Mitt Romney Now Says He’s Not Releasing Tax Returns For Religious Reasons

Mitt Romney has a new reason for why he won’t release more of his tax returns:

Mitt Romney says in a new interview that one of the reasons he’s distressed about disclosing his tax returns is that everyone sees how much money he and his wife, Ann, have donated to the LDS Church, and that’s a number he wants to keep private.

“Our church doesn’t publish how much people have given,” Romney tells Parade magazine in an edition due out Sunday. “This is done entirely privately. One of the downsides of releasing one’s financial information is that this is now all public, but we had never intended our contributions to be known. It’s a very personal thing between ourselves and our commitment to our God and to our church.”

While it may not be a major reason, Romney says disclosing his charitable donations isn’t something he wants to do.

(…)

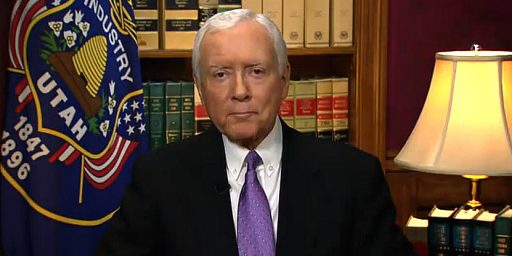

Rep. Jason Chaffetz, a Romney surrogate who is also Mormon, says he understands the presidential candidate’s concern with releasing more tax information.

“There needs to be a certain degree of privacy,” Chaffetz says. “Who he gives money to personally should be his business.”

The Utah Republican also says Romney shouldn’t have to make his donations an issue.

Not being Mormon, I cannot say just how important this issue of the privacy of what one donates to the Church actually is to the faithful, though I can understand the desire for individuals to keep their charitable donations private. It really isn’t anyone’s business what charities you, or I, or Mitt Romney donate to charity and what charities one donates to. However, Mitt Romney is running for President of the United States and, when you do that, you surrender at least some degree of your privacy.

For better or for worse, it has become a custom for Presidential candidates to release some reasonable number of years of tax returns. Indeed, this tradition was started by Romney’s father, himself a Mormon who apparently didn’t feel some kind of religious obligation to keep his own donations to the LDS Church secret. So, if George Romney was okay with it, I’m not quite sure why his son thinks it’s an issue.

Well, this is wildly unfair speculation, supported by nothing, but, since he seems to be begging us to speculate:

If Mittens was giving the church, say, 8%, that would certainly be a problem for him.

I’m sure his son *doesn’t* think it’s an issue. It’s just a convenient excuse. What’s Huntsman’s and Reid’s position on releasing their tax returns?

After already having released some returns, let’s just say that Romney is retroactively concerned.

Funny that a guy who wants to eliminate the social safety net and have charitable organizations fill the void…is afraid to lead by example. Has he been giving 20%…put it out there…be a role model.

I believe I read that the Obamas gave more to charity than the Romney’s based on the incomplete returns he did release.

Romney is hiding something…and it ain’t his charitable giving.

Who cares? Since Romney has no chance of being president, his tax returns are moot. Why not focus on the personal finances of Harry Reid who will be back as the majority leader in the Senate and Nancy Pelosi who could be on her way to returning as Speaker of the House. Since the Republicans are irrelevant, what Republicans do in their personal lives are irrelevant.

However, for the long term, the push for candidates to release more personal data is to limit the number of people who will be interested in politics in the future. I have begun to believe that the Democrats want to turn politics into a closed club for the family members of existing political dynasties.

Progressives will not be happy until everyone in a position of power in the U.S. is a graduate of either Harvard, Yale, or Princeton and had fathers and grandfathers who were politicians.

Well, if he was so sensitive about his LDS donations, maybe somebody should have told his wife toSTFU.

So no Mitt, that excuse does not wash and it sure as sh!t won’t wear. Try again.

@Craig: One of the many problems he might be hiding.

