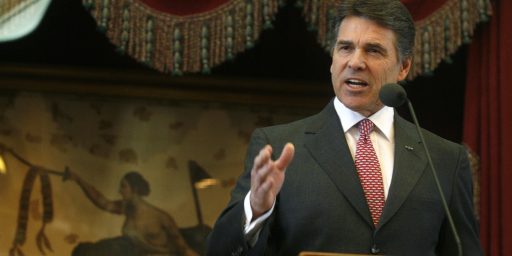

Rick Perry Walks Back Social Security Rhetoric

In five days, Rick Perry has gone from calling Social Security a "monstrous lie" to saying we need to have a conversation about fixing it.

Texas Governor Rick Perry took a big step today to walk back some of the rhetoric he’s used to describe Social Security, both in his book and on the campaign trial, in an Op-Ed in USA Today:

These are the hard facts: Social Security’s unfunded liability is calculated in the trillions of dollars. Last year, annual Social Security outlays exceeded annual revenues for the first time since 1983. The Congressional Budget Office projects that outlays will be roughly 5% greater than revenues over the next five years, worsening as more and more Baby Boomers retire.

By 2037, retirees will only get roughly 76 cents back for every dollar that is put into Social Security unless reforms are implemented. Imagine how long a traditional retirement or investment plan could survive if it projected investors would lose 24% of their money?

I am going to be honest with the American people. Our elected leaders must have the strength to speak frankly about entitlement reform if we are to right our nation’s financial course and get the USA working again.

(…)

For too long, politicians have been afraid to speak honestly about Social Security. We must have the guts to talk about its financial condition if we are to fix Social Security and make it financially viable for generations to come.

Americans must come together and agree to address the problems so today’s beneficiaries and tomorrow’s retirees really can count on Social Security for the long haul.

We must have a frank, honest national conversation about fixing Social Security to protect benefits for those at or near retirement while keeping faith with younger generations, who are being asked to pay.

This is a sharp turn away from calling it a Ponzi Scheme, a “monstrous lie,” or saying that it’s an unconstitutional system and that individual states should be allowed to opt-out of it. Given that the Op-Ed comes out the morning of a Republican Presidential debate, it’s also clearly meant to blunt some of the criticism he’s getting from fellow candidates over his rhetoric, and to knock down the charge that he wants to end Social Security, a charge that could be political poison in a state like Florida.

I’m not so sure it’s going to work. There’s already plenty of tape out there of Rick Perry making these statements that his opponents can use in states like Florida, Pennsylvania, and Ohio, and if they use it you know that the Obama campaign, the Democratic Party, and all the pro-Democrat 527 groups and SuperPACs will be using it too. If Perry has to explain himself again every time one of those ads comes, out, it could turn out to be a problem. I’m not sure it will be fatal for Perry, but this is clearly one of those situations where a candidates words will be used against him, again and again and again.

Of course, catch all statements like saying ‘we need to speak honestly about Social Security’ a “we need to fix Social Security” lead to a whole host of questions themselves. What kind of fixes does Perry, or any of the other candidates for that matter, think we need to be considering? Raising the retirement age? Ending or recalculating cost-of-living adjustments? Increasing the cap on the Payroll Tax? Means Testing? Or, is it something more radical like private accounts? My guess is that neither Perry nor any of the other candidates are going to want to put all their cards on the table when it comes to the specifics of reform, but once Pandora’s Box is opened it’s going to be hard to avoid coming up with an answer for very long.

It’s not just a “sharp turn”, it’s a complete 180. I realize that anyone who puts stock in the rhetoric of politicians is on a fool’s errand, but when you’re dealing with guys like Perry and Romney – who change even the most basic, defining point of their campaigns on a weekly basis – how can anyone be so foolishly gullible as to imagine that this time they really mean it?

That is a really weird claim. Looking for where it might come from, I find this:

So that is a math or econ fail on Perry’s part. It is about cash flow, and not return on “investment.”

Seriously, Perry totally misreports the meaning of that projection. On purpose, or because he hasn’t hired any economists as economic advisers?

