Feds May Allow More Tolls On Interstate Highways

Toll plazas coming to an Interstate near you?

The Federal Government may be on the verge of lifting a long-standing ban on the ability of states to charge tolls on Interstate Highways:

WASHINGTON — Drivers on the nation’s Interstates could soon be paying more to travel.

A transportation proposal sent to Congress by the Obama administration on Tuesday would remove a prohibition on tolls for existing Interstate highways, clearing the way for states to raise revenue on roads that drivers currently use at no cost. Congress banned tolls on Interstates in 1956 when it created the national highway system under President Dwight D. Eisenhower.

The administration said lifting the toll ban would help address a shortfall in funding to pay for highway repairs. The tolls, along with other changes, could provide an additional $87 billion for aging roadways, tunnels and bridges, the administration said.

The International Bridge, Tunnel and Turnpike Association, which represents toll companies and their vendors, applauded the administration’s decision.

“Tolling is a proven and effective tool to fund and finance more than 5,000 miles of roads, bridges and tunnels in 35 states,” said Patrick Jones, the group’s executive director. “To ensure our roads and bridges remain safe and reliable requires a variety of solutions. All options should be on the table so that states can choose the funding methods that work best for them.”

But the Alliance for Toll-Free Interstates, which includes American Trucking Associations, UPS, FedEx, McDonald’s and Dunkin’ Donuts, said it was disappointed.

“Tolling has proven to be an inefficient mechanism for collecting transportation revenue, consuming up to 20 percent of revenue generated, and those paying the toll may not even see that road improved because the president’s plan would allow toll revenue to go to other projects in the state,” said Miles Morin, spokesman for the alliance.

As anyone who travels the I-95 corridor between Washington and New York knows, there are already tolls along highways that are designated part of the Interstate Highway System. In most cases, those tolls exist thanks to waivers granted by the Federal Government for roads that were not originally part of the system or for other reasons. In some cases, roads that most people assume are part of the system actually aren’t The most prominent examples of that that come to mind are the New Jersey Turnpike and the Pennsylvania Turnpike. For the most part, though, you aren’t going to find a toll booth on an Interstate highway, and the money to keep those highways maintained is supposed to come principally from the Federal Government via the 18.4 cent per gallon Federal gasoline tax. In recent years, though, it’s become apparent that these funds aren’t sufficient to cover the expansion and maintenance costs that the roads are incurring. One growing reason for that, somewhat ironically, is the growing availability of more fuel efficient cars, which lead to less gasoline being purchased and, hence, lower tax revenues. Outside of allocating money from general revenues for highway repair and construction, which already occurs in any case, many transportation analysts seem to believe that increased tolling may be the only way to generate the revenue that the Interstate Highway System needs.

Toll roads seem to be one of those subjects on which everyone has an opinion. Back in my home state of New Jersey and the rest of the Tri-State area, toll amounts on roads like the Turnpike, the Garden State Parkway, and on the bridges and tunnels leading into New York City have been a subject of political controversy for decades. More than one candidate has run for Governor of New Jersey, for example, promising to get rid of the rolls on the Parkway, which is the primary road that people living in the northern and central parts of the state use to access the Jersey Shore. In addition to strong lobbying efforts by the union that represents the toll workers, those promises have usually fallen apart once legislators couldn’t figure out how to replace all that missing revenue.

Additionally, in recent years, states have begun using tolling for purposes not necessarily related to revenue generation .For example tolls on the bridges and tunnels into Manhattan have been used as much to discourage vehicles from entering New York as anything else. Hear in the D.C. area, Virginia has been working on a project that adds additional lanes to the Beltway and to I-95 and I-395 leading into Washington, D.C. The caveat is that these lanes are/will be restricted to high occupancy vehicles or drivers willing to pay a little bit to avoid sitting in traffic, with the toll fluctuating during the day based upon traffic volume. So far at least, the lanes seem to be quite popular. Indeed, I’ve used them myself during the trips I’ve had to make up to New Jersey over the past several months.