It was pretty clear way back when Gardasil became an issue that this was going to be a retarded election cycle for the GOP. But since then it’s actually gone full retard. At this point pretty much nothing would surprise me. Hell, by next week I’m half expecting Romney to declare that trying to make him release his tax returns means that he’s getting raped.

Then he shouldn’t have run for president, now should he?

Again, if he wants to keep it his business, if he wants privacy, there’s a simple solution — stop running for president. Then he can have as private a life as he likes.

But if he expects the United States to entrust its future into his hands, well, we’re going to need to know some things about him.

Bushes and Quayles were the first to come to mind.

What nonsense. If he doesn’t want to release the returns for religious reasons, it’s probably because he gave less than the requisite ten percent. Romney’s such a brazen liar and this is just another fabrication put out there to cover his ass.

Don’t show them, Mitt! Keep your tax returns hidden throughout the entire presidential campaign. This issue won’t hurt you politically. I promise!

Thinking sincerely and only of you,

Signed Prez Obama

It’s for a, uh, um, ah, religious reasons, yeah, yeah, that’s it, religious reasons! Just ask my wife, Morgan Fairchild!

I think that is unfair to retards.

As retarded as it is…Voter suppression still wins the election for Mitt. So I guess that means we are in for another 8 retarded years…to follow up on the Bush retarded years.

@superdestroyer:

You mean, like Romney?

Should Romney actually become President, I strongly believe that we’ll all be looking back in a couple years with great fondness on the “transparency” of the Obama administration (yeah, it’s in quotations because it’s not really that transparent in my opinion).

Romney: Tax plan? I can’t divulge the details just yet. Spending cuts? You’ll have to wait and see, trust us. Unemployment? Paul Ryan and I have a great plan that restores real American values, strengthening the middle-class and small businesses. Oh, what is the plan? We can’t tell you.

Yah, keep those returns hidden. Maybe we can move the conversation to the nature of this tithing and the way the tax expenditure force the rest of us to subsidize Mr. Romney’s purchase of decidedly non-charitable proprietary church bennies. Religion != Charity, unless we’re talking tax law or misleading surveys of blue state giving.

This is one of those explanations that may actually be another sharp stick poked into the ribs of the Religious Right. Just another way of reminding them that Mitt prays at a different altar.

Did the returns his father released show how much he gave to the church?

What happens if someone leaks his tax returns? It’s not a release sanctioned by Romney, but media would still report on them and the damage, if any, would be more or less the same as if he had released them himself. And we would all get answers if what he told us was correct or not (tax rates, tithing, etc).

Also, what would the punishment be for leaking tax returns?

@anjin-san:

As I recall it, they did, and his combined tax rate and tithing meant that he didn’t keep a lot of money.

@anjin-san:

George Romney would be so proud of his son…. not.

I’ll say this for him, he is a colossal weasel.

If Romney’s financial associations with his church are that secretive, then perhaps he should not be seeking to become the elected leader of a secular nation.

Guess his spin doctors and strategists will need to brainstorm another fallacious rationalization for Mitt trying to hide his past unethical accounting practices.

Release the tax returns, Mr. Romney.

It is not just libs who want to see Romney’s tax returns.

It is 63% of American voters who do.

The longer Mr. Romney delays, the more suspicious it appears.

Obama released 8 years of tax returns

GW Bush 10 years

Clinton 12 years

GHW Bush 14 years

George Romney 12 years.

What is the problem, Mr. Romney?

Release the tax returns.

Now.

If publishing tax returns causes issues with his religion, then why even release two years of them? How does two years pass muster, but more returns do not? Why not four, or eight, or 10?

I still find it astonishing that someone who has been running for president as long as he has didn’t put more thought into this, especially considering which candidate for president set the precedent.

Another #FAIL by Romney in trying explain why he doesn’t do what his father, another Mormon religious giver, did.

I’ve been saying since day 1 this was about the Mormon Church. But I don’t think it’s that he gave so much, I think it’s that he gave less than the prescribed 10%. That’s the only reason he would take this political beating — because he would be discredited in the LDS.

