Millionaires Club Has Lots of Turnover

Few people earn a million dollars in a year. Fewer still do it more than once.

Few people earn a million dollars in a year. Fewer still do it more than once.

Washington Wire (“Study: Lots of Turnover in Millionaires Club“):

A new study shows that the ranks of people earning $1 million or more are highly variable from year to year. That implies that millionaires aren’t quite the monolithic class that some political rhetoric might suggest.

In fact, from 1999 to 2007, about 50% of people who earned $1 million or more in any given year only managed to achieve the feat once, according to the research by the nonpartisan Tax Foundation. Another 15% did it twice.

Just 6% filed in all nine years with incomes more than $1 million. Millionaires often generate their income through one-time sales of small businesses, or other appreciated assets.

This isn’t exactly surprising: a million dollars is still a hell of a lot of money; outside of Fortune 500 CEOs, superstar entertainers, and professional athletes, almost nobody earns that much in salary. And business owners tend to reinvest most of their profits in their business rather than cashing it out as salary.

A recurring subject in OTB comment threads over the years is that the definition of “millionaire” seems to have changed. While the dictionary definition still refers to people with a million dollars in net worth, it’s increasingly being used to mean “earning a million dollars or more a year.” While some 600,000 American households accomplish that feat in any given year, the grand total that fit the old definition remains quite small despite inflation: 3,104,000 according to the World Wealth Report for 2010. That, by the way, represents almost a third of the world total.

The disparity between those two numbers is actually rather interesting: there are roughly five times as many American households with a million dollars in wealth as there are who earn that much in a single year. Rather clearly, keeping a million dollars is even harder than earning it.

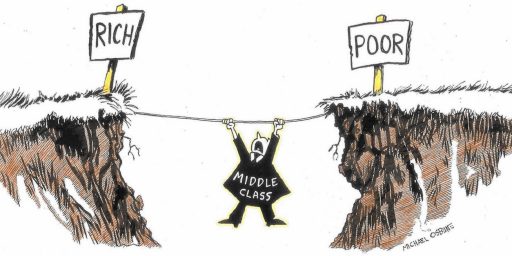

Well, you can’t use THAT as an illustration without showing THIS:

http://www.youtube.com/watch?v=tMyk7MXsseg&feature=youtube_gdata_player

Not as unholy able as it would seem.

Bingo!

Actually, not to nitpick, but a more accurate statement would be: “And business owners nearly always reinvest the overwhelming majority of their post-tax profits in their businesses rather than cashing those post-tax profits out as salary, draws or dividends.”

Hell, you can review 100 financial statements from 100 small to mid-sized companies and eight to nine times out of 10 you’ll find that they’ll retain as equity virtually all of their post-tax earnings. Which of course relates to the elephant in the room. Every dollar in federal taxes paid by small and mid-sized businesses is one less dollar they can use for buying new equipment, capital investment and, especially germane in this day and age, hiring new employees. Taxes are a four letter word.

3 million by net worth seems low … but living in OC might warp my outlook.

This page says that the 90-100th percentile in the US had a median net worth of $834K in 2001. Given that this is probably households, and there are around 115 million of them, then 5% of households (to split at the 95% leve) would be about 5 or 6 million millionaires.

That page talks about HNWIs and UHNWIs, which is the other alternate definition.

As this relates to policy though, a steep progressive tax scale would be made more “fair” by a serious income averaging component. We can actually tax the 1 or 2 timers differently than the consistent earners.

We don’t have to make one tax rate and pretend it is for only one kind of earner.

@Tsar Nicholas:

That’s cute, but it works that way for the little people too. Every dollar paid in federal taxes is one less Redbox rental, one less box of macaroni and cheese. One less dollar I can give to a small to mid-sized business. That would be horrible if my tax dollars go into a black hole, never to be seen again. But that’s not the case, is it?

This part is interesting:

These millionaires make the windfall millionaires look puny. And there’s no way the windfall millionaires can be puny if they’re making twenty times the average salary.

Come to think of it….you know what I’d do if I made in one year what I’d otherwise make in twenty? I dunno….but “complain about taxes” isn’t on my bucket list.

BTW, from that page:

@Tsar Nicholas:

I’m not sure James or the Tsar really focused on “profits.” Many of the things they talk about businesses doing are pre-tax, and costs.

If you pay a salary, that actually isn’t “profit.”

Now, conservatives usually try a wiggle at this point. “No” they say, “profit from 2012 would be used to hire new people in 2013!”

Well, your accountant can help you with that.

@Tsar Nicholas:

Also, those “3,000 new households a year [who] lay claim to $20 million or more in invested assets” have obviously made it through the minefield you claim is in their path.

We are obviously not squeezing them dry.

@john personna: I’m actually making a narrower point: even successful small business owners seldom have $1 million in income because they re-invest. That’s not taxed as income since, well, it isn’t income.

A business owner who pays himself $1 million, pays taxes on it, and then invests a chunk of what’s left back into the business isn’t doing it right.

“And business owners tend to reinvest most of their profits in their business rather than cashing it out as salary.”

Depends. For lots of service oriented businesses, you will just bonus out your salary (what we do) as there is not a lot to plow money into. However, what that means, is that most small businesses are not paying taxes. If it is put back into the company, you do not pay taxes. If it is put into salary, the company does not pay taxes. If you have a decent accountant and lawyer, as a small businessperson you should not be paying corporate taxes very often.

Steve

@Tsar Nicholas: Your still stuck in the 70’s when the problem was too little supply. Now the problem is too little demand. Your wrong on the percentage of small biz that are re-investing all there money back into the biz. They are not doing that today. I know, I am out there talking to these people every day. The reason they are not doing it is that there is not enough demand. There is no reason to add new equipment or expand floor space or anything right now. They are not using all their capacity so any money spent re-investing in the biz is just wasted.

So they save it in the bank earning nothing in interest. On a big scale you see it in companies like Apple sitting on huge hordes of cash. Its idle capital because there is not the demand to justify.

Big picture we would all be better off if companies took that money and gave all their current employees big one time bonuses. Workers are short capital right now and when they get extra, they spend it. That would get the money back circulating into the economy. But it is hard for the small biz owner to do that on their own. So they wait, sitting on the cash, planning on how to use it when the demand comes back, hoping the demand comes back soon.

I dont blame them, I am doing the same thing.

The supply side boasts to the economy worked in the 70’s but that was a different world today. Now we need to move capital from biz, large and small, to workers. We need to lower taxes on income, raise them on capital gains. We need to make it more profitable for biz to pay the money to their workers than invest in new capacity. Increasing idle capacity is wasted money, mal-investment, we already have too much of that.

Old people (and I am one) dont agree with that. Dagnabit, lowering taxes on biz and favoring investments over income worked when I was a kid, it will work again!

No, it it wont. Not this time.