Interestingly, though, the New York area and the Northeast aren’t the only areas with a lot of toll roads:

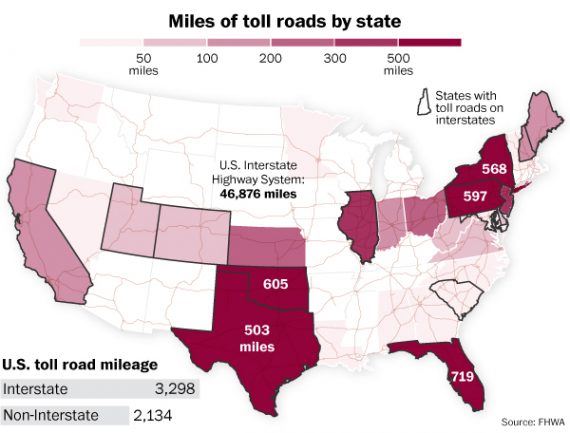

Texas is one of 29 states that charges drivers money to travel on certain roads. Texans pay for the right to drive on 503 miles of roads, both interstate and non-interstate. Florida drivers pay tolls on 719 miles of roads, while New Yorkers, Pennsylvanians and Oklahomans all fork over money to travel more than 550 miles of roads.

Here’s a map:

So, toll roads aren’t necessarily all that unusual, and are already quite prevalent in high population areas of the country. Allowing more states to make use of them wouldn’t necessarily be all that much of a shock to travelers who are likely already used to paying tolls.

If the Federal Government is going to allow this, though, it strikes me that there are several requirements that we should try to meet. First of all, obviously, the funds collected by these tolls should be limited strictly to highway maintenance and construction. Allowing this money to get put into a pot with all the other revenue the states or Federal Government generate would just defeat the entire purpose of the tolls. Second, the tolls themselves should be as reasonable as possible, not only because of the costs that ordinary citizens would incur if they had to start paying them, but because of the costs it would impose on the trucking and transportation industry. Finally, all future tolling should be electronic and the systems used should be interchangeable so that someone who travels through multiple states doesn’t have to purchase multiple transponders. More importantly, though, tolling should avoid as much as possible the old fashioned toll booth system, which just serves to slow down traffic and create traffic jams.

Many people will no doubt object to the idea of paying to drive on highways paid for with public dollars, but we need to generate the money needed to maintain these roads somehow, and a system like this that imposes at least a share of the cost on the people who actually uses the roads seems fairer than using general tax revenue. There plenty of ways that something like this could be implemented badly, of course, but done correctly Interstate Highway tolling could be done with minimal disruption to travel and at a fairly reasonable cost. At the very least, it’s an idea worth exploring.

This is the real sticking point. The price of consumer goods and (especially) groceries in the US are artificially depressed by what amounts to a federal subsidy on trucking. This subsidy has allowed long-haul trucking to all but replace railroads as the primary way of moving goods (and especially foodstuffs) long distances, despite the fact that railroads are vastly more efficient.

If Americans realize that they’re going to pay these tolls again in the grocery store as well as on the highway, public reaction may be enough to kill this plan. It’s an interesting exercise in public policy to ask where else the revenue to maintain the interstate highways could come from, that would have a less regressive effect on consumers…

Buy stock in Kapsch TrafficCom.

I’d rather pay 5 or 10 cents more in gas taxes than tolls. That’s probably a lot more efficient.

@Scott O:

Indeed. And if fuel efficiency is killing revenue, it strikes me that higher gas taxes would nudge more people towards fuel efficient car, setting up a cycle that reduces dependence on oil, with a net neutral tax effect.

I have always thought of tolls is a very regressive form of taxation. The poorest pay the same tools as the richest. Tolls roads are a way to limit where poor people live and their mobility.

We have a way to raise money for highway infrastructure: the gas tax. It hasn’t been raised since 1993. But, it’s a “tax”, and we all know what that means politically (how strange that Doug didn’t mention this option and who is driving the opposition to it). But, there is some support, both from business and organized labor (at least, what’s left of organized labor) to raise it:

http://www.reuters.com/article/2014/02/12/us-usa-transportation-tax-idUSBREA1B2B020140212

@DrDaveT:

DrDaveT, I see your point. On its face, I have no problem with a toll on a much-used road. Here, in El Paso, a toll has been affected on a stretch of the Loop 375 route that connects NW & SE El Paso. It was a huge construction project, and I have no problem paying a toll to use it. Now, a question to your point.