I am shocked, shocked….

Hmmmm….Which Apostle Rick should we believe? The one who wants 50 Social Security Administrations? Or the one who was born again today?

It’s interesting because there’s no evidence yet that Perry’s “Social Security begone!” rhetoric is having any negative effect AT ALL among Republican primary voters.

Mike

If Rick Perry were half a man instead of a politician. he would say what he means and mean what he says. Then let the chips fall where they may….that would at least show some integrity.

Please. I’ve been predicting this for days. Perry waited just long enough for Romney and Bachman to accuse him in print of wanting to destroy SS which is something he never said and most people know it, and now has broken out the chainsaw and cut that limb off.

Johnson when running for senate in WI also called SS a Ponzi scheme, and then when Feingold tried to call him out on it, used much this same rhetoric. Johnson got elected. Most people will say, “His (Perry’s) rhetoric was over the top, but at least he’s being honest with us.’ See if I’m wrong.

-Polaris

If you idiots in Washington hadn’t stolen the SS funds from the lock box, there’d be plenty of money in there earning interest and keeping the SS program alive. You idiots STOLE the seniors’ future. You put the SS funds in the general fund and then wonder why there’s not enough to cover SS? IDIOTS. I won’t vote for any of you.

Since when has SS been an investment program? It’s a safety net. (And a very popular one at that.) The investment stuff you’re supposed to do on your own.

“For too long, politicians have been afraid to speak honestly about Social Security.”

Says the guy who just last week described it as a Ponzi scheme….

BTW, If you read the internals of the latest CNN poll (cited here a couple of articles down I think), you find that Perry does very well with seniors even with this social security comments. That tells me that SS criticism doesn’t have blowback it once did.

-Polaris

Perry Sticking to His Guns on Social Security

http://www.nationaljournal.com/politics/perry-sticking-to-his-guns-on-social-security-20110912

???

@lou91940:

Half a man? Is the other half a pig and the other half a bear?

Is HE ManBearPig? Call Al!

@Herb:

Well isn’t it at least for the younger voter? We can quibble about the precise definition, but right now there isn’t much doubt that SS and the govt is making promises that it knows it won’t be able to fund in the future, and that the scheme depends on roping enough new

suckerstaxpayers to pay for the old recipients.The precise definition can be argued, but I think most people would say it’s close enough to justly call SS a Ponzi scheme.

-Polaris

@Polaris:

If he held back, it was at the precipice. In “Fed Up” he writes:

“Social Security is something that we’ve been forced to accept for more than 70 years now.”

What exactly is the follow-on to that? Is he just playing to his crowd, getting them riled that they’v’e been forced to accept SS for 70 years … and (in a quieter voice) something they’ll be forced to accept for another 70?

Perry backing off from what he said before or does? Big shocker. I guess he will soon retreat from his previous stances on illegal immigration, forcing girls to have HPV innoc, and TX shouldn’t succeed from the US.

This a$!clown will say anything to anyone at anytime to get elected. And sadly, people will gobble it up with a big spoon.

@Polaris:

There was probably never a time when Social Security could be left static, with no future changes, ever. That’s because its management has no decision-making power about contributions or benefits. It is addressed, in large blocks, periodically, by congress.

That isn’t how you’d run an annuity. There you’d be making constant adjustment, every year, based on earnings projections and actuarial data.

So no, it is only a lie or Ponzi scheme if you hold the preposterous notion that it will never be adjusted. Preposterous because it has been adjusted, again and again.

John,

SS is not an annuity and the idea that the SS administration floats around that your taxes are “contributions” and there is a “trust fund” (when we all know there isn’t) IMHO constitutes fraud.

SS is two things:

1. An incredibly regressive wage tax that I can’t imagine anyone would support on their own. In fact it’s the most poor unfriendly tax we have on the books and there is basically no way to be exempt if you earn wages (and you never have to pay it if you have non-wage income like capital gains).

