Janet Yellen Hints At Slow Economic Growth, But No Recession, Going Forward

The head of the Federal Reserve tells Congress that the economy is unlikely to enter recession this years, but isn't exactly going to be booming either.

Federal Reserve Chairperson Janet Yellin hinted in her Congressional testimony that the Board of Governors is likely to hold back on raising interest rates at least through the summer:

WASHINGTON — Weak economic growth in the United States could force the Federal Reserve to hold off on any imminent interest rate increases, the Federal Reserve chairwoman, Janet L. Yellen, told Congress on Tuesday.

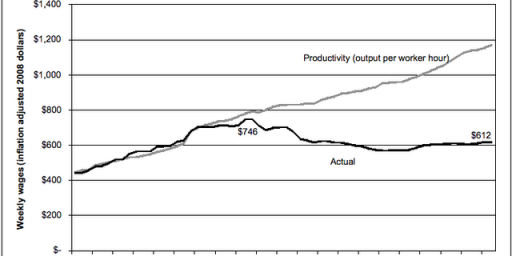

While Ms. Yellen said that the American economy’s long-term prospects remain favorable, she signaled that headwinds, including slower employment gains in recent months, weak productivity growth and the persistence of a sluggish pace of inflation have prompted the Fed to adopt a more cautious stance.

“The latest readings on the labor market and the weak pace of investment illustrate one downside — that domestic demand might falter,” Ms. Yellen said in testimony before the Senate Banking Committee.

Ms. Yellen’s overall message on Capitol Hill echoed her comments at a news conference last week after the Fed’s decision to hold rates steady. But her tenor suggested that there was little chance of an increase in the benchmark federal funds rate at the central bank’s next meeting, in July, and that a move when policy makers meet again in September is hardly guaranteed.

“Proceeding cautiously in raising the federal funds rate will allow us to keep the monetary support to economic growth in place while we assess whether growth is returning to a moderate pace,” she said.

Mirroring the habit of Fed leaders going back decades, Ms. Yellen hedged her bets, emphasizing her positive outlook for the years ahead, if not the coming quarter or two.

But she acknowledged influential voices in academia and elsewhere who have warned that long-term growth could be substantially below the pace achieved in the decades before the Great Recession.

“Although I am optimistic about the longer-run prospects for the U.S. economy, we cannot rule out the possibility expressed by some prominent economists that the slow productivity growth seen in recent years will continue in the future,” she said.

In the question-and-answer portion of the hearing, Ms. Yellen termed recent productivity growth “disappointing,” and pointed out that business investment had been similarly weak during the recovery. She added that the productivity issue was something Congress needed to address by improving polices for workplace training and other issues.

Ms. Yellen’s appearance is part of two days of testimony before Congress that the Fed leader is required to present twice each year. Another session is scheduled on Wednesday before the House Financial Services Committee.

On the good side of the economic ledger, The Wall Street Journal reports that Yellen told the Senate committee that the risk of a recession around the corner is ‘quite low,’ but warned that we’re likely to see the same tepid growth we’ve become used to for much of the past seven years:

Federal Reserve Chairwoman Janet Yellen said the chances of recession this year are “quite low” despite mounting worries that the U.S. could be heading toward a downturn after seven years of tepid economic expansion.

“The U.S. economy is doing well,” she said Tuesday, kicking off two days of testimony to Congress on the economic outlook and monetary policy. “My expectation is that the U.S. economy will continue to grow.”

Still, a clearly tentative Fed leader has a long list of factors she worries will hold growth to a modest pace in the months ahead. Output growth, hiring, business investment and corporate profits have stumbled or slowed in recent months, leaving the Fed unsure when it will raise short-term interest rates again.

Fed officials next meet July 26-27. Ms. Yellen gave no indication that she expects to lift rates at that time. Instead, she stuck to a line that the Fed will raise rates gradually, cautiously and without a set timetable.