Will a highway toll put such a high cost on the trucking industry, cumulatively, that it would cut into its profits and result in higher food costs? I realize as cost of production goes up, the cost to consume that production goes up proportionally; however, it’s difficult to me to justify — well, I guess that’s just it, isn’t it? As business costs rise, so will consumption costs. Individually, I’m disposed to live with that.

As for rising food costs vs. rising fuel costs in increased fuel taxes, I don’t know which would be worse for low-income and poor families. They’re already negotiating food vs. gas vs. rent vs. shoes decisions. What alternatives do we have that would not significantly impact them, but would only marginally impact we who can afford to pay a little more? The unintended chain of impacts is never-ending …

@Scott O: Probably so. I talked to a guy who drove on some toll roads in Florida. They have a system where you can somehow pay ahead and not stop at those toll booths. That constant stopping and starting can use more gas.

In a lot of states, that gas tax money has been spent on other things. That’s a problem. There is talk of charging by the mile, using the odometer to figure it. Well, any average mechanic knows how to finagle those odometers. Even the LED kind can be altered as there are many websites and devices that can do just that. So the mileage thing may not work. I understand the need for improving highways. and raising gas taxes could help there. One relief would be to increase and expand the mileage deduction on the income tax. One tax preparer told me that you can count mileage to and from school events (non profit), and to church (non-profit). Everyone should be able to count mileage related to work. Gas prices hit the average middle class working people very hard. Most of us do not have any alternative.

Some ideas for updating our aging interstate highways: more technology such as imbedded track lighting, heat strips that melt snow and ice, blowers and barriers where fog can be a problem, and dedicated highways to high volume destinations such as Disney World, beach areas, speedways, and national parks, Another way to raise money would be to have sections of the highway with no speed limit and set up a charge based on number of miles; of course no trucks or buses. The highway departments need to start preparing for smart cars that will be hands off driving.

I remember the infamous “drive 55” speed limit of the ’70’s. No one paid any attention to it, if you did you got ran over or blown off the highway by an 18 wheeler. Many a sign was spray painted to read 65 or even 85 mph. And any gas savings was minuscule since it took longer to get somewhere, thus driving longer.

“Take the bus and leave the polluting to us”

@ratufa:

It’s worse than that. We have become, in essence, a “right to drive” nation. In rural and exurban areas, our economy has evolved to one in which personal transportation is a necessary prerequisite for employment. In urban and suburban areas, our individualist culture has stigmatized public transit to the point that it is the option of last resort for all commuters.

If people have a right to drive, because they have a right to work, then a gas tax is a job tax, and ridiculously regressive. Non-regressive alternatives invariably produce squawks of ‘Socialism!’ or worse.

Traditionally, the gas tax has been a pretty good proxy for a tax on mileage. If fuel efficiency gets us to the point where we no longer buy enough gas for that to work, then we should just tax mileage instead. Make odometer part of the state inspection, then have the DMV charge accordingly. It may also lead to lower auto insurance rates for low volume drivers, as low mileage would be easier to prove.

@dennis:

When was that done? I used to live in El Paso, but it was a while back–holy crap, almost 20 years.

@DrDaveT:

That’s not really true where I live (Washington D. C. metro area). Most of us wish Metro were more convenient to us, because driving into and out of D. C. during rush hour sucks.

@Mikey:

The metro trains in DC is fine for the middle and upper middle class. The distinction in DC is the metro bus. People seem to only ride the bus when they have no other choice.

@Mikey:

While the rest of us wish driving into and out of DC during rush hour were more convenient to us, because the Metro sucks.

The Pennsylvania Turnpike is an interstate. The main part (Ohio border to King of Purssia) is I-76, King of Prussia to the Jersey Border is I-276, and the Northeast extension is I-476.

May “Allow” more tolls…? The word the contestant is looking for here is, “Impose.”

@Jeff: They both suck. But IMO the Metro sucks less, mainly because I can get into D. C. in less than half the time it would take to drive, and I don’t have to pay usurious sums to park.

