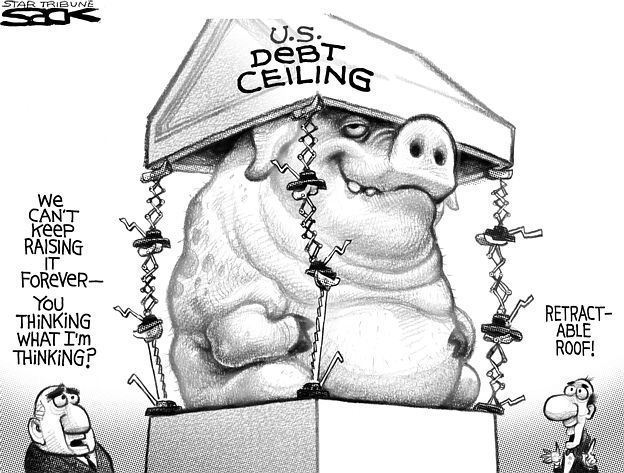

The Debt Ceiling Will Be Raised — Get Used To It

Demanding that the new GOP House hold the line at the current number is satisfying rhetorically, but all-but-impossible politically.

Sometime in the next several weeks, federal government debt will hit the Debt Ceiling, which Congress raised to $14.29 trillion last February, a mind-boggling number. I’m fond of the Boxcar Metaphor, so I ran some back-of-the-envelope calculations to bring that popular visualization up to date:

- A single $1 bill measures 0.06890922 cubic inches.

- One million dollar bills total 68,909.22 cubic inches (39.88 cubic feet)

- So $1 trillion dollars is 39,880,000 cubic feet.

- A standard CSX 50′ boxcar has an interior capacity of 5,238 cubic feet.

- Thus, $14.29 trillion would fill 108,798.24 boxcars.

- The total length over couplers of a 50′ boxcar is 54′ 5″ (653″).

Thus, $14.29 trillion dollars in singles would fill a train 1,121 miles long to transport, not counting engines. Such a train would stretch from my hometown of Louisville, KY to the outskirts of Santa Fe, NM, assuming a straight track all the way.

Well, I’m sorry to have to say this to my fellows on the right who are so adamant that we not raise the Debt Ceiling, but we’re going to have no choice at all but to add quite a few miles to that train. Demanding that the new GOP House hold the line at the current number is satisfying rhetorically, but all-but-impossible politically. Our fiscal house is simply too disordered to bring it into line in the very short window before the magic number is reached. That would be true even if we had a Senate that would go along.

The federal government will not default on its debt obligations if it doesn’t raise the Debt Ceiling. That claim is obviously specious, amounting to little more than fear-mongering. In reality, a few exceptions aside, both positions are mere posturing. Speaker Boehner has, thankfully, avoided this seductive trap and framed the issue more realistically:

I’ve been notified that the Obama Administration intends to formally request an increase in the debt limit. The American people will not stand for such an increase unless it is accompanied by meaningful action by the President and Congress to cut spending and end the job-killing spending binge in Washington. While America cannot default on its debt, we also cannot continue to borrow recklessly, dig ourselves deeper into this hole, and mortgage the future of our children and grandchildren. Spending cuts – and reforming a broken budget process – are top priorities for the American people and for the new majority in the House this year, and it is essential that the President and Democrats in Congress work with us in that effort.

The idea of tying a Balanced Budget Amendment to any increase in the Debt Ceiling is powerfully attractive but, alas, probably more than can be accomplished right now. That’s not to say it shouldn’t be a bargaining chip in the debate, it’s just that we run into the aforementioned problem of a Democratic Senate that simply won’t go that far. There’s always utility in the leadership being pulled by its base, but I fear that they’ll take any compromise that falls short of their desires as “caving.” In the long run, that would do more harm than good.

As a practical matter, Boehner’s call for significant spending cuts and meaningful budget reform are the sort of reasonable, achievable goals we should expect to be accomplished in the current political environment. And with the overwhelming majority of the public opposed to raising the Debt Ceiling at all, he’s got the leverage to make it happen. If Boehner & Co. can accomplish that and put us on a long-term path toward fiscal sanity, they’ll deserve applause.

I had a suggestion to shut up those screaming “crisis!” now. A package deal — debt ceiling of 15 trillion now, but goes down to 14 trillion on Dec 31. And down one trillion a year for the next ten years.

The cynic in me says it would pass and then be broken immediately, but I think it’s a workable plan…

J.

Before we can pay down any debt we must first stop borrowing and we are a long way from that. This ship of state turns slowly but turn it must. What can’t go on forever must eventually stop and we can’t keep borrowing more and more.

The debt ceiling must be raised but we have to stop spending soon.

