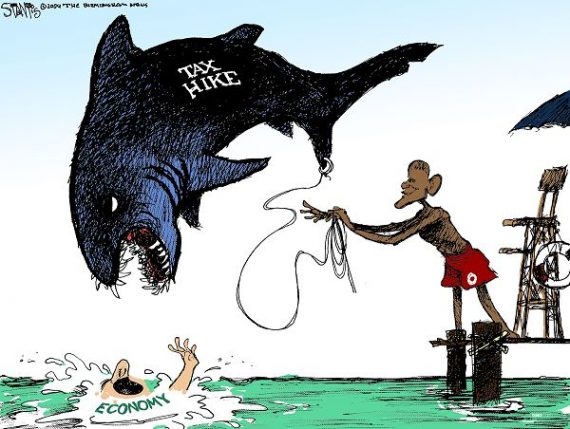

Higher Taxes Don’t Lower Deficits

File this under So Blindingly Obvious, Only A Congresscritter Could Miss It: Raising taxes doesn’t lead to lower deficits because Congress will just spend the money:

Richard Vedder and Lowell Gallaway of Ohio University co-authored a often-cited research paper for the congressional Joint Economic Committee (known as the $1.58 study) that found that every new dollar of new taxes led to more than one dollar of new spending by Congress. Subsequent revisions of the study over the next decade found similar results.

We’ve updated the research. Using standard statistical analyses that introduce variables to control for business-cycle fluctuations, wars and inflation, we found that over the entire post World War II era through 2009 each dollar of new tax revenue was associated with $1.17 of new spending. Politicians spend the money as fast as it comes in — and a little bit more… [N]o matter how we configured the data and no matter what variables we examined, higher tax collections never resulted in less spending. [Emphasis added.]

Absent a Balanced Budget Amendment, the only way I can see that we’re going to get real, meaningful spending reductions is to follow the base closure method: Set up a commission specifically devoted to proposing cuts which Congress then votes on as a whole package. I’d be happy to have both, actually.

Of course, to be accurate, the actual finding is that increased spending causes higher deficits, not the taxes themselves.

I see the finding as increased taxes lead to increased spending which makes deficits worse. An argument can be made that deficit reduction plans should not use increased taxes.

“Set up a commission specifically devoted to proposing cuts which Congress then votes on as a whole package.”

As I remember, Republicans in Congress wrote a bill to do just this then voted against their own legislation en masse once Obama came out in support of it.

Generically, I suspect if one looked into it that deficits typically only come down in periods of unexpected economic growth relative to the existing fiscal policy framework

The chairmen of the deficit commission proposed a 2:1 ratio of spending cuts to tax increases. I think there’s a bit of wiggle room over that. I would welcome a national consensus on the rate at which we’ll allow spending to grow.

However, there’s reason to believe that there are limits to how high the effective tax rates can be raised: Hauser’s Law. It’s not dispositive. But it is suggestive.

So far it has held true regardless of nominal rates as long as we’ve had automatic withholding. If it continued to hold true it would mean that the only way to keep deficits below some specific level would be to restrain spending increases.

I’m not sure which is worse, that people do US-only, national-only studies, and extend them to all possible futures – or that people believe them.

This is an example of “data mining,” in the pejorative sense. If you look at any data set you can find artifacts. The smaller data set you select, the more artifacts you’ll produce.

Dave mention Hauser’s Law, but nobody really believes Hauser’s Law. I mean, you can start at the Wikipedia criticisms section:

http://en.wikipedia.org/wiki/Hauser's_Law#Criticisms_and_commentary

Or you can try to find a mainstream, big gun, economist who buys into this episode of data mining.

(BTW, I think there’s a bug in the “posting too often” code right now.)

So, it looks like everyone is agreed that raising taxes in general does not result in lower deficits.

Can we NOW finally admit that CUTTING TAXES also does NOT result in lower deficits?

“Of course, to be accurate, the actual finding is that increased spending causes higher deficits, not the taxes themselves.”