In a Wall Street Journal survey this month, economists said the probability of a recession in the next year had risen to 21%, up from just 10% a year earlier.

Ms. Yellen played down that worry and sought to cast a positive light on the outlook, pointing to the prospects for continued growth driven by U.S. consumer spending.

Ms. Yellen played down that worry and sought to cast a positive light on the outlook, pointing to the prospects for continued growth driven by U.S. consumer spending.

However, long-run headwinds to economic growth were a central theme in her prepared remarks and the questions she fielded from a mostly polite crowd of lawmakers on the Senate Banking Committee.

“Considerable uncertainty about the economic outlook remains,” Ms. Yellen said. Consumer spending and investment could falter, she said. Moreover, slow productivity growth could persist, which would hold down wage growth and income generation.

“We cannot rule out the possibility expressed by some prominent economists that slow productivity growth seen in recent years will continue into the future,” she said.

As has typically been the case, and in the grand tradition of predecessors such as Alan Greespan and Ben Bernanke, Yellen’s answers in response to specific questions about Federal Reserve policy were often quite general and purposefully vague, but from them and from other evidence we can get a fairly good idea of what the Board of Governors and the other analysts at the Fed think about the both the current state of the economy and its future course, especially through the remainder of the year. Namely, while it it appears that we’ll continue to see the same disappointing, lackluster growth that has typified the recovery that began in 2009, it’s unlikely that the economy will enter recession any time in the near future. If that happens, then Barack Obama would end his time in office being rather lucky when it comes to the state of the economy. While the first months of his first term were spent dealing with the impact of the Great Recession, we know now that the economy had actually started turning the corner by the end of 2008, and was officially ‘out of recession’ as measured by Gross Domestic Product by mid-2009. In any case, that’s a marked difference from Presidents Reagan, Clinton, and George W. Bush, all of whom dealt with economic downturns at some point during the course of their Presidencies. At the same time, while the recovery has been long-lasting, it has also not been very robust. The number of quarters where economic growth was higher than 2.5% can be counted on one hand, for example, and the jobs market in particular has been sluggish from the beginning, with many people who were impacted by a recession that is nearly a decade in the past still looking for work. This contrasts with the recoveries under Presidents Reagan and Clinton, which saw several periods during which annualized GDP growth would be as high as 3.5% or even 4.5% and is more consistent with the way the economy operated under George W. Bush, when the economy grew, but at hardly the rate we’d seen for most of the post World War II period..

In any case, given what we’d heard from the Fed last week, when it announced that it was once again skipping on raising interest rates and hinted that a rate increase was unlikely in July but could come in September, Yellen’s words should hardly come as a surprise. What’s potentially important about all of it, of course, is what it could mean for the 2016 elections. The general rule is that a growing economy is generally good news for incumbents and bad news for challengers because voters become reluctant to change horses in mid-stream if things seem to be going well. The curve ball that may be coming for the election, though, is that there’s plenty of evidence that the public perception of the state of the nation and the economy is far different from what the statistics show. The benchmark right direction/wrong track poll, for example, currently shows that some two-thirds of Americans believe that the country is on the wrong track, a number that has been fairly consistent for some time now. A separate question that nearly every pollster asks, which asks voters if they are personally satisfied with the state of the nation, shows that 70% of respondents are dissatisfied. Numbers like this likely in part explain in part why renegade candidates like Donald Trump and Bernie Sanders have had success appealing to voters. What impact this will have on the election is unclear, but the fact that it’s already clear that we’re headed into an election where mudslinging will predominate over actual discussion and debate, it’s likely to mean a lot of frustrated, dissatisfied Americans in November no matter who wins.

The economy can’t grow when one of the largest sectors is held flat. Republicans have gotten the economy they wanted…but they haven’t been able to push it into recession in spite of their best efforts.

That bodes poorly for Trump.

His only hope now is to wish for a terrorist incident.

