Keep Politics Out Of The Federal Reserve

President Trump is trying to politicize monetary policy. He should be resisted on this front.

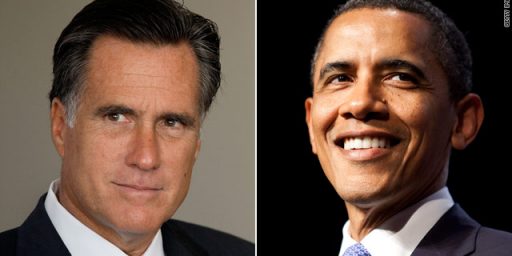

Steve Rattner, a Wall Street trader and analyst who served as President Obama’s adviser during the effort to bail out the American auto industry during the first term of Obama’s Administration warns against allowing President Trump to politicize the Federal Reserve Board:

Once again, the Federal Reserve has regrettably become a favorite whipping boy.

President Trump has been lobbying it to lower interest rates, even though the unemployment rate is 3.8 percent. Progressives are still complaining that the central bank didn’t do enough to stimulate the economy in the wake of the 2008 recession.

More worrisome, Mr. Trump has been attacking the Fed’s actions with more vitriol than any previous president in memory while proposing two highly partisan and unqualified nominees to join a distinguished board that has historically been free of any political agenda.

The policy critics on both sides are about as wrong as imaginable. And above all, we need to guard the independence of the central bank, the most important government institution that has not been divided by the deep partisanship so evident elsewhere.

In an era when even the Supreme Court divides routinely along ideological lines, the Fed still maintains an analytical and, as the former chairman Janet Yellen liked to say, data dependent approach to policymaking.

As Rattner goes on to note, there have been times in the past when there has been conflict of sorts between the Federal Reserve and the political branches of government. One of the most notable examples of this in recent memory. of course, came during the time in the late 1970s and early 1980s when the Board, led by Paul Volcker, put an increasingly tight rein around monetary policy in an effort to combat the combination of inflation and a stagnant economy that the United States experienced throughout the 1970s and particularly in the late 70s under President Carter. Those policies, which included a radical tightening of monetary policy and other moves, eventually pulled the economy into a deep recession early in President Reagan’s first term that eventually required him to scale back the extent of spending projects and his signature tax reforms in order to accommodate the state of the economy at the time.

Fortunately for the country. both Reagan and President Carter. who initially appointed Volcker to his position as Chairman of the Federal Reserve Board, kept any criticism of Volcker out of the public eye and allowed him to do his job. As a result, the inflation monster was finally killed in the early 1980s and the economy proceeded to enter a very substantial recovery because of that. Eventually, Reagan reappointed Volcker to a second term which he served before being replaced by Alan Greenspan, who was also permitted by the Presidents he served under to run a politics-free Federal Reserve. Additionally, subsequent Presidents followed the example of Carter and Reagan and allowed the Fed to pursue its mission with little political interference.

As Rattner notes, that has changed under President Trump:

Happily, the Senate has already made clear that Herman Cain — with little relevant experience and charges of sexual harassment swirling around him — would have been unlikely to survive confirmation. (Mr. Cain withdrew his name from consideration.) And Stephen Moore, with a raft of tax peccadilloes, would also have to explain past statements like “I’m not an expert on monetary policy.”

Mr. Trump and his aides base their call for the Fed to lower rates on quiescent inflation, a phenomenon that could well be either aberrational or a new normal. Put me down as generally skeptical of pronouncements of a new normal.

And having come of age as a young Times reporter covering economic policy during a period of rampant inflation, I’m particularly skeptical of declaring inflation dead and buried.

Regardless, few mainstream economists believe that the interest rate increases to date have impeded the recovery, nor would cutting them materially accelerate growth.

“The president is using the Fed as a scapegoat for his own economic policy mistakes,” Mark Zandi, the chief economist of Moody’s Analytics, told me. “The Fed’s actions last year have no bearing on long-term economic growth.”

