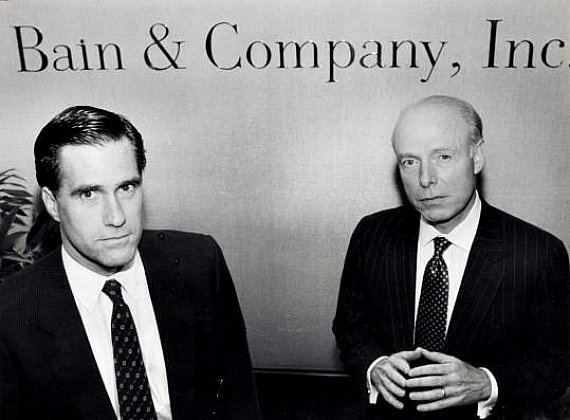

Mitt Romney, Bain Capital, And The Politics Of Creative Destruction

Mitt Romney is taking heat for his role at Bain Capital. He shouldn't.

It was inevitable that Mitt Romney’s involvement with venture capital firm Bain Capital would become a political issue at some point in 2012. After all, Ted Kennedy’s campaign used it as an issue during their tougher-than-anticipated 1994 election fight and the prospect of the Obama campaign, or affiliated groups, focusing on the issue of people who had been laid off as a result of the restructuring deals that Bain Capital was a part of during the time that Romney was a partner there would be a part of the General Election Campaign was inevitable. What I don’t think anyone expected, though, is that the first shots in the Bain Capital war would be fired by Republicans:

NASHUA, N.H. – The Democrats started it, and now Republican rivals are piling on. Mitt Romney is suddenly playing defense about his career as a venture capitalist–and in a Republican primary campaign, of all things.

The attacks on Romney’s Bain Capital career from fellow Republicans may be coming too late in the game to knock him off his path toward the nomination. They may also be ineffective in a party that lionizes capitalism and the business sector that propels it. Raising hackles about Romney’s flip-flops on abortion and other key issues and comparing his Massachusetts health law to “Obamacare” seems like safer ground.

And looking toward the general election, the GOP field is providing a cache of video that Democrats are no doubt already hoarding for use in a in the likely event that Romney is President Obama’s opponent.

Just on Monday, a super PAC bankrolled by allies of Newt Gingrich said it is planning a $3.4 million media blitz in South Carolina that attacks Romney as a ruthless corporate titan who profited on the backs of hundreds of laid-off workers.

In Concord, meanwhile, Jon Huntsman turned a Romney remark about liking to be able to fire insurance companies into a Bain reference. “What’s clear is, he likes firing people; I like creating jobs,” Huntsman said.

Rick Perry took up the anti-Bain attack at a campaign event in Anderson, S.C. “I have no doubt that Mitt Romney was worried about pink slips – whether he was going to have enough of them to hand out,” he quipped, poking at Romney’s attempt at a feel-your-pain moment on Sunday.

If the attacks on his career at Bain Capital sound familiar, it’s because the Democratic Party has been waging them for weeks, trotting out bitterly unemployed people who blame Romney for their predicament.

It was Gingrich who was first among the Republican candidates pushing this line of attack, starting at the NBC Debate yesterday morning, and it is a pro-Gingrich SuperPac that is allegedly working on a 27 minute film about Romney’s time at Bain Capital, a trailer version of which has already hit the Internet:

The SuperPac ad comes at the same time that Gingrich is confirming to reporters that he intends to push this issue in South Carolina, describing what he had planned as a “political bloodbath” to one reporter. Gingrich’s attitude, it seems, has boiled down to not so much doing what he needs to do to win the nomination so much as doing whatever he can to destroy Mitt Romney even if that means putting the General Election in jeopardy. In other words, the old Newt is back and more vindictive than ever. If he and his supporters keep this up, who knows what shape Romney will be in by the time all this is over. As for the other candidates, I suppose one can hardly blame candidates like Perry and Huntsman for grabbing on to any issue they can to strike out at the seemingly unstoppable frontrunner. It is, however, a strange attack for Republicans to be making, and one that strikes me as being completely wrongheaded no matter what source it comes from.

For his part, Romney’s defense of his time has gain has been two-pronged:

Romney’s two-pronged response to the anti-Bain is emerging. The first approach is to pitch himself as a guy who puts on his pants one leg at a time, just like everybody else. “I know what it’s like to worry whether you’re gonna get fired,” he told hundreds of people gathered in Rochester on Sunday. “There were a couple of times I wondered whether I was going to get a pink slip.”