2. A wealth transfer system from the young to the old that doesn’t even account for who actually needs the money.

I can’t imagine anyone supporting either half seperately. BTW, these aren’t just my words. They were origianlly uttered by Milton Friedman shortly before he died.

-Polaris

He shouldn’t have changed course. Witness:

Moral of the story: Voters tend to stick by people who stand for something and don’t back down. Watch for Perry’s numbers to fall now, as understanding of this walk-back hits the voters. Whatever advisers he’s listening to should be fired.

@Polaris: “We can quibble about the precise definition”

That’s exactly what Perry wants you to do, Polaris, quibble about the precise definition. Because the “precise definition” says that SS is NOT a Ponzi scheme.

What we should be doing, rather than indulging Perry’s rhetorical flourishes, is actually quibbling about how to keep SS afloat, and I expect we’ll hear more about that tonight in the debate.

Probably not from Rick Perry though…

@Polaris:

Sounds like you need to do some finance reading:

That is exactly what SS is. It is a “series of future payments to a buyer [retiree] in exchange for a series of regular payments [ss tax]”

Note that while SS does have some wealth-transfer, it is very much structured to give higher benefits to higher wage earners (and contributors).

If it were all a big wealth-transfer thing, then everyone would get the same pay-out, whether they worked or not.

Eric,

I don’t think Perry has backed down at all. He never called for the destruction of SS, he only called it what it is.

Edit PS: In short he hasn’t made a sharp turn at all except in the minds of some here who weren’t likely to vote for any republican anyway.

John,

No. SS is a tax and wealth transfer system. When the first recepient paid in about 24 dollars and got over 24 thousand in return, that should have told everyone right away that the jig was up. Annuities are NOT run the way SS is although the SS administration would love to have you believe otherwise.

It’s a combo tax and welfare system and both halves are indefensible on their own.

-Polaris

@mike:

“This a$!clown will say anything to anyone at anytime to get elected.”

Oh yeah! HE is the ONLY one to EVER do so!

Yea, thats the ticket! I’ll go with that!

John,

If SS really were an annuity, we’d have adjusted the benefits to ‘means test’ and to raise the benefits ages (to at least 70) years ago, but any attempts have been poisoned.

Please. It’s not.

-Polaris

@Polaris:

Do you notice that the definition above says nothing about internal operation? It just says a contract for a future payment series in return for a current payment series.

Now, is SS a well-run annuity? No, because it is managed by congressmen, lazily, and with only crude periodic updates.

Probably true, but since republican primary voters don;t elect a president alone, it’s not really the important issue. I have no doubt Perry can win the primary. But if he doesn’t pull back from the third rail his presidential bid will look most resemble that of Michael Dukakis.

@john personna:

Except that it’s not. If you buy an annuity from an isurance company or have one in a private pension, they are required to hold enough assets to cover the net present value of those future payments. Social security isn’t holding anthing, and relies on the payments of future beneficiaries to cover the current beneficiaries.

The only thing that distinguishes Social Security from a ponzi scheme is that it’s not an intentional fraud. But I don’t think the fact that the people administering it have truly convinced themselves that it’s possible to sustain this really marks a point in its favor.

Certainly, no insurer, bank, or private company would be allowed to run a pension the way Social Security is run.

@Stormy Dragon:

Not legally anyway.

-Polaris

Because no insurer, bank, or private company is capable of the things the Government is. And that is another reason the Ponzi Scheme discussion is stupid. But Perry wants you to discuss it for the same reason that Palin wanted you to discuss Death Panels…because when you do the terrorists win. The terrorists in this case being the Teavangelicals.

@Stormy Dragon:

They may not be holding enough, but it is actually trillions, isn’t it?

Thinking of Social Security as a mandatory annuity adds more than it hides. It shows what the financial problems are, why demographics and actuarial data should be more closely tracked, and why adjustments should be much more frequent.

You don’t need a weatherman

To know which way the wind blows…

Subterranean Homesick Blues

Bob Dylan

@john personna:

Not really. The social security trust is in US bonds that can’t even be sold on the open market. The only way to cash in $1000 of those bonds is to transfer $1000 from the general fund. The situations is really the same as if the bonds didn’t exist at all and we just paid for things from tax revenue. The only distinction is how the accounting is handled.