(…)

Mr. Trump’s saber rattling has unnerved international allies. A week ago, the European Central Bank’s president, Mario Draghi, said that he was “certainly worried about central bank independence,” especially “in the most important jurisdiction in the world.”

We should all be worried. And most important, Mr. Trump should keep his hands off the Fed.

To some degree, Trump’s criticism of the Federal Reserve can be seen has having sprung from a general antipathy toward the Federal Reserve Board that has developed among conservatives over the past decade or so. To no small degree, that antipathy started at least in part with the Presidential candidacy of former Congressman Ron Paul who spent the better part of his later years in Congress, and his Presidential campaigns in 2008 and 2012. calling for an “audit” of the Federal Reserve by Congress that seemed designed more than anything to be oriented toward increasing the amount of political control over Fed policy if not eliminating the Federal Reserve altogether and returning the nation to the gold standard, a position that has been popular among some conservatives and libertarians for years while others, such as myself, tended to favor the pro-Fed position taken by people such as the late Milton Friedman, who advocated for changes to Fed policy but generally accepted the idea that it is an institution that has done more good than harm notwithstanding the fact that mistakes on its part clearly contributed to the Great Depression of the 1930s and the Great Recession of the latter part of the first decade of the 2000s.

In any case, Trump’s position seems to be animated by both this wing of conservative economic thought and by his general belief that the institutions in Washington that have traditionally been outside politics — such as the Supreme Court, the intelligence agencies, the F.B.I., and the Department of Justice should primarily be loyal to him and carry out his will and his policies. For obvious reasons, this is a particularly dangerous position to put the Federal Reserve in given the fact that changes in monetary policy motivated by politics rather than economic data and expertise has the potential to impact the economy not only of the United States but the rest of the world as well. For this reason alone, Congress should act to make sure that the President keeps politics out of the Fed, Effectively blocking Herman Cain’s nomination was a good start, but it is unlikely to be the last we hear from the President when it comes to monetary policy.

The know nothing in the White House shouldn’t be commenting on monetary policy at all since he doesn’t understand it and won’t listen to experts. However long he is president, I hope our institutions can survive in tact.

You know what’s hilarious about the yearning for the gold standard? the twin claims that 1) it’s an objective value, and 2) that it can’t be manipulated by the government to “cause” inflation.

1) There’s no intrinsic value to gold. You can’t eat it, drink it, make tools with it, build with it, etc. It has uses in electronics, physics experiments and the like, but not that many. It is used extensively in jewelry, even in cultures that never used it as currency. But as currency it’s no more intrinsically valuable than paper money.

2) You can so cause inflation with gold currency or with other currency based on precious metals. All you need to do is use alloys containing less precious metals. This happened in the Roman Empire in the Crisis of the Third Century. things got so bad, aside from the Crisis itself, that Diocletian wound up paying the legions in kind, and setting up price controls across the Empire (which didn’t work well at all).

There are other problems with precious metals. For example, it was common to snip off a piece from gold or silver coins. The coin was accepted at face value, and the snippets, obviously many of them, could be sold as bullion. This was a persistent problem for a very long time. The story is that Isaac Newton came up with the idea of making coins with ridges on the edge. then if you got one with missing ridges, it meant it was missing some weight.

I don’t know whether that’s true, but it’s “such a good story, it simply must be told.”

@Kathy:

I am baffled that more people don’t understand that.

@Teve:

Tradition.

Gold has been a store of value in many, many cultures, even before such cultures adopted coinage.

One of the earliest currencies we know of was barley in Sumeria. This makes good sense. It’s relatively uniform, easily divisible into fractions of a given measure (say a pound, half pound, quarter pound, etc.), relatively durable (lasts a few years), and intrinsically valuable (you can eat it cooked, or drink it if you make it into beer).

