current interest rates — and even if it did, the economic effects would be disastrous.

Nouriel’s base case, then, is Argentina 2001: after all, Greece has a much higher debt-to-GDP ratio, much higher deficit-to-GDP ratio, and much higher current-account deficit than Argentina had back then. And if that’s the base case, there’s no way that Greek debt should be trading anywhere near its current levels.

but so is Mohamed El-Erian writing at the Financial Times:

The Greek debt crisis is now morphing into something much broader. No wonder the European Union and the International Monetary Fund are scrambling to regain control of the rapidly deteriorating situation. There is talk of a bigger bail-out package for Greece. The heads of the European Central Bank and IMF have made the trip to Germany that is reminiscent of the Ben Bernanke-Hank Paulson trip to Congress in the midst of the US financial crisis.

He goes on to warn that Greece may default. Paul Krugman is alarmed, to say the least:

Think of it this way: the Greek government cannot announce a policy of leaving the euro — and I’m sure it has no intention of doing that. But at this point it’s all too easy to imagine a default on debt, triggering a crisis of confidence, which forces the government to impose a banking holiday — and at that point the logic of hanging on to the common currency come hell or high water becomes a lot less compelling.

And if Greece is in effect forced out of the euro, what happens to other shaky members?

I think I’ll go hide under the table now.

Portugal is in a similarly difficult position, largely born of inadequate economic growth. As noted in the piece on Nouriel Roubini’s statements cited above, Spain is in even worse shape.

In the near term this will mean that holding Euros is unlikely to be a substitute for holding dollars as a reserve currency and that in turn will increase the demand for dollars, propping up their value and depressing our exports.

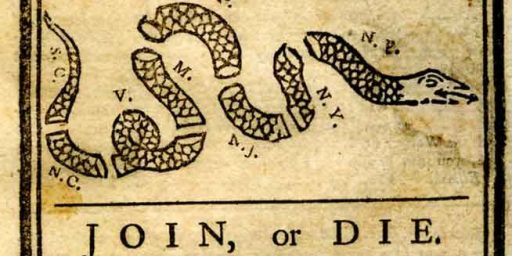

At this point the health of the Euro is largely dependent on the willingness of Germans to support their more profligate neighbors. If the op-ed in Der Spiegel is any gauge, their patience may be wearing thin. In the longer term Europeans must find some better resolution to the folly of a common currency without common fiscal policy.

Haven’t much time myself this morning, but I’ll mention that Felix Salmon has been doing good coverage. The line “Nouriel Roubini, it can be safely said, gives good panel” was funny.

I realize this has larger implications, but I think the really important thing is that I’m doing some personal appearance deals that are priced in Euros. So I could be screwed if the Euro collapses.

Harry, next time ask for gold or can goods..

Missing in all this, of course, is how Obama/Reid/Pelosi et al and their “Trillion Dollar Stimulus to Nowhere”,Government Motors, Obamacare,etc., have placed us on our own collision course with financial panic and ruin. “The VAT will save us!” they say. Except those in the worst trouble already HAVE a VAT which has been steadily increasing to no avail. Krugman is right to be hiding under a table. We’re seeing the fruits of his great ideas come to pass. It’s no longer the outmoded “tax and spend” of yesterday. No..Those are the failed policies of the past. Now it’s the all new “spend- then tax.” Brilliant! That deserves a [Nobel]prize..and a trip to Greece.

Too much hinges upon Germany. I dont follow the internal politics of Germany closely enough to have a good feel for where they are going, but what gets printed over here looks negative. Would be interested in james’ take on the defense implications of the EU falling apart.

Steve