Is Lack of Investment Holding Back the Recovery?

People and businesses are sitting on cash out of fear, creating a vicious cycle.

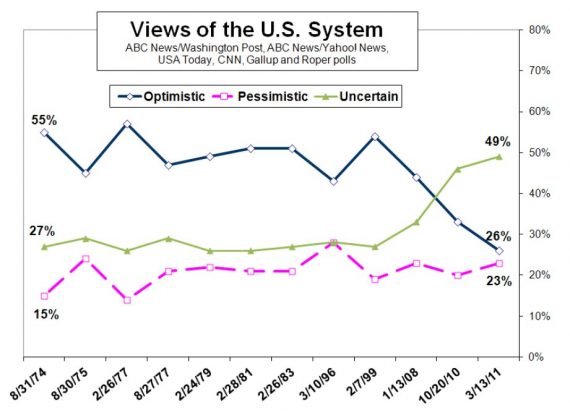

Over at his site, Dave Schuler, noted the rise in uncertainty for the past 12 years. Dave concludes his post thusly,

Uncertainty has its own costs. When you’re uncertain about the future you’re less likely to take risks. An employee may decide not to take that new job. A consumer may decide not to make that additional purchase. That manager may decide to hold onto cash to see what happens next rather than expanding his business.

I’ve also been reading several posts by Robert Higgs on regime uncertainty and its potential effect to slow an economic recovery (here, here and here). Coupled with all the stories of firms sitting on large piles of cash (here, here and here).

I’ve also looked at the BEA’s numbers on total GDP, Personal Consumption Expenditures and investment, and the picture is one of where GDP and PCE have recovered to the point where they exceed their levels prior to the recession, but investment spending is still lagging considerably below its pre-recession levels.

So, I’m wondering is the anemic economic growth at this point and time really a function of lack of consumer spending or is the weak investment spending the real culprit? To the extent that labor and capital are compliments more spending on capital might also necessitate more spending on labor on the parts of firms. And is the increased uncertainty that Dave noted in his post a factor in this lack of investment? And how much of that uncertainty is due to the government? Considering the our precarious fiscal state, the deficits that show little or no sign of decreasing for sometime, health care reform, financial reform, Quantitative Easing parts 1 and 2, TARP, and now our growing commitments abroad.

If investment does not rebound then economic growth will likely remain sluggish. That will not help the employment situation. Both will likely exacerbate our fiscal situation which in turn could lead to even more uncertainty about the future as politicians look to additional measures to deal with the problem.

Who was surveyed?

If it was the general public (you know, the 90% who have seen their incomes/wealth stagnate or even decline) then it is no surprise uncertainty increased.

Who has the money to invest?

The top 10% whose income/wealth has soared.

No, it’s not lack of confidence. It’s greed.

Looking at the first link with the Nat Income and Product Account Table, it seems to me that almost the entire loss of private investment is from residential (line 11) and structures (line 10) which makes sense. Non-residential (line 9) and Equipment/software (line11) are actually higher in 2010 than in 2005.

Taiko,

That is just it, after excluding residential investment you still are taken back to 2005…two years before the recession.

I would have to ask Jack if those greedy millionaires would be even more greedy by investing all that cash? Which is it I wonder? Sit on the cash for fear of losing money type greed or invest it and make money greed? Which is worse? If it’s not a lack of confidence they could make some money why would greedy people sit on their cash? The reality is your statement makes no sense.

Let’s recap the financial situation. Housing, a large economic driver, is about to double dip. Oil, which some attribute to starting the recession, is on the rise again. Government regulations are increasing. Health care is still an unsolved problem. Debt is growing at a record pace. China is still producing goods at prices we can’t match. Pension bombs await every state government on who we rely for infrastructure. Heck, things can’t get much better.

As I was growing up it was typical that in difficult times you held to money rather than spend it. That may be contrary to modern Wall Street thinking but it would make sense that people are staying out of investing to a degree because it does carry, well, risk. Risk is something many of us are growing averse to.

How are these two separable? Chicken or egg, either contracting would produce a feedback in the other.

BTW, overlay the S&P 500 on this graph and you will see a correlation as well. There was much less uncertainty when returns were consistent. A violent 10 years in the market corresponds with an increase in uncertainty. That is not unreasonable.

(Yeah, with a long historical lens, I’m going to say the 2000 market crash was the start of our current problems.)

“Taiko,

That is just it, after excluding residential investment you still are taken back to 2005…two years before the recession.”

Ah, I see what you’re getting at.

But in 2005 we were in the middle of the RRE boom, no? So wouldn’t it be reasonable to assume that the RRE investment number for 2005 would be elevated above historical norms? I wonder how the 2010 RRE investment total compares with numbers prior to the boom and the historical average.

Don’t look for something that started in 2000 (1999?) in 2005.

The rich are just waiting for the next bubble to form.

If you ran a business you’d be sitting on cash too. That sort of stuff happens when a neo-socialist apparatchik controls the highest office in the land.

There is something different about this recession. It’s not like the past. I ran into this

the other day. It makes more sense than I’ve heard in a long while. At first, it seems over the top. After researching the sister sites a little more, it starts to make sense. This can be scary if this is really happening. Just my take. What do you think?

http://www.DeathByTechnology.us

If you look at the optimistic downturn, it coincides with the free trade agreement. There is nothing optimistic about 57,000 factories that are closed and more than six million jobs lost. We are spreading our jobs among 2 billion cheap laborers and you cannot be optimistic with lost jobs or loss in pay and benefits. The tax cuts have been spent and not stimulating, the low interest rates have been down for years and not stimulating, the government keeps on spending, and the states wants casinos to create jobs all the while we keep sending jobs overseas. There is not much of a reason for a corporation to invest in our country when they have cheap labor to go to. Half the products we buy are foreign made, so it is less stimulating today to buy into our country than 30 years ago. You have more takeovers and consolidation. So the uncertainty keeps going up. James Joyner said it was good that other people in other countries are getting jobs, but he has no answer to the jobs lost here.

Small business cannot create jobs if the factories are closed in the communities. And there are only so many products to be made spread about 2 billion cheap laborers. Democrats keep spending and republicans are lost in their ideology. You need upward movement for the middle class instead of threatening them by taking away their jobs and their benefits, while raking in profits.

“So, I’m wondering is the anemic economic growth at this point and time really a function of lack of consumer spending or is the weak investment spending the real culprit? To the extent that labor and capital are compliments more spending on capital might also necessitate more spending on labor on the parts of firms. And is the increased uncertainty that Dave noted in his post a factor in this lack of investment? And how much of that uncertainty is due to the government? Considering the our precarious fiscal state, the deficits that show little or no sign of decreasing for sometime, health care reform, financial reform, Quantitative Easing parts 1 and 2, TARP, and now our growing commitments abroad.”

Heh. The point I’ve been harping on for a good year and a half now. And I’m routinely called a naysayer, a greedy Republican businessman (eg: Jack), a turd or idiot or – by one frequent commenter – an Obama-driven racist. And of course my view is just irrelevant because – what the hell – its all “anecdotal” anyway. Erudite economic and business analysis if I’ve ever seen it!! And by people who don’t have to cut the check no less. (snicker)

But why do I say things about uncertainty? Oh, I don’t know………maybe because I’m a professional investor who supplies investment capital? Maybe because I sit on the Boards of companies making capital investment decisions? Or that I speak with a rather large swath of business owners who express the same sentiments?

Nah. Couldn’t be that. It must be all anecdotal……..evil, greedy and politically or racially driven to boot.