Certainly technically correct, but as anyone who has had to deal with budgets knows, give’m a dollar and they will figure out a way to spend it. I think the (correct) essence of Dodd’s comment is that government knows that it’s spending will only be throttled by public/voter backlash to taxation, or bond market backlash to borrowing. Since the bond market has allowed them to get away with it, spending settled in at 1.17 of tax revenue increases. But that party is about over…….

“Generically, I suspect if one looked into it that deficits typically only come down in periods of unexpected economic growth relative to the existing fiscal policy framework.”

Sounds right to me. It takes time for them to figure out how to raid the re-loaded cookie jar.

“So far it has held true regardless of nominal rates as long as we’ve had automatic withholding.”

The most brilliant, but evil and insidious, mechanism ever devised for fleecing the public. Just as home or car buyers look almost exclusively at the monthly payment, so do wage earners tend to look only at the take home number. (unless they are just entering the work force and that perceived fabulous salary is really only…….WTF happened???!!!)

“The chairmen of the deficit commission proposed a 2:1 ratio of spending cuts to tax increases.”

There was a “deal” struck between Reagan and Tip O’Neill on just such a mix. Are you all sitting down? The spending cuts just never seemed to materialize. Shocking, really. (snicker)

Good one, Jack. It must be that no matter what country, or state, or locality you live in, your taxes are already perfect!

Actually, bad one, Jack.

With an alternative source of financing – borrowing – it renders your premise moot. Lowering taxes would put pressure on borrowing capacity and actualy reduce spending. And you are about to live it.

As for a more general premise dear to the left, that taxation does not affect behavior…………ever lived near a state border where things like alcohol, cigarette and gas taxes are different? And did you see the recent report on population migration and taxation? But of course, taxes don’t matter……………….

Drew, we know that debt levels and credit availability vary out-of-sync with tax rate, so what’s the point?

I think that the pressure on borrowing is more about the economic downturn than it is about tax policy.

I simply do not buy the “starve the beast” logic. The counter-evidence to that notion are the Bush Tax Cuts followed by Medicare Part D, two wars, etc.

JP and Steven –

I think you have both missed the point. The credit markets have pretty much been wide open to the government for 50 years. Just look at the increasing national debt, and the source of that: spending less taxes = deficit, for 50 years. Said another way, when public backlash to taxation has reared its head, there have always been the debt financing markets as the safety valve to support more spending, because fears of excessive debt incurrance have been much more of a theoretical concern; certainly much less tangible to politicians than episodic tax backlash. But I repeat, that is coming to an end. In corporate finance-speak: the United States is at long last broaching its debt capacity. And that, actually, is the salient point here.

To create a business analogy. Suppose you are a two product company. You sell widget “A” with cyclical demand and profit. You sell widget “B” with steady and increasing demand and profit. Total profit, and what you can spend, is not governed by the profits of widget”A,” but by combined profits, and really governed more so by widget “B.” Taxes, of course, is widget “A”. Increasing debt capacity is widget “B.”

So, Steven. My point is that US debt capacity is reaching its limits, and therefore the control valve will be taxation, and “starve the beast” will, in fact, be relevant and effective. Else we broach policies of pathetically low growth, or Grecian or Ireland-like debt high wire acts.

And JP, your point about the phasing between tax rates and credit availability are just wrong, silly and irrelevant. There has been no point in our lifetimes when the US could not draw upon the credit markets, no matter the tax rate. We could always finance the government. Further, the only point in time I am aware of where financing costs (“crowding out”) seriously impeded private (or public) business activity was in the financial crisis of 2008 – 2009. And that was extraordinary.

Historically, the argument surrounding marginal tax rates goes to incentives and growth, and trying to find taxation levels that do not harm them. (not govt spending or private financing considerations) But there is a paradigm shift in motion. And raising tax rates in an age of slow growth, just because the spendthrifts in government have tapped out their limit at the bank and have no stomach for fiscal responsibility is no reason to do it. In fact, it could be economic suicide.

Why, when Bill Clinton discussed reincarnation, did he want to come back as the bond market?