@Jeff: Any halfway backyard shade tree mechanic knows how to finagle and work the odometer to roll back or “slow” run by changing the gear ratios or turned back putting the cable into a drill and running it backwards. Oldest trick in the books. Even the newer LED odometers can be “reset” without a lot of difficulty. So “proving” mileage may be kind of tricky when the states start seeing all these low mile numbers. If the mileage tax is approved, then there should be a deduction for people who have to drive to work, drive to the store, drive to church, and take their kids to school.

@DrDaveT: I would love to be able to hop on a train or light rail to get to the mall, work, church, store, theme park. But out here it is not available and I don’t think the people would take to being told where they can live. To get to Disney World from here would take two days on Amtrak counting a day layover. I can drive it in 10 hours but would prefer the airlines if it did not cost so much. Maybe I will look into a package deal next time that includes the air travel cost. The thing is once you get into the resort you do not need to drive the car until it is time to go back home.

I have no problem with taking the bus or rail, but I will not ride some graffiti scarred, smelly conveyance that may also be a haven for criminals and thugs. That is what turns a lot of us off to some forms (not all) of public transportation. And I work at different places each day, so I have to have a car.

This country is built on mobility. The best thing is to just improve on our system through modernization and vehicles that get better mileage or use hydrogen. There is also the cold vapor gas engine that is said to get 50mpg and more, with exhaust that is nothing but water vapor.

@Mikey:

I think you and @Jeff just made my point for me — you either avoid Metro (because it sucks) or you use it instead of your preferred alternative of driving your personal car and paying to park, because rush hour traffic sucks even more. In either case, Metro is a last resort.

And, picking up on @superdestroyer’s comment, I’m willing to bet there is a bus (Metro, DASH, RideOn, whatever) that runs near your home and would take you to a Metro station. You don’t do that because (a) you would have to leave much earlier and get home later, and (b) it’s a bus.

@DrDaveT:

Once one starts making connections using public transportation, the time it takes is much longer than just driving. Traffic may be horrible in DC but if you live in Rockville and work in Alexandria the car is the fastest way to get there. Taking a bus to a metro train to another metro train to walking takes a long time. Also, one has to pay to park at the metro stations in the suburbs. Parking plus train fair back and forth is about the same as parking in most parts of DC.

Outside of NYC and SF, driving is probably always faster. IN northern Virginia, the fastest way to downtown DC is to pick up a slug and get in the HOV lanes. The second fastest and the cheapest is to be the slug.

I find it weird that map doesn’t outline Massachusetts. The Mass Pike is a toll-road and it is indeed an interstate, I-90

One idea I thought of is to have set highways for tourists. You would buy a ticket to use the highway just like buying a plane or train ticket. Exits would abound with restaurants, convenience stores, hotels, fast food, shops. Like, you could get a ticket that would get you to Washington, DC and back, Las Vegas, Orlando, Grand Canyon, etc. No trucks, buses, commuters.

@Stormy Dragon:

“The Pennsylvania Turnpike is an interstate.”

And so is the NJ Turnpike for most of its length (I-95). However, in both cases, they were built before the Interstate system was, and were later integrated into it (poorly, in the case of the PA Turnpike, where the connector between it and I-95 is finally under construction, and many other interstates do not connect directly to it, such as I-80 and I-81).

@superdestroyer:

Often true, but that’s by design and by choice, not an iron law of nature. Driving is faster because of specific public policy choices going back a hundred years that (a) privileged cars and roads over public transit and (b) discouraged dense urban housing and encouraged suburban and exurban sprawl. If you look at other countries that made other choices, public transit is often faster, cheaper and more convenient than driving.

@Moosebreath:

Yes, but there’s a difference between “The Pennsylvania Turnpike wasn’t originally an interstate” and “The Pennsylvania Turnpike is not an interstate”.

@DrDaveT: I wouldn’t mind riding the bus, but its schedule doesn’t match my needs (which is, of course, probably true of the subway for some people as well). Metro runs trains much earlier and later than the bus runs.

If I worked in D. C. regularly, I’d take the VRE (surface train) because the station is half a mile from my house.

@superdestroyer: A friend of mine has a 15-passenger van and an assigned parking spot at the Capitol. He’s the most popular guy in the slug line…

I was visiting my sister in Houston a couple of months ago and they have toll roads everywhere. My sister has a bar-code on her windshield that is read by a reader when she gets on the toll road so no toll booths. Seemed to work pretty well. My sister also noted that new toll roads seemed to get finished a lot faster.