Here’s the deal: serious people make investment decisions by present valuing the expected risk adjusted income stream against the investment requirement. Finance 101. This ain’t charity. You can’t tell these capital providers or business owners that they are greedy pigs, they should have the returns taxed away if the investment works (and if doesn’t, tough titty), and that the cost of employing people to fulfill the capital investment potential is going to be uncertain……but probably certainly more……….and expect them to open the spigots. That’s simply insane.

Unless, of course, you are insane. So we have Paul Krugman – todays Lester Thurow and no doubt tomorrows Thurow trash heap buddy. And anyone seen the video of the former SEIU union boss who wants to take down the banks, starting with JPMorgan. I’m sure he believes in what he’s saying. But he’s insane…………oh, and evil. This will destroy the environment for the little guy. I suspect he knows that; he’s just a shill for his union buds………speaking of greed.

As for those who agree with him. I believe the phrase is “useful idiots.”

The left needs to get real.

I want to echo was Steve Plunk said above. The last several week I’ve been hearing from people saying that the capital gains taxes need to go up because the robber barons are making lots and lots of money off investments. Greedy bastards. But if they don’t invest, well that’s greedy, too. The obvious answer is to for them to just lose their money.

Yes.

Sure.

IDK, all the BEA does is break down investment into non-Res and Res. The Res might be mostly real estate or other types of investment.

But look at the non-Res investment and you’ll see that from 2004 to Q1 2008 it was increasing that whole time. Then after that is dropped to a low point comparable to Q3 2004.

[Note: when I refer to capital, I’m using it in the context of economics–i.e. plant and equipment, not money]

I know one argument is that there is excess capacity, but I think that is flawed thinking and treating capital (plant and equipment) as interchangeable from one line of production to the next. For example, we might have loads of capital for producing something that is no longer in that much demand. Can that capital be simply switched over to some other line of production?

For example, private investment for businesses does include the following under structures:

Now the temptation might be to say, “Ah-ha! There the housing/real estate boom!” Yes, but do we still need that much investment there in capital for building houses, improvement and such? Probably not. If anything we have an over-supply of housing. Sure you could sell it, but for what? The point is that most of that capital is not going to be seeing much use if any for awhile. So while there is “excess capacity” for building homes, that does not translate into excess capacity for other goods and services. Granted those investments are “sunk”, and some portion of the investment can be recovered, but probably not all of it. If a firm holds on to the equipment it maybe years before it is used productively again.

Stimulating investment in areas other than building homes maybe very well boost employment. It is the one area of GDP, our economic output, that is severely lagging. Everybody like the cash for clunkers and the first time home buyers credit, why not an investment tax credit. This has the added bonus of enhancing our productive capacity for years to come unlike buying up POS cars that were unlikely to be of much use in producing goods and services several years hence.

Labor and capital are not formless globs that are pushed into a black box production process that yields goods and services. They are quite differentiated and part of our problem might be that we’ve spent years acquiring the wrong types of capital, both physical and human.

So Gerry W –

Since we shouldn’t buy non-US products because it affects the local economy and employment……………should Illinois stop buying Wisconsin cheese? Indiana stop buying Michigan cars? Nevada stop buying California PC’s? Arkansas stop buying Florida tomatoes? North Carolina stop buying New York financial services? Every state for itself?? How about every county for itself?? Or every town?? Or every household??

Where do we stop? Your argument comes straight from the history museum of ridiculous ideas spouted as we switched from an agrarian economy to an industrial economy.

See-ya. I have to go build a steel mill in my backyard now so those evil bastards in Minnesota won’t – heh, steal – our Illinois steel jobs…………….

Other than the fact that they have at ever increasing amounts…not counting the current down turn. It would really help your case if you could point to some data. For example, from 2004 – 2007 Non-Residential investment increased from 10% of GDP to just under 12% of GDP. Even excluding structures and focusing on software and equipment the trend was upwards. Further, manufacturing as a percentage of GDP has been between 11% and 13% since 1987. Granted the current recession has knocked manufacturing for a loop, but up until 2007 manufacturing was growing in real terms pretty much year over year. In 2007 the U.S. manufacturing accounted for $1.690 trillion while in 2000 it was $1.3965 trillion.

Just because the U.S. doesn’t make all the stuff it used to make doesn’t mean it has become a nation of burger flippers and casino workers.

Ah the uncertainty canard.

Probably an outgrowth of supply-side economics which of course is also total bullshit.

Demand. What’s that famous formulation? Supply and certainty?

I guess Henry ford was certain about tax rates so he stated making cars. Oh wait…he wanted his workers to make enough to create demand for his product.

Certainty. Next thing you are going to tell us tax cuts pay for themselves.

Drew,

I never said we not stop buying anything domestic or foreign. What I have been implying is that we live in a world that has 2 billion cheap laborers and there are not enough jobs to go around. The world has opened up and so be it, however, it thins out on what products we can make here. We no longer make the toasters and irons or the TVs. In the past, we had tax cuts, so that we could spend into the economy. That does not work today as half the products bought are foreign made, so it is less stimulative, unless it is reciprocal. And it is not reciprocal.

You can have tax credits or whatever else, and it is all admiral, but the fact remains is I don’t know what will fill in the factories that are closed, or what product that can be made here and not some other country. All the economists keep dancing around these issues and they never have an answer.

Again, in the past, you had tax cuts to buy into the economy. But that does not work as well when half the products are foreign made. So the economics has changed with globalization.

Or it could be that investors are still terrified by the near collapse of the economy under Bush, and want to stay cash heavy.

Perhaps the truth lies somewhere in the middle, as it often does.

Steve Verdon,

I sit in a town in the Midwest with closed factories. There is nothing said on TV, by any economist, or anyone else that has said anything about how to create jobs in our country, outside of the usual. Well, the usual is not working.

Again, we have 57,000 factories closed and some 6 million jobs lost. We see the pressure of lost jobs and loss of wages and benefits because of 2 billion cheap laborers. You can cite the statistics but that does not refer to people being employed. You can have higher GDP or output without employees. Does this include Apple, who has its products made in China? What about six sigma and lean manufacturing and more loss of jobs. What about the internet which took away front office people. Also automation. We have all these efficiencies, but it is not relating to employment. As Bush came to Ohio and said “free trade is good” factories would continue to close. There are some 2000 lost jobs in my town of 14,000. Everything said by economists don’t mean crap. No one has come up with an answer yet. You can lower taxes in which we had for years, you can have credits and whatever else, but China and Mexico will make the products. Yes, we will create some jobs, but that is just a trickle and at less pay. You need an upward movement for the middle class, and I don’t see it. There is more and more competition and while good in normal times, it hurts the middle class as the middle class has no place to turn to. And in my town, if you are lucky, you may be able to flip burgers. And those jobs are hard to come by now. It is interesting to see so many economists so disconnected with the real world.

“Here’s the deal: serious people make investment decisions by present valuing the expected risk adjusted income stream against the investment requirement. Finance 101. This ain’t charity.”

These guys were investing when tax rates were much higher. When the economy was much more tightly regulated. Why not now?

Steve

How many people commenting or posting here, besides Drew, and, of course, myself, actually have to meet a payroll? Do you have any idea how sick I am of people who don’t know what they are talking about telling me what I’m doing wrong, or not doing enough of, or can pay more because they think I should/ for reasons they find useful? Or just because I have the cash and they don’t?

Yes, Charles, we all bow down before your Galtian wonderfulness. We all acknowledge that owners are the only people who produce, and that those who work for them are nothing but parasites stealing their money. Investors are gods, workers are worse than scum. Bless your soul, for you are the greatest thing the world has ever invented.

