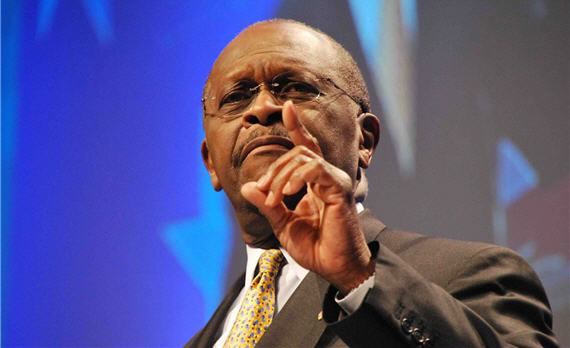

Herman Cain Tries, And Fails, To Defend 9-9-9

Herman Cain's 9-9-9 double talk is starting to show

Yesterday on Meet The Press, Herman Cain admitted that his tax plan would result in some Americans paying more taxes:

Republican presidential candidate Herman Cain acknowledged on Sunday his “9-9-9” tax reform plan would raise taxes on some Americans but denied criticism it would help the rich while hurting the poor.

“Some people will pay more. But most people will pay less,” Cain, a former chief executive of Godfather’s Pizza who has never held elected office, said on NBC’s “Meet the Press.”

The acknowledgment of higher taxes could give ammunition to a growing number of Cain critics, including anti-tax crusader Grover Norquist, who oppose his plan.

(…)

“Who would pay more? The people who spend more money on new goods. The sales tax only applies to people who buy new goods, not used goods. That’s a big difference,” Cain told NBC.

Of course, what Cain doesn’t acknowledge is that a sales tax, especially one like his that has no exemptions for items like good such as many state sales taxes do, would disproportionally impact the poor and the middle class. Put simply, people with lower incomes spend more of their money because they have to, therefore they are going to end up being impacted more by such taxes. Additionally, as Gregory tried to get Cain to acknowledge yesterday, a national sales tax would have a serious impact on small business in states that already have a high sales tax. As Dave Schuler pointed out in a comment to an earlier post about 9-9-9, the sales tax rate in Chicago right now is 9.75%, including both state and local taxes. Add the Cain plan into that and you’d have an effective sales tax of 18.75% on goods that aren’t exempt under state law (on those goods it would “only” be 9%). Even here in Virginia, where the sales tax is relatively modest, we’d end up paying an effective tax rate of 14%. Numbers like that would be devastating for lower income earners, and for small businesses.

Gregory tried to address that issue with Cain yesterday, the result was, well, frustrating:

Visit msnbc.com for breaking news, world news, and news about the economy

MR. GREGORY: But that doesn’t make any sense to me. If I’m already paying state taxes, and I have a new Cain administration national sales tax, I’ve got more state taxes.

MR. CAIN: No you don’t.

MR. GREGORY: How so?

MR. CAIN: David, David.

MR. GREGORY: You’re not saying they’re going away.

MR. CAIN: Your state taxes are the same. Your federal taxes, in most cases, are going to go down. That’s muddying the water.

MR. GREGORY: The Wall Street Journal says you have one on top of the other. There’s a combined levy.

MR. CAIN: That is not correct, David.

MR. GREGORY: Right.

MR. CAIN: Let’s try this one more time. State taxes are there today. The current tax code is a 10 million word mess. You have probably 100 — you have thousands of loopholes and tricks and what I call “sneak attaxes” in the current code. State taxes today, whatever they are, zero or some number, has nothing to do with replacing the tax code. Nothing.

Cain is right that the Federal Government has no control over state taxes, and Gregory misspeaks at the beginning when he said that “I’ve got more state taxes,” when he should’ve said sales taxes. Cain, however, is either blind or idiotic to ignore the impact that a combined federal and state sales tax would have in jurisdictions that already do have a sales tax, and the impact that a combined levy approaching 20% on the sale of goods would have on the middle class, and on small businesses. The most likely explanation for Cain’s convoluted response here is that he simply hasn’t thought these issues through. As we’re learning, that’s true of many of the planks of his platform.

Update: Hank Adler points out a particular problem with 9-9-9 as it applies to groceries:

One need only look to the annual report of Safeway to understand the impact of 999 on grocery prices. Because the grocery business is incredibly efficient and there is significant competition, there are very, very low margins in the industry. The pretax profit in good years for Safeway is only about 2% of sales and the Federal income taxes therefore are less than 1/2% of sales. After making a reasonable guess based on other information in the Safeway annual report, the total Federal income tax plus Safeway’s portion of their employees’ payroll taxes is less than 2% of sales. Assuming that would all be passed through to the customer in the way of price reductions, the price of food must increase by about 7%.

