Lower Home Prices Aren’t Necessarily A Bad Thing

The housing market has changed over the past five years, and that's a good thing.

From The Independent further confirmation of the extent to which the housing market has fallen from its heyday:

The ailing US housing market passed a grim milestone in the first quarter of this year, posting a further deterioration that means the fall in house prices is now greater than that suffered during the Great Depression.

The brief recovery in prices in 2009, spurred by government aid to first-time buyers, has now been entirely snuffed out, and the average American home now costs 33 per cent less than it did at the peak of the housing bubble in 2007. The peak-to-trough fall in house prices in the 1930s Depression was 31 per cent – and prices took 19 years to recover after that downturn.

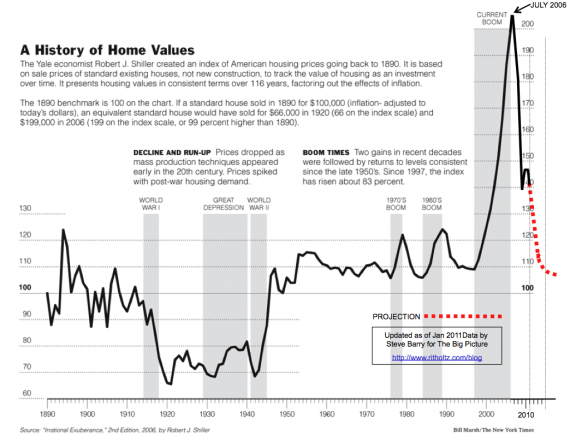

If the numbers themselves don’t bring the message home to you, then this Case-Schuller Price Survey chart, updated through January 2011, most assuredly will:

That spike that starts in the late 1990s and runs all the way through July 2006 is a the housing bubble. It was caused by a number of factors, including government policies that encouraged lenders to give loans to customers that may not have met traditional tests of credit worthiness. However, primarily, it was caused by a classic speculative bubble, by homeowners who came to view their homes as a piggy bank rather than a long term investment, by homebuilders who built new developments as fast they could, and by lenders who stretched rational lending rules to the limit in order to profit from the housing boom.

If you stepped away from it and looked at it rationally, it’s clear that the whole thing was unsustainable in the long run. People who barely made enough money to rent an apartment are not going to be able to make the payments required under an LIBOR loan for several hundred thousand dollars. Continuing to build new houses was eventually going to create a saturated market, forcing prices down. Treating mortgages like securities simply to make more money off them was a recipe for disaster. And, most importantly, everyone seems to have forgotten that prices don’t always go up, even when the economy is good. Some people did see the collapse coming, but they were largely dismissed in an era where buying real estate was the new way to make a quick, easy buck.

Some bloggers, conservatives of course, blame the current state of the housing market on President Obama, but that misses the point entirely. Certainly, the unemployment situation and the relatively weak state of the economy are contributing to the slow rebound in home sales. However, the biggest contributor is the fact that the collapse of the housing bubble created a massive supply of foreclosed home which continue to flood the market, putting downward pressure on prices. That, combined with the fact that lenders are nowhere near as loose with credit as they used to be, is the reason the market hasn’t boomed back, and is unlikely to for some time to come.

And that’s not necessarily a bad thing. The housing bubble caused tremendous damage to the economy, damage we’re still dealing with today. The idea that anyone would want those days to return is, quite honestly, mind boggling. The American Dream of owning a home is still alive, but it’s just dealing with a more rationalized housing market now (meaning that you might end up owning a townhouse instead of that five bedroom house in the suburbs).

Home prices are likely to continue to fall until the market reaches an equilibrium point. That won’t occur until the foreclosure and at-risk properties are cleared from the market. That won’t until the economy itself recovers far more than it has to date. What’s clear, though is that the Housing Bubble isn’t coming back, at least not for several more years. Considering the risky lending, faulty decision making on the part of homebuyers, and irrational exuberance on the part of everyone that accompanied it, there isn’t any reason why we should want those days to return .

It’s a bad thing if people still aren’t buying.

But there are several reasons for that, including the fact that lending standards are much tighter than they used to be (a good thing) and people do not have the same irrational exuberance regarding home prices that they had in the bubble years (also, a good thing)

Eric:

So it would be great if they were buying overpriced homes? What other overpriced things should I be buying?

meaning that you might end up owning a townhouse instead of that five bedroom house in the suburbs

Or you can finally afford the five bedroom house because it’s been foreclosed on.