How do you reconcile a Balanced Budget Amendment with the CUTGO plan they implemented. How can you even pretend that they are serious about reducing the debt when they still wont touch Medicare? Have you even looked at the source of our future debt? Here, I will help you out. I will know that you and other members of the GOP (and libertarians who claim to care about debt) are really serious about this when you pledge to repeal Medicare Part D. It was completely unfunded. It adds a massive amount of spending to our budget.

Steve

As a libertarian GOPer, I would eliminate Medicare Part D this afternoon if I could. I’d also privatize SS, repeal ObamaCare, and significantly cut military spending/overseas deployments.

How’s that?

With all the talk about how much of our debt is held by the Chinese, it is interesting to note that it is roughly equal to our outstanding student loan program, which has a default rate of more than 25%. How about we take the student loans and give them to the Chinese as payment?

That should give us a buffer on the debt ceiling.

@Dodd

I think he’s in the “seductive trap,” too: “I’ve been notified that the Obama Administration intends to formally request an increase in the debt limit….While American cannot default on its debt [that is, I agree the debt limit must be increased lest we do default], we cannot also continue, etc.”

Or so I read him: “Yeah, we have to increase the debt limit so we don’t default, but we also have to control spending.” I.e., Republican boiler plate.

@Sam

I considered specifically mentioning reference to default, but decided not to because it’s implicit in my overall criticism of that assertion. But, no, the “seductive trap” is posturing at one extreme or the other. Since everything else he says is pretty much spot on, he isn’t in it.

We could get out of the deficit crisis by going back to Clinton era tax rates and closing the corporate tax dodges.

Will the debt limit be increased? If all one has to go on is past performance the answer is yes.

Should the debt limit be increased? If you want to reduce government spending the answer is no.

Dodd, end the Bush TAX Cuts, all of them.

Yeah, let’s raise taxes almost $4 trillion in a recession. That’ll help.

As has been said a million times, we don’t have a revenue problem. We have a spending problem. Spending as a percentage of GDP is higher than at any time since WWII:

Extracting more money from the private sector won’t solve the problem. Cutting spending is the solution.

In this case Dodd, I disagree. Making the problem any worse is not the solution, Better to take our medicine now and start cutting immediately, back to. say, the safety nets we had in 1990.

We’ve been through the kabuki dance before of accepting higher taxes or more debt with the promise that spending would be reined in or cut. It’s always been just another big lie.

top p, seriously, look at a chart of fedeal spending the last thirty years and you can easily see that the problem isn’t that we aren’t taxed enough but that spending has gotten completely out of control. It’s f*cking criminal.

“As has been said a million times, we don’t have a revenue problem.”

Actually we do. We have usually taken in 18-19.5% of GDP in federal revenue. For 2009 and 2010 it has been about 14.8%. It is even worse when you factor in the decrease in GDP.

On the spending side, your chart is misleading. It includes the stimulus. This spending bum will recede, but we will be left with entitlement spending which is what will drive future debt.

Steve

The 90s were prosperous all around, so you can’t argue those tax rates are punative and the 00s and the overall anemic growth during that time period prove the Bush tax cuts weren’t particularly stimulative.

I have no problems with taking 4T out of the “private” economy (where it is at best spent to benefit a relatively few wealthy people and more often being moved out of the country (or horded) by large corporations and banks) to provide basic services to everyone and actually putting it back into circulation.

When the wealthy of this country really are suffering or being asked to sacrifice anything meaningful then we can revisit the conversation of cutting services.

“The debt ceiling must be raised but we have to stop spending soon.”

Social Security, Medicare, Medicaid, and Defense…have at it…

“How’s that?”

All that’s fine in Ayn Rand Land…but none of it will happen in the real world…

“top p, seriously, look at a chart of fedeal spending the last thirty years and you can easily see that the problem isn’t that we aren’t taxed enough…”

Oh? Are not tax rates at the lowest they’ve been in a very long time? If we are going to look at spending as a percentage of GDP, let us also look at tax revenues as a percentage of GDP…if it can be argued that spending is too high, it can also be argued that tax revenues are too low…seems like both things need to be adjusted, as they inevitably will be…

So many problems, where to start?

“The federal government will not default on its debt obligations if it doesn’t raise the Debt Ceiling. That claim is obviously specious, amounting to little more than fear-mongering. ”

Actually it’s that argument that is specious since it goes something like this: There’s no reason we have to default just because we don;t raise the debt ceiling, which is true if you posit some magical way to close the deficit for this year in the few remaining months left. Which is, you know, insane bullshit. Without that magical pixie dust budgeting, not raising the debt ceiling does in fact mean a default.

