Moody’s Is Right, Eliminate The Debt Ceiling

Moody's is on the right track. The current debt ceiling law has done more harm than good.

As Steven Taylor noted earlier today, Moody’s recommended today that the United States should just get rid of the debt ceiling entirely:

Ratings agency Moody’s on Monday suggested the United States should eliminate its statutory limit on government debt to reduce uncertainty among bond holders.

The United States is one of the few countries where Congress sets a ceiling on government debt, which creates “periodic uncertainty” over the government’s ability to meet its obligations, Moody’s said in a report.

“We would reduce our assessment of event risk if the government changed its framework for managing government debt to lessen or eliminate that uncertainty,” Moody’s analyst Steven Hess wrote in the report.

The agency last week warned it would cut the United States’ AAA credit rating if the government misses debt payments, increasing pressure on Republicans and the White House to come up with a budget agreement.

Moody’s said it had always considered the risk of a U.S. debt default very low because Congress has regularly raised the debt ceiling during many decades, usually without controversy.

However, the current wide divisions between the House of Representatives and the Obama administration over the debt limit creates a high level of uncertainty and causes us to raise our assessment of event risk,” Hess said.

Not surprisingly, this recommendation is already generating commentary, both good and bad. Over at Commentary, Jonathan Tobin concludes a post titled “There’s A Reason We Have A Debt Ceiling” with this observation:

As Senator Marco Rubio said yesterday on CBS’s “Face the Nation”: “The debt limit is not really the problem here, the problem is the debt.” So long as Congress has something to say about that limit and can use the power of a deadline to create an opening for reach change, the nation will be forced to deal with the debt.

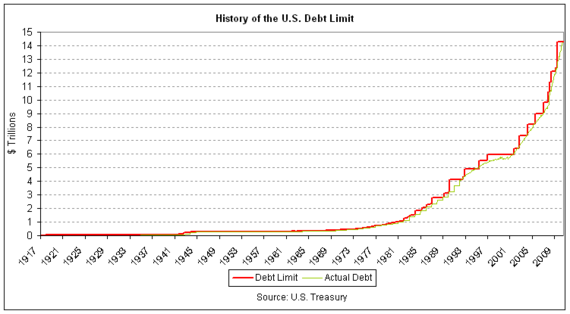

Oh really? Even a cursory glance at the history of the debt ceiling from 1917 to present has shown that it really does nothing to force the nation to “deal with the debt.” Instead it’s been a method by which Congress has been able to demagogue on the debt issue, pretend that it is acting responsibly, but in reality do absolutely nothing. If Members of Congress, and their constituents, truly wanted to constrain Federal spending and the growth of government then Article I of the Constitution already gives it all the power and authority it needs to accomplish that goal. The reason the national debt has increased isn’t because Congress kept increasing the debt ceiling, it’s because Congress kept spending more than we took in. The only way we’re going to get the debt under control is to stop doing that, and there’s nothing about a debt ceiling law that helps accomplish that.

The fact that debt ceiling has done nothing to stop the growth of the National Debt really shouldn’t be a surprise, because that’s basically what it is intended to do:

Judging from the NY Times coverage of the 1917 episode, legislators paid little attention to the implications of mandating a ceiling. They focused instead on Treasury Secretary McAdoo’s request for a higher borrowing limit so as to fund an expensive war effort. The ceiling was created to empower, not rein in, Treasury (prompting a failed effort to create a congressional committee to oversee Treasury’s actions). Similarly, the creation of the aggregate ceiling in 1939 reflected congressional deference to Treasury, granting the department flexibility in refinancing short term notes with longer term bonds. As the Senate floor debate makes clear, senators viewed the move as removing a partition in the law that hampered Treasury’s ability to manage the debt.

In other words, the debt ceiling law was intended to take the issue of the issuance of Federal Debt out of the hands of Congress, and place it in the hands of the Treasury Department in order to make it easier for the Federal Government to issue debt. In the context of the times, debt was being incurred in order to finance World War One. After that, it was used to finance public works, public assistance during the Great Depression, and of course everything else the Federal Government has spent money on for the past century. Congress did nothing to change the debt ceiling law during this time, and it’s easy to see why they didn’t. Because putting the authority to issue debt fully in the hands of the Executive Branch makes it easier for Congress to authorize new spending without having to worry about where the money to pay for it will come from. Why would we want to continue with a system that has created the very problem we say today we want to solve?

