Food Rationing in America

Some stores are now implementing limits on how much of a given product that people can buy at a single time.

Major retailers in New York, in areas of New England, and on the West Coast are limiting purchases of flour, rice, and cooking oil as demand outstrips supply. There are also anecdotal reports that some consumers are hoarding grain stocks.

Of course when you get deeper into the story you find out an interesting tidbit that suggests the problems are probably more due to how stores handle logistics than due to actual shortages.

“There have been so many stories about worldwide shortages that it encourages people to stock up. What most people don’t realize is that supply chains have changed, so inventories are very short,” Mr. Rawles, a former Army intelligence officer, said. “Even if people increased their purchasing by 20%, all the store shelves would be wiped out.”

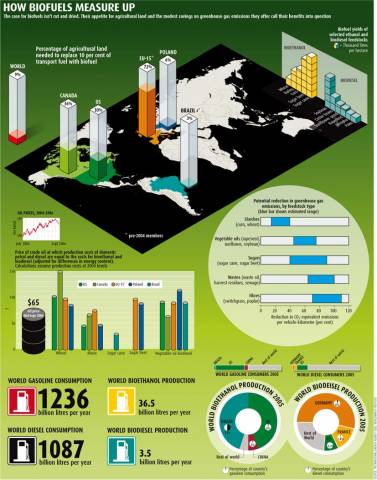

Still, there is a problem with food prices right now. They are going up, and going up quite a bit. One reason for this is the switch to biofuels due to government mandates. The subsidies for using corn for ethanol production has helped drive up the price of corn. This in turn causes people to substitute away from corn to various substitutes which are also going up in price.

These factors combined are why we are seeing riots in various places around the world and also why there are signs of problems here in the U.S. Green fuel initiatives that have pushed biofuels are a big mistake. From Ronald Bailey’s Reason article on this topic,

In the last year, the price of wheat has tripled, corn doubled, and rice almost doubled. As prices soared, food riots have broken out in about 20 poor countries including Yemen, Haiti, Egypt, Pakistan, Indonesia, Ivory Coast, and Mexico. In response some countries, such as India, Pakistan Egypt and Vietnam, are banning the export of grains and imposing food price controls.

Nice eh? And yet, biofuels were supposed to be good for the environment and break the grip of the OPEC oil cartel and put a dent in the petro-dollars flowing to terrorists. Nevermind that oil is at its highest price in nominal and real terms. That biofuels would lead to these kinds of problems was obvious. If biofuels were indeed a cheaper alternative to oil, then economies would have switched. I don’t care what kind of lame-brained conspiracy theory you adhere to regarding ExxonMobil or other oil companies, the switch would have occured. What this means is that biofuels are more expensive that oil as an energy source, and that forcing a switch would mean we end up worse off.

Think of it this way. Suppose you consume two goods, bread and apples. There is a third product, mangoes, but they are very expensive, and very few of them are consumed. Now the government comes along and forces everyone to consume 3x the number of mangoes as before. What happens? People end up consuming less bread, less apples, and while consuming more mangoes their overall food consumption is lower as well. Is this a sound policy? Of course not. But dress it up in the nonsense of environmentalism, trot out his Eminence Al Gore to pontificate on the virtues of mangoes, and for good measure wrap it all up in the American flag and a bad policy becomes a reality.

This isn’t to say that oil prices are part of the problem, as are natural gas prices. As Bailey notes in his article, the rising price of natural gas has increased the cost of applying fertilizers. Why are natural gas prices high? Well in part because of policies to promote technologies that are as clean or cleaner than natural gas in producing electricity. Again we can turn to economics here. If the technology for generating electricity via a “clean” coal process are more expensive than simply building a combined cycle natural gas plant which do you think will get built? That is right, people will build more and more natural gas plants until the cost of running a natural gas plant becomes as costly as running a “clean” coal plant. As for oil, the problem here should be obvious. Farming equipment runs on gasoline and oil products are used to get the food to the markets. Increase both of these costs and the price of food has to go up as well.