To put it differently, do you think that, say, Ford wouldever be allowed to invest it’s entire pension in Ford corporate bonds? If they did, do you think the pension would be considered well funded no matter how large it was?

@Hey Norm:

Well yes, the government can print arbitrary amounts of currency, so it could theoretically devalue the dollar to the point where it can once again cover the social security obligations, but I doubt anyone would consider that an acceptable solution.

What the people receiving social security really want is to have the value the contributed eventually paid back out, and the Government doesn’t have the ability to arbitrarily create value.

@Stormy Dragon: Ford is not an autonomous currency issuer with a flexible system of exchange: the federal government cannot go bankrupt involuntarily, so there can be no meaningful comparison to any corporate entity because the feds are not revenue constrained. Inflation is a different story and has to be managed, but it can be managed effectively while continuing to meet our fiscal obligations

I think Perry’s going to learn that once you threaten to kill Social Security you’re stuck with that position no matter how much disingenuous b.s. your paid consultants try to spread to the contrary.

@john personna:

You are pulling apart his statement in a technical way (cash flow vs investment return). When in fact Perry is simply looking at the bottom line of SS, saying at a point in time (2037), seniors will be getting only ” 76 cents back for every dollar that is put into Social Security unless reforms are implemented, “which is true. He then goes on to compare their investment in SS to any investment plan they might make with other similar money, and reflects on such an investment plan’s ability to sustain an investor’s interest with the following:

So, you are incorrectly parsing his words to find something erroneous in his comments.

@john personna:

“So that is a math or econ fail on Perry’s part. It is about cash flow, and not return on “investment.”

And what happens to cash flows when Obama wants us to keep slashing payroll taxes?…

Exactly, where does Perry walk back the “Ponzi scheme” meme ?

A “Ponzi scheme” is not financially sound and sustainable for the long term.

Just calling it a “Ponzi scheme” doesn’t mean that it doesn’t have a good purpose, I mean, who would join in any “Ponzi scheme” unless they thought there was some good to be had .. at least for themselves.

Rick Perry’s piece in USA Today calls for a conversion of this “Ponzi scheme” into something else.

@Stormy Dragon: The only thing that distinguishes Social Security from a ponzi scheme is that it’s not an intentional fraud.

Let me correct you, and pile on a few more distinguishing characteristics:

1) In a Ponzi scheme, participation is voluntary — the schemer has no authority to compel you to participate.

2) In a Ponzi scheme, you can get out at any time — as long as you’re willing to write off all you’ve paid in so far.

3) In a Ponzi scheme, you decide how much you want to pay in.

4) In a Ponzi scheme, you at least have the satisfaction of knowing that there’s at least some chance the perpetrator will end up in jail.

J.

Kevin Drum: A Venn Diagram for Rick Perry: Social Security Is Not a Ponzi Scheme

@OzarkHillbilly: Here’s the slightly longer version.

@Jay Tea: You’re right. SS is worse than a Ponzi scheme.

-Polaris

No Ponzi scheme is transparent. We have known for years that our demographics would cause shortfalls in SS. Anyone can go online and look at its revenue and outlays.

We can vote to change SS. Only the schemer generating a Ponzi can change anything.

The goal of a Ponzi is to make lots of money for the one who creates it. There is never any intention of paying contributors, though some payouts may need to be made to maximize the scheme.

While there are some similarities between the two, the deep fundamental differences make SS something other than a Ponzi. While you can find reasons to want to eliminate SS, market efficiencies being one, it is not because it is a Ponzi. It does not pass the smell test.

Steve

Personally, the suggestion that Perry might believe SS is unconstitutional is more problematic than what is a hyperbolic criticism of the program’s deficiencies. President Perry can propose his needed reforms to SS and Congress will dispose of them. But having sworn to uphold the Constitution, he could be quite mischievous if he truly believes SS is unconstitutional.

