GDP Growth 2.8% In 4th Quarter: Not Great, Not Good, Barely Okay

Another weak GDP report that portends stagnation ahead.

The Commerce Department released its first estimate of economic growth in the final quarter of 2011 and, while the economic continued to expand, the pace at which it did so wasn’t very impressive:

The American economy picked up a little steam last quarter, with output growing at an annualized rate of 2.8 percent, the Commerce Department reported Friday.

The pace of growth was faster than in the third quarter, when gross domestic product expanded at an annual rate of 1.8 percent.

Even so, both figures were below the average speed of economic expansion in the United States since World War II. And it would take above-average growth to recover the ground lost during the Great Recession.

“At this rate, we’ll never reduce unemployment,” said Justin Wolfers, an economist at the University of Pennsylvania. “The recovery has been postponed, again.”

Still, the 2.8 percent rate is likely to be seen by many as something of a relief, given that just last summer many economists were predicting the country would soon dip back into recession. Few analysts are still forecasting a double-dip in the near term, but they say the recovery is likely to remain disappointingly sluggish.

Growth in the fourth quarter, after all, was driven mostly by companies rebuilding their stockroom inventories, and not by consumers who were shopping more or foreign businesses buying more American-made products. And companies are likely to have only so much appetite for refilling their backroom shelves if consumers are still unwilling to buy those products.

Consumer spending rose at an annual pace of 2 percent, slightly better than the 1.7 percent in the previous quarter, Friday’s report showed. But based on early data, it looks as if consumer spending deteriorated toward the end of the year. This may be because of unseasonably warm December weather, which probably lowered families’ household electricity and gas bills, said Jay Feldman, an economist at Credit Suisse.

Consumers also benefited from lower gasoline prices, but that was not enough to offset consumers’ concerns about their stagnant incomes.

“We did have some relief on gasoline prices in the fourth quarter, but that didn’t cause people to go out and spend more vigorously,” said Nigel Gault, chief United States economist at IHS Global Insight. “It just means they didn’t have to dip into savings.”

One of the biggest drags on growth in the last quarter was government spending cuts at the federal, state and local levels, according to the Commerce Department report. National defense spending fell a whopping 12.5 percent, for example, an unusually large dip that economists do not expect to see repeated in the beginning of 2012. Strapped state and local governments are likely to continue cutting back in 2012, as they have done nearly every quarter for the last several years.

At the federal level, Congress has not decided whether to renew a temporary payroll tax cut and extended unemployment benefits past February, when both are scheduled to expire. Allowing these policies die as planned would shave a percentage point from gross domestic product growth this year, said Ian Shepherdson, chief United States economist at High Frequency Economics.

One of the more positive surprises in the report was in housing. Investments in sectors like home construction and repairs rose 10.9 percent last quarter. The housing sector is so small now, though, that it didn’t provide much oomph.

Based on the retail sales report for December that we saw earlier this month, it’s pretty clear that consumer spending did slow during the final month of the year. Something that is very atypical for a month that includes the biggest shopping season of the year. Therefore, it’s not surprising to see the consumer side of the economy contributing to a less than expected GDP report. Additionally, as Reuters notes, a large part of the growth in the 4th Quarter came from business building up inventories:

The economy in the fourth quarter got a temporary boost from the rebuilding of business inventories, which logged the biggest increase since the third quarter of 2010. The buildup followed a third quarter decline that was the first since late 2009.

Excluding inventories, the economy grew at a tepid 0.8 percent rate, a sharp step-down from the prior period’s 3.2 percent pace and a sign of weak domestic demand.

(…)

Inventories increased $56.0 billion, adding 1.94 percentage points to GDP growth. Excluding inventories, the economy grew at a tepid 0.8 percent rate, a sharp step-down from the prior period’s 3.2 percent pace.

The robust stock accumulation suggest the recovery will lose a step in early 2012.

In other words, inventory growth, which is not something likely to occur again in the current quarter unless consumer activity picks up, accounted for two thirds of the increase in economic output in the 4th Quarter. It helps boost the number up for one quarter, but it’s not a sign of sustained economic growth. And that’s what we need.