(…)

The second part of Romney’s response is to punch back. At Sunday’s debate, he lumped Gingrich with Obama and suggested that both are hostile to free enterprise. He told the business-friendly crowd on Monday morning, “Sometimes I don’t think [Obama] likes you very much. I love you!”

The Romney campaign followed up with a statement expressing sympathy for the unemployed and repeating the comeback he used in the debate.

“It’s puzzling to see Speaker Gingrich and his supporters continue their attacks on free enterprise,” Romney’s spokeswoman Andrea Saul said. “This is the type of criticism we’ve come to expect from President Obama and his left-wing allies at MoveOn.org. Unlike President Obama and Speaker Gingrich, Mitt Romney spent his career in business and knows what it will take to turn around our nation’s bad economy.”

The Wall Street Journal has a longish piece today about Bain’s record while Romney was there, and it’s quite honestly about what you’d expect for a venture capital firm in the 1990s, some big hits but also a lot of misses, but one is left with the overall impression that most of the companies Bain became involved with were already on their last legs well beforehand and that even a modest number of successes is a good thing:

Amid anecdotal evidence on both sides, the full record has largely escaped a close look, because so many transactions are involved. The Wall Street Journal, aiming for a comprehensive assessment, examined 77 businesses Bain invested in while Mr. Romney led the firm from its 1984 start until early 1999, to see how they fared during Bain’s involvement and shortly afterward.

Among the findings: 22% either filed for bankruptcy reorganization or closed their doors by the end of the eighth year after Bain first invested, sometimes with substantial job losses. An additional 8% ran into so much trouble that all of the money Bain invested was lost.

Another finding was that Bain produced stellar returns for its investors—yet the bulk of these came from just a small number of its investments. Ten deals produced more than 70% of the dollar gains.

Some of those companies, too, later ran into trouble. Of the 10 businesses on which Bain investors scored their biggest gains, four later landed in bankruptcy court.

Of course, filing for bankruptcy protection is not necessarily an indication of business failure. Chapter 11 of the Bankruptcy Code covers reorganization of troubled businesses and, while the successful completion of a Chapter 11 Plan isn’t an easy thing to do, it does happen with regularity. In addition, the Journal notes that most of the bankruptcies happened during the economic downturn in the early 2000s, so it’s quite probable that what we’re looking at there are firms that were already financially precarious who were overwhelmed by a recession and, in some cases, the collapse of the dot-com bubble. That’s the most important thing to remember about a firm like Bain, I think. Any investment firm that concentrates on businesses that are financially precarious to begin with is going to have a mixed record of success at best. It’s far easier to walk into a health company and take it over than it is to reorganize a firm that is in financial trouble and on the verge of total collapse. When that’s your line of business, a high failure rate is going to be inevitable. What’s important to remember, though, is that if it weren’t for investors like the people who were part of Bain, none of those companies would have likely survived much longer and all of the people who worked for them would have been out of work, not to mention the damage that would be done to the companies that were their suppliers.

The focus of the criticism of Bain and Romney, of course, is the fact that in many of the cases where Bain stepped in there was not insignificant downsizing that caused people to lose their jobs. While these individual stories are tragic and deserving of sympathy, it’s important to note that Bain was not in the business of creating jobs:

They were in it to make money for their investors and themselves. Then again, the same would go for Bill Gates, Steve Jobs, Michael Dell, Warren Buffett, and just about every other successful entrepreneur and investor you could name. But that is the miracle of free-market capitalism. The pursuit of profits by creating value benefits the rest of society through higher incomes, more jobs, and better products and services.

This has been what capitalism has been about from the beginning, and it is what’s responsible for the advanced technological society we live in today. Joseph Schumpeter described the process as “creative destruction”:

The opening up of new markets, foreign or domestic, and the organizational development from the craft shop to such concerns as U.S. Steel illustrate the same process of industrial mutation—if I may use that biological term—that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.

W. Michael Cox and Richard Alm from the Dallas Fed describe the process in more detail, and the dangers inherent in trying to stop it:

Herein lies the paradox of progress. A society cannot reap the rewards of creative destruction without accepting that some individuals might be worse off, not just in the short term, but perhaps forever. At the same time, attempts to soften the harsher aspects of creative destruction by trying to preserve jobs or protect industries will lead to stagnation and decline, short-circuiting the march of progress. Schumpeter’s enduring term reminds us that capitalism’s pain and gain are inextricably linked. The process of creating new industries does not go forward without sweeping away the preexisting order.