My understanding of the history of the program was that a decision was made early not to hold the contributions in some sort of lock box, since you don’t want the government taking that much money out of the economy. You also don’t want the government investing the money in the private economy since it would be subject to all kinds of political bias and distortionary favoritism. The government IOUs were the next best approach and made complete sense at times when payments into the system exceeded payments out.

I don’t think its fair to call SS a ponzi scheme unless you think we should have either (a) held participants contributions aside, or (b) allowed the government to invest a certain percentage the money in stocks or bonds.

@Herb:

You’re right, the ‘precise’ definition does not have the wording of ‘Ponzi Scheme’ in it. Do you think if it did it would have even passed Congress, back in the 30’s? No, the label “Ponzi Scheme” merely describes how it functions in real life, as it depends on new, money contributions by others to keep it running. Without these monetary infusions SS would not be able to keep it’s future promises to seniors.

However, I think there are more people, than many realize, who believe SS is not a sure thing any more. And, that is why Perry’s message of caution is resonating with all ages of the population. He is also not recommending SS’s abolishment, but rather that it needs to be reviewed and revised in order to re-energize it’s funding.

Obviously, though, Perry’s warnings are countered by “yellow press” kind of rhetoric from the social progressives. My hope is that a growing number of concerned people will be able to see beyond the hysteria being whipped up, sorting out the hyperbole with what is really on the table, and think for themselves what is the best, fairest way to deal with SS.

Ironically, I see progressives view of defined benefit pensions, SS, medicare as similar to those who believe in cryogenics — freezing one’s body in order to attain immortality. This, in essence, is what progressives want people to expect, even demand, in their retirement — that fiscal compensation promises be frozen in time, forever safe and viable, from all the vicissitudes of life in play, without change, no matter what circumstances befall this country or it’s financial institutions. Basically, we are told to expect nothing less than what all these mandatory government programs planned for us long ago. But, as many sages have said before us, the only guarantee one can count on is there will be “change.”

The ironic thing is that if Perry has his way, SS probably would be turned into something much closer to a Ponzi scheme for many Americans.

@Jay Tea:

You make some good distinguishing points, Jay Tea, between Ponzi Schemes and government programs — the basic one being that the former is voluntary and the latter mandatory.

But then that is how most socially progressive programs are installed — by force and in perpetuity. That’s what is so unfair about union shops, in that they won’t allow diversification or differentiation of opinion, thought, or how or where member’s money should be spent. It is all very authoritarian in how unions run their shops. If a member disagrees, they simply can’t opt out, not pay their dues and represent themselves in their own labor relations with their employer, unless they also opt out of a job. Consequently, Unions become a divisive wedge between employers and employees, often to the detriment of the employee in that unreal demands close down or cause the employer to move it’s operations elsewhere, out of town.

That’s why it’s such an oxymoron when social progressives call themselves ‘liberal.’ Indeed they are tyranny shrink-wrapped in a social justice packaging.

@Neo:

Oh, oh, it’s time for the progressives to aim their criticisms at Chris Mattews, now. He crossed the line and actually made an unscripted pragmatic comment.

@ponce:

I hope he continues to talk about SS, even broaden the conversation to include more ideas on rectification. Sometimes a person just has to be a broken record for the truth to finally sink in, much like, back in the day, when non-establishment types had to say over and over again, “The earth is not flat…the earth is not flat.”

@jan:

That is false. We get back 100 cents (plus the interest Stormy does not believe) back on every dollar we put in (collectively). The problem is that (collectively) that is only 76/100 of what is scheduled to pay out in 2038.

That is totally different than Perry’s (and your) misinterpretation.

@Stormy Dragon:

Re. Trillions

Why do you phrase this so carefully? Why does “sold” matter in this discussion?

“Hold to Maturity” is all you need.

@That Guy:

That is an interesting question, isn’t it?

I fear the answer is that he wants to balance it by yet-more increases in qualification age. That “reduces” the program far more than a means test would.