As an alternative, Moody’s suggests the United States look to how other countries handle their debt issues:

Stepping further into the heated political debate about U.S. debt problems, Moody’s suggested the government could look at other ways to limit debt.

It cited Chile, widely praised as Latin America’s most fiscally-sound country, as an example.

“Elsewhere, the level of deficits is constrained by a ‘fiscal rule,’ which means the rise in debt is constrained though not technically limited,” Moody’s said, adding that such rule has been effective in Chile.

It also cited the example of the Maastricht criteria in Europe, which determines that the ratio of government debt to GDP should not exceed 60 percent. It noted, however, that such a rule is often breached by the governments.

No system is going to be perfect, of course, unless legislators and citizens want it to be, but our method of control the debt is 94 years old, and its record is eminently clear:

Perhaps it’s time we tried a different approach.

Agreed.

There’s something unsound about requiring politicians to periodically vote on debt ceiling bills, in huge lump sums, disconnected from the the perhaps popular appropriations they’re connected to. You end up with something the public doesn’t understand and consequently opposes by large margins, but that for the good of the country you absolutely must pass — the political incentives are all wrong.

Hey Marco…

Hows about you and everybody else in Congress just do your job?

In the meantime here’s some important information about the Republican response to the debt ceiling: the Cut, Cap, and Balance Act. This thing makes the Ryan plan look liberal. It would drop the GDP by 0.7% and it would eliminate 700,000 jobs. Immediately. On top of the 9.2% unemployment situation the Republicans regained the House by promising to fix. You can’t make up how idiotic these people are.

http://www.cbpp.org/cms/index.cfm?fa=view&id=3537

FIGHT THE CAUSE – NOT THE SYMPTOM

OsiXs (Revolution 2.0)

It really doesn’t matter. Whether Congress imposes the “debt ceiling” to periodically have this discussion or not. Someday, somebody is going to impose a debt ceiling upon the US. Might be China, might be some other country, might be the bond market. But at some point, all of a sudden-like, the US debt will become high risk. Then we default, then we have massive cutback, then we have a crisis. On the upside, we might have war, until the bullets run out.

The debt ceiling is now a cause of market uncertainty and the downsides of a default outweigh any benefits the debt ceiling may have. I’m of the opinion that Congress is implicitly authorizing the debt ceiling increase when they pass the spending bills. It could be useful for every bill to have a “debt ceiling score” from the CBO detailing the required increase that will be authorized when the bill is passed.

I view it the opposite. Only Congress has the power to create debt. Under the nondelegation doctrine, Congress can only delegate its power to the executive by delineating the general policy the Treasury is to follow, and the boundaries of this delegated authority. Removing the boundaries creates as many problems as it solves without incorporation of different restrictions.

I think it’s more likely that the Treasury has been given insufficient guidance in the event there is insufficient funds, and these need to be expanded and only if a more comprehensive approach is put in place should the ceiling be removed as unnecessary.

@JKB:

That’s a probability if we continue to “kick the can down the road.” It’s a phrase that has been used by both the left and right when it suits their point. However, that is what we have done for years. Again, with a national debt 62% of our GDP we are rapidly becoming an insolvent country. Insolvency will either be dealt voluntarily by us, or, it will be imposed on us by becoming so embroiled in debt that someone else will be telling us what to do, and how to act.

I really think because there are no bread lines, and because there are those who are not effected by our flat-lining economy, we continue to think all we have to do is up the taxes and magically more money will materialize, and like those fairy tales “we will live happily forever.” It’s not going to happen this time. Right now on Drudge, he is highlighting Borders shutting all its stores. Reader Digest is selling out. A government funded electric car company is folding. Business is weakening. You pull their wallet out for more money and more businesses will throw up their hands and say “No more!”

