Our Greek Cousin

Rodina Scenario, Rosy’s Greek cousin, is alive, well, and proposing solutions to the Greek debt crisis:

Rodina Scenario, Rosy’s Greek cousin, is alive, well, and proposing solutions to the Greek debt crisis:

The Greek government and the European Union (EU) leadership, prodded by the International Monetary Fund (IMF), are finally becoming realistic about the dire economic situation in Greece. They have abandoned previous rounds of optimistic forecasts and have now admitted to a profoundly worse situation. This new program calls for a total of 11% of GDP in terms of “fiscal adjustments” (i.e., reduction in the budget deficit; now meaning government spending cuts mostly) in 2010, 4.3% in 2011, and 2% in 2012 and 2013. The total debt to GDP ratio peaks at 149% in 2012-13 before starting a gentle glide path back down to sanity.

This new program is honest enough to show why it is unlikely to succeed. Daniel Gros, an eminent economist on euro zone issues based in Brussels, has argued that for each 1% of GDP decline in Greek government spending, total demand in the country falls by 2.5% of GDP. If the government reduces spending by 15% of GDP — the initial shock to demand could be well over 30% of GDP. Obviously this simple rule does not work with such large numbers, but it illustrates that Greece is likely to experience a very sharp recession — and there is substantial uncertainty around how bad the economy will get. The program announced last weekend assumes Greek GDP falls by 4% this year, then by another 2.6% in 2011, before recovering to positive growth in 2012 and beyond.

Such figures seem extremely optimistic, particularly in face of the civil unrest now sweeping Greece and the deep hostility expressed towards Greece in some north European policy circles.

The pattern of growth is critical because, under this program, Greece needs to soon grow out of its debt problem. Greece’s debt/GDP ratio will be a debilitating 145% of GDP at end 2011. If we put more realistic growth figures into the IMF forecast for Greece’s economy, e.g., with GDP declining 12% to end 2011, then the debt/GDP ratio may reach 155%. At these levels, with a 5% real interest rate and no growth, the country needs a primary surplus at 8% of GDP to keep the debt/GDP ratio stable. They will be nowhere near that level. The IMF program has Greece running a primary budget deficit of around 1% of GDP in that year, and that assumes a path for Greek growth that can only be regarded as an “upside scenario”.

Unfortunately, many Greeks find this draconian proposal intolerable:

ATHENS—Greece’s fiscal crisis took a new turn to violence Wednesday when three people died in a firebomb attack amid a paralyzing national strike, while governments from Spain to the U.S. took steps to prevent the widening financial damage from hitting their own economies.

U.S. Treasury officials have been quietly urging their European and International Monetary Fund counterparts to put together a Greek rescue plan more quickly to contain the damage, it emerged Wednesday, as U.S. policy makers worry the continent’s problems could undermine a U.S. recovery much as U.S. housing woes hammered Europe in 2008.

In Spain, rival political leaders came together Wednesday with an agreement that aims to shore up shaky savings banks by the end of next month. Banks in France and Germany, which are among Greece’s top creditors, pledged to support a Greek bailout by continuing to lend to the country. Investors, meanwhile, are pouring money into bonds of countries seen as less exposed to the crisis, from Russia to Egypt.

Anxiety over the euro-zone economies sent the euro down to about 1.29 to the dollar, its lowest level in more than a year. The Dow Jones Industrial Average fell for the second straight day, losing 58.65 points, or 0.54%, to close at 10868.12.

Greece’s 24-hour nationwide general strike brought much of the country to a standstill, closing government offices and halting flights, trains and ferries.

The level of growth required for Greece to keep its head above water is simply not credible. Greece’s primary industry is tourism. With a torpid world economy marked growth in that sector is unlikely, especailly as long as Greece remains yoked to the euro.

While a bailout scenario similar to that proposed for Greece is barely imaginable for the other, smaller members of the Euro-zone in similar debt problems, Portugal, Ireland, and Hungary, it is absurd when considering a resolution to the debt problems of larger economies like those of Spain and Italy, only in slightly better circumstances than Greece. German voters will simply not stand for it. Neither will American voters if the IMF becomes a party to the serial bailouts.

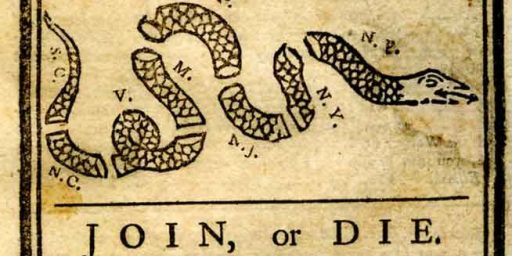

A better, sounder solution is a controlled unwinding of the euro, described by Peter Boone and Simon Johnson at the link cited above. Two questions remain. Will European leaders seize on that solution in time to prevent the crisis from spreading?

And who will bail us out when our turn comes?

Apparently not the Fed:

The American people are pretty hard working and pretty well educated. I’ve kind of assumed that after the recession bottoms we’d all get real on projected budgets and deficits.

Despite my native cynicism I don’t think we’d go the Greek way, and take mobs to the street to preserve government spending.

(The Tea Party is half interested in preserving entitlements, but they are at least half interested in cutting spending too :-/)

Does Mr. Bernanke really think he is the dog and Congress is the tail?

You mean when perception can no longer keep pushing reality to the background? When fiat money or policy can no longer do the trick?

The simple answer is, of course, no one. Think of when the Soviet Union collapsed, or all the third world economies that had the IMF or others to come in and help them, even with the painful austerity measures required. As the worlds’ last remaining superpower, who can be the adult to our financial profligacy and petulance?

re. Greece and today’s market blip … might make my concerns about high frequency trading a little more mainstream. Let’s see if Tobin taxes pop up as the cure.

The EU will break up. Will it affect NATO? Do these countries pull out of Afghanistan?

Steve