Geeze, what is it about business guys these days? They need their asses kissed 24 hours a day or they start to sulk like those bankers who are paying themselves a hundred million a year for tanking the economy and whine about how no one gives them the love they deserve.

Wr…

What Chuck is upset about is the end result of a supply side economy. Capatalism is no longer about producing it is only about consuming. Cutting chucks taxes leaves him more room to consume. Demand is no longer necessary. Unfortunately supply side economics is bunk. Hence the uncertainty.

Charles,

I don’t know what you do and maybe I am naive about your situation. I can only tell you what the Midwest had, and that was manufacturing. You take away the factories and you cannot have a small business as you need clientele who are employed themselves. A guy started a store down the street and closed up two months later. Something I could have told him before. People go to the big box stores 10-15 miles away. Too much competition. What we had in my town was the factories. One big one is left, and that is only because it is locally owned. What I have said, is that we need an upward movement. Now, what that is, I don’t know. But we have seen all the ideologies, we have seen all the tax cuts and all the spending and nothing is working as we have globalization and a dozen other problems that need to be addressed. And no one is addressing them or don’t know how to address them. Apple is sitting with 50 billion dollars and pays a dollar an hour. All the power to them. But what do we have to replace or to deal with that. Do we continually bash the middle class? And pin the middle class against the middle class? And since all the pundits and republicans especially on FOX has all the answers, I would like an adequate answer. After all these years, I still do not get an answer, outside of criticizing the middle class.

Trumwill, do you mean capital gains should “go up” from historical norms? Or historic lows?

“Why not now?’

Because the herd is confused.

There is nothing more pathetic than getting a tax cut, and then whining that any increase, even if it is still below the historic rate, is class warfare and they are out to get you.

No wait, there is one thing more pathetic. The Norquist Veto

BTW, Drew is funny. Uncertainty has been building since 2000. For the last year he has been pinning it on his political enemy.

How self-aware is he?

Jeez, Wall Street spends the last decade cranking out headcheese and selling it as steak, when the con fails the whole damn system blows up taking down housing and almost taking down the whole economy. And you wonder why there’s uncertainty?

John P, what I typically hear is that Capital Gains should be taxed as regular income. Income is income and it shouldn’t matter if you made it off of investments or work. Besides which, lower CG taxes end up benefiting the wealthy. The argument certainly has appeal to me. Right up until I start considering the pros and cons of investing our own money. Now I find myself thinking “So wait… if I lose money, I lose money, but if I gain money, I only gain two thirds of it*? That’s really kind of a disincentive. Maybe I should just get CDs and save the money.”

* – If CG were taxed as normal income, I mean. On the other hand, if it were taxed as normal income, would I be able to write off losses to my total income? I’m kind of new to this.

In any event, Plunk’s original point that making money off investments is a sign of greediness… but so, according to Jack, is a desire not to invest.

I’m pretty sure — as only someone not blessed with a degree in economics can be sure – that all the “analysis” about why we are where we are is bullshit, and that we’d probably be just as well able to confront the future utilizing the Azande Poison Oracle . But I do have a question for Drew. He writes:

If I’m not mistaken, wasn’t Drew vehemently opposed to the the “to big to fail” arguments for TARP? That is , that the big banks, like JP Morgan, should have been allowed to drown in their own shit and not be bailed out. I think so, because when Steve wrote:

Drew responded:

So it seems to me that Drew and that evil, insane ex-Union dude have more in common than Drew would like to admit, at least as far as taking down the big banks go.

Congrats, Steve. It’s nice to see you discovering the wildly obvious.

Here are the next baby steps you can take:

#1. The uncertainty is both the cause and the effect of plumetting spending by businesses and households. Things like a sudden large fall in the value of assets creates… uncertainty! Which creates… a fall in spending! Which creates…. MORE UNCERTAINTY!

#2. This is called a “recession”. Or, if credit dries up, a ‘depression’.

#3. Look, you’ve discovered the validation of stimulus (otherwise known as countercyclical spending). See, when consumer stop buying all the things from all the people, then the government steps in and buys them instead only long enough for people to stop assuming that everyone is going to stop buying everything! Then they are no longer ‘uncertain’, or, to be more specific, certain that bad things are going down and they should avoid risk like crazy.

#4. Unless, of course, loony Republicans successfully convince people that avoiding/fighting recession is less risky and deliberately exacerbating it with FURTHER SPENDING CUTS is LESS RISKY! Yayyy!

The problem we have Trumwill, is that several kinds of taxes are at historic lows while deficits are at historic highs, and we’ve got ideologues like Nordquist investing in further gridlock.

IMO there are several ways to increase the fairness, and simplicity, of capital gains taxation. Here’s one:

0-5 years hold time: regular income tax

5-10 years hold time: 1/2 regular income tax

10-20 years hold time: 1/4 regular income tax

20+ years: tax free

That is actually so simple that you could get rid of 401K complexity and management fees. If you want to save tax free for retirement, just buy a balanced index fund and hold it until retirement.

My simple system would bring in far, far, more money, as the hedge fund billionaires would fall in the first category. Regular folks would trend toward the longer holds, especially with this encouragement.

BTW Trumwill, on your own money … I’d think you are in a position to get a lot of your investment money into tax sheltered accounts and/or tax-free bonds. SEP-IRA is awesome if you can qualify (you can shelter 25% of gross income).

IANAL, IANAIA … lots of good books on how to (a) make an asset allocation, and (b) divide that allocation between taxed and tax-free accounts.

Related: When Economists Misunderstand Biology

“IMO there are several ways to increase the fairness, and simplicity, of capital gains taxation.”

How is that fair when the richest 20% of Americans own 85% of this country’s net worth?

The first thing to understand is that “fairness” is part nature, and part nurture. Simians have a fairness concept, as relates to M&Ms. We share some of that, and then extend it with social mores.

My position (pragmatically centrist, but coming from a right of center ideology, genetic or not) is that it depends a great deal on mobility, what those folks were born with. If Gates and Buffet were born from a middle class, like me, it doesn’t bother me too much that they achieved what I could not. That those two “get it” and are ready to recycle that wealth in one lifetime is awesome.

I’m less comfortable with trust fund dilettants, or EuroTrash (Euro or not). And for that reason I love the “death tax.”

I don’t think income taxes need to be in any way a “fix” for income distribution.

BTW Ponce, one of the great ways the left f’s up the middle class is by being way too down on unearned income. By retirement, every worker (blue or white color) should have some unearned income set up.

Combine my capital gains changes above with a tax-free interest and dividends exemption up to median family income. Oh the liberals will scream about how their bosses will get the benefit.

But can they really not notice how this would improve their own lot? It would make possible casual, incremental, savings for their own retirement. Simply add a little to that Mutual Fund when you can, adding back in every dividend, tax free, no worries … until or unless you do actually get rich enough that the dividends represent a real income.

(I should add that the 401K/IRA/Keogh thing is a result of Cognitive Dissonance on unearned income. If you jump through the right hoops you can (pay the brokers extra fees and) save for your retirement.

The hoops don’t help, IMNSHO.)

“By retirement, every worker (blue or white color) should have some unearned income set up.”

john personna, how does the cut in the capital gains tax benefit the average worker? The bottom 80% of the population owns only 7% of the country’s financial wealth, see

http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

Do these people pay much in capital gains tax? What’s the basis for your statement?

First of all, why do you think my plan is a “cut in capital gains tax?”

Wouldn’t we need some sort of proof that the rich are 20+ holders of the same investment vehicles?