And then you have your ultra liberal limousine liberal, like Warren Buffet, who agrees with taxing the rich except when it comes to trashing those jet exemptions.

Warren Buffett not a fan of Obama jet rhetoric

@ Jan…

“…we are rapidly becoming an insolvent country…”

This shows such a deep mis-understanding of fiscal and economic realities that it makes me sad. Really sad.

It would be nigh on impossible for the US to become insolvent.

What is really troubling is that you clearly have strongly held convictions based on this terrible lack of real knowledge.

I do not know if you are a follower of the Tea Party.

I do know that the intransigence of the Tea Party is forcing this nation into a bad place, and it is largely based on a lack of knowlege and a rigid ideology based on that lack of knowledge.

BTW, suggesting that Border’s closing is a sign of how bad things economically and the problems with government shows a real lack of understanding of the changing dynamics of the publishing industry and the effects of a radically disruptive technology.

@mattb:

I knew that someone would bring up the “changing dynamics of the publishing industry.” I actually started to type this into my post, but it all gets too long.

Yes, the print media is changing, which includes books, magazines, newspapers. But, even though this is a trend of the times, it is still a component of a struggling economy, where an industry is dying off, albeit for whatever reason, and people in those industries are losing their jobs. And, there is very little in place, now or in the near future, to replace these fallen jobs.

We’re talking the current economy and it’s conditions, aren’t we? Not cursing about the nuances of what is in and what is out.

Norm — I don’t know what economic planet you are from, but insolvent means not being able to pay your debts. In 2012 our national debt will be 72% of our GDP. It is felt that when a country reaches 90% there is a fiscal collapse. Why don’t you review some of the stats of our Western European friends, comparing and contrasting where their national debt is now and what their financial standing is.

I probably didn’t explain myself properly. I don’t think the debt ceiling should be ignored because “Congress is implicitly authorizing the debt ceiling increase when they pass the spending bills”, that’s why I think Congress should eliminate the current debt ceiling. I’m not opposed to the idea of putting something else in it’s place, as long as it’s useful for something other than occasionally causing fake emergencies.

@ Jan…

We are not like our European allies. There are several reasons for this. But most importantly you just show another example of lack of economic knowledge.

I would suggest you do what a lot of people do…educate yourself, keeping an open mind in the process. Holding crazy ideas because Drudge or someone else gives them to you is unhealthy….for you and the republic.

Seriously.

Whatever happened to obama’s “paygo” legislation, whereas for every dollar in spending wanted, you had to find equal money somewhere else other than borrowing to fund it ? It’s this same philosophy that the republicans are proposing for the current crisis: for every rise in the debt ceiling there should be an equal lowering or cut in something else.

It’s like cleaning out one’s closet, and getting rid of all the clothes you don’t wear. There are so many overlaps as well as abuses/misuses of government and their funds. But, no one wants to get in there and weed it out. All they want to do is add more garbage to the pile, all with the knowledge that we are going broke in the process!

It seems like government is good at giving lip service to pragmatic ideas — it’s the feel good approach to their leadership. But, when it comes to the implementation, that’s a whole other thing.

Heh jan, I’ll see your Buffet and raise you a Buffet:

So, Norm, enlighten me. What are those reasons why we can ignore our spending habits and not find ourselves in similar economic ruts like the Europeans are experiencing.

And, don’t talk about how much larger we are than they are with an infrastructure that holds so much more value, so much so, that we can weather debt-ridden economic storms much better than they can.

@jan:

I’m afraid you are way behind. What’s happened is that both parties agreed to extend the temporary Bush tax cuts, and then neither party pushed spending cuts to match.

That’s important. Neither party.

Fast forward to when the debt ceiling runs out (of course, with extended tax cuts, continued wars, and no spending cuts) and suddenly the GOP is back to their same old magic.

The check is in the mail. Someday, a future

lawamendment will have themojomechanism to reduce spending that cannot possibly be named today.@john personna:

Because Bush raised the debt ceiling that gives us an instant pass to do so now. Why don’t you go back and check those figure on how much debt we were actually carrying during the Bush years. There’s a huge difference then than there is now.