The gasoline tax has in the past paid for road maintenance but we are using less gasoline so usage fees would seem to me a reasonable substitute.

I’m not sure it would fly here in the Pacific Northwest however. We desperately new a new I5 bridge across the Columbia river but it was rejected by both Oregon and Washington because a toll would have been required to pay for it.

On the gas tax: 20 years with no inflation adjustment has had more effect on total revenues than fuel efficiency. If we hadn’t had thirty years of Reagan tax nonsense SE it would have been indexed to inflation and we wouldn’t be talking building toll booths.

@superdestroyer:

Absolutely. In my case, I can either catch a bus outside my front door (60 minutes to work), walk 10 minutes to a bus hub (40 minutes to work), or drive myself (15 minutes to work).

But that’s a choice we make as a society. It doesn’t have to be true that there is only one bus every 15 minutes, or that buses do not have reserved lanes, etc. Other countries (and cities) have made different choices.

Edit: …as Rafer Janders has already said at least as eloquently, upthread.

And you will, but not until the new tolls have been instituted.

@MarkedMan: Gas is too high now. I and others have to drive to work, the stores and malls, and many other places. Out in rural areas there is no alternative.

The suburbs may have a solution: rail lines that are mainly used by freight trains. If you could adapt some sort of light rails to that you might just have something that would ease the traffic jams every day as people go into the cities and then head back home to the suburbs.

Let’s look at this for a moment:

1) The government decides to tax gasoline consumption, and grows dependent on the revenues.

2) The government decides that we need to reduce gas consumption, and mandates that vehicles get better and better meliage — as in “miles per gallon,” or “gasoline consumed.”

3) The revenues from the gas tax UNEXPECTEDLY!!!!! start to drop, and the government has no idea why it happens, or what to do about it.

@Jenos Idanian #13:

“1) The government decides to tax gasoline consumption, and grows dependent on the revenues” to maintain the interstates that we use said fuel to drive on. Seriously man, do you think the government can somehow magically maintain infrastructure without income via taxation?

@Grewgills: I’m starting to think that a lot of the regular crew here read my postings only until they think they find a “gotcha” point, then thoroughly beclown themselves in patting themselves on the back.

You quoted Point 1, and there’s nothing inherently wrong with Point 1.

You didn’t quote Point 2, and there’s nothing inherently wrong with Point 2.

The problem is that Points 1 and 2 are diametrically opposed to each other.

It’s like two guys start painting a room from opposite corners. One picks blue, the other yellow. There’s nothing wrong with either color, but when they meet in the middle, hilarity ensues.

Except in the real world, the laugh’s on us.

@dennis:

Income taxes and property taxes — but there are two immediate problems with those. The first is that they are unpopular with those who purchase politicians. The second is that there is no chance that the extra revenue raised would be used only for the infrastructure maintenance that we’re talking about.

@Tyrell:

Nonsense. Gas is still dirt cheap, compared to (a) what it costs elsewhere, and (b) the externalities it imposes on our children.

@Jenos Idanian #13:

That is just silly. There is no opposition between taxing consumption of anything and wanting to reduce consumption of that same thing. All sin taxes specifically tax something to reduce consumption. Try again.

@DrDaveT: EVERYONE pays property taxes. Even if you don’t own property, you lease it from someone who does — and they pass that tax on to you.

And income taxes? You gotta rig the hell out of it to avoid being regressive, and even then the rich can just restructure their money into providing non-“income” revenues.

I like the idea of a national sales tax, generally, but ONLY if coupled with an abolition of the income tax and some other taxes. Exempt food and clothing and medicine and other necessities, of course.

People have a lot of money? So what? That’s meaningless. It’s only when that money is exchanged for something that it exerts any power. “Money” is merely a placeholder for “value,” and having, say, $5 billion in the bank does NOTHING for you until you take some of it out of the bank and use it.

@Grewgills: You really need to work on your reading comprehension if you can’t see the contradiction between “set up a revenue stream that you depend on” and “act to reduce the consumption that feeds that revenue stream.”

States discovered that with tobacco taxes. They fought like hell to reduce/end smoking, then freaked when those tobacco revenues started drying up.