(…)

Over the past two centuries, the Western nations that embraced capitalism have achieved tremendous economic progress as new industries supplanted old ones. Even with the higher living standards, however, the constant flux of free enterprise is not always welcome. The disruption of lost jobs and shuttered businesses is immediate, while the payoff from creative destruction comes mainly in the long term. As a result, societies will always be tempted to block the process of creative destruction, implementing policies to resist economic change.

Attempts to save jobs almost always backfire. Instead of going out of business, inefficient producers hang on, at a high cost to consumers or taxpayers. The tinkering short circuits market signals that shift resources to emerging industries. It saps the incentives to introduce new products and production methods, leading to stagnation, layoffs, and bankruptcies. The ironic point of Schumpeter’s iconic phrase is this: societies that try to reap the gain of creative destruction without the pain find themselves enduring the pain but not the gain.

Of course, that’s economics and it involves accepting what Bastiat called the idea of the seen and the unseen. Seeing the jobs that are lost when a venture capital firm comes in and reorganizes a distressed company is easy. Seeing the jobs that would be lost, and the other financial losses that would result if nothing were done is much harder. Yes, the restructuring is a risk, but if that risk isn’t taken then it’s quite likely that there would be nothing left and even more people would be hurt. Just like any businessman, the venture capitalist has to perform economic triage if he’s going to save the company and make it profitable again.

None of this is to say that Romney, or the people are Bain are altruists dedicated to saving struggling companies for the good of America. They went into this business because they believed they could make money, the benefits that others accrue from their actions are, at least to them, purely incidental. The same is true of Steve Jobs and Steve Wozniak when they started Apple, Bill Gates when he started Microsoft, Sergey Brin and Larry Page when they started Google, and Henry Ford when he started making cars. They were all interested in making a profit and, in doing so, they created things that benefited everyone. One doesn’t have to believe that actors in the economy are altruists, though, or ignore the idea that they are primarily concerned with earning a profit to recognize the role that what they do plays in the process of economic progress.

All of this is a difficult political argument to make, of course. It’s far easier to empathize with the workers featured in the video embedded above than to wrap ones brain around the idea of creative destruction and accept the fact that progress often means temporary loss. Nonetheless, that doesn’t mean that politicians should pander to mindless populism just to advance their own careers. I’m no Romney fan, but on balance I think these attacks based on his tenure at Bain are mostly ridiculous nonsense and its unfortunate that his opponents have chosen to take up the banner of mindless populism.

“While these individual stories are tragic and deserving of sympathy, it’s important to note that Bain was not in the business of creating jobs”

Umm, someone should tell that to Mitt, since his campaign has become largely based on the fact that, because of his business experience, he knows how to create jobs, while the current President does not.

I agree with Jay entirely.

If Romney didn’t make job creation the entire rationale of him campaign, then I’d be more inclined to agree with you. Not only that, but he has explicitly referred to the jobs created by Bain using laughable statistics.

If Republicans are annoyed, it should be because this should have been out there a whole lot sooner, rather than sending him into a general election without testing him on this. After all, as you point out, this is the strategy Kennedy used, and the obvious path for Obama to attack. Republicans should want to see how he handled it. Now we get to see if he has a glass jaw at the highest level.

“Seeing the jobs that are lost when a venture capital firm comes in and reorganizes a distressed company is easy. Seeing the jobs that would be lost, and the other financial losses that would result if nothing were done. ”

Whoa whoa whoa. Nothing would be done? Take a look at just what Bain did with Ampad for example. That wasn’t a faltering company on the brink!

1. The suggestion that Newt is the one out of line here, after he was subjected to a multi-million dollar negative ad barrage and conservative pundits dumping on him to an extent never before seen in modern Republican politics, is proof that someone is letting their personal animus cloud their perspective.

2. The first two commentors are right on the money. Putting aside his demagogic crap about how 2012 is a battle for the “soul” of America, Mitt’s main argument is that he’s got the business experience to better lead this country out of its economic troubles. That makes it entirely appropriate to focus on exactly what Mitt’s experience entails.

Mike

Aaaah, predatory capitalism.

Have a batting average of .129, make hundreds of millions of dollars.

Nice work if your rich and powerful daddy can get it for you.

Doug’s concept of populism is mis-guided…as are most of his notions…but I agree that it is tremendously amusing to see the Not-Mitts pulling back the curtain on the wizard.

This is Republican/Democratic dicotomy in a nutshell. It’s the OWS movement’s argument writ large.

Romney was in the business of creating wealth. That’s what capitalism does. If it creates jobs it does so only as a by-product and not by intent. To the contrary, it often requires the destruction of jobs and thus communities, as was the case with Bain. That is the sad un-filtered truth…but it does not make for much of a campaign slogan. So instead the GOP in general, and Romney specifically, spins a fairy tale of creating jobs in a blatant attempt to hide the ugly truth. This is the real populism that you decry.