If you have a job.

Real Estate would be very different if who your neighbors were did not matter. However,in the real world,the neighborhood affects the education of one’s children, one’s insurance prospects, one’s employment prospects,and one’s general quality of life.

Many people were overspending in order to avoid being around poor people. It is not that people will be living in a townhouse. It is that they could end up living in a townhouse in a lousy neighborhood.

This is why so many people believe that the U.S. is on the wrong track. There are fewer good neighborhoods and the economy is not producing the type of jobs that allow people to live in the good neighborhoods.

Is that chart really predicting house prices will back down to where they were in 1976?

Or am I reading it wrong?

ponce, don’t remember where I read it or who said it, but real housing values have been flat for decades. (meaning that they only keep up with inflation) if you look at the chart the projected relative value of a home is the same as it was in the early 1900’s

and by “flat” I mean no real growth. peaks and valley cancel each other out.

The red dot-dot-dot is just somebody’s idea. It has no guarantee.

And FWIW, while US home prices on average have only tracked inflation, not all neighborhoods are average. Some have done much better. Some have done much worse.

I remain unconvinced that homes were over-valued, at least in most areas of the country. You may, however try to convince.

Eric:

Um, I guess I would point to the fact that prices shot way, way, way up overnight.

And then dropped like a rock. And are still dropping.

Doesn’t the fact that they’re not selling pretty clearly demonstrate that they are overvalued (ie asking for more money than the house is worth to buyers)?

You’re a little late coming to this party, Doug. I posted on this very subject, taking note of the very graphic you’ve got in your post, a couple of weeks ago.

I suppose it depends on the operative definition of “bad”. Returning to the pre-bubble trend will certainly ring a lot of deadweight loss out of the economy. Much of that deadweight loss will be in banking, home construction, and retail. Healthcare is consumer spending, too, BTW. For that to occur we’d need to stop subsidizing those sectors.

Such a reallocation of resources will cause an enormous amount of pain in the form of capital loss and unemployment.

However, I have a question for the assembled commentariat. Why should prices return to the pre-bubble trend? Why shouldn’t real housing prices drop to their level of the 1920s and 1930s? Is there something magic about the post-WWII trend? As I’ve been posting for some time over at my place I think there are demographic and income reasons to believe that things are in the process of changing pretty basically from their post-WWII norm.

Dave:

How much are we comparing apples and oranges? A pre-war home is not a 60’s-70’s home is not a 80’s to present home. Homes are bigger, better insulated, contain more appliances, etc… How much is that accounted for?

@Dave:

You’re right, of course, but the obvious response is to ask how much capital was diverted into the housing market during the 7-8 year run of the housing bubble that could have been better allocated elsewhere. This is one of the costs of a speculative bubble.

@Michael:

This is why the best analysis of housing trends would be to adjust both for inflation and for increased value. It’s far too late in the evening for me to try to do that, perhaps later this week.

Oh, come on, Doug, it’s only 11:30 EST on a Sunday night.

Reynold you prove once again how little you actually know. Prices did not shoot up over night. They grew steadily. As people tried to make money on the market by turning houses, loans, due to liberal lending policies instituted by the community reinvestment act caused people who should not have been buyers to be buyers, prices continued to rise until. Pop! Buy the way Mikey, you should invest in an overpriced education. It would do you absolutely not good because you cannot fix stupid and there is no guaranteed of any return on your money. Next, I have a bridge across the Golden Gate I would like to sell you. Next I have some carbon credits. Half price for what Gore sells them for.

The answer to Dave Schuler’s question is of course that nobody knows.

As regards michael’s observation that houses aren’t the same, it’s not all gravy. Lots and yards are smaller too.

(In short term Case-Shiller tracks same-house sales, so this is all compensated for, but I don’t believe there is a long term survey that makes the same adjustments.)

Actually, if memory serves correctly, the index makes an attempt to correct over time for “value,” although I believe its dominated by one variable: size.

Dave is, and has been, asking the $64 question: who’s says what “equiibrium” is? I have posited that there is no reason to believe it should go back to the “old days” just as we have better cars, food etc than 30 years ago.

That said, watch for pockets. So SW Florida, Palm Desert, Scottsdale, Ashville, NC etc will be fueled by baby boomer retirement and tax advantage. IL. PA, NY (but not NY metro), OH, MI etc are toast.