@Jenos Idanian #13: Your analysis is reasonably correct, except for one important detail. You keep talking about “the government” as if it were one thing — one decision-maker, one controlling interest, one mind. I’ve noticed that this is a hallmark of sorts.

The Congress decided to fund interstate highway maintenance using gasoline taxes, back in the Eisenhower administration.

Various later Congresses enacted fuel efficiency standards, especially after the “oil crisis” of the ’70s.

The Department of Energy (and its predecessors), with the support of various Democratic administrations, promoted these fuel efficiency efforts.

I’m not sure I see the grand paradox here that you do. A simple inflation adjustment on the gas tax would have avoided the whole problem. Fuel efficiency has not improved by nearly enough to offset the massive increase in cars and trucks since the ’50s.

There’s a difference between having a lot of toll roads, which is true for Texas, and having Interstates with tolls, which is not true for Texas to any great extent. I believe there are no Interstates with tolls here, but a few miles may have escaped my notice.

I’m fine with toll roads, but I oppose tolls on Interstate highways.

@superdestroyer: in most countries the “poor” don’t have cars, they’re for the rich. there’s a huge difference between being “poor” in America than elsewhere.

back to the topic, i don’t think interstates should be allowed to put tolls on highways that are (in theory) paid for by taxpayers. let the toll road crowd build and charge for the right to travel on said roads.

@DrDaveT:

Um…only JUST AS eloquently…? 😉

@Jenos Idanian #13:

If you don’t like regressive taxes, why would you favor a national sales tax? That’s the most regressive of all.

A wealth tax would be fairest, but it’s a bitch to implement.

Oh, please. Having $5B in the bank provides:

1. At least $100M annual income, effort-free

2. Total financial security, regardless of natural disasters, health crises, or other “Acts of God”

3. Access to any politician you wish to influence

I’m sure I could list a few more if I thought about it.

But you seem to have missed the point. The reason the wealthy should pay the most for the infrastructure is that (a) they have benefitted the most from it, and (b) they suffer no lost utility. The difference between having $5B and having $6B is… nothing. There’s nothing you can do with $6B that you can’t do with $5B. There’s no difference in financial security, in lifestyle, in ability to ensure the comfort of your family and heirs, in ability to indulge in philanthropy, in anything. The marginal utility of that extra billion is just the personal satisfaction of keeping score against the other billionaires.

As for property taxes, they do not get passed on dollar for dollar. Supply and demand still applies. And for non-rental properties, it isn’t an issue at all. The property taxes I pay on my home do not get passed along to anyone.

@Jenos Idanian #13:

This is just dumb. The gas tax was last raised in 1993. We all know what happened in 1994. Do you really think that the non conservative part of “the government” didn’t know that further increases in the gas tax would be necessary or maybe indexing it to inflation? Unfortunately we don’t live in a world where logical policies can be implemented.

Something that the self-appointed defenders of the rich simply do not seem to grasp. Forget about billionaires, people I know that have wealth in the 25-50 million range live lifestyles that are far, far beyond what even well off, upper middle class folks enjoy. Wildly so.

Multiple homes – beautiful ones. Private planes. Million dollar + car collections. Want to kick it in the South of France for 6 weeks? Let’s go. You kid is got into an Ivy League school? Here’s a check that will cover everything.

Never having to say “we just can’t afford it.” And these guys are pikers compared to a multi-billionaire.

Take away 10-20% and you have… an amazing lifestyle that is far, far beyond what even well off, upper middle class folks enjoy. Wildly so.

You really don’t have a clue about the world beyond Podunk, do you?

@Jenos Idanian #13: Except, moron, you left out the part where right-wing fanatical anti-taxers keep the gas tax from rising with inflation for decades. Your wonderful little observation is just more sug crap from a man who’s never had an actual thought in his life.

@Jenos Idanian #13: ““Money” is merely a placeholder for “value,” and having, say, $5 billion in the bank does NOTHING for you until you take some of it out of the bank and use it.”

And so we can now add economics to the vast and always growing list of things Jenos knows nothing about.

@DrDaveT: ” There’s nothing you can do with $6B that you can’t do with $5B.”