Some might think it’s a bad thing to hope for recessions and terror strikes…not Republicans.

@C. Clavin:

Those Republicans who are wishing for these bad things to happen, shouldn’t we create a word to describe them?

hmmmm, oh yeah. EVIL

The next fed president or board member that predicts a recession will be the first. They are probably the most optimistic people on the planet.

Come on. Yeah, it was really turning the corner. Please, Doug. Yes GDP stopped contracting after Q2 2009, but did not return to its October 2007 level until July 2011. And lest you forget that after the economy had “turned that corner” in mid 2009, the country still lost 1.2 Million jobs from July – December 2009. Seriously man?

Doug, you need to stop equating the Great Recession with these recent recessions under recent Presidents. Neither of those administrations dealt with 4 quarters of GDP contraction or 23 straight months of job losses. None even come close to be comparable

Yeah, so consistent – Real GDP numbers below. Throw in the war spending and housing market for 2003-2005. I mean, not harping on you too much, but you are trying to paint some rosy picture for the prior administration while brushing over the current. That whole paragraph is really partisan econ analysis

Date Value

31-Dec-15 1.98%

31-Dec-14 2.47%

31-Dec-13 2.45%

31-Dec-12 1.28%

31-Dec-11 1.68%

31-Dec-10 2.73%

31-Dec-09 -0.24%

31-Dec-08 -2.77%

31-Dec-07 1.87%

31-Dec-06 2.39%

31-Dec-05 3.03%

31-Dec-04 3.12%

31-Dec-03 4.36%

31-Dec-02 2.04%

31-Dec-01 0.21%

@Jc:

On every single issues show where there are Republican guests, they all do that, compare the 2008-2009 recession with the garden variety recessions.

These people willfully make a false comparison. In no other recession did American homes and businesses experience an aggregate 25% loss of wealth – $17 Trillion, and job losses of over 700,000 per month. We nearly plunged into another Great Depression. The growth we’ve experienced since the 2008-09 catastrophe – 2% to 3% for nearly 6 years, and steady if modest jobs growth – is not flashy and exciting, however it has exceeded the economic performance of all other western countries that experienced a crash in 2008.

I am confident that history will judge this president favorably when they review economic performance in light of the worst economic collapse since the Great Depression.

gee, remember when the middle class could put money into a savings account and make 5+% interest on it? most of them don’t anymore, the feds war on the middle class has got to end, like our fake economy. it’s funny how most people don’t say much about this, the banks are getting a sweet deal at our expense. i mean really, the rich are benefiting at our expense- how much easier can i say that! and i don’t hate the rich like most of y’all….

@Jc:

You nailed it. Doug is writing alternate history here, with a libertarian bent. Doug wants the recovery to begin in late 2008-BEFORE the ARRA, the stimulus, and auto industry rescue, so that Obama Administration policy can’t get credit for fostering the recovery.

Obama therefore didn’t pursue good economic policy: through great good fortune, he just happened to become President when the economy “naturally” began to recover .

Now most economists would think this is nonsense: but Doug is a libertarian, and if the facts don’t agree with his ideology, well the facts have to massaged into shape.

Yup. Barry Ritholz:

This is the consensus view on the recovery by economists. Right wing ideologues see it as Doug does. Ritholz’s statement probably should be posted on every one of Doug’s articles on the economy.

@al-Alameda:

I don’t think it was your intention, but this is a misleading and false statement. For stocks (and real estate as well), every buyer has to be a seller, and vice versa, every security has to be held by someone until it is retired. Therefore, as a function of math net transactions have to be zero. Stock prices are a reflection of future returns (the lower price you pay the higher the expected return, or conversely, the higher price you pay the lower your expected return). Just because a few very zealous people were willing to reduce future returns by paying higher prices for specific securities doesn’t change that fact.

@C. Clavin:” But she acknowledged influential voices in academia and elsewhere who have warned that long-term growth could be substantially below the pace achieved in the decades before the Great Recession.”