“As has been said a million times, we don’t have a revenue problem. We have a spending problem. Spending as a percentage of GDP is higher than at any time since WWII”

Yes and right now spending should be way higher than it was during WW2. We are, you know, prosecuting a hugely expensive “war” (more than one if you consider the “war” on drugs too). We’re also in the middle of a huge recession, you know that thing solved by spending? Oh and we have a significantly gray-er population than during WW2.

All of which means that if we are spending less than during WW2 we ABSOLUTELY have a spending problem.

We certainly need to do something about government pensions at all levels. In California, this is the elephant in the room that politicians don’t want to talk about. I don’t know as much about federal pensions, but state and local are totally out of hand here.

@c.red

Since $3T of that almost $4T was left in the hands of the middle class when everyone from Obama all the way over to Jim DeMint agreed those rates wouldn’t be touched, your class warfare fails.

Your economics would fail anyway, even if that weren’t the case. Unless the Hoover tax policies that gave us the Great Depression have suddenly become a good idea.

@Thaloc

Perhaps you could try reading the linked articles. Gov’t revenue is more than adequate in the short term to cover debt service. That’s a no-brainer, since that has to be prioritized over nice-to-have-but-nonessential discretionary spending.

The notion that Afghanistan and Iraq (and even the WO(S)D) are comparable to the entire United States economy being turned to a war footing is a non-starter. Expensive though they are, they’re a drop in the bucket compared to the percentage of GDP we devoted to WWII.

We’re never going to be able to tackle the $75T or so in unfunded long-term entitlement obligations hanging over our heads by continuing the same profligacy that’s landed us in this mess.

Talk about “insane bullshit.” Ye gods.

Err… Not really.

http://costofwar.com/en/

Do the math.

Dodd,

One way of reading your “spending as a % of GDP” chart is that GDP is the problem, not spending. Excluding the continuing weak economy and the one-off stimulus since 2008, gov’t spending is about where it’s been for four decades.

You hit on the issue yourself when you rejected a tax increase “in a recession”.

People who are intellectually honest- in this case, including yourself- admit that meaningful spending cuts have to involve reducing entitlement payments. My question is why that cutback won’t have just as nasty an effect on the fragile recovery as a tax increase? Either way you’re hurting the household budgets of millions of people who tend to spend most of what they make.

Wouldn’t it be smarter to wait until unemployment is lower, government spending is more likely to be crowding out, and the economy can better weather a storm, before we start talking about extracting spending concessions? In other words, why is $14T such a magical limit? Why not $20T, if spending the extra money helps the economy grow proportionally?

It is the nature of government at all levels to have a spending problem. When taxes are raised spending is raised, when taxes are cut spending is raised. It’s been that way for decades so raising taxes is not the answer.

Government, again, at all levels, should be doing or not doing whatever it takes to grow the economy and let the private sector create jobs (notice I didn’t say the government should create jobs?). They shut off energy though we need it desperately, they regulate to the absurd, and they eat away capital markets leaving crumbs for the private sector. Our government has become a parasite killing it’s host.

That sound a lot like the Broken Window Fallacy.

And I obviously don’t think $14T is a magic limit, since the whole point of my post is that we’re going to have no choice but to go past that number.

The stimulus cannot be adjudged anything other than a failure, even measured on its own terms. Quantitative Easing is already increasing inflation, sapping the working class of their buying power (which is nothing other than a hidden tax increase). And, directly to your point, debt service will become unsustainable as we approach $20T. Near-zero interest rates and conversion of a lot of debt to short term notes has kept debt service from skyrocketing for the last few years, but obviously rates will eventually go back up. A return to historical average rates (5% or so) would put debt service on $20T at just over $1T, exceeding all discretionary spending.

Now is the time because now the political conditions exist to actually accomplish the task. Which is fortunate because we simply cannot continue on the current path.

Dodd : You’re magical OMGZ WE CANNOT RAISE TAXES 3% ON THE RICH WHO ARE SITTING ON THEIR MONEY CAUSE IT”LL KILL THE ECONOMY (because how will the banks survive if the rich put a couple million less in the banks???)!!! but cutting millions out of the pockets of the people who would be forced into spending the money asap is good. Kinda blows my mind…

The current tax rates in the United States are very low compared to other industrialized nations in general…

I’d like to see some proof on the assertation that $3 Tr would be taken from the middle class by raising the tax rates (heck, on your assertation that $4 Tr would be taken out of the economy by raising the tax rates as well). But here is the thing; so what?

The middle class of America is still relatively wealthy. The effects on lifestyle would be almost negligible; I lived through the nineties they weren’t a time of economic turmoil or social despair (much less so than the last decade). Most of the programs you want to eleminate just distribute lots of money back to the middle class, and provide a safety net of basic services that nobody wants to use, but everybody is grateful for when they need them. Incidentally, those programs also provide some opportunity for some individuals to escape poverty cycles and become more productive to society as a whole, which is a net good for everyone.

