Obama’s Wimpy Debt Reduction Plan

As more details roll in on President Obama's millionaire tax hike, it's looking like it was drawn up by J. Wellington Wimpy: "I'll gladly pay you Tuesday for a hamburger today."

As more details roll in on President Obama’s debt reduction plan, it’s looking like it was drawn up by J. Wellington Wimpy: “I’ll gladly pay you Tuesday for a hamburger today.”

The Hill (“Obama to propose $3T in cuts, threaten to veto tax cuts for wealthy“):

The $3 trillion in deficit reduction is made up of money saved from ending the war in Iraq and drawing down in Afghanistan, raising taxes for the wealthy and corporations and cutting about $540 billion in Medicare and Medicaid, administration officials said Sunday night.

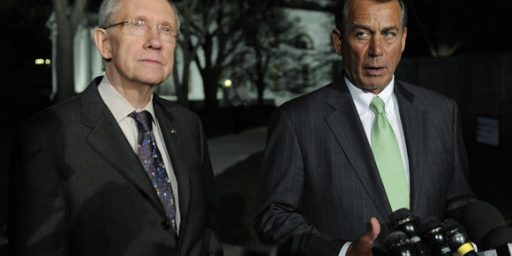

The proposals represent the president’s vision for the path he thinks the supercommittee should take; not the elements of compromise Obama sought with House Speaker John Boehner in a “grand bargain” in July.

Of the mandatory program cuts, Obama will propose $248 billion in cuts and reforms to Medicare — 90 percent of which would come from reducing overpayments — and $72 billion in Medicaid and other healthcare programs, all over 10 years.

WaPo (“Obama’s debt-reduction plan: $3 trillion in savings, half from new tax revenue“):

Combined with his call this month for $450 billion in new stimulus, the proposal represents a more populist approach to confronting the nation’s economic travails than the compromises he advocated earlier this summer.

Obama will propose new taxes on the wealthy, a special new tax for millionaires, and eliminating or scaling back a variety of loopholes and deductions, officials say. About half of the tax savings would come from the expiration next year of the George W. Bush administration tax cuts for the wealthy.

But the president won’t call for any changes in Social Security, officials say, and is seeking less-aggressive changes to Medicare and Medicaid than previously considered. He will propose $320 billion in health-care savings but will not include raising the Medicare eligibility age from 65 to 67, officials said.

Any reduction in Medicare benefits would not begin until 2017, they said. Other cuts in domestic spending would bring the total spending savings to $580 billion. About $1 trillion in savings is also expected from winding down the wars in Iraq and Afghanistan.

NYT (“Obama Plan to Cut Deficit Will Trim Spending by $3 Trillion“):

Mr. Obama will call for $1.5 trillion in tax increases, primarily on the wealthy, through a combination of closing loopholes and limiting the amount that high earners can deduct. The proposal also includes $580 billion in adjustments to health and entitlement programs, including $248 billion to Medicare and $72 billion to Medicaid. Administration officials said that the Medicare cuts would not come from an increase in the Medicare eligibility age.

Senior administration officials who briefed reporters on some of the details of Mr. Obama’s proposal said that the plan also counts a savings of $1.1 trillion from the ending of the American combat mission in Iraq and the withdrawal of American troops from Afghanistan.

So, the idea is to get a promise to raise taxes in exchange for spending “cuts” achieved by ending two wars when they’re planned to end and some Medicare savings that will begin toward the end of the next presidential term and phase in over the next two terms after that? Sweet.

I get that this isn’t so much a plan as a campaign strategy. But even by that standard, this is pretty silly.

given the state of our economy, high unemployment and low growth, these somewhat modest measures seem wise than a major austerity proposal to me.

what you call wimpy would probably be the most significant deficit reduction in history.

maybe that word…wimpy…doesn’t mean what you think it means.

You know what is silly, James? What is silly is enacting major immediate spending cuts in an economy where growth has slowed to less than one percent, while the bond market has pushed real interest rates negative. The world is paying us to borrow money, but we do retain the option to deliberately shoot our own economic recovery in the head. (‘austerity’).

That’s not just silly. It’s cruel, and it’s not very bright.

Frankly, any economic analyst with two neurons to rub together, including wild-eyed leftists at the economist, are calling for immediate stimulus and medium-term deficit reduction.

I want to go a step further and say that weak, nonfactual work like this keeps OTB a second-rate source of commentary. All you contribute here is your own gut feelings, passed off as self-evident Why should we care? It’s not an article, it’s a LiveJournal entry.

Anything north of a trillion is a good cut … and this is in addition to whatever the “super committee” is doing in parallel, right?

Did you forget the committee?

Ah … edits as I wake up … we get to see the committee cuts on November 23 of this year.

If the committee just books the end of the wars, that will be very wimpy.

According to Ray Fair’s econometric models in order to stabilize our debt situation we need roughly $7 trillion of some combination of additional revenue (beyond that under current legislation) and spending cuts and the longer we wait to begin the process the more it’ll take. We are currently paying about $500 billion per year in interest on the debt.

Its called an opening negotiating position. A sign perhaps, that this administration has finally figured out how to play DC hardball.

Yeah, and the “wimpy” thing just doesn’t quite work here…

Now if we had a debt problem this would be important. We don’t. We have a demand problem. Stabilizing our debt situation will not create any jobs…nor will it create economic conditions that will create jobs.

@Hey Norm:

I’ve got a buddy who had his software testing job shipped to India, just last month. How much demand does it need to bring that job back?

Good article at The New Yorker on the flip side:

@Hey Norm:

I think that a half trillion per year in interest payments is a problem.

The compromise that he was offering last time was 90% of what the Republicans wanted, and they spit it back in his face. He’s not going to start this round of negotiations with that. If he did, you’d be sitting here saying what a weak negotiator he is.

@ JP…

It’s not that I don’t think it happens…or that it isn’t a problem that needs to be addressed…I just don’t think it’s the reason we are stuck at 9% unemployment. Again…I’d bet States have laid off more employees in the last year than jobs have migrated overseas.

My firm has the same opportunity to off-shore work…but we feel we have better QA/QC control here…but that’s a different discussion.

@ DS…

$1/2T in interest is a problem and I would have prefered the Bushies had not stuck us with it…but it is not THE problem.

@Hey Norm:

FWIW, some claims here (AFL-CIO site):

@ JP…

We’ve lost 600,000+/- public sector jobs in the last 18 months alone…well over 1M since the Bush Contraction began. Some experts expect to lose another 800,000 additional jobs by July, ’12.

Again…I’m not saying off-shoring isn’t a problem…but we have been steadily adding private sector jobs for quite a while (though it has definitely slackened off since the stimulus money has dried up – coincidence?).