An immediate increase of 7% in food prices or the mere thought of this could destroy any chance Herman Cain has with retired and low income voters. As this voting block does not pay income taxes, the resultant reduction in their spending power would surely result in these voters looking elsewhere.

And that doesn’t even cover what would happen to the price of a pizza from Godfather’s

What Cain should do in make the 9% tax a value-added tax, that way no one will notice that their taxes went up and they’ll blame the”greedy business that raised its prices.” A win-win! (You’d think that a guy who ran a retail business would be able to figure this out himself.)

A number of people have run the numbers and it seems pretty clear that the lower and middle class will see their taxes increase, while higher income earners will see their taxes drop. I am not sure that is what we want when we face such massive unemployment.

For analysis of Cain’s foreign policy positions, I would very highly recommend Drezner. Cain has clearly thought a great deal about the important issues facing our country.

http://drezner.foreignpolicy.com/posts/2011/10/15/this_is_herman_cains_foreign_policy

Steve

C’mon…It’s all double talk from that side of the aisle. Cain is no different.

The best example is the current favorite….The bottom 47% don’t pay income taxes, but they should have some skin in the game…which is just double talk for we want to raise taxes on the poor and middle-class.

The two so called “Jobs Bills” from the Republicans are nothing but tax cuts for the rich and de-regulation…which only benefits the rich…and neither of which produce significant jobs.

Yeah…Cain is talking bullshit…but he’s a republican…so it’s expected.

That does seem to be the plan. Cain knows who he works for…

This is much of what so-called “conservative populism” amounts to once you strip away the rhetoric. It’s a four-part sleight-of-hand that consists of (1) advocating policies that primarily or exclusively benefit rich people (2) using some convoluted variant on the trickle-down theory to claim the policies will benefit the average person (3) emphasizing that it will lower “your” taxes without specifying who the likely beneficiaries are (4) attacking opponents of the plan as “elitists.”

Wait, you mean Herman Cain’s fantasy tax proposal fails to withstand even basic scrutiny?

Well, I for one am just shocked.

Does anyone else wonder how Godfathers can still be in existence?

How is this any dumber than Reagan’s Cut-Taxes-To-Collect-More-Taxes nonsense? The GOP has been in magic fairyland since the Gipper first sold that snake oil. This is the same old same old.

Except revenues did go up in the 80s after tax rates were lowered. The problem is, so did spending.

U.S. government receipts fell in 1983.

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=200

They also dropped after Bush’s tax cuts…

@ Doug,

The boom in the 80’s had much more to do with a pretty steep drop in the cost of oil after 1981, Volcker easing up on interest rates in 1982, a de-valuation of the dollar, and deficit spending (as you mentioned). Reagan’s tax cuts fall pretty far down the list in terms of their economic effect.

Unfortunately for us, we have little control over oil prices, interest rates are already at incredibly low levels, the value of the dollar isn’t high enough to de-value it, the Teavangelicals have managed to steer the spending discussion towards austerity, and effective tax rates are already at an historical low.

There’s nothing in Reagan’s bag of tricks (or luck) that is going to help us today.

Receipts also seem to have gone down after Mr. Bush the Younger cut taxes, and went up after Mr. Clinton raised taxes. So much for magic.

Whenever a Republican speaks, assume the opposite is true. Cain claims his plan would cut taxes for the poor and middle class, but they actually would do the opposite. Republicans claim revenues go up when taxes are cut, when in fact the opposite happens.

Republican reality is the Bizarro World, where everything is its opposite.

Herman Cain’s plan of 9-9-9 will ruin this country. Sales taxes will be added to all food, medicine and alcoholic beverages. We can not afford in this unstable economy to have our taxes raised. This is the main point congress is trying to put to the President right now. Herman Cain to me is Obama in sheep’s clothing. I am thankful I know now by Fox News this information. Herman Cain has never held an office worthy of the Presidency. Herman Cain wants to ruin America and the American Dream. My fellow friends this is not a time to get giddy about a candidate who does not care about the American people one bit. Herman Cain is out to ruin America. The pizza plan as I like to call it is not a sustainable plan. It is highly toxic if passed in congress. We wouldn’t be able to afford the necessities we need. Senior Citizens which I care deeply about would not be able to get the medication they need to survive. Health Care cost “you think their bad now” if elected to the Presidency those cost under Herman Cain’s plan would sky rocket. Herman Cain is not a leader for the American people. He is out to destroy the American people.