One of Governments roles is to absorb the blows that capitalism occasionally rains down on society…indeed, the blows that Bain itself rained down on countless households and communities… through the creation of a social safety net which, unfortunately, can only be maintained by taxing the wealth created by capitalism. It’s a mutually benficial relationship.

To date the argument of the GOP, and now Romney, is that the wealthy already give way too much…and the “others”…the 47% that pay no federal income tax for instance…take way too much…and the social safety net required in part by their actions is immoral. The GOP and Romney wish to renig on their end of the relationship.

Their goal in posing this argument…reniging on the social contract…and the reason they are forced to continually lie about it…is to make it even more wildly profitable for those who do it…and even more catastrophic to those they harm in the process.

That is where my criticism of the GOP and Romney lies…and one of the choices that those who vote Republican make.

As for Gingrich et al testifying to this truth…well it’s pretty funny how often Obama’s opponents destroy themselves.

Meep-Meep.

Creative destruction may be an important part of our economy, but as soon as Romney talks about how he was creating jobs it’s all fair game. Especially as his policies will end up increasing the costs to the unlucky workers by destroying the safety net, and increasing the rewards for the lucky few at companies like Bain.

Romney is perfect for today’s GOP though, as I have no doubt his presidency would end up mirroring the Bain model, with his cronies in the GOP doing extremely well, while the country ends up like the AMPAD factory.

@MBunge:

The issue that seems largely unexamined in the consideration of Romney’s candidacy is just how relevant “business experience” is as a qualification for high political office. Just as corporate executives are not in the “business” of creating jobs, but rather, in creating and managing profitable businesses, so political leaders are not in the “job creation” business per se, either. The best that public sector can do is to foster the conditions, through fiscal and regulatory policies that encourage private sector growth — nothing more.

While the Schumpeter’s “creative destruction” image is vivid, concise and expresses a broad consensus viewpoint of economists, across the political spectrum, it is — like Adam Smith’s “unseen hand,” only an image — nothing more. If Romney, as an executive of a venture capital firm specializing in turnarounds, was involved in the “creative destruction” of jobs in distressed firms, that only means he was playing in the thick of the private enterprise jungle. It does follow that he knows any more about “job creation” than President Obama.

Here’s an excellent article on Romney, Bain, and the revolution Bain ushered in: The Romney Economy. The question the article raises for me is just how close to a mafia bust-out were some of Bain’s more questionable ventures, for instance, the Stage Stores shennanies

It’s one thing to re-shape and re-engineer a company from a stuttering engine of manufacturing to a productive entity, but in far too many cases the take-over johnnies are simply looking for any excuse to suck out any remaining worth to themselves while pink-slipping the employees, reneging on pension plans, and driving the whole thing into bankruptcy.

I wonder how much higher of a success rate would Romney & Crew have had were they not so insistant on paying themselves such high salaries and packages.

In fact, the problem with Romney´s Business Experience is that he is the kind of short-sighted CEO that destroyed whole industries in the United States by pursuing short term gains and nothing else, not someone similar to Steven Jobs or Bill Gates. Besides that, the size to GDP of the financial industry in the US is a big problem, not a asset. Promoting someone from that particular industry is not good(Even if giving the job to lawyers is not better).

“The same is true of Steve Jobs and Steve Wozniak when they started Apple, Bill Gates when he started Microsoft, Sergey Brin and Larry Page when they started Google, and Henry Ford when he started making cars. They were all interested in making a profit and, in doing so, they created things that benefited everyone”

That is completely false. Those companies were about creating products and wealth. Bain was/is vulture capitalism at its worst. They create nothing, they asset strip companies.

According to the New York Magazine article, Romney strikes me as the exact antithesis of the Jobs/Gates entrepreneur. He wouldn’t move over to Bain Capital unless he was sure he’d make a good salary and get his old job back if it didn’t work. That’s not exactly the kind of entrepreneurial drive that builds new companies from the garage to the factory in under a decade.

You know, a lot of IT people just like making cool stuff. And yes, you can make very good to insane money doing it, and everyone likes making money. But to suggest that the beginnings of Apple and Google were strictly about profit, and everything that flowed from that was secondary is a profoundly ignorant statement.

The tagline for Wozniak’s woz.org website: woz.org | Welcome to a free exchange of information, the way it always should be – does not sound like a man who puts profits above all else to me.

