Fill Mah Bucket…With Cash!

Now the city governments are lining up for their share of the bailout.

WASHINGTON (AP) – Three big city mayors asked the federal government Friday to use a portion of the $700 billion financial bailout to assist struggling cities.

The mayors sought help with their pension costs, infrastructure investment and cash-flow problems stemming from the global financial crisis.

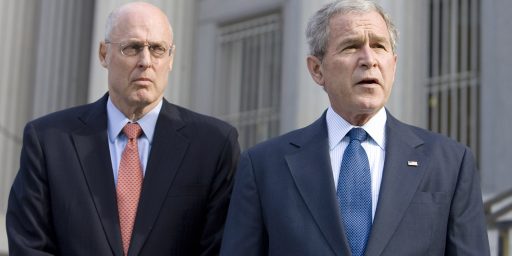

The mayors—Michael Nutter of Philadelphia, Shirley Franklin of Atlanta and Phil Gordon of Phoenix—made their request in a letter to Treasury Secretary Henry Paulson.

Note to self: Draft a letter to Secretary of the Treasury Henry Paulon asking for…let me see, $1 billion dollars.

This is becoming some sort of sick and pathetic joke.

Those of you who supported the bailout…are you happy? Seriously, it appears that now the attitude is, “Well since you are bailing them out, how about us?”

The bailouts a “sick and pathetic joke.” And only going to get sicker, more pathetic-y and less funny: http://is.gd/7yT3

Yes to Paulson plan. No to GM, city governments and Steve Verdon.

I know how to draw a line.

Which Paulson plan? As I understand it his most recent round of media visits emphasize that he’s thinking on his feet, and not going with plan A or plan B.

BTW, you guys know about the Bloomberg lawsuit right? Bloomberg Sues Fed to Force Disclosure of Collateral. I can’t remember if I saw that one here or not.

1975 NY Daily News Headline regarding their request for a bailout:

Who knew Gerald Ford would have been the right man for the times. Ford did have a better idea. Maybe we should all be Fordists now.

I supported the Paulson plan that was presented for the approval of the citizenry. Not the Dodd version that “reigned in” the Treasury and gave it authority to spend the money on anything.

Well I wasn’t really supportive of the Paulson plan, and I sure as heck am not supportive of this. Somebody needs to say “No” and tell everyone to grow up and balance their own darn budgets city, state and company alike.

I thought Paulson was the one who put “or anything” in the original bill …

The real problem here is that it takes a big-gun economist to tell us if we are up the creek, what kind of creek, and if we have a paddle.

Based on those answers, and if you trust the economist(s), you might start holding your nose and going for some bailouts.

I go back and forth on that myself. I believed, wanted to believe, the economists who said a Lehman bailout was not needed … but now it’s universally accepted by the big-guns that it was a mistake not to.

Bailing out states and cities is certainly wrong, but we don’t know if it is the greater evil. If we’re trying to be reasonable it’s a hard problem. Much easier to give a glib answer either way …

If you want more of something subsidize it. Rescuing bankrupt cities just means that they will be a never ending supply of bankrupt cities to be rescued. Their respective elected leaders will never get serious until they have to.

The problem, for the city and state at least, is that for quite a while they have borrowed large sums for short terms to cover costs between the times when tax revenue comes in, but the market is no longer willing to lend it to them. Our economy is built on credit, it’s always been like that, and when credit freezes up even well balanced budgets get hit.

Awwww! Darn it.

On that front:

4 insurers ask government to let them acquire thrifts so they can receive bailout funds

The problem, for the city and state at least, is that for quite a while they have borrowed large sums for short terms to cover costs between the times when tax revenue comes in, but the market is no longer willing to lend it to them. Our economy is built on credit, it’s always been like that, and when credit freezes up even well balanced budgets get hit.

Hey I won’t disagree that this part of the problem, but you know what that still doesn’t mean the US taxpayer should be responsible for balancing their budgets out. They need to figure out what things they can cut, but this idea that we can borrow our way into prosperity and do everything we want (in government or as part of a company) has got to stop. Some people are going to hurt-that’s the reality, but we have become addicted to bail outs to the point that we do not care about the risk.

Gotta draw the line somewhere and say no more. Well I am at that point and want my legislators and my president to say “no more.”

That’s changed a bit. Tax-free money market funds, which invest in those things, were paying over 5% a month ago … they’re back to a more typical 1.7% now.

It’s not a problem of balance, it’s the reality that their expenses come an a regular rate, but their tax revenue comes in chunks. They borrow money to cover the expenses that come up before the next chunk of revenue, then they pay it back.

That’s good news, but the bond market is still rough as far as I’ve heard, which means that any infrastructure spending is still either on hold, or going to require borrowing from the fed.