Where was Mr. Obama during all this evil Republican manipulation of the economy? Oh, right. He was in charge. The economy has been subpar during the entire tenure of the Democrats and Hillary promises more of the same.

Job growth has been scant and the new jobs in the Great Obama Economy are crap jobs. Obamacare premiums are projected to go thru the roof next year, further damaging the middle class and Islamic terrorism is not to be mentioned. Some legacy.

@al-Alameda:

“I am confident that history will judge this president favorably when they review economic performance in light of the worst economic collapse since the Great Depression.”

And compared to other developed countries as well. Since the Great Recession ended, US GDP growth is about 1.75% per year, admittedly slow. On the other hand, the Euro zone is about 0.8% per year, and Japan is under 0.1% per year.

@Avid sportman:

Actually, I was not misleading and stated nothing false at all.

The crash of the housing market alone, in aggregate, although it varied across the country by location, caused a loss in the value of commercial and residential real estate of about 20% of value – which was part of the diminished wealth of many, many Americans. The same was true of the crash in the equities market – the DJIAA plunged from $17K to less than $9K – a loss directly reflected in the holdings of institutional and individual investors – it took years to get back to pre-crash levels.

I’m not sure why people want to diminish the magnitude of the 2008-09 crash?

@al-Alameda: I’m not diminishing anything, I’m simply pointing out a mathematical fact. When the DJIAA fell from 17K to 9K, the net flow of money was exactly 0. It has to be, because as I stated before every buyer has to have a seller and vice versa. The net worth of a country is a culmination of real assets, private investment, infrastructure, intellectual property etc. Securities are not economic wealth, they are a claim on future returns made possible from savings (real estate is roughly the same principle). When you say we lost XX trillion in wealth from a stock market decline, yes you are making a misleading and false statement. There are plenty of ways to show the severity of the great recession, this just isn’t one.

@Avid sportman: Based on that sort of argument, the real estate crash never happened either.

Unless you held Lehman Brothers.

Also, does it count when the government is the only buyer?

@Jc: I’m not sure if you’re being serious but, Yes it does. If you want to sell something you need a buyer. That’s true whether it’s a hedge fund, the US Gov, BOJ or a retail investor.

@Jc: It still applies until trading of the stock is halted.

If you want to talk about the retarding effects of the public equities and housing assets crash, then you have to acknowledge the stimulative effects of the Fed pumping those assets back up. It’s not a one way street. Where’s the beef?

Also, in this fair minded discussion (snicker) you have to acknowledge the change in calculating GDP with respect to intellectual property, estimated to be between +1.5% – +2.0%. That means that calculated in the historical manner, GDP has been essentially zero for awhile now. Not quite robust……

@grumpy realist: It’s not argument, it’s how things work. Every security has to be be held by someone until retired, whether it’s bonds, stocks, etc. Take today for example, as of me writing this, there were roughly 17.55M SPY shares traded. The price is down, about $0.16. Some people made money, some lost, but in aggregate all the transactions net to 0. It’s really no different a concept than when I hear people say there’s tons of cash on the sideline waiting to flow into stocks. That’s not true, the only time money enters the stock market is during an IPO.

All of this is just as true in bull markets as it is in bear markets. Suggesting that my argument is flawed because it would mean that the housing crash didn’t happen isn’t applicable. You’re ignoring crucial components like leverage, and default. The effects of debt deflation on the real economy.

“That’s not true, the only time money enters the stock market is during an IPO.”

What you guys are debating is movements in the stocks of cash, vs valuations, among various asset classes. Changes in expected cash flows and the value placed on those cash flows do impact wealth.

What these jokers can’t get their minds around is that if economic activity declined due to diminished wealth it should have been restored upon asset appreciation.

@Guarneri:

Yes, most of that loss in wealth has indeed been restored in the years since the 2008-09 crash – not necessarily to all of those who lost it.