How is it that what Steve Jobs & Steve Wozniak, Bill Gates, Sergey Brin & Larry Page, and Henry Ford all did with their respective companies can be equated with what Mitt Romney did with Bain Capital? An odd comparison, to say the least…must be the libertarian thing…

No, of course not, they should instead pander to mindless greed as some way to show what supposed business geniuses they are just to advance their own careers…we heard about the business career of George W. Bush too as a reason to vote for him, and we see how that turned out…

The problem here as I see it is we in the US have equated rubbing money together to make more money without creating anything new is an economy. Bain Capitol was not so much a venture capitol company as a leveraged buyout company where they risked little and profited no matter what happened. This is what is called Vulture Capitalism not Venture Capitalism.

GWB was our first MBA president, and Willard would be our second. Both HBS, of course. And both 1975.

The tea party is getting precisely the candidate it deserves (link):

Romney and Bain perfectly illustrate the true nature of post-Reagan American capitalism, and how it led to where we are. The country is now going to spend the next ten months studying that illustration in detail. This will be a great lesson for the country. Romney will be providing a big public service, but not in the way he intended.

@TheColourfield: Good point! The difference is that Apple, Microsoft, Google and such make products and services where as Bain made only deals. Our country has become one where the major “products” are loans and derivatives. Romney is simply part of that cohort.

If it is ok to live in such a place, then Mitt’s your man.

Yes. This has been described as the financialization of our economy. It has to do with people getting rich by mostly just shuffling paper around, while creating little or nothing of real value.

Most people probably don’t understand the scope and importance of this phenomenon, but thanks to Mitt a lot of people are going to get more educated about this.

http://www.forbes.com/sites/stevedenning/2011/11/14/was-romneys-turnaround-of-dade-a-triumph-or-a-smoking-gun/

Excellent Forbes article, thanks. Clear explanation of a complicated picture.

I agree that many people — especially progressives and other anti-capitalists — don’t appreciate the fact that wealth can be bound up in losing ventures and needs to be “set free”, so to speak. For that, sometimes layoffs are necessary.

Salaries are up to whoever is paying the bill or owns the company.

However, I suspect that there may be things wrong with some practices even from a capitalist standpoint.

For example, does it really seem like the costs of re-training and the value of (potentially lost) employee knowledge are adequately expressed in the accounting practices of companies? These costs are real, have a probable dollar value, and impact the business. Yet are they on the books in black and white to be used in decisions about layoffs? They don’t act that way. Of course when things get really bad, you either have the money or you don’t. However, until you have these accounting practices in place, you don’t really know if your job-cutting is going to benefit the company.

Then there’s the matter of raiding pensions. Workers spend their careers at companies in the expectation of a pension payout, and I’m pretty sure they would have judged matters differently if they had known there was an escape clause for the company that said “unless we feel like spending the money”. Let’s just say there are some things in business today that push the envelope of what I would call an enforceable, valid contract. Valid, enforceable contracts of course, being a necessary fundamental of free trade.

However, my real beefs with Romney are over (non) separation of church and state, and the fact that he doesn’t consistently practice defense of free trade and individual rights. Massachusetts health care law? Egads. That rules him out right there. At least with overt socialists (Dems), we know where they stand.

Poor Mitt…he wouldn’t have a clue if one hit him in the forehead…

Maconis and all of these commenters seem to be in perfect agreement that “Bain was not in the business of creating jobs”. Someone should tell Romney.

Here are two more articles worth your time:

After a Romney Deal, Profits and Then Layoffs

And a commentary on that article from Forbes:

Was Romney’s Turnaround Of Dade A Triumph Or A ‘Smoking Gun’?

The Forbes article maintains that there is still a lot we don’t know about the Dade deals, but the author concludes that there is enough for the following:

Creative destruction is ok, but all destruction is not creative.

Ron Beasley suggested that Bain Cap was an LBO firm…you’re exactly right. But risked little?? Not so sure about that…most PE firms, or VC for that matter, DO NOT SUCCEED. Very difficult industry to make money…only 10 investments made 70% of their money…it is HIGH RISK, which is why their returns need to be high b/c they lose on so many investments. Trust me, I know, I have a small lbo firm…its difficult to sleep knowing how much debt is there, but through business process improvement and improved management the company is better…

I don’t think this would be much of an issue if Romney wasn’t going ’round blathering about what a great job creator he is.

“Job creation” is a complicated thing. Romney is claiming that he was a net job creator. I don’t know if that’s true and I suspect it’s unknowable (it’s a bit like “jobs saved” with the Stimulus. You can estimate it, but it’ll be a fuzzy number at best).