I don’t think the Wall Street wheeler-dealers who pop the mega-incomes really are. Oh, there are a few Walton and Bass family members who hold old stocks, but as I say, I’d catch them with the death tax.

(I think, with a 0-5 year holding as regular income, my plan might actually be an increase (for many))

Oh, maybe I misunderstood your question.

The real problem the bottom 80% have is that they cannot save. The average 55 – 64 year-old only has $69,127 for retirement (link). At even 5% return that’s only $3456 per year as an income source. Essentially useless. Such a person would be living off Social Security and using that savings for emergencies only.

What we really, really, need are inducements for savings. And, as I remember my youth, none of my peers saved “because the government takes it away, anyway.”

My change makes savings, in small steps, possible. And surely the idea placed in front of the young, that if they start saving now, it is tax free later … has to be an inducement.

Again I think 401K/IRA/Keogh fail, because they are cumbersome and put up all kinds of behavioral-economic barriers.

john personna, if the Bush era tax cuts on capital gains had been intended to boost investment, they would have applied only to property and equities purchased after their enactment. Instead, they applied to all property, so they rewarded wealth at least as much as they encouraged investment. In my own case, the tax cuts were a windfall. But I think they were awful public policy. I am no economist, but I can’t help but notice that the gains in productivity made in the US since the 70’s have all gone to the upper few per cent of the population, leaving the rest of the public with stagnant incomes. For a time the middle class kept up its standard of living by borrowing using homes as security and by increased work outside the home by wives and girlfriends, but even this doesn’t work any more. So I think a) the tax policy you favor isn’t going to accomplish much in the way of encouraging savings because the middle class is so strapped for money, b) a shift from consumer spending to investment isn’t required at this time anyway because corporations already have lots of cash, and c) the economy isn’t going to recover until the middle class has enough money to sustain a vigorous consumer economy. Putting it bluntly, the economic policies favored by the Republican party are not going to transfer money to the bottom 80% of the population, and the union busting presently underway in the industrial Midwest by Republican governors is going to hurt even more.

I have a feeling you’ll disagree. If you do, please explain why.

It’s all about aggregate demand. If aggregate demand increases, uncertainty will decrease. Right now, we have idle capacity, because we are not consuming as much as we are able to produce. This could be fixed by increasing the supply of money, which is in high demand. That would allow consumption to grow closer to our real capacity to produce

I don’t really understand why everyone just assumes basic macroeconomics doesn’t exist. Perhaps the simplest explanation is the best.

Sam, why the heck are you talking to me about the Bush era capital gains taxes?

Did you not read my posts?

I wrote:

jeez …

I thought financial services were still taking home a disproportionate amount of our GDP. How do you reconcile the financial services industry making a crap ton of money with a lack of investment? The financial services folks clearly have the money that they need to make money off of.. So they’re seeing investment.. so wtf? What’s not adding up?

I can counter drew’s sentiments from the ground floor. The people I see who have been laid off haven’t been laid off because their companies are going insolvent, or because they need more capital to keep these people employed. It’s because the business owners want to keep their 5-10 million per year safe, and make sure their buddies, who own other services companies, are getting the wealth their workers are creating for them.

Also, “uncertainty” is a human trait. Markets markets aren’t uncertain. People are. It’s an emotional response being used to justify ignorant behavior.

“Sam, why the heck are you talking to me about the Bush era capital gains taxes?”

What the hell are you yelling at me for?

(I think you meant Stan 🙂 )

Smart move using a pseudonym when posting such ignorant clap trap. Anyone who thinks I’m a supply sider or Dr. Higgs is one is an ignorant fool.

Gerry,

My problem is that your interpretation of the evidence you have is wildly at odds with a slightly bigger time frame. If it is all off shoring and out sourcing and what not then it is just an amazing coincidence that it started with the greatest recession since the 1930s?

Businesses close during recessions. A sad but true fact. Unemployment rises, people suffer. But to look at this and lay it at the feet of international trade is nonsense. Trade is trade, and if trade between countries is bad, why isn’t trade between states or counties or cities bad?

Yes of course unemployment is a lagging economic indicator. So this is not surprising. And I bet the lag in unemployment this time around is going to be really long. Hopefully we wont hit the next recession any time soon, but there is unfortunately a good chance we will hit it before unemployment/employment has recovered. And based on the evidence I’m left wondering if all this focus on the “demand side” isn’t somewhat misplaced. Note I use the term demand side loosely here. If a firm wants to invest more it is increasing its demand for plant and capital. Which of course will be supplied by other firms. Those firms seeing an increase in the demand for their products may very well turn around and increase their demand for labor and capital. Dragging in your hobby horse of international trade is merely a distraction.

JP,

Well the graph only offers annual numbers, a quarterly or monthly break down might show that while the year-over-year trend is up, there were periods of decline…heck we might be in one now. I kind of doubt it, but it is a definite possibility, and if so good, hopefully investment will follow along.

HankP,

No, I know that during a recession uncertainty would increase. I’m not talking just about uncertainty but regime uncertainty. That changes in “how the game is played” has made investors, and not just in the finance industry, skittish. And that that effect is now having an adverse impact on economic growth.

glasnost,

See what I wrote to HankP, you are not understanding my position, try reading it again and note that I’m not just talking about increases in uncertainty that go along with an economic down turn, but something a bit more than that. Significant changes to the rules that make investing harder to do until the impact of those rules is figured out. Given that we are almost a year into the recovery and the typical recovery in the U.S. (post WWII) lasts about 5 years and we might take quite some time for unemployment/employment to recover an increase in regime uncertainty might not have be such a great thing.

The recession is over.

No totally wrong. I’m not arguing for stimulus spending, I’m arguing for policies that promote private investment.

This post is not about fiscal policy…or at least spending. I know you might be more comfortable talking about that topic, but it is off topic.

Stan

A bit misleading to use the statistics that exclude the value of one’s home. And if you sell your home for a profit (i.e. you are retiring and the kids have moved out) you could face capital gains.

When you include the value of one’s home the share of net wealth for the bottom 80% nearly doubles. Granted that was in 2007, so the housing bubble likely had an impact there, but that percentage has been fairly stable over time, with a slight decline. And keep in mind these are percentages, so as total wealth increases an your percentage of total wealth stays roughly fixed you are accumulating more wealth.

Exchange, trade, and economic activity is not usually zero-sum. That is if the rich get richer it is not axiomatic that the “poor have to get poorer”. Although, that could also be the result since nothing inherently prohibits it either.

Yes, sorry Sam, dyslexia and/or bad vision strikes again.

SteveV, I think the real story is still going to be the break from trend, and the formation of a new trend around 2000. Though, if anything, that climb to uncertainty has _slowed_ in recent years.

john personna,

“BTW Ponce, one of the great ways the left f’s up the middle class is by being way too down on unearned income. By retirement, every worker (blue or white color) should have some unearned income set up.”

That’s what Social Security is there for. The trouble with asserting that the middle and lower classes should save more for retirement is that essentially all of them are living paycheck to paycheck, and have no spare income to put into retirement. For example, my office’s 401k plan had a employer 100% match up to 3% of income, and so few people were taking advantage of that free money that the plan was in danger of losing its tax exempt status, and had to convert into just giving away the first 3%, whether or not the employees made any contribution.

This goes back to the problem that for the last 30-40 years, the lower 80% of the country has not increased their income in real terms, as all of the economic gains have been sucked up by the upper income groups. Reverse that, and you will find the lower incomes suddenly able to save more.