On the other hand, it can be lost with ease, it’s not waterproof, it’s liable to be stolen by mice and rats, and I’ve a feeling it looses some of intrinsic value if it’s also valued as currency: you won’t want to eat it if you can trade it for steak; the butcher won’t want to eat it if they can exchange it for new cutlery; the blacksmith won’t want to want it if they can trade it for a chariot, etc. so it gets spent instead of getting consumed.

@Kathy:

I thought that we were still on at least some sort of gold “standard” until just a few years ago someone filled me in that it had been done away with some time ago. In fact it might have been on this site.

That leaves the big question – about Fort Knox.

@Tyrell:

Yeah, Nixon pulled us off convertibility in 1972, replacing a “gold standard” with “full faith and credit.”

@Kathy:

Don’t even need to debase the metal. IIRC there was serious inflation in Europe after Spain started hauling back lots of gold from the New World.

And since we’re talking history, putting the UK back on the gold standard after WWI was Churchill’s biggest mistake, a cause of the Depression. It’s arguably a worse mistake than Gallipoli in that there was some chance Gallipoli might work. I’ve seen economists claim recovery from the Great Depression was almost entirely a matter of how soon a country went off gold.

Going to a gold standard simply means committing to a very tight money supply, but one subject to random variation. The Prairie Populists weren’t wrong to talk about being crucified on a Cross of Gold. It also, as you imply,would drive up the cost of necessary, utilitarian applications for electronics and heat shields.

@Kathy: @Teve: Gold has some value simply because its supply is so limited. But that also limits its utility as a global medium of exchange—there just ain’t enough of it to adequately perform that function. (In addition to all the other issues Kathy notes.)

@Tyrell:

Nixon took us off of a gold exchange standard where we held all of the gold and others trusted us to manage it on their behalf. They pegged their currencies to the dollar trusting that we actually had all of the gold we claimed to have. France, in particular, didn’t believe us. From what I read, it probably would have collapsed at some point anyway.

@Teve:

Me as well. Money itself is a store of value but doesn’t really have any inherent value and mostly functions as a medium of exchange. To the extent is has inherent value, much of it would come from the fact that the US government demands that you pay your taxes in dollars.

@Kathy:

All they have to do is find more gold in South Africa, Australia or wherever and if they bring it home they either have to print more money or up the amount of gold that a unit of currency is worth which would mean having to adjust exchange rates with the rest of the world since exchange rates are fixed on a gold standard.

@gVOR08:

Don’t forget Spain managed to bankrupt itself with all the gold and silver it stole from the New World. Which in a way is a fitting punishment.

Years ago I saw a story about an econ study. The question was whether the Fed eased interest rates to help incumbent president win reelection. They looked at monetary policy versus the election schedule. They concluded that the Fed did not ease to help presidents, they only did it for Republican presidents.

Do interventions to increase the Dow Jones improve the national economy? The price of Apple is about $200. If the price is hyped up beyond the intrinsic value by currency manipulation, how does that help the three hundred million Americans who own very little Apple? I can understand how it helps those who own a decent chunk of Apple, but won’t the overall stimulus lead to inflation that soon erodes the value of the run-up? I have a very poor understanding of economics and seek enlightenment.

Oh, noes… my comment was caught in the SPAM filter.

🙁

All I know, and what many have known all along, is that Teump is susceptible to whoever’s whispering in his ear this week. And with the high turnover, it’s very erratic.

@Robert Prather:

Gold is the wet dream of capital. Not only can the government not debase gold’s value by printing money, the purchasing power of gold increases linearly as the economy expands. It’s a world of deflation. If, say, you held 1% of all gold in 1919, and kept that until our day (assuming a static gold supply), you’d control the same percentage of the world’s vastly enlarged economy today. And you would have just sat on your ass. Good work of you can get it. Think of it as having owned Manhattan since the beginning, and taken a fixed fee from every dollar made. Gold suits an entrenched oligarchy that would rather not compete with the muscle or the brains driving the economy.

Word on Twitter is that some Republican senators are going to join their more sensible Democratic peers and sink Moore’s nomination.