AND just to be complete, Obama the socialist has moved to the middle, with $4T in spending cuts on the table, and just a little tax increase on the edges. Tiny increases. No more (stupid) ethanol subsidies, some crazy jet things, and that’s about it.

The Tea Party Republicans can’t take that deal because they’ve put themselves in the crazy position that canceling ethanol subsides is the kind of tax increase that their base wanted to prevent.

Seriously? The tax credit is a credit, remember? It is government playing favorites and dispensing cash in energy. That’s something conservatives are against. Remember?

“Buehler … Buehler … Buehler ….”

@john personna:

How could the republican party push spending cuts when they didn’t have the House, like they do now, and their margins of representation were much lower in the Senate than they are now? The democrats had all the cards for two full years, and both houses of Congress for two years prior to that with Pelosi at the helm.

@jan:

You should have checked before asking me to. It would have been less embarrassing

GWB expanded the debt by 20% in his 2005–2009 term. That is the largest single increase since WWII, and Obama has not yet bested it. (He has a 9% increase so far, and has his $4T in cuts on the table.)

Sorry forgot the link.

I repeat, Dems and Repubs did it in the 1990’s…. why can’t they do it again now?

It ain’t hard guys….

@jan:

I can understand why they might have a hard time passing them, but that’s not what I’m asking.

I’m asking why they cannot name them. That is the really preposterous thing. They convince their core that they are working for cuts without ever naming them.

You know, Politico had a really shrewd accessment a few days ago:

Get that, Republicans love tough-sounding votes but often fix the deck so they lose and can score political points without having to live with the results.

That is exactly what you are falling for now.

We should note that this new balanced budget amendment fits that pattern exactly.

It is a tough-sounding plan, but one destined to fail, which nonetheless and can score political points, without producing results we’d have to live with.

@john personna:

Oh John, get real! Obama talks the talk, but doesn’t walk the walk.

He put that 4 trillion out there, like a fiscal mastermind, as nothing but window dressing to cajole republicans into his web. Just like what the dems did to Bush Senior, when they promised cuts after he raised taxes, going against his pledge to the people (“Read my lips…no taxes”). Bush delivered and they did not. This cost him the presidency too, as the people turned against him. I think, strategically, that is why Obama offered such a tempting deal hoping to lure the republicans in, and then their constituency would turn against them, and Obama would be able to secure another term.

This is all about Obama’s reelection, you know!

The republicans learned from that lesson that you get the cuts on the table first before you talk about anything else. Obama couldn’t name any cuts other than 2 measly billion dollar’s worth, enought to cover a half a day of our borrowing debt. And, when asked again at his presser he talked for 6 minutes without naming a specific cut — only mumbled something about raising the age of SS.

@OzarkHillbilly:

I think at first pass Obama is actually willing, and maybe Boehner too. They might have risen above their parties. But the bulk of them, the two parties’ political machines, are using this as a stepping stone to 2012 and a new battle for congressional supremacy.

@jan, that is totally the game.

You reject the Obama proposal, and tell us that because you rejected it, it was never there.

Don’t think we are stupid enough to buy it.

(If you want to test Obama it’s easy, accept the plan and demand the full $4T in cuts.)

Yah…. half the Bush deficit was off the books. How much deficit was there before Bush? Really, I wonder how stupid you people are?

Ahhhhhhhhhh…….. never mind… wrestling with pigs…. the pigs enjoy it.

@ Jan…

First, I did not say we could ignore our spending habits. If you have to lie to make an argument it’s not much of an argument.

Do you know what the money Europeans use is called? Do you know anything about the European Union? Answer your own questions. Don’t look to others for answers…they will feed you garbage and call it knowledge.

And for the record, I suggest all tax cuts are proportionate to tax receipts and outlays….

Texas, Alabama,. Arizona,Georgia, Misery, etc would not do so well. However New York, Illinois, Massachusetts, and California would do just fine….

Time for the south to start carrying their fair share of the load.

@john personna:

The republicans had a budget, via Paul Ryan, that addressed cuts, reforms etc. What kind of budget have the dems submitted. Answer —> nada! Nothing for over 20 months, except scathing remarks towards Ryan’s plan. It’s much easier to complain than to deal.

