Federal Budget Cuts That Exempt 65% of Spending

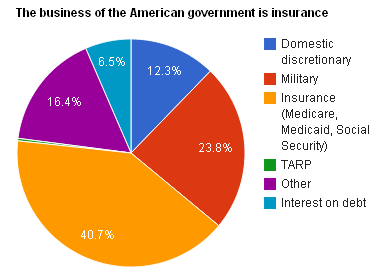

Ezra Klein dubs the Federal government "an insurance conglomerate protected by a large, standing army."

Ezra Klein looks at a pie chart of Federal spending and concludes, “it’s an insurance conglomerate protected by a large, standing army.”

That’s about right. He’s also right when he adds,

But you wouldn’t know it to listen to the debate over the budget. When House Republicans talk about cutting spending and the Obama administration talks about freezing spending, neither group is talking about the vast expanse of the government’s commitments. They’re looking at a small corner of the budget, the 12.3 percent known as non-defense discretionary spending. The stuff that’s not Medicare, not Medicaid, not Social Security or the military. It’s the odds-and-ends, so to speak.

[…]

Politicians get this: Deficits are unpopular, and so are the specifics of deficit reduction. So they’ve developed a few ways to sound fiscally responsible without committing to anything politically damaging. The term “waste, fraud and abuse,” for instance. There is plenty of waste, fraud and abuse in the government, but there’s little agreement on what that waste, fraud and abuse is. Farm subsidies, for instance, don’t seem like waste to farmers. The defense budget looks tighter to hawks than it does to doves. Gov. Mitch Daniels was right when he told the crowd at CPAC that waste, fraud and abuse are worth little when it comes to cutting the deficit. Focusing on the three items “trivializes what needs to be done, and misleads our fellow citizens to believe that easy answers are available to us.”

Promising to freeze non-defense discretionary spending has also come into vogue. It has the dual advantages of sounding tough while remaining vague. But the single biggest chunk of that spending is on education — and education, according to the Pew poll, is the part of the budget that Americans are least interested in cutting. As more specifics of these freezes emerge, and more of the people who depend on or favor these programs protest, we’ll see how they fare.

Now, I’d quibble that most people have no clue that education is mostly funded by states and localities, with the federal component tangential at best and counterproductive at worst. Then again, even if we finally achieved Ronald Reagan’s promise of closing the Department of Education, it would amount to a rounding error compared to Defense and entitlements.

There’s a lot of money that could be cut from the Defense budget; more if you include the off-budget spending on the wars in Iraq and Afghanistan. But it’s politically difficult — and not just because most major military end items are produced across enough Congressional Districts to ensure plenty of allies on Capitol Hill.

And what Ezra calls “insurance” is surely the part of the budget that’s most in need of control, because the Baby Boomers are about to retire and health care costs are skyrocketing. But we’ve just been through something called “health care reform” and managed to simultaneously not to address any of the real problems and create such a toxic political environment to ensure no one wants to touch the issue for a dozen years.

The best we can ever seem to screw up the courage to do is some manner of across-the-board spending freeze or “cut” — often defined in the Washington sense of small increases of spending that are less than the projected larger increase. It’s pretty pathetic, really, but all we’re likely to muster.

Then the easiest way to balance the budget is to…raise taxes.

“Then the easiest way to balance the budget is to…raise taxes.”

But I don’t think you could raise taxes enough, without addressing entitlements, to do the trick. Oh, I suppose if you raised everybody’s taxes 10-15% (and everybody means everybody), then you might be able to do something, but I doubt even that something would do the trick.

It has to be a combination of raising taxes and cutting spending. Who has the balls for this? No-bod-ee.

For the record, I would be open to have my Social Security cut by 10% (even 15%, after that, though…). But I’m pretty sure I’m in the minority of SS recipients. And anyway, Social Security is not the real problem, Medicare is the really, real problem. And here, you talking about asking folks to tolerate a higher level of pain and suffering in their lives. That is a hard sell.

sam’s right: we have to raise and cut. Every other supposed solution is nonsense. Everyone knows it.