Of course, if things continue the response will be for farmers to grow more crops. Higher prices for corn and wheat will induce suppliers to consider using lands that at lower prices were not cost effective to plant. However, it is unlikely that we will see something like this. Instead a politician, who is running for president, will seize upon this problem and state, “Something must be done.” This candidate will come up with some dopey policy like the dopey policies noted above. The other candidates feeling the pressure to also be seen as “doing something” will each come up with their own foolish policies. The idea of actually just ending the biofuels policies likely wont make it to the discussion. If we are lucky the problem will resolve itself before any of the candidates actually takes office and some other “crisis” will occupy by their time coming up with nonsensical policies.

Steve, in order to draw some of the conclusions you’re drawing in this post you need to quantify the effects of the various factors affecting food prices to determine their relative importance.

I think there are several possible culprits including

– oil prices

– increasing demand

– bad trade policies

– bad agricultural policies

– use of food crops for biofuels

– the Fed

James Hamilton seems to think that the Fed is a major culprit. I have my doubts.

Producing all commodities seems to be highly dependent on oil so oil prices look to be the major culprit. But why are oil prices rising?

Total production hasn’t fallen so it’s not a supply bottleneck per se. Demand has risen so that’s a good place to look. But one of the reasons that demand is rising is that too many major consumers (including us) subsidize oil consumption. China and Pakistan, for example, both sell gas below world prices.

Biofuels have been a complete disaster of unintended consequences for the greenie movement.

The forced march to their use has impacted the availability and price of food across the board.

Farmers are foregoing payments to keep land out of tillage for wildlife habitat, instead they are plowing and planting this once unworked land to take advantage of the high prices for corn, etc.

Reports are that now that food is scarce, resistance to GM crops is dropping across the world.

And let’s not forget that all that ethanol moves primarily by truck to mixing points, where petroleum moves by pipe over the long distances.

And let’s recall, please, that this entire merry go round started because of the myth of global warming. The idea of breaking away from Oil was a secondary concern, initially.

.

Actually, Dave world consumption of oil is falling, if marginally. Which, given it’s long upward spiral is in itself, telling.

It’s to the point in this country where as of today, we have more crude stockpiled, even exclusive of the reserve, than we have had in the last 15 years. We also have more distilates, such as gasoline, than we have had for the same period… 15 years. Laws of supply and demand don’t sound like they’re in full play, here, to me.

And as an aside, to give some perspetive on this topic, I touched on the bit with trade deficit with with Canada and Mexico, a couple days ago. The Democrats like to claim that NAFTA has us coming out on the short side of a huge trade imbalance with those two contries. The article I did was an answerback to John Engler of the WSJ who wrote:

That perspective should giev you a rough idea how much oil can affect the fincials of everything else.

Now, about Soros and his buying and selling… has anyone looked at that, I wonder?

Oh, this is just another Chicken Little story. If the fad catches on, the MSM will have a spasm of alarmism, and nothing will come of it. Remember asbestos? Remember Toxic Shock Syndrome?

For around four years now they have been trying to scare people with a mutant bird flu pandemic crisis, the West Nile virus panic and who knows what all. Nothing much has ever come of it.

One among many including higher gas prices, higher demand for grains due to increasing population and increasing wealth in countries like India and China*, etc.

To make the analogy more apt:

Suppose the government subsidizes apples, so they are the most commonly eaten. There are two other products that were not subsidized at nearly as high a level and farmers were just beginning to learn how to farm them efficiently, mangoes and papayas. Further suppose that mangoes and papayas held a greater promise to feed people over the long term and when farmed properly were better for you. Now the government increases the subsidies to mango and papaya farmers (but still far less than it subsidized the production of bread and apples) and mandates that all mixed fruit sales contain a small percentage of mangoes and papayas.

The transition costs could be high, some farmers would not farm them properly (limiting or eliminating their potential benefits), and some would point to these failings and say that mangoes and papayas are a terrible idea and we are not ready for tropical fruits. Others would suggest that that subsidies and mandate quotas only be recognized for properly grown fruit rather than give up on the whole venture.

An alternative would be to eliminate all fossil fuel subsidies and tax the pollution caused by fossil fuels so that the user actually pays the real extraction and environmental costs. This could go a long way to leveling the playing field for ‘alternative’ energies. This would be a much more painful solution as fossil fuel prices would jump in price from their artificially low current levels.

* families are able to eat more and are increasingly eating meat (not nearly as efficient at turning grain calories into human mass).