Obama was backing away from his cuts, and especially addressing the entitlements almost from the moment the republicans walked out of his office. The 4 trillion dollar deal was a total scam.

As for the enormous spending created under both administrations:

I did look my facts up.

This is the blog I found the information on, which was taken from the CBO.

I don’t think the Republicans themselves want the Ryan plan to be voted on. They don’t want the general public to understand what its Medicare changes are, not before the 2012 elections. I mean, go ahead, have them push it for a vote. If they control the House, have them pass it out of the House.

At some point you have to see the pattern. They like splashy things that have no chance.

And again, remember that they are moving FURTHER from immediate action with this ‘Cut, Cap and Balance’ thing.

It’s crazy. They’ve got you passing on $4T in cuts to accept much less, and a snowball’s chance of an amendment in a year or two.

@Hey Norm:

Norm, I’m certainly not lying. And, you sound oh so condescending in your comments, making sweeping statements while supplying little context to support them.

For instance:

So, Norm, show your economic knowledge and say something educational other than snoddy remarks.

Why are my ideas crazy? Because they differ with yours? Oh please…When there is nothing to add, just call others names. That certainly throws them off the scent that maybe you have nothing to add.

@john personna: jp, the link is not working, but I recall saying what you quoted, and agree with what you said.

tom

@jan:

As I say, I think you are being played by your own party.

They aren’t helping you achieve the goals you describe.

They are only mobilizing you for 2012, when the balanced budget amendment will be your banner.

Then it will fail, and they will think of something else to wind you up.

@john personna:

The Ryan Plan was a framework for change — a very sensible salient one too. The republicans, though, were divided on the plan. However, I still think we will see parts of it go forward in future legislation.

As a democrat, and yes, I’ve been one my entire adult life, I think the republicans are showing more creativity and courage than the dems (unfortunately). I plan to change my affiliation to Independent, as the democratic party is way out of line, IMO and is the one doing the most damage, at this given point, to the country. During Bush I was of another mind. But, Obama is outstripping Bush in all the negative ways.

And I really wonder about the person who objected to this:

@ Jan….

You said that I said something I never said. That’s lying.

And in addition…you started the snotty remarks.

Do a google search on “why the US is not like Greece”

Help yourself be a better you.

@jan:

JAN, either you are an idiot or you think I am. The Ryan Plan was “tax cuts for the rich” and “Medicare cuts for us”, It did not even pretend to balance the budget…

Are you stupid? Or do you think I am?

OK, now you are a liar.

George Friedman, who has a geopolitical blog and is an author, has given his take about why the US is not like Greece. And, while arguments like his are compelling, I don’t think you can take our rapidly increasing debt and blow it off as not being like Greece’s problems.

The very reasons they are in their fiscally vulnerable position is because of out of control entitlements and pension programs. We have the same issues brewing in this country. And, to dismiss them, or not to address them, unlike what some gutsy states are currently doing, is simply unwise.

I also think you are nitpicking about the lying meme. I didn’t call you one. If you want to interpret something as that, then that’s on you and not me.

Ozark

We disagree. In reading the Ryan plan I don’t see the rich as being advantaged in his plan. Medicare remains intact for those 55 and over, and provides more options for those who are younger.

Yes, I am a democrat. But, at this point a DINO, meaning in name only. The party has proved to be very disappointing to me. It deludes people into thinking they are compassionate, when what they are doing is enabling people so that they become dependent on government. Class warfare and racial tension are what they are counting on to stay in office. I think they have overstepped their bounds, with more and more people like me leaving the party and turning into Independents.

@jan: The Ryan plan was a way to shift the same costs from Medicare to individual seniors, while at the same time not doing anything to help with the overall increase in health care costs.

Also, the blog you linked to lists FY2009 under Obama, when in fact that was the last year for Bush. It’s pretty hard to take them seriously if they can’t even get the most basic facts right.