@michael reynolds: I’ve been hearing you say that, and while I can’t say I totally buy it, what seems more plausible to me is that it would not only expose Romney as not tithing the correct percentage, but potentially expose quite a few other high-level church officials who do not as well. Perhaps he’s not simply protecting himself, but protecting other deficient tithers in leadership positions that would have to deal with the LDS congregation as a whole. You don’t really think the LDS leadership would do anything to Romney, even if it was just him not giving the 10%? Maybe if he was giving 2% of his income to dally with prostitutes, they might, but I’m sure he could make a compelling case (behind closed doors)that even if he doesn’t cut them a check for 10% every year, he’s still doing more than the little people. Either way it and any sanctions would be miniscule and kept secret.

@michael reynolds:

No, as I’ve written before, his effective tax rate is lower than his tithing. (Now the tithing may be lower than 10%, but I doubt it, most likely, as a prominent Mormon, LDS elders have seen his tax returns, and even if, he won’t lose many Mormons if he gave less).

This will be a problem with independents and moderate republicans who’ll find out that he’s paying a lower tax rate than they themselves do, but also a problem with Christian social conservatives, who may not have problem with his tax rate, but will have a problem with him giving more money to his, in their mind, cultish church than what he paid in taxes.

If Mitt Romney was concerned about keeping his charitable deductions private there has always been an easy option – don’t report them on his itemized deductions.

There is no law that says you have to report your charitable contributions, you only have to do it if you want to get tax relief on them.

The majority of US residents use the standard deduction, rather than itemize, and therefore do not get tax relief on their specific charitable contributions. Yet that does not stop them being very generous to their churches and other organizations.

Mitt Romney could have kept his religious giving private, released his tax returns and run for president – it just would have meant a bigger tax bill.

He probably tithes the same way he pays taxes.

Make a jillion.

Shelter a jillion minus $10.

Here you go, LDS, here’s your dollar!

Interesting, this comes out the very day the NY Times (using the Gawker docs) calls Romney a tax cheat:

@Phillip: You are probably right that the LDS church wouldn’t punish Romney severely if they found he was under-tithing. As I’ve said recently in another context – you peoples little laws don’t apply to people like the Romneys. Nor LDS rules, likely.

However, Mitt’s been just short of swearing on a Bible, or Book of Mormon, that he tithes and pays 13% taxes. He never says “federal income taxes”, just taxes, but at this point if it were disclosed that he had paid less than 10% pretax to the church, or less than 13% federal income tax, even the lowest information voters, and James Joyner, might be forced to recognize that Mitt is an irredeemable liar.

@gVOR08: Maybe we should just change that IOKIYAR to IOKIYARWG (RichWhiteGuy)

@PJ:

Impossible. Tax returns have a way of shutting that all down.

If they are released, it can only be because Mitt consented.

@swbarnes2:

People at the IRS can access tax returns, so they can both be copied and leaked.

It’s not like a person wanting copies has to visit the IRS and have a retina scanned to make it possible, you just have to sign a 4506, send it in, and wait.

Keep in mind that Mitt gave 23 years to McCain. Probably some people who got to handle that material are not huge fans of Mitt.

What is the only issue for which Mr. Romney has not flip-flopped? He stands firm on not releasing his tax returns. Why so firm on this issue?

Mr. Romney is running for President of the United States.

This is a position of Trust.

Ronald Reagan said, “Trust but Verify.”

Mr. Romney has said, “Trust me,” re his tax returns.

It is not unreasonable for voters to want to “Verify.

It is not just liberals who want to see Romney’s tax returns.

It is 63% of American voters who do.

The longer Mr. Romney delays, the more suspicious it appears.

Obama released 8 years of tax returns

GW Bush 10 years

Clinton 12 years

GHW Bush 14 years

George Romney 12 years.

What is the problem, Mr. Romney? Release your tax returns.