Since the GOP claim is that the government doesn’t create (real) jobs, and/or shouldn’t be in that business anyway, I’m unclear as to why Romney is claiming that he’s a great job creator and thus will be a good POTUS. Granted, I’m not a politician, but I’d probably just say “hey, I was competant at what I was doing. If elected POTUS, I’d bring that competance with me, even though the job is different.”

Well Rob, I can’t disagree…I assume Romney was taking political advantage of the fact that it is a fuzzy number, with various ways to calculate…ie, do you include jobs that were added subsequent to investments? do you exclude jobs that were essentially sold to another company? I just don’t know…Or maybe he would argue the above, that many of these jobs would have been gone if it wasn’t for their investment to begin with, especially in a distressed situation where they can’t get cash from a bank…what do they do? The only option is to close doors and everyone is on the street. Multiple ways to look at this…

I guess my point is, is that it is difficult to initiate an investment in a distressed business with the intent to pillage with dividend payments, while having an enormous debt load (likely 2x ebitda) where payments have to be made beginning in Yr 1, usually.

And to your concern…to do well in an investment (typically) you need to grow the company, which usually means adding employees (and i’ll admit some maybe overseas, but not always)…having a company with better margins and larger in size, increases the exit multiple when selling to the next buyer…thats where the real money is made, on the multiple expansion (buy at 6x ebitda, sell at 8x ebitda)….and the only way to get there is to grow the company…

There is a distinction between Bain Capital’s “venture-capital” deals and their “private-equity” deals. The venture capital deals happened early on in Mitt Romney’s tenure as CEO of Bain Capital. They were investments of Bain Capital’s money and other people’s money, and consequently, Romney and crew were careful in handling assets of those deals. They had a few success stories like Staples and Sports Authority.

On the other hand, the private-equity deals were pursued as corporate “buyouts” of companies that typically secured majority control of mature firms, helped reorganize them, then sold them off a few years later. These were Romney’s business deals that scored the biggest gains during his time at Bain — and those that were significantly more fundamental to building Bain’s industry-leading reputation than the small venture-capital investments that dominated the early part of his business career. The Wall Street Journal points out that ten of these private-equity deals produced 70 percent of the dollar gains that Bain made during Romney’s tenure from 1984 until 1999 — or about $1.75 billion in total. But they also resulted in some of the most high-profile bankruptcies and job losses that Romney’s political opponents have seized upon. Four of the 10 companies that made Bain the most money under Romney went bankrupt, the Wall Street Journal points out. In 1992, for example, Bain invested about $5.1 million in American Pad and Paper and reaped an estimated $102 million four years later when the company went public. Ultimately, however, AmPad would go bankrupt in 2000—and the Democratic National Committee has highlighted the workers that lost their jobs in the aftermath. The “private-equity” deals are part of Romney’s business background that candidate Romney tends to downplay. The only private-equity buyout that Romney routinely mentions on the campaign trail is Domino’s Pizza — a household name that hasn’t gone belly up. One example of a humongous failure was a company called AmPad (American Pad and Paper) that Bain Capital purchased for $5 million that later placed AmPad in finanical difficulty and $400 million in debt while Bain Capital continued to charge lucrative fees to buoy the company but it eventually went bankrupt and roughly 200 people lost their jobs after the plant closed, while Bain Capital and its investors ultimately made more than $100 million on the deal on that $5 million dollar investment. So it has the appearance of chicanery and is perceived by a discerning public as a ruthless takeover of a company for the sole purpose of personal gain. In other words, Mitt Romney and Bain Capital appeared to be in it only for the money they could make out of the deal and apparently didn’t give a flyin’ fig about the workers who lost their jobs or that the company eventually went belly up.

But the distinction between the two sides of Bain — and the two sides of Romney the businessman — has been frequently lost, both among the political players and the reporters covering the debate. Romney is often described simply as a “venture capitalist” and Bain as a “venture capital firm,” perhaps because the vagaries of private equity might be lost on the general public. But the difference between the two kinds of investments is key to understanding whether Romney’s time at Bain is a political asset or a vulnerability according to a Washington Post article.

This distinction you’re making is quite important, and almost universally misunderstood or glossed over (at least in the current coverage). Many people are using the term “venture capital” carelessly. This group includes a writer I cited above (I cited him because he was making good points despite this error). This group also includes Doug, and the National Journal article he cited.

‘Venture capital’ is about investing money to help start new companies. Strictly speaking, ‘venture capital’ is a subset of ‘private equity,’ but the latter term generally means buying a part or whole of an existing, mature company (and buying it privately, rather than via a public stock exchange).