David

Obama’s stimulus passed in Late January of 2009, and was under his watch and his spending pattern. You’re looking at a chart and acting like Bush was directing legislation in 2009, because it was designed as his budget. Most budgets are passed the year before (except for obama’s last budget). But it is the guy in the oval office who directs the spending. For instance, even though TARP was passed in ’08, Bush left a big chunk of the money for obama to use and direct as he saw fit. So, the facts are correct in that link, and they come directly from the Congressional Budget office.

Also, the Ryan Plan was a framework, as I previously said. It was not an end all be all. However, as a plan, it has provided many more ideas and possibilities than Obama has offered. One of the sticking points of medicare, which is going bust in 2024??? is to see how they can restructure the benefits so as not to pull the rug out of older people, while giving more opportunities to younger ones. What’s wrong with that?

As far as increased health care costs — that involves having more competition among insurance companies, encouraging preventative practices, weeding out abuses, fraud and misuse of health service, tort reform, etc. It’s going to take a comprehensive health care plan, not like the current one in place which, as of today 54% want repealed to 39% who want it to stay in place. The rest don’t know.

Hmmm, and all this time I thought it was pulling us back from the edge of the cliff Bush left us on and killing bin laden. Silly me…

Ummm – you might want to dig a bit deeper. That’s like explaining a solar flare by saying “the sun makes big fire”. Modern economies are pretty complex critters…

@jan: i’m unaware of a single country with an efficiently functioning private health care industry. How about instead of just trusting your hypotheses about “more competition” and the like, you direct us to some empirical evidence that we can observe before we enact any more health reform?

So, Ben why don’t you deal with the specifics on healthcare, including empirical data. I would love to read it!

“The Ryan Plan was a framework for change — a very sensible salient one too.”

No, it was a fairy tale. It depended on a bunch of assumptions that were ridiculous.

Such as, for instance, non-defense discretionary spending dropping to 2% of the budget by 2016, without any proposal for how that’s actually going to happen. As an aside, Obama had proposed getting non-D discretionary spending down to 2.8% in 2020, and that wasn’t particularly realistic either.

http://www.washingtonpost.com/blogs/fact-checker/post/fact-checking-the-ryan-budget-plan/2011/04/05/AFIaZpnC_blog.html

That article hits some of the key points. It assumes tax cuts = massive economic growth, which historically simply has not happened. If the Laffer Curve has any applicability, it’s in relatively high-tax environments (1970s Sweden, for instance). The USA in 2011 is a low-tax environment already. At this point, any benefits to the economy from tax cuts are subject to diminishing returns.

I had ideological issues with the structure of the Ryan plan (pushing medicare costs off the government’s books and onto seniors, more tax cuts for the rich, slashing non-defense discretionary spending – but not defense spending, oh no we can’t touch that!!, etc). But even if you put those objections aside, the math just plain didn’t add up. It didn’t come close to adding up. It was typical fuzzy faith-based math (like T-Paw’s plan that calls for 5% growth in perpetuity! LOL). CBO scoring, unfortunately, isn’t all that helpful because they just plug in the assumptions, even if they’re ridiculous.

Simpson-Bowles was a bipartisan attempt, and sadly that too relied on fuzzy math. As I recall, they just arbitrarily capped federal healthcare spending at a certain % of GDP and washed their hands of it. That’s similar to Ryan’s vouchers/premium support payments. It doesn’t address the underlying problem of rising healthcare costs, but it does push those costs off the books (partly). I find that fantastical for two reasons: 1) seniors have a lot of political power; and 2) the idea that people paying more of their own healthcare costs will result in costs coming down via free market-style competition doesn’t wash for me. Healthcare doesn’t work like that*. Expenditures might fall, only because people who can no longer afford care (b/c the government is no longer footing the bill) simply won’t get it. That, to me, is a seriously suboptimal solution.

As for healthcare in other countries, Jan, surely you can use google. Have a look at what all the other advanced countries in the world spend on their healthcare systems (every one of which is more socialistic than our own). Every one of them spends a significantly lower % of GDP on healthcare, and the outcomes are roughly the same. That’s just the quick & dirty look. If you’re serious about it, there is a ton of info out there on the web about the differences between the various systems. People interested in healthcare reform have been looking at stuff like that for a long time.