Moreover, it turns out that the economy only grew at a pathetic 1.7% rate for the entirety of 2011. As Brad Plumer notes, this is far from sufficient to lead to the kind of economic growth we need to get back to full employment:

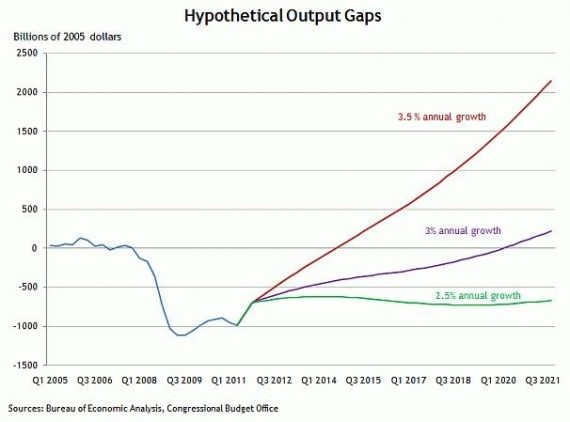

Ever since the financial crisis hit, “real GDP” (what the economy is actually producing) has been lagging way below “potential GDP” (what the economy could be producing, given our existing workforce and resources). That means the country needs some catch-up growth to get back to full employment. Dave Altig, senior vice president and research director at the Atlanta Fed, drew up a chart showing how much growth we’d need to get back to close the output gap. If the United States grows at just a 3 percent rate, it will take until 2020 to get back to full employment.

Here’s the chart that Plumer is referencing:

Cuts in government spending are also a factor slowing down economic growth, but its worth noting that this is part of a vicious cycle created by a slow economy. Especially for state and local governments that must balance their budgets, slow economic growth means less tax tax revenue, which means that something will need to be cut somewhere. That’s a reality that every state government has had to face over the past several years, and even Democratic Governors like Jerry Brown and Andrew Cuomo have been forced to pare state budgets bloated by years of generosity. Furthermore, real economic growth is only going to come when manufacturing, industrial production, and consumer spending are moving forward and there’s very little government can do about that.

This number will, obviously, be revised at least twice more over the coming months. If the past is any indication, we’re more likely to see a downward revision than an upward one so, it may turn out in two months that actual 4th quarter growth was closer to 2.5%. Good, maybe, but not good enough. We’re far from being out of the woods yet, folks.

Update: As far as future economic growth goes, I believe the best indication of just how anemic it is likely to be came in the Federal Reserve’s announcement earlier this week that it does not plan to raise interest rates for at least the next three years:

WASHINGTON — The Federal Reserve, declaring that the economy would need help for years to come, said Wednesday it would extend by 18 months the period that it plans to hold down interest rates in an effort to spur growth.

The Fed said that it now planned to keep short-term interest rates near zero until late 2014, continuing the transformation of a policy that began as shock therapy in the winter of 2008 into a six-year campaign to increase spending by rewarding borrowers and punishing savers.

The economy expanded “moderately” in recent weeks, the Fed said in a statement released after a two-day meeting of its policy-making committee, but jobs were still scarce, the housing sector remained deeply depressed and Europe’s flirtation with crisis could undermine the nascent domestic recovery.

The Fed forecast growth of up to 2.7 percent this year, up to 3.2 percent next year and up to 4 percent in 2014, but at the end of that period, the central bank projected that the recovery would still be incomplete. Workers would still be looking for jobs, and businesses would still be looking for customers.

“What did we learn today? Things are bad, and they’re not improving at the rate that they want them to improve,” said Kevin Logan, chief United States economist at HSBC. “That’s what they concluded — ‘We’ve eased policy a lot, but we haven’t eased it enough.’ ”

The economic impact of the low-interest rate extension, however, is likely to be modest. Many businesses and consumers can’t qualify for loans, a problem the Fed’s efforts do not address. Moreover, long-term rates already are at record low levels and, like pushing on a spring, the going gets harder as it nears the floor. Finally, the Fed already was widely expected by investors to hold rates near zero well into 2014, limiting the benefits of a formal announcement.

“I wouldn’t overstate the Fed’s ability to massively change expectations through its statements,” the Fed’s chairman, Ben S. Bernanke, said at a press conference Wednesday after the announcement. “It’s important for us to say what we think and it’s important for us to provide the right amount of stimulus to help the economy recover from its currently underutilized condition.”

This forecast, of course, assumes that there won’t be any outside factors such as an international crisis or a resumption of Europe’s Soverign Debt problems, that end up retarding economic growth in the coming years. There’s reason for optimism, but also caution. And there’s really nothing to celebrate right now.

With oil at, near or above $100 bbl that’s the best that can expected. And it’s only going to go up not down.

There’s that Small Government wet dream again…austerity during a recovery…f’ing genius.

Doug ever heard of a trend line. If real GDP growth over the year was 1.7% and the last quarter was 2.8% what does this tell you? It wasn’t an incredible number but neither was it awful either by comparison with previous US quarters or peers (the UK shrank by 0.2%). And as a reference point real growth over the entire Bush presidency averaged 2%. No one is claiming the US economy has fully recovered from the worse recession to hit this country since the thirties. I know you’re heavily invested in the economic failure storyline but do try to manifest some realism. What’s most likely to happen this year is the same slow steady upward trajectory we’ve seen over the last year or so. Auto sales were nearly 13 million last year and the head of Auto Nation is forecasting a 14 million car market this year which is more or less back to its natural level of 14-15 million units. Let me assure you Americans do not buy 14 million autos in a weak economic climate.