I think, Moosebreath, that this is one of those places where it is very dangerous to lump “middle and lower classes.”

Two reasons:

First, if you are going to help the lower classes, you are going to have to draw from the middle.

Second, the middle class actually has the option of saving. If they are not, they are choosing consumption.

As an aside, a guy called into a local radio station recently, complaining “what’s this about $250K/year being rich? my wife and I make that and we are living paycheck to paycheck.”

That’s our societal problem in a nutshell. You may not see your “lumping” as extending out to that guy … but if your “paycheck to paycheck” middle class folk are upgrading cars and houses, competing on vacations with the neighbors …

@moosebreath…

when did the middle class stop increasing their income in real terms? that’s right…with reagonomics. trickle down or supply side economics was supposed to reward the well off, which in turn would “lift everyones boat”. but that has never happened. middle class incomes hav flat-lined. things got a little better under clinton, but not by much at all. it’s time we just stop listening to republicans and their wackly economic theories – like tax cuts that magically pay for themselves. do that and the entire country wins. keep listening to them and we will continue to find ourselves in trouble.

BTW, how do you reverse that?

I suspect that it is a function of population and increased connectivity (in goods traffic and information). That may not be a good thing to “reverse.”

See also the Justin Timberlake Effect.

norm, the shift also coincides with the invention of the shipping container, and the rise of telecommunications.

never under estimate the impact of the shipping container

I rest my case. I’m not “self aware” and such.

Its a fascinating phenomenon. I could be wrong, but I suspect I’m the only person commenting here who is a senior partner in a private equity firm (14 years) and been a participant in investing well over half a billion in capital – quite well I might add. And I note that Charles A is castigated, he probably being one of the very few commenting here who own a business.

No. We have the IT pros, authors, mush headed college students, non-economics professors, various opium den trolls and so on telling us we haven’t a clue……………………………and then they sit back and wonder why the unemployment rate won’t decline. Oh, that’s right, its ALL Bush’s fault.

I can see it now: NEWS BULLETIN 2015 – “The unemployment rate unexpecedly increased today. President Obama called a news conference to explain that former President GW Bush……….”

Why then Drew (Rational Discussion Flowchart) did you not address what I think is the critical issue from a standpoint of rational analysis?

What happened in 2000, or so, when the genuine shift in trend occurred?

For extra credit, of course, why did things _improve_ under Obama.

That’s what we call it, when the rate of increase in uncertainty is moderated: Improvement.

Re capital gains on the sale of your home, Steve Verdon, to my best knowledge profits up to $500,000 from the sale of the principal residence of a married couple are not taxable as either capital gains or ordinary income. Very few middle and lower class people realize profits of this magnitude on the sale of their homes. So I’ll again say that the decrease in the capital gains tax enacted during George Bush’s administration was a winner for the wealthy, not for the middle class. The elite, George Bush’s base, contributed to his campaigns and to the Republican party’s, and he paid them back with tax cuts. Boss Plunkitt would have approved.

First Austin, now Drew. Amazing to see how the “business elite” now feel so free to trumpet their superiority over all those morlocks out there who actually do the work. Explain to us lowly trolls, Drew, how those wonderful private equity firms behaved over the last ten years and what they did to help the economy.

Oh, wait, you mean they and the large banks looted the world’s economy, threw us all into a global repression, and managed to transfer billions of dollars from the working class to the banking class?

Then of course we must let the Drews of the world lead. Maybe they’ll share a penny or two with us if we’re subservient enough.

Steve Verdon,

The amount of jobs lost to outsourcing has been going on for a long time. We can look to Japan in the 80’s. And actually, the world opened up with the fall of communism. Businesses closed in my area long before the recession. As I said, Bush came to Ohio at different times and said “free trade is good” and factories closed. Now, at the national level, no one noticed. After all, we had the tax cuts and it all felt good. While in the background the fed was accommodating as they do today. There was a support for more and more housing, which was overbuilt. Although that did not effect my area. Many problems were adding up and no one noticed. Deficits piled up, the infrastructure was ignored, two wars going on and not paid for. In other words, our jobs were going overseas, our money was going to Iraq, and our infrastructure or our country and its problems were ignored. Now, you add technology or automation, six sigma and lean manufacturing, and changes in consolidation and take over laws and what we end up with is lost jobs.

http://growth.newamerica.net/publications/articles/2010/who_broke_america_s_jobs_machine_27941

Well, luckily I am retired. Yes, business close or slow down with recessions. And each time everyone came back to work, except this time as the factories are permanently closed.

I must be missing something. Trade between countries is not bad if you have a level playing field. A dollar an hour in China does not add up to equal trade to us. Our trade deficits show this. We lost a lot of industry and there are people from China to Egypt who wants jobs and there is simply not enough jobs to go around. I do not get the analogy of comparing our trade with our states to cheap labor countries. Our products we made in our country went out to supply the world. Simply put, the factories closed down and went to cheap labor countries.

William Cohen, former defense secretary, said that he thought we would be doing more trade with India. Outside of high end products, I don’t get it. Are we going to sell the toasters and irons to India? For one thing, we don’t make the products. And another thing, why pay a higher price when they have the chance to buy the toaster or iron from China? I see closed factories and yet these pundits talk of free trade as if it is working. And along with those closed factories, the local businesses have closed up because you need employed people to come to your business. The last jewelry store closed up and the laundry mat closed up.

I am sure there will be more investment in capital and in equipment. However, it won’t happen with the factories that are already closed. I do not see what widgets we can make here and not in China or some other country. I do not see factories that will hire (outside of Ford, GM, etc.) the hundreds or thousands of people. Any new jobs will be a trickle. And we used to look forward to new gadgets to make. Apple gets their gadgets made in other countries. The world has changed with globalization and the internet. Businesses have adapted by going to cheap labor. Our country has not adapted and the failed ideologies just keep going on.

jp,

“First, if you are going to help the lower classes, you are going to have to draw from the middle.

Second, the middle class actually has the option of saving. If they are not, they are choosing consumption.”

I will diasgree on the first, as it is possible to draw primarily from the upper end. As norm pointed out, during the Clinton Administration, these trends slowed if not stopped. I know suggesting returning to the horrors of a 39.6% marginal income tax rate gets one branded as a Marxist around here, but I suspect it will be a good start.

On the second, the primary problem is that so much of a middle class household’s income goes to housing costs, which are tied to wanting one’s kids to be in good schools. Not sure there’s an easy fix for this.

On how to reverse the last few decades, again, higher marginal tax rates would be a good start. Providing a counterbalance to the power of the rich through private sector labor unions would also help.

Drew,

All I can tell you is in what I saw. The factories closed down while Bush visited Ohio and said “free trade is good.” We had the tax cuts for a decade and it did not create prosperity, nor did it create jobs. The fed has been printing money. Our country, both parties decided to overbuild in housing while we lost jobs in manufacturing. Our infrastructure was neglected while we spent for war. And to this day, most all the pundits think that free trade is working as factories close. We have an additional 2 billion cheap laborers in the free market system and that will put pressure on middle class jobs and wages.

You mean Japan that has been having sluggish economic growth for over a decade? That Japan?

So, the economy is a dynamic and changing….I’d even say evolving process, so this is not surprising. Expecting the businesses to remain open forever on the other hand would be unreasonable.

Are you arguing for fat manufacturing, no consolidation and not adopting new technology? You solution is economic stagnation or something else?

Trade is trade, whether it is between states where there is a wage differential or between countries with a wage differential the logic is the same. Using your logic we should curtail both. Unless your position is based on nationalism.