* due to a number of factors including asymmetry of information and the fact that ration decision-making is a lot harder in that context (“shall I pay $5 for this hammer” is funamentally different than “shall I pay $X for this cancer treatment).

So Jan why don’t you deal with the specifics on the Greek debt crisis, detailing exactly how “out of control entitlements and pension programs” are the only casual factors? I would love to read it!

Here’s a cut at a progressive plan:

1) Get the military budget down to the equivalent of $450B in today’s dollars, over the course of, oh, say 10 years. We’re currently at $700B for the DoD plus another $47B for Homeland Security so I’m talking about a $300B cut… $30B/year on average. Our defense spending as a function of our GDP would drop to be more in line with the spending of our allies, though we’d still be in the top tier. I’m looking for us to spend ~3% of GDP on our military, as opposed to the current 4.8% or so.

This means fundamentally changing the mission we’ve given our military, obviously. It requires winding down the Iraq, Afghanistan and Libyan wars. I’d like to see a USA that is much more hesitant to “intervene” in some shithole on the other side of the world. We’re perfectly capable of maintaining an immensely powerful military with ~$450B/year.

2) Implement a true “single payer” healthcare system. This obviously supercedes Medicare and Medicaid and the VA. The government would provide a relatively basic plan to everyone. Additional coverage, over and above the government plan, would be available in the private sector for those who have more $$ to pay.

We currently spend 17.4% of our GDP on healthcare (split almost evenly between public and private spending). The next highest rich countries are the Netherlands and France, at a 12%. Most of the Western countries are clustered between about 10 and 12% of GDP. If we can hit 12.5%, that’s still a huge savings. This doesn’t address the healthcare cost inflation that all countries appear to be experiencing, but it buys us time.

It also decouples health insurance from employment, which I’d think would end a major hassle and expense for employers, especially small employers.

3) End the War on Drugs. Legalize, regulate, tax. Increased treatment spending should go with it (if one prefers, the tax revenue from drug sales could be dedicated to it), but even with that there should be significant cost savings. The worry for me would be increased DUI (and DUI enforcement problems), but I think we should risk it.

4) Tax reform that rips out all of the deductions/subsidies in the tax code, ends preferential taxation of capital gains (income is income, and should be taxed as such), removes the AMT, and rebalances the rates accordingly such that we retain a progressive income tax system. I’d junk the current tax code in its entirety and start from scratch.

5) Phase out all government subsidies – every single one of them. Much like deductions in the tax code, they will creep back in over time, but I think a reset would be beneficial.

6) Institute PAYGO. It’s not magic, but it should help. Want a tax cut (including a deduction)? Pay for it by finding spending cuts. Want a spending increase? Pay for it, either by finding cuts elsewhere or raising taxes.

I know this is a pipe dream. However, if Obama were HALF the socialist he’s alleged to be, something like the above would’ve been his opening salvo.

@JKB: Your fatalism is unwarranted. If we’re borrowing too much, how come short term interest rates are almost 0% and long term rates are near 40-year lows?

@jan: Pretty much every thing you said in response to Norm is wrong. Those European countries are in a trap of their own making by adopting a common currency when they are not sufficiently integrated. Even Greece would not be in this bad of a position if they had their own currency and let it float.

As for this 90% BS you’re coming up with, the U.S. debt exceeded 100% of GDP after WW2 and we did just fine.

A classic Michael Ramirez political cartoon on the debt ceiling fears of utter diaster:

Events that never materialized

A little humor mixed with facts…….

@Rob Prather:

Although the debt was similar to current times, the economic climate was far different. Our’s is considered weak, stagnate, decreasing consumer demands — in other words a terrible petri dish of circumstances coupled with our high debt. It was just the opposite after WWII, which is why they did “just fine,” even though they were saddled with high debt.

A descriptive piece of the economy, post WWII, is linked below:

The post war economy: 1945-1960

Yes, 2011 != 1946. Very true, and we need to remember it. Which is why I *do* care about the debt. I’ve cared about our national debt since I was in highschool (early 90s). I’ve learned more about it since then, of course, and that has tempered my thoughts on it (I used to just get excited about the raw dollars. Now it’s % of GDP that I look at, and I think that’s far better). I was appalled at the spending under Bush, precisely because that was a time we should have been running surplusses. I know that the debt we’re taking on now will cost us down the road, as there is no free lunch.