‘Venture capital’ is more likely to be about actually creating a new company and new jobs, whereas ‘private equity’ is more likely to be about vultures attacking and looting an established company that is troubled. (And the latter is a complex subject, because it can be about ‘creative destruction’ done in a necessary and relatively moral way, or it can be about pure predation done in a highly immoral way.)

Describing Mitt/Bain as VC is giving him a lot more credit than he deserves, because mostly what he did is not VC, and mostly what he did is much more morally clouded than VC.

Hopefully as the discussion continues we’ll see coverage that handles this important terminology more carefully.

It should be noted that this correction you’re pointing out was also pointed out above by Ron Beasley:

It’s important to understand the dishonesty of Mitt’s defense.

‘Capitalism’ and ‘free enterprise’ are made up of many things besides ‘finance.’ And ‘finance’ itself is made up of many things besides ‘private equity.’ And ‘private equity’ itself can be done either in a relatively moral or immoral way.

Mitt is being attacked because much or most of what he did at Bain appears to be in this category: immoral private equity. His defense is to say essentially this: ‘any attack on my career in immoral private equity is an attack on capitalism itself.’ I just explained why this is nonsense. It’s like saying that any attack on a malpracticing doctor is an attack on the concept of medicine. But the argument has effectiveness, because so many people are so ignorant about the meaning of these various terms. It’s wonderful that thanks to Professor Newt, a lot of people are now going to get a much-needed education.

Wall St is able to rape America by thriving on mass ignorance. It also thrives on secrecy. Private equity, in particular, thrives on secrecy. These crooks can get away with murder because the deals are private, and not subject to the public disclosure requirements that apply to publicly-traded companies. Notice that Mitt and Bain have stonewalled all requests for detailed information about what he did there. But Mitt has created an impossible situation for himself. His stonewalling is untenable, because he chose to make his business experience the key element of his resume. Likewise for his poor judgment in repeatedly making a specific factual claim about how many jobs he created. He is going to come under enormous pressure to document that claim.

Hugh Hewitt is a Romney supporter. In 2007 he wrote a glowing book about Mitt (published by Regnery, of course). He correctly predicted that critics would use Bain to attack Romney. He also predicted that Mitt would respond with lots of detail about the companies that Bain invested in. He predicted that the Romney web site would “provide a case history for each company … as well as a Romney commentary on each transaction.” (The book is searchable/browsable at Amazon, see p. 204.) At least so far, that part of Hewitt’s prediction is quite wrong. Mitt’s stonewalling is the opposite of the full disclosure that Hewitt predicted.

Newt fully understands all this; the way Mitt has painted himself into an impossible corner. Notice what Newt said to Shepard Smith a couple of days ago:

Newt said it again yesterday, on another Fox show:

Newt is pressing Mitt for full disclosure, the kind of disclosure that Hewitt predicted Mitt would do years ago, voluntarily. Trouble is, it’s in the DNA of the private equity business to operate in darkness, so Mitt/Bain are deeply reluctant and (I think) deeply unprepared to respond to this fair demand for disclosure (notice that Mitt is also refusing to release tax returns). Therefore Mitt’s bind is quite serious. Something to watch for in coming weeks is the pressure for details, and Mitt’s refusal to show details.

Notice where the burden of proof is. Because Mitt chose to brag about his resume, his critics do not have the burden of proving he did something wrong. Mitt has the burden of proving that questionable cases (Ampad et al) were handled morally.

A lot of people are comparing this situation to the way Kerry got swiftboated. It’s not a perfect comparison, but it’s fair and interesting in at least a few important ways. One key similarity is the way Kerry and Mitt created the opening by choosing to highlight a portion of their resume.

But here’s a key difference: in 2004, the country didn’t really have much to gain by having a detailed national discussion about Vietnam, and about whether or not Kerry was really in Cambodia on Christmas. On the other hand, in 2012 the country does have a lot to gain by having a detailed national discussion about how post-Reagan American capitalism has become something debased and perverted, thanks to vulture capitalists like Bain and their government enablers.

Professor Newt has just launched a national seminar on this subject. Mitt/Bain is the perfect case study, and Professor Newt is the perfect teacher. He is actually knowledgable and articulate on the subject. Because of the way Mitt trashed him in Iowa, Newt now has an intense personal motivation (and that’s why a dormant issue has suddenly erupted; everyone expected Obama to bring this up, but no one expected it to be a big deal in the R primary). His pal Adelson is the third-richest person in the country, so Newt has an unlimited budget (thanks to Citizens United). And the message has infinitely greater credibility when it comes from Newt’s mouth instead of Obama’s (and of course Perry and some others are delivering the same message).