In theory we have the Party of Raise and the Party of Cut, except that neither can even be honest within those limits. The Party of Raise only wants to raise on a tiny slice of the population that cannot by itself get the job done, and the Party of Cut seems to think we can balance the budget on the backs of PBS and NPR.

It’s beyond being a dialog of the deaf, it’s a dialog of liars. And the fault lies with the people of this country who bought into magical thinking and now cannot snap themselves out of the dream.

I’m a little uncertain about the operative definition of “easiest” in that sentence. I have a vague recollection that the Obama Administration just found raising taxes or, at least, raising them to a level that might actually do something about the deficit, impossible.

>No ponce the easiest way is to stop spending. We have a government we cannot afford.

So maybe we should just cut 20% off each department, (especially) including the two biggest spenders, defense and insurance?

Nice thought, it will simply never happen under either party.

Head over to Steve’s piece “Understanding the Budget (Graphic of the Day)” in the Quick Takes section, and click on the NY Times link to get a very nice view of what the budge looks like.

About taxes, Kevin Drum says something worth pondering:

if we simply let the Bush tax cuts expire in 2012 — all of them — and went back to the Clinton tax rates of the 90s, our medium term deficit problem would be reduced to 3% of GDP in a stroke. That’s pretty manageable. And we could do it, too: it’s not as if the 90s were a hellscape of jackbooted IRS thugs confiscating all your money and driving the economy into the ditch, after all.

Beyond that, we should do something sensible about reining in the growth of Social Security and Medicare.

In other words, the things we should do are precisely the things that are completely off the table. This is called “listening to the will of the people.” Welcome to America.

I’d throw in the defense budget as something that needs sensible reining in. As Kevin points out, 80% of the federal budget goes to entitlements, the Pentagon, and interest on the national debt. Where are we making the cuts? In the other 20%, natch. As my DI’s used to say, “outfvckingstanding”.

Easy? Why on earth must we approach this problem looking for the easy way out? And easy for who? Politicians? The public sector?

The problem with the ‘easy’ tax raising solution is the effect the raising of taxes has on the economy and economic growth. Moving money from a productive private sector to the rat hole of public spending is no real answer even if it might be easy. The fact is even if we do raise taxes the public sector has no incentive to cut spending. It’s in their nature to always have unmet needs that require higher spending.

The solution is to throw in those other pieces of the pie that are supposedly off limits. I’m fifty years old but know good and well I better accept cuts in Social Security and Medicare. I’m pro defense and know cuts will have to be made there as well. I also know good and well that killing the engine of our wealth creation is the wrong path to go down.

We need pro business policies that have to with production and efficiency not what might be good for Wall Street traders. We need energy at reasonable prices that won’t impede economic growth. We need less California style regulation. We need the simple understanding tat being a business person is no less a being a public servant than anyone down at city hall or the state capital. The unseen portion of the fix is economic growth robust enough to allow us to grow out of some of this problem.

Modern America doesn’t owe it’s success to mid level bureaucrats at the EPA or the last IRS head. It is what it is because of jobs produced by American business and especially small business. Government needs to get out of the way.

A clever soundbite but then where does it take us? In per capita terms our spending on the insurance component is somewhat smaller, and on the standing army considerably larger, than just about every modern western state. Thus in practice there is perhaps some scope for modest cuts in the standing army (which will be ardently resisted by many who insist we have a terminal deficit crisis) but few if any on the insurance side which will soon see increased demands on it’s purse. A budget has revenue side and an expenditure side and faced with above realities it’s inevitable that revenue, which in effective terms is at 60 year lows, will have to be increased. Part of this will come from economic growth and the balance from some modest increases in the tax take. Of course this recognition isn’t advanced by nonsensical and simplistic claims like this:

“Modern America doesn’t owe it’s success to mid level bureaucrats at the EPA or the last IRS head. It is what it is because of jobs produced by American business and especially small business. Government needs to get out of the way.”