Oops, that was Carville discussing the Clinton brush with “bond vigilantes”

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=adGdbnMsKTQg

JP –

Sigh. If you want to make the case that the bond market was tapped under Clinton, make it. Don’t, as is your usual want, make vague, cheap and arcane references and then just walk away. Step up and definitively make the case. Just make the case, dude.

PS – Hint: you might want to inspect absolute debt, debt to GDP, and interest rate statistics before you walk out on that limb. Just sayin’.

@Drew:

The thing is, I don’t see the US as being in a position to be unable to borrow any time soon.

So…cutting taxes will finally reduce spending and somehow supposedly reduce the deficit, even though this chimera has been proposed many times in the past and never, ever worked? When this new dynamic finally occurs, will everyone get magical ponies too?

So a tax increase can be added to the list of things that causes Congress to spend more money. It joins sunrises, sunsets, moon rises, oxygen, … … … Serious policy debates can be had over when a tax rate cuts economic growth to the point of reducing federal tax receipts, but it is going to take more than noticing that Congress likes to spend money to prove a point.

Arcane, Drew?

I’ve read references to the “I want to come back as the bond market” dozens of times since I got into the econ and politics thing and began reading.

It’s not a case I need to make. All I need to do is drop reference to it, to remind anyone with similar experience of the story. The link is there for anyone new to it.

Steven, the world savings glut, NPR’s giant pool of money, has shaped things in recent years. Unfortunately we are rolling through an era of global debt crises.

People generally accept this means low borrowing costs for the US (but not the states!) in a short term, with the near certainty of “higher” rates later on.

No one with sense will claim to know how much higher.

Steven –

Look, you may be correct. But I think a sober view of QE, international commentary, and gold price movement all are saying we are approaching that point, lest we just accept hyperinflation and dollar devaluation.

JP –

So sad. I’ll go you one further. Clinton is supposed to have said (Stepho’s book) “you mean to tell me my Presidency is in the hands of a bunch of fucxxxing bond traders?!” But the fact of the matter is that the bond market was open throughout his Presidency, and until today. Rather than make juvenile arguments aimed at me, you ought to observe Steven’s response, where he decides to respectfully disagree with my assertion. I think he is wrong; he thinks I am wrong. Fine. But that’s the real issue – have we reached max debt capacity? – and the call of a lifetime right now. But your inane references to the Clinton administration are, well, bizarre.

Drew, I stay calm and you make two attacks. In the second, amazingly, you use “juvenile” to describe my calm entries.

Remaining calm, you’ve moved the bar quite far now. Instead of saying credit was always easy for the government, you are just saying “the bond market was open.”

Remember, your original claim was:

“There has been no point in our lifetimes when the US could not draw upon the credit markets, no matter the tax rate. ”

Moved goalposts noted.

(And of course you are REALLY far afield from the “higher taxes don’t lower deficits” starting point.)

Sigh. Time to move on. Steven and I have a basic policy disagreement. Only time will tell who is right.

You, odo, are now just masturbating: “Instead of saying credit was always easy for the government, you are just saying “the bond market was open.”

There is no difference, except to those scrambling for a safe haven debating position. Real interest rates, or inflation/currency devaluation just have not been a problem for the US government in our working lifetimes, JP. They simply have not. I am in disagreement with Steven about prospects; that’s a legitimate disagreement. But you are off in odo-JP wonderland trying to figure out some crazy way to make a crazed debating point. Grow up, “calm boy.”

Who is juvenile? When you come up against questions too hard, you strike at what you hope is below the belt. I mean, look at yourself. You don’t really explain your idea, you go ad hominem.

I guess what I like is that I can show my self-control. I mean, I can go off on people, but I don’t have to. I have a choice.

Your position was that government had not come up against a lending limit. Except, it is well documented that it had, or at least the President perceived that it had, in recent history.

So rather than deal with that, you become increasingly belligerent.

BTW, I assume you were alive in the Ford administration. Did you wear a WIN button?

And, for redundancy, your claim:

“The credit markets have pretty much been wide open to the government for 50 years. ”

Wide open, but President Clinton thought they bound his actions.