The entire situation is quite perfect and wonderful. The subject matter is timely and important, and a lot of people are going to learn things about capitalism that the GOP would prefer them to not know. That’s why the squirming is so exquisitely intense. And it’s only just begun.

Shorter Doug Mataconis: All populism is mindless and laid-off workers should be grateful Bain Capital and Mitt Romney made profits. Why is everyone so angry about this?

Thanks for revealing that libertarian ideology is like peeling a sociopath onion: there’s always a greater lack of empathy beneath each layer.

Anything goes to make a dollar is NOT Capitalism. Under your strict definition drug dealers are Capitalists like Mitt Romney.The drug dealer or corporate raider are both wrong. Gov. Perry and Newt Gingrich have a right and obligation to attack these forms of Capitalism. The business venture was three separate parameters is it moral, ethical, or legal. The drug dealer is immoral and illegal. Mitt Romney is immoral and unethical. Decent people loath, despise, and hate both of these Capitalist. It is right to shine a light on the drug dealer and a Vulture like Mitt Romney because they both exploit. REAL Conservatives are now attacking Scumbags like drug dealers and Mitt Romney REAL Conservatives are true to their Values which are by the way are AMERICAN values.

Silvia – Let me ask you this question – Which approach do you believe would be the most profitable and less risky….

A. Buying a company with the intent to dividend pay yourself until the company is near insolvency, terminate your employees and run an auction to sell off remaining assets to potential buyers…

OR

B. Buying a company with the intent to improve process, terminate non-productive employees or not needed employees (which should always be done), and utilize best practice of another company in the PE’s portfolio (if applicable) to improve efficiency, ultimately improve margins, provides excess cash flow which can be used for further growth and/or dividends pmnts back to PE. A growing company, with improved margins will then yield an attractive acquisition target and possibly MULTIPLE EXPANSION, which is the best to make profits for a PE firm.

Choosing B will yield you a better return and provide significantly more cash flow…not to mention the industry will actually perceive you as true PE firm, but your reputation will considerably better executing choice B tranx as opposed to Choice A. Choice A won’t get you very far in the private equity world.

Most companies could not be Al Dunlap’d or T Boone Pickens’d – THEY ARE/WERE CORPORATE RAIDERS. Good PE firms when looking for targets could not have that kind of reputation, otherwise sellers will not sell to them – most sellers consider these businesses as their children, if Bain or Carlyle or GTCR or TPG or Hicks Muse had that reputation, they will likely be excluded from the bidding process.

Raiding a company in a “vulture” like approach, with the intent to literally fire everyone and sell all assets to multiple buyers only makes sense when the company is near/ or at liquidation…I’m not speaking about chapter 11-reorganization, but chapter 7.

You should also remind yourself, that Romney’s experience came from Bain CONSULTING – operative word is consulting. His expertise was to improve businesses, streamline processes, help co’s focus on core products/services, and divest in areas that weren’t profitable…that’s capitalism in my eyes. So with a consulting background, it should significantly more likely that he would actually utilize those tools at Bain Capital.

Mitt Romney Is trying to count jobs of companies that managed to burn the leech (Bain Capital) off and survived. Much like jobs saved ….. only god could knows the answer along with knowing the number of grains of sand in all the world. Then there is Mitt Romney’s commercial trying to take credit for Staples. Staples as a start up and now Mitt Romney is claiming credit for all it’s jobs. Then there is the Steel mill that local and state governments bailed out along with a sales tax increase form everybody in the area. In short Mitt Romney is a proven Liar but for some strange reason his lies are called Flip-Flops meaning he is truthful regardless how many time he tells contradicting stories about the same issue or thing. To the point Mitt Romney’s claims of job creation are simply not true because he never created any jobs here. Mitt Romney out sourced jobs to China and Mexico. Mitt Romney has cost US jobs.

Mitt Romney Is trying to count jobs of companies that managed to burn the leech (Bain Capital) off and survived. Then there is Mitt Romney’s commercial trying to take credit for Staples. Staples as a start up and now Mitt Romney is claiming credit for all it’s jobs. Then there is the Steel mill that local and state governments bailed out along with a sales tax increase form everybody in the area. In short Mitt Romney is a proven Liar but for some strange reason his lies are called Flip-Flops meaning he is truthful regardless how many time he tells contradicting stories about the same issue or thing. To the point Mitt Romney’s claims of job creation are simply not true because he never created any jobs here. Mitt Romney out sourced jobs to China and Mexico. Mitt Romney has cost US jobs.