Sure there is. You can lord it over the poor schmuck who only has 5B. And isn’t that really the point?

This thread is probably close to ending but one thing not discussed is the wear and tear on highways by trucks. Quick internet research: 1 truck = 9600 cars. 99% damage, 35% revenue: trucks cause 16X more wear than cars, etc.

Bottomline: trucks are grossly undertaxed.

@Scott:

If long-haul Trucking’s externalities were internalized, freight rail would clean up. Granted, freight rail already does pretty well.

Of course, if we attempted to tax trucking in proportion to the wear & tear they cause (or even move in that direction), there would be a massive freakout (“war on truckers”) and so on.

@Tyrell: What are you talking about? “Cold vapor gas engine”?

The only system I know of that will produce water vapor as the end result is a fuel cell engine. Your major problem is storing enough hydrogen so you drive a decent distance before needing to refuel. And if you’re getting your oxygen from the air rather than from storage there are problems to deal with carbon monoxide poisoning of the catalyst.

The other major problem is the cost of the catalyst–platinum ain’t cheap. Which is why fuel-cell systems work better as a part of a co-gen system with hot water as another by-product.

If you’re talking about some fantastic invention you read about in an ad in the back of Popular Mechanics which the gasoline companies are secretly concealing from you—well, in that case I have a bridge to sell you as well. And you’d probably buy it.

Look at this: http://fuel-efficient-vehicles.org/energy-news/?page_id=968

And this: http://www.greenoptimistic.com/2008/07/17/john-weston-vapors-fuel-463-mpg (Includes NBC interview)

These are reputable sites and not trying to sell stuff.

Popular with whom? The existing HOV structure is popular on I95, the change to HOT is not at all popular with many commuters, and the communities 10-20 miles outside the Beltway. I haven’t talked to any slugs or drivers that are looking forward to the change.

I truly hope these lanes won’t be the debacle I fear, and that weekend traffic doesn’t skyrocket in my community because of tolls on currently free HOV lanes.

BTW, my 30-45 min drive would take almost 2 hours if I used Metro and cost 2X more.

@Tyrell: Yeah, two gee-whiz sites hyping this guy and insisting he’s got a great new invention and gee, it’s just too bad that no one wants to invest in his invention.

Not trying to sell something my foot!

I also suggest you pick up a book on automotive systems and educate yourself on how engines actually work.

@Ron Beasley:

What a surprise, voters do not want to pay for something that they will use. Sometimes I think the new American motto is either:

“If it’s for free, it’s for me!”

or

“If it’s free, it must be for me!”

@Neil Hudelson: The electric cars are a lot higher in price, so the payoff takes several years if you are just figuring in the gas savings. However, a lot of people overlook or do not realize that these electric motors have few moving parts (the cd changer actually has a lot more moving parts than the engine), does not require an oil change or coolant, no spark plugs or points to change, and what little maintenance that is required is very cheap. These engines can go on and on. Most people do not realize that many cars actually have a conversion kit available so the gas engine can be swapped out for an electric motor. This, of course, would require a sizable expense or someone who is really skilled in mechanics.

@grumpy realist: Watch the documentary “Gashole”. It explains why we are still using gasoline powered vehicles. Think: oil/government complex.

@Tyrell: Dearie, I’ve got a manuscript lying around somewhere that I wrote covering the history of electric cars in the US and the history of the MIT Solar Car team. (Never finished the project because another book project took precedence.) The problem with electric cars–and what has plagued them ever since Day 1 of their invention–has been their lack of range. Edison attacked the problem of developing a better battery and got nowhere. There have been batteries developed on other chemistry, but up to now, the major problem has still remained a) lack of storage capability and b) decay of the battery after N duty-cycles.

ICE cars took longer to take off because of the lack of gasoline filling stations originally meant you had to carry all of your fuel with you. As the network of fueling stations developed in the US, more and more people shifted from electric cars and steam-driven cars to ICE cars.

Electric cars work in areas where they’re used as commuting cars or the daily route is short enough that a day’s charge is sufficient to cover the distance (public-transit buses, delivery trucks within a city.) They still don’t have the perceived flexibility that ICE vehicles have, which is why their market is still limited.

Now if you want to talk about the conspiracy of the auto companies to get rid of the trolley lines….