Doug:

“Based on the retail sales report for December that we saw earlier this month, it’s pretty clear that consumer spending did slow during the final month of the year. ”

Kiplingers:

Last updated: January 12, 2012

Expect retail sales to grow by 6% in 2012, somewhat slower than the 7.4% pace set in 2011. Consumers are gaining more confidence in the economy and are willing to spend on purchases put off during the recession. Holiday sales, which include November and December sales, minus restaurants and autos, grew 5% over the previous year.

@Brummagem Joe: You just re-made Doug’s point. Holiday sales growth (5% year-on-year) lagged the all-year sales growth (7.4% year-on-year).

Doug:

“Based on the retail sales report for December that we saw earlier this month, it’s pretty clear that consumer spending did slow during the final month of the year. ”

WASHINGTON — Retail sales barely rose in December, but the gain was enough to lift sales to a record level for 2011. It marked the largest annual increase in more than a decade.

Sales inched up 0.1 percent in December to a seasonally adjusted $400.6 billion, The Commerce Department said Thursday. It was the second straight month that sales have topped $400 billion. Never before had monthly sales reached that level.

The government revised the November sales to show a stronger 0.4 percent gain – twice the original estimate. That pushed sales in November above $400 billion on a seasonally adjusted basis.

Joe,

Perhaps you ought to read this, rather than an economic forecast, because it’s what I was referring to:

Uh, why would businesses be building inventory if they didn’t think they could move it?

Sam,

If you read the links, you’d know that during most of 2011 business inventories were shrinking. It’s inevitable there would be a quarter were that would not be the case and inventories would be re-stocked. The point is that building up inventory is not, in and of itself, sustainable economy growth. We’re unlikely to see the same inventory growth in the 1st Quarter of 2012, for example

@Chris Lawrence:

Wow only a 5% increase over December 2010. Disastrous. The point is that Doug’s criteria is a bit silly.

@Doug Mataconis:

A 5% increase over the comparable prior year period (which imho is the only valid benchmark) and an overall annual increase of 7.4% is not a seriously weakening retail climate by any stretch of the imagination. And auto sales went up by nearly a million. I have contacts in the automotive component industry and they are doing high fives at the moment.

Let’s not overtax Obama’s brain and give him a chance to prove he is worth re-election.

The annual budget request, according to the Budget Act, is due next Tuesday. Will he deliver it on time, or has his campaigning around the country diverted his attention from his primary job.

True, absent stimulus spending. And it is a bit coy of you to describe it this way, without revisiting the choice, and your position on the choice.

In mock ignorance we could say “State spending falls, school spending falls … what could we have done?” If we wanted to do that …

@Neo:

Constitutional fail.

@Doug Mataconis:

“The point is that building up inventory is not, in and of itself, sustainable economy growth.”

Doug, it’s not as simple as that. If I’m going to retail more volume I need more inventory and this process then carries right back down the supply chain. Auto inventories in a 14 million car market are going to be higher than when the market bottomed at around 11.3 million units in 2009.

I get the impression that the build up in inventory is primarily cars. The Japanese Tsunami disaster slowed down supply. Now its coming back.

Again…the really big deal is Government shrinking. Just like the UE numbers…making the Government smaller is holding back the economy. And the stimulus that “did nothing” ran out.

Look…common sense tells you to save during the good times, and spend it during the tight times when you need to. Republicans have turned this on it’s head. They spent like drunken awol air-nat’l guardsmen during the good times, and are now pursueing austerity in the midst of a recovery. It’s upside down. It’s killing us. And yet they tell us they are the only ones who know how to run the economy. Right.

@Doug Mataconis:

So, perhaps libertarian minded austerity isn’t the best policy choice to foster growth?

Oh, you needn’t worry about that…his political opposition (even weaker than GDP growth) all but guarantees his re-election…

Shocking! Of course, when has libertarian minded austerity ever proven to be the best policy for anything…

@Hey Norm:

Whatever it is, and autos will certainly be part of it, inventory building as you emerge from a slowdown is entirely normal. Doug need to take a second look at his charts because as he says we have an economy that is operating well below capacity because of private deleveraging, strapped federal/state budgets, etc. As it returns to full capacity the amount of inventory in the system expands to match the increased level of economic activity. Inventory growth can be somewhat ameliorated by more more efficiency but turns, shorter supply lines, JIT, etc are probably maxed out.

As I noted in the update, the Federal Reserve Board obviously isn’t nearly as optimistic about short-term economic growth. Otherwise, they would not have announced that interest rates will continue to be near zero (or, if you adjust for inflation, real interest rates are actually below zero but that’s another issue) until at least 2014.