This is nonsense, that is precisely what drives trade. If it costs just as much to make it in China as here, then there is no basis for trade. They make enough for domestic consumption we make enough for domestic consumption. It is precisely these differences that create the opportunity for people in both countries to be made better off.

This was always true. It is implied by profit maximization to maximize profits you have to also minimize costs.

Your right, jp. I’m clueless. I don’t invest in real live businesses. I don’t speak with hundreds of business owners. We don’t make decisions and invest alongside business owners. I have absolutely no first hand experience with the sector of the economy that produces by various estimates 55% – 70% of all job growth. None. Zip. Zero. I’m actually hallucinating.

Your statistics are definitive, and oh, so “logical.” I’ll try to read more Taleb, Roubini and Time Magazine in the future so I can get it right. I’ll try to learn…..

Source please.

Epic fail, Drew. I asked you a clear question (what happened in 2000?) and gave you a clear field to answer.

Steve Verdon,

What I have been saying is that was the start of globalization and both parties in our country has sat around with their failed ideologies and just let the jobs leave. Japan took a certain amount of steel, auto, and electronics. Hong Kong took the textiles, jobs went to Mexico, and today, China is doing a good job with the rest. But hey, we got the tax cuts and all is rosy.

Yes, the economy is changing and businesses will do what they do. I do not ask for stagnation. I expect our leaders in Washington to be on top of the game. We don’t sit around with tax cuts and watch our jobs go overseas and say “free trade is good.” We don’t watch South Korea advance the best battery technology and ignore it. We don’t let Singapore take away embryonic stem cell research over religious issues. We see state capitalism in China at 8% growth. And it is easy for them because they are starting at the bottom. We are a more mature industrial nation and we have to work much more harder to maintain the lifestyle we have/had. And that means investing in our country, in our people, and in the future. Just sitting on tax cuts and then laissez-faire does not make it in a globalized world.

We have traded with a lot of countries and it is beneficial. But to compare the trade with other countries to cheap labor makes no sense. The middle class cannot win with 2 billion cheap labors and those that get paid a dollar an hour compared to 15, 20, or 25 dollars an hour. We are losing the middle class and there is no upward movement. I have been saying this since 2004 and it holds true. And facts are facts. 57,000 factories closed. And what are you going to do about it.

Again, there is a disconnect. The corporations will do what they do. And I am not totally blaming them, because if they don’t cut costs then they lose. But as a country, what are we doing? While democrats go to spending programs, the republicans just ignore everything. And in the end, with a diminishing middle class, you end up with an oligarchy. We have seen the trickle down and it did not trickle down. I suspect you don’t want Washington to do anything, but as we see, doing nothing is not an answer. As I said before, we need to invest in our country, in our people, and in the future. Other countries do it and why not we? Tax cuts and laissez-faire is just as much of a recipe for disaster as with the democrats spending.

For the life of me, in every aspect of our lives, be it, our households, in coaching, in business, we manage our problems. But when it comes to the highest office of our land, that CEO is not supposed to do anything. Well, I saw it for eight years and we are where we are over ignorance and arrogance. We have globalization and we “our nation” has to deal with it instead of saying “it is good” when people are losing jobs. Now, either the republicans are for the middle class or they are against them. So far, it has all been for the rich. For eight years we have seen the true colors come out. I expect results. And I blame the republicans more as they “know” economics more. But all you get is failed ideology.

Source please, Mr. Verdon? This comes from a liberal blogger,

http://www.democracyjournal.org/20/the-hood-robin-economy.php

but I’ve seen stuff like this all over the internet. The basic academic studies are by Piketty and Saez, see

http://economistsview.typepad.com/economistsview/2007/01/thomas_piketty_.html

and here’s Saez’s home page:

http://www.econ.berkeley.edu/~saez/

As to why this has happened, I suspect part of it is economic, due to increased use of information technology, to globalization, and perhaps to illegal immigration, and part is due to a change in social mores. For reasons I can’t understand American executives have lost their reluctance to allocate an ever increasing share of their firms’ profits to themselves and their stockholders, much more than foreign executives. Sorry, Verdon, this is so well known I’m not going to provide sources. Also, I apologize in advance to Drew and charlesaustin for showing undue deference to their superior knowledge and value to society.

Steve,

“Source please”

Ask and ye shall receive. source, derived from Census Department data.

See also “Between 1979 and 2005, the mean after-tax income for the top 1% increased by 176%, compared to an increase of 69% for the top quintile overall, 20% for the fourth quintile, 21% for the middle quintile, 17% for the second quintile and 6% for the bottom quintile.” as quoted here.

“Epic fail, Drew. I asked you a clear question (what happened in 2000?) and gave you a clear field to answer.”

Only in your mind, jp. But look, I capitulate. You point to a figure in a book, cite a source. You must be correct.

I’m just the guy out here doing what the thread is all about: investing. I’m obvously a clueless idiot who is absolutely out of his mind – there are empty Jack Daniels bottles and tipped over bongs strewn about my party room – and I haven’t invested a cent, made a boat load investing, and am not at the hip of business owners 365 days a year.

No way. You see, the book says……….

I gotta go………study my Rational Flowchart now so I can get educated and understand the investment environment, and then call my banker, those financial balances I have with him aren’t real……..the Rational Flowchart – and jp – say so……

Drew, I was talking about the graph up above, and how to my eyeball uncertainty took off around 2000, and continued in a trend from there.

Looking at it again, I can see that the inflection point is actually between 1999 and 2008 … and following through past Dave’s page to the underlying data …

http://www.langerresearch.com/uploads/1121a2%202011%20Politics.pdf

Notice that there are frequent measurements from ’74 to ’81? Those are from ABC news. Not only are the data from ’83 onward more widely spaced each and every one is from a different source. Ye gods, they are mixing data with different methodologies?

I’d say now, in answer to “why increasing uncertainty” we have to say insufficient data. Principally, 9/11 and the wars happened in missing part of the data. We don’t have sampling to see how they moved “uncertainty” (but I think we all remember it).

There, I changed my opinion front the top of the thread, and demonstrated mobility, as recommended in the Rational Discussion Flowchart.

And my change was data driven, rather than stuck in ideology.

Moosebreath, it shouldn’t really surprise you that I’m OK with moving taxes back toward historical levels. I basically said that above. And I really think that if you ran my proposals against the IRS data, they’d be revenue enhancing (there are much bigger loopholes now than anything I’m proposing). Of course, I can only offer that as my belief, given that I don’t actually have access to IRS data and a computing cluster.

On the other hand, I’m don’t really have high confidence that you can mine “the rich” through income or capital gains taxes. Being rich, really rich, isn’t about income. Actually, that’s almost by definition.

And maybe you missed my death tax endorsement?

Actually, since it wasn’t quoted up top, I should share the text of the question that goes with that top chart:

It was not about leadership, or personalities, it was about “our system of government and how well it works.”

Ezra Klein, why am I not surprised. He should redo his work with total compensation. We have made a number of bone headed policies that have basically moved growth in compensation from wages to non-wages–i.e. health care.

Further, I don’t think Klein understands how measures of income inequality work. The Gini Coefficient is related to the Lorezn curve, the Lorenz curve depends on the population. So, when Klein writes:

Immigration can certainly play a role in increasing inequality. If more immigrants enter the country and earn at the low end of the spectrum then inequality might go up. Is it the only factor, no, but to ignore it or present it so badly…The poor dunderhead seems to be conflating inequality with wage growth.