You can call it class warfare if you want, but I tend to think of it as paying back to the system that allows us to earn our priviledge and a minimum moral obligation to our fellow citizens.

The cost of extending the tax cuts for everyone for the next 10 years would approach $4 trillion, the Associated Press reported, citing congressional estimates. Eliminating the breaks for the top earners would reduce that bill by about $700 billion.

$4T – $700B = $3.3T.

Of course, the words “cost” and “bill” are totally inappropriate. It’s not the government’s money.

And, BTW, reducing military spending or giving individuals ownership of their retirement accounts do not constitute cutting “social safety nets” that benefit the middle class. Eliminating Medicare Part D doesn’t either, since it’s not a safety net but, rather, a program available to everyone.

“Of course, the words “cost” and “bill” are totally inappropriate. It’s not the government’s money.”

Really? Who minted it? Who sets its value through inflationary policy? Who criminalizes defacing or destroying it? Who sets limits on how it can be transported and used?

It IS the government’s money. They have created a legal scrip and there is an implicit contract involved when we choose to use that scrip. The value may be ours but as soon as we choose to take US GOVERNMENT BILLS as the medium to carry that value we have to accept that they are government property that they may take back when and they like, in return for the service of having them.

Don’t like it? Use barter.

“And, BTW, reducing military spending or giving individuals ownership of their retirement accounts do not constitute cutting “social safety nets” that benefit the middle class.”

Technically true, but in practice false. That’s because a safety net that you can squander is NOT a safety net. It has to be safe or it is not a safety net at all. And there’s simply no way to argue that privatized accounts are safe.

Ye gods.

A few comments:

– The graph that Dodd linked to is slightly misleading wrt to the magnitude of Federal spending, since it also includes state/local spending.

– The $14 trillion in debt includes both publicly-held debt ($9-some trillion) and intra-government- debt, such as the Social Security trust fund. This makes a difference when calculating such things as the direct burden on the taxpayers for servicing the debt should interest rates rise.

– It doesn’t make much sense to talk about taxes, deficits, and spending in isolation. The total decoupling of taxes from spending is a contributor to our current situation, where the primary tool we have left to force politicians to control spending is to have a deficit crisis.

– There aren’t any magic bullets, such as taxing somebody else, reducing programs you personally don’t care about (aka “government waste”), or other such painless solutions, for fixing this mess.

– Most government spending is either popular with a large portion of the public (e.g. Medicare & other entitlements), or have influential lobbying groups (e.g. various agricultural subsidies) . Some other government functions, such as some public health services, may be worth keeping but don’t have a lot of lobbying power behind them. Finding enough programs to cut that 1) It makes sense to cut them, 2) The cuts might actually make it through the political/lobbyist meatgrinder, and 3) The total cuts add up to a significant amount of money, is going to be hard.

– Politicians who go into the deficit reduction process with the idea that cuts in major budget items (defense, Medicare, Social Security, etc) are off the table or that any tax increase is impossible are crippling themselves, both by ignoring ways to cut spending/raise revenue and by hurting their options for negotiations with members of the other party.

‘Of course, the words “cost” and “bill” are totally inappropriate. It’s not the government’s money.’

It is true that it’s not the government’s money,

It is false to say that it’s totally inappropriate to use the word “bill”.

To see why, this analogy might help:

Suppose you give $80 and your credit card to a friend of yours so they can go the grocer and buy $100 worth of stuff. You expect them to spend $80 of cash and put $20 on the card. If, after spending $100, they come back, hand you $20 and say they decided to spend $60 dollars of cash and put $40 on the card, a few things are true:

1) That $20 in cash you just got handed is “your money” in any ordinary use of the term . It doesn’t belong to whoever services your credit card or to your friend. But, that’s not the whole story, because:

2) $20 more will be added to the bill you get from your credit card company.

3) No matter how the $100 is divided between cash and credit, you’re still spending $100 and are responsible, now (cash) or later (credit) , for coming up with that money. If you don’t want that to be true, don’t spend so much.

4) Whether or not your friend did you a service by “letting you keep your own money” depends on your trade-off between having the money now and having more debt. There isn’t a fixed answer to that.

5) If you’re one of those people who thinks, “Hey, I just got $100 worth of stuff for $60!”, then maybe you should have ponied up the $100 in cash up front.

> You can call it class warfare if you want, but I tend to think of it as paying back to the system that allows us to earn our priviledge and a minimum moral obligation to our fellow citizens.

That makes you a decent guy. Pretty sure the tea party won’t have you now that you are on record though.