Obviously conservative blogs haven’t reported the news to you and other conservatives that the equities markets have regained value the value lost in the collapse, and the housing markets too have rebounded, thereby restoring lost wealth to many Americans. It is not the same as it was when the recession was deepest, we have steadily worked our way back.

@Avid sportman: your stuff reads like the babblings of a random word generator programmed with financial buzzwords. What do you think happens to a listed company when there’s a stock market crash?

P.S. And let’s not forget the entire collection of side-bets called the derivatives market….of which the “value” has been estimated to be multiple times of the actual stock market–until the stock market crashes and you discover the problem with being leveraged 150:1.

@al-Alameda:

Purchasing power is purchasing power. It is shifting all the time.

But to your point, why do you think Obama and Clinton have not been screaming bloody murder about the Fed pumping the stock market while destroying the incomes of retired grannies living off fixed income securities?? Couldn’t be to support political contributors and for political propaganda purposes. Right?

It’s morally inexcusable.

@Guarneri:

You’re still denying the severity of the 2008 financial collapse?

It was just another shift in the ever changing sands of purchasing power? Really?

Let me be clear: Allowing another Great Depression to happen would have been morally inexcusable.

@Grumpy Realist:

I think Avid Sportsman belongs to a class of self-deluded madmen we call believers in Austrian economics( I think Doug may be a member also). He probably believed that the Fed Reserve’s QE2 monetary policy would lead to hyperinflation, and is still amazed it hasn’t. Read Noah Smith here on what Austrian economics devotees believe.

@al-Alameda: There is also a failure to compare and contrast the U.S. economy in this article and others with other major 1st World/OECD economies, where the U.S. has outperformed Japan and the EU for the last eight years, despite a dysfunctional Congress and and an opposition party (the Republicans) bent on economic sabotage (Repeated Debt Ceiling Crises) as well as just being unwilling to compromise cranks once they squeezed the maximum tax cuts for rich people they could out of Obama in winter of 2012-13.

Basically, as Daniel Alpert, Lawrence Summers, and Dean Baker in their different ways have pointed out the 1990s saw a huge expansion of the global economy as first Eastern Europe, and then China, became members of the trade market, introducing a 1/2 billion new workers onto the world. A lot of stuff started getting made, but the increased savings and declining relative incomes left insufficient demand and mal-investment in in its wake. In the U.S. two bubbles boosted demand in the 1990s and Oughts, but the collapse left nothing to replace it and Governments’ fiscal austerity since 2010 has diminished demand as people rush to safe assets and cash, as evidenced by the decline in the velocity of money. https://fred.stlouisfed.org/series/M2V As Dean Baker puts it: ” …To my view there’s not much complicated about the story. We lost a huge amount of demand when the housing bubble collapsed and there is nothing to replace it. That is essentially #4, presented as secular stagnation by Larry Summers…” http://cepr.net/blogs/beat-the-press/causes-of-stagnation-mankiw-s-big-five

Recently, there has been a recent decline in non-residential business investment, as the fracking boom turns into the fracking bust and U.S. manufacturing suffered from the rise of the dollar, a rise triggered by the end of the FED’s QEIII program and incessant promises to raise interest rates. This has slowed the economy as could be logically predicted just using the National Accounts Identity. The problem the Fed has is that the financial elite and banks want higher interest rates and the FED wants to raise rates so it will be able to cut rates if has to in a recession. However, every step it takes to that end aggravates the likelihood of a recession, and exporting demand to Europe and China as the dollar strengthens, depressing inflation, and causing credit to tighten.

What we need, but won’t happen is an audit and complete transparency of the Federal Reserve, an organization so powerful that it does not answer to congress or the president !

There needs to be a complete, independent investigation of the Federal Reserve. The curtain needs to be pulled back.

See “Secrets of the Federal Reserve”

Also “The Coming Economic Crisis”