That totally ignore the fact that much of US economic success was founded on tariff protection and govt spending on everything from the railroads to the internet

“Now, I’d quibble that most people have no clue that education is mostly funded by states and localities,”

I think you’d be surprised Jim. Half our little town budget goes to the school system and most people I’ve discussed this with over the years have no idea. They think most of the funding for the schools comes from federal govt and the state.

BJ, With due respect my claim is neither nonsensical or simplistic. It points out the one big thing so often ignored by liberals, the private sector creates the wealth this country depends on.

While railroads received land grants the money to actually build came from private investors. The Great Northern built their line without even the benefit of land grants. I expect the government is owed some due for the internet but it was long ago pushed aside as private capital poured in and the internet became what it is today only because of the private sector.

Government spending is inefficient, politically corrupt, and often misguided in it’s application. The private sector van misspend as well but at least it’s their own money the waste instead of mine.

But back to my point, that mid level EPA bureaucrat isn’t creating wealth or even encouraging it. The IRS isn’t interested in the economy but only in tax collections. Let’s throw in the multitudes of agents of government that harass business people across the country. Sound familiar? I don’t have all day to expand on the statement but none the less it is a far cry from nonsensical or simplistic. You could say calling it that is nonsensical and simplistic.

First, there is no reason to touch Social Security, it’s fine. I think all suggestions from those that lump Social Security in with Medicare and Medicaid should be ignored, laughed at, and generally dismissed as the unserious nonsense that they are.

Second, if tax increases are off the table, we are again done. There’s no point bothering with people who are not being serious.

We need to address the growth of medical costs in this country — that is clobbering budget projections for Medicare and Medicaid. But, the Republicans will scream about “Death Panels”, “Rationing” and “Socialism”. Again, they are just not serious people.

We need to chop down the defense budget a bit. We haven’t yet heard the calls of “Traitor!” and “Weak On Defense!”, but given the Republican reaction to everything else, I think it’s only inevitable.

When half the country is run by the Silly Party, you can’t get anything done. I wish the Democrats wouldn’t try to meet the Silly Party half way.

If I had my druthers, we would have an automatic tax increase of 0.5%, on every tax bracket, capital gains, and corporate taxes, each year that the budget isn’t balanced. It would spur the congress-critters to actually get serious about cutting, and drag us — kicking and screaming — to a tax rate that will actually support the government that people want.

Although we could solve most of the budget problems with a combination of tax increases (by letting the Bush cuts expire), judicious cuts and small adjustments to entitlements, I think we should also look at the fundamental problem that creates deficits –

Our government has legislated mandatory spending (social security, medicare, medicaid, and a few other things) without legislating mandatory tax support. Hence as these expenses increase, they consume more and more of the budget.

People like the programs, but are being lied to by politicians about their cost.

Hence, we should create taxes for these items that increase in value automatically to cover increased costs.

If people’s Medicare/Medicaid tax was going up every year to cover increased costs (which drive the bulk of our deficit), suddenly everyone would pay attention to the real choices we make in the budget.

This reform of the process would not only balance the budget, but keep things honest. ALL MANDATORY SPENDING SHOULD BE PAID FOR BY MANDATORY, AUTOMATIC TAXES.

Steven Plunk says:

Monday, February 14, 2011 at 19:30

“While railroads received land grants the money to actually build came from private investors.”

With due respect Mr Plunk it would help if you understood how finance works. If the govt grants you a franchise to build a railway and millions of acres of land (before you’ve laid a rail) which you can then sell to ranchers, farmers, industrial enterprises etc then you’ve a ready made basis for bonding which you then use to finance the building of your railway. Or to take another example the airline industry in this country is essentially based on two govt programs. The mail service which provided much of airline income in pioneering days and then the huge strides in airframe technology that came out of military aviation in WW 2.

“People like the programs, but are being lied to by politicians about their cost.”

They are hardly being lied to the figures are all in the public domain. They are just clueless and politicians take advantage of the fact.