Europe also spends more and has put policies in place to reduce inequality. This kind of vapid simplistic comparison is just bad. For example, read the this post by Greg Mankiw and the excerpt from a comment over at Matthew Ygelisas’ blog by Peter Whiteford, namely,

And to be clear here, the theory that Klein is pointing to to explain the stagnation of the median wage, the Hacker and Pierson theory, isn’t something I’m totally against. I’m just not sure it is the explanation for stagnating wages. For that to be the case you’d really have to cook up a theory of grand collusion. I’d be more interested in seeing numbers on total compensation adjusted for inflation over time.

That is about the incomes for the top 1%. It does not follow that just because the to 1% of income earners have gotten richer everyone else has to have gotten poorer, that suggests that trade and exchange are zero-sum games which it is not. In other words, this second link does not support your claim.

A very persuasive argument.

I’m sorry it looks to me like all those lines have a positive slope. Granted the slope for the 20th and 40th percentiles are quite low, so increases over time are minimal, but for the 60th and above the positive slope is indeed quite obvious.

Further, I’m not quite sure you know how to read that graph. To see if your claim is true we’d look at the 80th percentile line. That line represents the income level such that the incomes less than or equal to that level of income constitute 80% of incomes. And looking at that number from 1980 to 2010 (30 years) we see that income cut off has gone from about $80,000 to around $110,000. That implies that incomes are rising. Granted for those over that threshold their incomes are rising faster, and for those in the top 5% it has risen even faster, but the idea that things are stagnant the data just aren’t there, at least not for 80% of income earners.

Steve,

Nice that you ignore the text I posted. As it states, over a 26 year period, the 4th quintile increased its real income by 20%, or less than 1% per year. If you don’t call that stagnation, then having discussions with you is pointless.

“And my change was data driven, rather than stuck in ideology.”

You bet, jp. And you need to learn to take “yes” for an answer. I capitulated.

In fact, in future meetings with Boards, investors or business owners I intend to set them straight. “Don’t you see the 2000 numbers you fools? Your investment concerns are completely irrational !!”

No doubt motions, seconds and unanimous “ayes” will follow.

If not, perhaps you could send me your contact info so I can have them contact you and you can set them straight yourself.

Yes, Steve Verdon, the 80th percentile line shows a steady increase after 1975. Although you didn’t mention it, the 90th and 95 percentile lines have an even larger slope. They’re doing great. You also didn’t mention that the income of the 60th percentile line has increased only sightly, and that the 40th and 20th percentile lines show hardly any increase over the last 30 years. That’s my point. According to David Wessel of the Wall Street Journal, see

http://www.npr.org/templates/story/story.php?storyId=7543065

and other sources I hesitate to quote because of their left wing provenance, productivity is going up but the average worker isn’t sharing in the gains. Furthermore, and this is only conjecture, I think income inequality is really going to take off once the effects of the Supreme Court decision on campaign financing and the destruction of public employee unions in the industrial Midwest shift the political balance even further to the right. How much inequality can a democracy tolerate? That’s what we’re going to find out.

Moosebreath, considering that is income that excludes non-monetary benefits, I don’t consider that stagnant. The problem is the policies that were put in place decades ago that are siphoning income from wages into the un-taxed non-wage portion of total compensation. Is it good? No, of course not. Its been a problem I’ve advocated fixing for quite sometime. Will it get fixed? Not in my life time nor yours.

Further, there is the second part of you claim. Simply because one groups income rises faster than anothers does not translate into the rich are getting richer at the poor’s expense. It maybe the case, but pointing to income trends does NOT explain the dynamic behind the trends. You need to explain WHY it is happening. If I get a $50 raise, does that mean you have to have your pay reduced by $50?

On the contrary I did mention it explicitly.

No, I did cover that as well, okay I skipped over the 60th percentile, but I did mention both the 20th and 40th.

Really? Total compensation is flat too? If it costs more to employ a worker because health care costs are rising, it is entirely possible that the wage portion of income will stagnate. However, the worker is still getting value from the health care. A value actually greater than if the health care benefits were paid as wages. So, I’m unpersuaded.

This is where the real problem is, IMO. Having a strong activist central government and allowing for the purchase of influence by the wealthy is going to be quite problematic. Note this is not a Right-Left issue so much since corporations, especially large ones, are probably pretty non-partisan. Using government power to secure economic rents is what they really care about and if they do it via a Republican or a Democrat I don’t think they’ll really give a shit. This is more of an individualist vs. corporatist issue, IMO, when you get right down to it. Do we want a government of the people, by the people and for the people, or a government of the corporations, by the corporations, and for the corporations. Given that corporations prefer less competition to more, higher prices to lower, and so forth, I’d prefer the former.

A good one for Moosebreath:

http://www.themoneyillusion.com/?p=9359

I believe the middle class can and should be two marshmallow folk. Many with even humbler beginnings can and should also …

I don’t wholly agree with Sumner’s anti-re-distributive argument, but I do catch a resonance with our discussion above. The world shouldn’t just be about redistribution, and we shouldn’t just accept over-consumption as the way of the middle class.

“The world shouldn’t just be about redistribution . . .”

We’re experiencing income redistribution now, and on a massive scale. As Warren Buffett said, we’re in a class war, and his class is winning it.

So fix the death/estate tax.

Buffett and those like him actually do the right thing even with current law, but you can catch those who don’t. Let them run up single-lifetime fortunes, send their kids to good schools, bit then tax estates, or alternately gifts/inheritances as straight income.

BTW, Buffett might even agree with me that the world shouldn’t _just_ be about redisribution. Prudence should be a responsibility.

john personna, you’re on target with your 7:11 post, and I agree completely with your 7:14 post.

Equality of opportunity is my goal, not equality of outcome.

Steve,

“You need to explain WHY it is happening. If I get a $50 raise, does that mean you have to have your pay reduced by $50?”

There’s your fallacy. If you get a $50 raise, and everyone else gets a $1 raise, it likely is not even close to an accurate method of apportioning who created the gains. And yet that is what you are defending.

You are dodging the question. Is trade zero-sum? Your argument is that it is because wages haven’t gone up while ignoring a significant part of compensation for many Americans.

Good link.

So, we give up 57,000 factories or some 6 million jobs. Other workers have cuts in pay and benefits. All the while we have a difficulty of getting our of a recession. We are running up deficits and debt. Small towns especially are devastated with closed factories and less revenue. China and other countries gain on jobs. And the only thing we gain is a consumer can buy cheaper products.

I would like to know, how do you get upward movement that we had before. What will replace those lost jobs. What will preserve the middle class.

And so far, watching FOX, CNBC, etc. all these years, no one has given an adequate answer.

“You are dodging the question. Is trade zero-sum? Your argument is that it is because wages haven’t gone up while ignoring a significant part of compensation for many Americans.”

No, you are the one dodging the question. You appear to be saying that the serfs should be happy to be cut in on a few crumbs and ignore that the upper management took nearly all the cake.

Or as the joke goes, a CEO, a tea-party member and a union member sit down at a table with a box with a dozen donuts. The CEO takes 11 donuts, and then says to the tea-party member, “Look out, the union guy is going to steal your donut.”

With respect to jp’s link, the last sentence is crying out to be fixed:

“I do think they are usually the one marshmallow party, but in this case

manya very few of the furthest right Dems oppose means-testing Social Security, andsomenearly all conservatives support the idea.”As for the merits of his argument, means testing on the basis of lifetime earnings and not on current assets will likely lead to a significant number of seniors starving. If that’s what you (or he) is calling for, then say so directly. Means testing on current assets can work, but the transaction costs will be fun (e.g., if a senior owns an art collection, does it need to be valued every year to see if he is still eligible?).

