Whelan, Griner, and the State of Our Politics

Knowing what FNC is likely saying without watching FNC.

The Warren And Sanders Plans To Cancel Student Loan Debt Won’t Solve The Problem

Senators Warren and Sanders have both proposed plans to forgive student loan debt and make public colleges tuition-free. That’s easier said than done.

Warren Proposes Student Loan Forgiveness and Free College

It’s an interesting idea, although one fraught with moral hazard.

No, the Party can’t “Do Something” about Trump

The nature of US parties means that Trump more or less is the GOP at the moment, and hence the GOP will do nothing about Trump.

Sports Leagues File Suit To Stop Sports Gambling In New Jersey

All of the major sports leagues are trying to stop New Jersey’s efforts to legalize sports gambling. They should not be allowed to succeed.

Obama’s Timidity In The Face Of Extremism

The Obama Administration’s response to the protests in the Muslim world has been entirely wrongheaded.

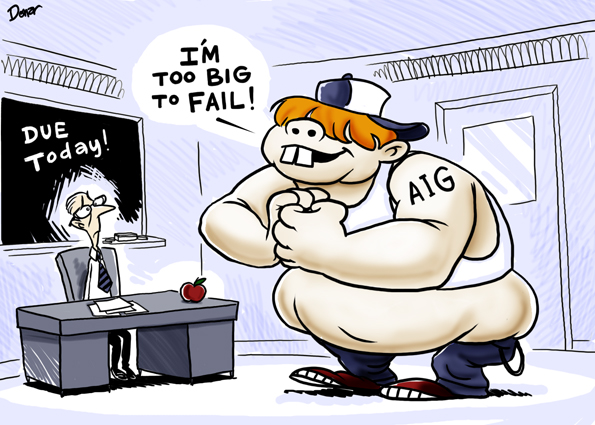

Auto Bailout Politics

Romney eked out a win in the Michigan primary. He’s going to have a harder time there in November.

Another Example of Fee-for-Service Fire Department Letting a Home Burn (and its Implications)

A story from Tennessee raises further questions about the role of government.

Eurozone’s Perpetual Crisis

European leaders continue to kick the can down the road on a crisis that could bring down the global economy.

A (Partial) Solution To The Student Loan Problem?

A change to the Bankruptcy Code could go a long way toward alleviating the burden of student loan debt that seems to be motivating some in the “Occupy Wall Street” movement.

U.S. Government Sells Chrysler Stake, Losses Higher Than Reported

On paper, the U.S. lost $1.3 billion on the Chrysler bankruptcy, but the true cost is far higher than that.

Merkel Wins Again

Once again, Angela Merkel has held her ground and forced the other EU leaders to accommodate Germany’s policy concerns. This time, it’s a set of amendments to the Lisbon Treaty to deal with sovereign debt emergencies.

The Wall Street Journal Versus Moral Responsibility

In arguing against lifting liability caps on offshore drilling, the Wall Street Journal is arguing against both moral responsibility and the free market.