@PD Shaw:

Don’t forget, other governments own our bonds. We could do the same (own foreign government bonds) with a positive sovereign wealth fund … though as you say, the risk of corruption is high.

(Shorter Me: I’m thinking that, net-net, a sovereign wealth fund is a good thing to have.)

@john personna:

Normal bonds can be sold, and is SS had that kind of bond, there would at least be some basis to claiming they’re an asset as there would be a way of exchanging them for cash with a third party.

@john personna:

I believe in the interest. But again, that interest is paid out of general revenue, so the existence of the bonds doesn’t change the effect from what the situations would be if the bonds did not exist. Again, the bonds really only exist as part of the SS accounting system, not as an actual financial asset.

@Stormy Dragon:

The question of whether the bonds are real, or earn real interest is appropriately applied to a “system” consisting of Social Security inflows, outflows and accumulated savings or debt. That is the right place to draw the circle, when looking at Social Security solvency.

When someone says, “wait, let’s do a whole-government cash accounting” … they can, but that doesn’t change Social Security. It only overlays other credits and debits for the other, bigger, “system.”

From the standpoint of Social Security, if you hold bonds, if you get interest on bonds, then you have a fund. Period.

I wonder, if SS was currently borrowing against the general fund, would you say it has no debt?

BTW, I own some bonds that I never plan to sell. Other people buy them and sell them, but not me.

Does that make them less real? Are they no longer bonds?

Mitt Romney, Michele Bachmann and every single Democrat share your hope that Perry continues to threaten to kill Social Security, Jan.

“That’s why it’s such an oxymoron when social progressives call themselves ‘liberal.’ Indeed they are tyranny shrink-wrapped in a social justice packaging.”

Which programs are tyrannical? Social Security is incredibly popular. Do people love tyranny, or are they just stupid?

” Consequently, Unions become a divisive wedge ”

6.9% of private sector employees are unionized. I fail to understand why you would obsess over this tiny bit of our population.

“Ironically, I see progressives view of defined benefit pensions, SS, medicare as similar to those who believe in cryogenics”

I read extensively across the spectrum. The progressives I read write extensively on changing these programs. Most actually talk a lot more about Medicare as it is a larger contributor to our future debt. On Social Security there are a number of left leaning writers who advocate that it should be fixed first as it is the easier fix.

Steve

As usual, Mataconis’ lead in is completely disengenuous. Perry’s comments about Social Security in no way implied abandonment of the program. In fact he reassured recipients that they would continue to receive benefits. Funny how leading Democrats (all the way back in 1999) and Nobel winning economists can label the program a “Ponzi Scheme” but if a Republican candidate for the Presidency does it, Matconis suggests that the candidate is out to destroy the program.

Pitiful. Transparent. Partisan. The Mataconis trifecta…

@Polaris: It tells me that they never believed him in the first place. My guess is they knew he was just flapping his gums. I saw one quote from a woman who said she had heard what he said and she wondered how he would fix the system…it never occurred to her that he might actually mean what he said in terms of the constitutionality of the system. She just figured he was running his mouth.

The problem is he has put a spot light on this now and sooner or later he will have to answer questions for people like her..and I can tell you she will not vote for him if she thinks he will cut her benefits.

@Gulliver: Actually Perry did imply abandonment of the program. After all, Republicans have been talking about social security reform for years..why do you think Perry’s remarks raised such a stink? Well because he not only called it a Ponzi scheme and a monstrous lie and a fraud, and a failure and unconstitutional…he said that states should be able to opt out which would kill the program..

In the end all of that was just so much hot air designed to get attention for Perry and it looks like it might have backfired on him. Maybe Romney’s fliers accusing him of not supporting the program forced him to come out with something other than demagoguery.

@jan: Oh come on. Bush talked about it and he came up with a plan too and where were all these conservatives then? They would have far more supportive if he had just trashed the program but not really done anything about it..and I am sure that is what a lot of people thought Perry would do..say mean things about it and not much else..but once Bush offered a plan that required real change, it was crickets chirping out there.