Gerry, I think the Rust Belt and jobs problem is really unique, and not part of a general wealth distribution problem. Globalization happened. In part it was from innovation (those shipping containers) and in part it was from trade liberalization.

I wouldn’t be opposed to a small, uniform, tariff. I call that “almost free trade.” Moving to that would actually increase efficiency (getting rid of the crazy an special tariffs we have on sugar and t-shirts), but it should also provide a uniform bias toward US workers.

5%?

It probably wouldn’t even need to be that high. And you know, it would really help that deficit. It used to be that tariffs were a significant source of income for the government. In an era of free trade … where are you going to go? More income tax? A VAT?

In hindsight, I think globalization happened with the fall of communism. We lived for some 30 years with increasing wages and benefits and had an upward movement for everyone. Those containers (innovation) ($2000 each) makes free trade easier. Tariffs may be needed, but it gives a false barrier to protect workers here. I would like to know more about policies that will create jobs and have that upward movement again. Since past policies or ideologies have failed, it seems like no one has any answers. And I just get sick and tired of the right wing saying “they” have all the answers, in which, they have no answers. They have done nothing for the middle class and it continues to destroy unions and the middle class. And then they have the audacity to say the government does not have to do anything while the bleeding goes on.

Its like saying that a CEO of any company does not have to do anything. The president and 535 congressmen and senators are responsible for the 50 states and especially when it comes to building our country. I do not think that a city or a state has the capability to compete with 2 billion cheap laborers. And beyond that, it just looks like there is some sort of “one world” order going on here.

I am singling this out. But here is another. Corn for ethanol and it is still going on. Terrible policy. And yet nothing done. I suppose in the end, we have a government that does not work.

About that link. Scott had this to say in the comments:

FWIW

While I’m moderate in my politics, I’m conservative enough in my ideology to believe that “policy” isn’t what creates jobs. Given a playing field (hopefully level) we all create jobs, or not.

Remember sam, I mentioned above the radio-caller making $250K, and living paycheck to paycheck.

I’m pretty sure he’s a one-marshmallow guy.

Was the interstate system a policy? Did the interstate system create jobs? What is our policy today? Just give away our jobs and do nothing more? What jobs or widgets can be created here and not some other country? I feel this is a major problem. We live in a globalized world, and all you get from the left is some defensive spending program and from the right they just say tax cuts and ignores what the world is doing. Tax cuts may have been good within our border for short periods of time, but throw in 2 billion cheap laborers and you have a different world to deal with.

Yes, it is up to corporations to create jobs, and yes the free markets make sense. But what will be our policy to have the upward movement that we had. Is it just to destroy the middle class with cheap labor and do nothing? Do we let our infrastructure fall apart? Does the president have the power of a CEO in which he should manage our country or is the president just a puppet and does nothing?

I do not see enough jobs to go around. There isn’t enough products that can be made to create jobs. And those products will be made by cheap labor, by robots and automation, and with less employees with lean principles. And anyone in China or India certainly will not buy a product from us at a higher price. (We don’t make the products anyway) While our choices are limited, while we have given up some 6 million jobs, we can have a policy of investing in our country, in our people, and in the future. That should be the main focus. It is no more than what a CEO would do for his company.

Overall, for the history books, this will be many decades of upheaval. And future generations will look at this, as with other mishaps, and they will ask; Why didn’t they do something about this at the time?

The interstates gave us competitive advantage and public goods, but they were kind of “missing” following the development of the automobile. Similarly computer, internet.

I think we have good reason to protect net neutrality, for competitive advantage and public good.

As we’ve discussed before, some would like high speed rail to be that big. But I don’t see it.it could not be a fraction of the innovation creator than the net still is. They are talking about a new tech boom in the valley.

What else is there?

By excluding benefits–i.e. your obstinate refusal to look at total compensation you are showing that you aren’t interested in the facts.

Well, we are really in a pickle. We gave away some 6 million jobs. We used up all the stimulus we had as we had years of tax cuts and years of pushing down interest rates. The deficits and debt keeps on going. Besides taking away jobs, the trend is to cut out unions, pay, and benefits. Anyway you look at this, it does not add up. It all has to be reversed and it is getting harder to do it as time just goes on. What will be that ingredient that will create the upward movement?

If a politician makes a mistake, that mistake needs to be corrected. Clinton signed the free trade agreements, and yet today, after the loss of jobs, there are those that say “free trade is good.” But it is not working. And these same people want more free trade agreements.

While the best scenario is for the free market and the private sector work, it is not working. You throw 2 billion cheap laborers into the system and you are killing your own middle class. Obama screwed up by not focusing on jobs in the first place. And Bush was totally absent with his ideology.

The priority by those in Washington is to make our country work and to make capitalism work. I think looking at capitalism, it needs help at times. The interstate made capitalism better. So government has a role. It gets me when people say for government “to get our of the way.” As we have seen under Bush, it did not work and the middle class lost.

As I said, as time went on so long, it will be most difficult to get ourselves our of this rubble.

We are doing some things that I will talk about. But what we needed, at least on a psychological level, a president that will say that we will invest in our country, in our people, and in the future.

In our country: May be high speed rail within reason, a new air traffic control system, and our infrastructure in which we are some 2 trillion dollars behind.

In our people: Mandatory vocational training as we need to compete with globalization.

In our future: Federal grants to universities for new discoveries.

Now, we are doing a lot of this already. It just needs to be articulated instead of hearing the same old failed ideologies.

We wasted some 800 billion dollars on the Bush tax cuts. Cities from Detroit to small towns could have been rebuilt and small businesses would have benefited. The Bush tax cuts is spent money and we have nothing to show for it.

I suppose tariffs are also needed.

You can start energy independence with natural gas for 18 wheelers.

I would also find all the entrepreneurs and give them whatever incentives it takes to create new industries and jobs. But as time has gone on, I am losing any optimism.

I see a 30 to 60 year period or more of the middle class losing. It is nothing new. You can look back at history, anywhere in the world and wonder why things happened the way they happened. It started under Reagan and it keeps on going.

One for Gerry:

http://marginalrevolution.com/marginalrevolution/2011/03/lazy-boys-shakedown-chinese-furniture-makers.html

Interesting.

On another note.

GE did not pay any taxes. Heck, I just went on SS and I pay little in taxes. Is anyone paying taxes?

http://www.nytimes.com/2011/03/25/business/economy/25tax.html?_r=1&partner=rss&emc=rss

Steve,

“By excluding benefits–i.e. your obstinate refusal to look at total compensation you are showing that you aren’t interested in the facts.”

This is quite a laugh, given how allergic you have been to responding to the facts I’ve cited.

That said, let’s look at benefits from the point of view of a typical worker in the 70’s and in the 21st century:

The worker in the 70’s typically had benefits; the worker today frequently doesn’t at all, due to the employer’s use of part-time labels, even for workers who would work as many hours. Advantage — 70’s.

The worker in the 70’s typically had a defined benefits pension, the worker today a 401k with minimal employer match. Advantage — 70’s.

The worker in the 70’s had far better sick and vacation policies than the workers today (again, arising from the rise of the part-time label for full or nearly full-time workers).

Even with respect to health benefits, the worker in the 70’s got a better deal. He paid far less (both in premiums and co-pays) than today’s worker, typically paying nearly nothing for full health insurance, as opposed to paying a substantial chunk of the cost of more limited health insurance. The employer in the 70’s got a better deal as well, as he paid far less to provide full health insurance then than his share of health insurance now, but that’s the effect of the rise of health costs.