@Doug Mataconis:

There’s plenty of reason for pessimism here. Take a look at … it’s not pretty.

@Doug Mataconis:

Nobody is disputing this Doug but the very fact that the Fed is keeping interest rates low will encourage growth. But your unrelieved gloom is overdone. I note that you never responded to the point that this awful1.7% for last year is precisely 0.3% lower than the growth rate for the ENTIRE Bush presidency when we experienced one of the great bubble economies of the last 100 years.

John D’Geek says:

Of course it’s not pretty. But he’s mainly making the point that like Japan we’re in a liquidity trap, something that Keynesian economists have been pointing out for three years. Viz.

ROACH: It is going to take really aggressive structural policies aimed at changing behavior rather than the big bazooka of monetary and fiscal stimulus, which the authorities have embraced as an answer to a crisis. I think what we found in ’08 and ’09 is that aggressive monetary and fiscal stimulus can stop the crisis but it can’t spark a sustainable recovery. There’s no traction when you’re in a ‘liquidity trap’ when interest rates are too low and debt loads are too high to get real actors in the economy to respond.”

And do you know how you get out of a liquidity trap? The reason the “authorities” have embraced monetary remedies is because the obvious ones of fiscal stimulus are blocked by Republicans for political reasons. Having said that he overstates the comparison with Japan. We’ve seen a massive deleveraging in the private sector and amongst consumers over the last three years which he seems to be ignoring and which the Japanese never achieved. Our situation in terms of corporate and consumer debt is very different from say Britain whose economy probably looks most like ours in Europe. And because we’ve deleveraged in the private sector it does provide some room for an expansion of consumer spending which after all is around 70% of GDP.

I am more interested in the ridiculous price of gasoline and the daily increase in food prices.

@Lomax:

If the economy continues to expand gas prices will go up further.

How many understand that to go to the gold standard now, we’d need massive devaluation?

Currently you can trade $1738.35 for Euros today, and then for one ounce of gold.

But the day after the gold standard, you must trade $3,647.51, which means you can get about half as many Euros. They did not change their Euro/Gold price.

BTW, because gold is “cheap” today, it shows the dollar is “strong.”

Oh, this guy says the exchange price would be $10,000 per ounce.

He doesn’t really talk about it in the international sense, trading with all those countries keeping their existing currencies and their gold prices …

It could never work for reals, or at least pre-apocalypse.

Why does anyone believe that a country that is not competent enough to build a pipeline will be able to create high levels of economic growth.

Deficit spending during bad times just transfer some of the bad times into the future. Deificit spending to keep government employees in their cubicles not just means higher taxes in the future.

Deficit spending to stimulate the economic would make sense if people were willing to cut government spending during the good times. However, since people do not support government spending during the good times, the result is the ratchet effect when spending always goes up.

@superdestroyer:

What about moon bases?

@john personna:

Space exploration is just a form of what some economist would call national monument building.

An economic case for space exploration cannot be made. I doubt that all of the economic benefits from the existing satellite network would equal all of the money spent on space exploration (including all of the defense spending in the 1950’s).

@superdestroyer:

Like say, when Bill Clinton rasied the top marginal rates, instituted a paygo system (amoung other things) and set the nation up with a nice tidy rainy day surplus?

@superdestroyer:

Deficit spending during bad times just transfer some of the bad times into the future. Deificit spending to keep government employees in their cubicles not just means higher taxes in the future.

Deficit spending to stimulate the economic would make sense if people were willing to cut government spending during the good times.

Er….you do realise you’re contradicting yourself there don’t you. Probably not.

@Brummagem Joe:

Look up the ratchet effect. State governments raise taxes in the bad times because they are not allowed to run deficits. Then when the recovery happens, the states receive a huge windfall that they spend and make long term financial commitment with. Repeat during every down cycle and state taxes just keep going up. See California for a good example.

Since the feds can just borrow money, the feds borrow more during the bad times, start new “temporary” programs that never go away and the cyclce gets worse with each downturn.

Eventually the U.S. will get to the point that it will not be able to tax and borrow enough to keep everything going. The only interesting thing is that most of Europe will get there before the U.S.

@superdestroyer: start new “temporary” programs that never go away and the cyclce gets worse with each downturn.

Er…the two occasions when the cycle got dramatically worse was at the end of the Reagan and Bush 2 presidencie. Reagan left office having tripled the public debt and Dubya left office after having achieved the twofer of doubling the publica debt and leaving the worst recession since the thirties.

@superdestroyer:

The U.S. government does not borrow money and does not fund spending with taxes. It has a different monetary and banking system than the EMU and cannot go broke.