People like to talk about change a lot more than they actually like to experience it.

@Terrye

Having an opt-out provision for the states doesn’t destroy the program inherently, except that the “monstrous lie” requires every penny it can get its hands on to keep it from diving rapidly into the red instead of gradually sinking as it has been. If you think this is going to lsubstantially hurt Perry than you are sorely out of touch with the intelligence and acuity of the Senoir and middle class in this country. Everyone knows SS in the current form is broken, has been robbed blind in spite of assurances that it would not be, is a monument to broken promises, and is destined for failure. The only question is how fast.

Also, you realize that under your logic, Obamacare was “destroyed” the moment that this Administration began giving out waivers left and right to large companies. They’re up to about 1100 waivers now aren’t they? And it certainly – under your logic – will be destroyed if (when) the individual mandate is ruled unconstitutional.

Thos that want to label Perry as toast for being honest and straightforward with this issue are grossly underestimating the American people’s disgust with the continuous lies coming from the political class.

“Also, you realize that under your logic, Obamacare was “destroyed” the moment that this Administration began giving out waivers left and right to large companies. ”

The waivers only last until the ACA and the subsidies really start in 2014. Once the whole program starts, there is no need for the waivers.

Steve

@Gulliver:

When you think about internal migration, people who move from state to state, separate social securities become completely crazy.

@john personna:

That depends; were you the issuer? Because my problem is not with treasury bonds specifically, but with the idea that bonds being held by their issuer constitute net assets. Each one creates an offsetting liability, and when both are held by the same party, you can’t really say any real saving is going on.

When we can’t afford to pay out the promised payments, does it really matter to the recipients whether it’s because SS in particular or the government in general is broke?

@Stormy Dragon:

No, Social Security does not issue bonds under its own name and from its own revenues.

No, the broader government is not in default, and their bonds are among the world’s most trusted investments.

Really dude, you’ve built this argument that since SS does not currently sell US Treasuries, they are not bonds anymore. Never mind that they could sell, and should the US debt disappear, SS would simply buy corporate or foreign government bonds.

@Gulliver: Of course an opt out for the state destroys the program..How would it even be possible? It is ridiculous on its face.

Perry just threw out red meat to a red meat audience without really thinking about solutions or alternatives..he just wanted to make a splash. That is Perry..but when push came to shove, he backed down. That is Perry too.

This is all so ridiculous…a significant portion of the conservative base seems to really hate Social Security and talk as if they would like nothing more than to destroy it…these people should just admit these things rather than having to walk back anything…of course, if such people are politicians, they shouldn’t expect to get elected to any position, including dog catcher, by sharing their honest views…

@Stormy Dragon:

What he said.

@john personna: Really? US bonds are AAA rated bonds….oh wait…..

-Polaris

@Polaris:

On average they are, yes.

But more than that, as a supporter of the free market you should trust rates, beyond all else, to gauge their support.

Currently Social Security and Medicare use 8.5% of nonentitlement revenues (federal revenues dedicated to all other programs besides the two). By 2020, the deficits will grow to almost 25% (http://eng.am/poetWU). This means that within 9 years, in order to pay projected benefits to retirees and the disabled, the federal government will have to stop doing about one out of every five things it does today.

Restructuring Social Security to make it sustainable would fix this dilemma and put an end to the argument of whether or not the program is a “Ponzi scheme.” Such things as raising the retirement age could help. This switch would eliminate less than a one-third of the projected deficit. However, this needs to be done because people are living longer; therefore more people are getting paid for longer periods of time while fewer people are paying into the system. It would help to reduce benefits. If Social Security payouts were reduced by 3% or 5% for new beneficiaries, about 18% or 30% (respectively) of the funding shortfall would be eliminated. Also, bigger contributions should be required from workers and employers. Right now they pay 6.2% of earnings up to $106,800, or as much as $6,622 per year, into the Social Security system. If the contribution rate were increased to 7.3% of earnings, Social Security’s projected deficit would be eliminated (http://eng.am/rtUMqX ).