I cannot, however, fault Obama & the Dems right now for the deficit, given the ’08 panic & fallout from that. Much of this is on autopilot (benefits kicking in when people lose jobs), plus the Bush/Obama tax cuts (I am disappointed that the Dems caved on those). I would fault them if they shrugged and ignored the longer-term debt issue. They are not, however, and that was true before this ridiculous debt ceiling standoff started. They simply made the perfectly reasonable observation that deep cuts *today* are a bad idea, given the state of the economy.

It makes all the sense in the world to try and reach a concensus on future spending. Sadly, it requires that Presidents and Congresscritters elected years from now will have to hold to the deal. Dems who might see a boom as a good time to rachet entitlement spending back up, GOPers who see it as an opportunity for a tax cut, and people in either party who think it’s a great time for another bright, shining war…

Still, they need to try.

Oops, missed update to this tread. Just wanted to respond to @jan:

This makes no sense… By this logic the loss of buggy makers in the transfer to cars would be the sign of a struggling economy. Or that the move from small scale independent books stores (with numerous closings) in the 1980-early 2000’s and the transition from bricks-and-mortar to clicks-and-mortar would both be signs of struggling economies.

In ever one of those cases jobs were lost in one sector, while other (and typically less) jobs came online in a different sector (or area of the same general sector).

Borders is a business failure, due to rapid expansion (during a period where they were paying through the nose for retail space), bad management decisions and structure, a changing retail market (they rapidly expanded just before e-commerce hit in full), and a changing publishing infrastructure.

Even if everyone was flush with cash right now, Borders would most likely still be going under — it just would have taken longer.

@mattb:

In a booming and/or at least an economy where there was some kind of notiiceable job recovery, then I would agree with you — that one antiquated sector would be replaced or shifted over to another, offering no harm or foul, just like your buggy vs car analogy.

But, again our current state of affairs shows no job recovery, no confidence in the market (except the stock market which even some of the stock experts are questioning i.e. Charles Payne), and basically with bookstores closing it is just more jobs lost, and no real jobs gained elsewhere to make up the difference. In the Borders example alone, it amounts to 10,000 who will join the unemployment lines. I don’t see 10,000 more coming on line in,lets say,the ebook industry.

I haven’t read all t comments, but unless there was a comment by an economist, this will be useful The national debt of t U.S. is slightly below t world average according to the CIA. which puts its current level into perspective, The national debt can play an important role in t stabilization, and of course t destabilization of the economy. It is s fallacy (of composition) to think of the national debt as equivalent to a private debt. . Like t rest of the world, the U,S. is on a fiat money standard in which money can be created at a very low cost. whereas under t traditional gold standard money depended on the supply of gold. T discovery of gold, e,g, in California and Alaska, expanded t U.S. money supply and created prosperity, Too many people have obsolete ideas based on t gold standard,. T present consensus is that money must be managed carefully by monetary authorities (t US Treasury and Federal Reserve). The objective of the monetary authorities is to stabilize the economy, to minimize inflation and recession. Monetary policy is used as much as possible to stabilize the economy, but when it has become used up, like now fiscal policy should be used as a backup.A budget deficit is expansionary and should be used now,

Most economists are appalled at the different proposals being put forward in Washington,

What disturbs them most is that the “Great Recession” is being almost ignored in public debate. The focus is instead overwhelmingly about a questionable debt crisis which could be managed on a medium or long-term basis, if it exists at all. According to the latest CIA World Factbook, it does not exist. The CIA Factbook’s figures show that the U.S. public debt ratio to GDP is less than the world average for that ratio. One doesn’t have to be an economist to see that these inverted priorities are dangerously irrational. Of course, the public debt should be watched carefully., but it should not blind us to our present catastrophe. The present prolonged economic downturn is the worst since the Great Depression of the 1930’s. About 19 million Americans are officially counted as unemployed. Counted together with their families, about 50 million people suffering from unemployment.