The Bush Boom

Kevin Drum reports that,

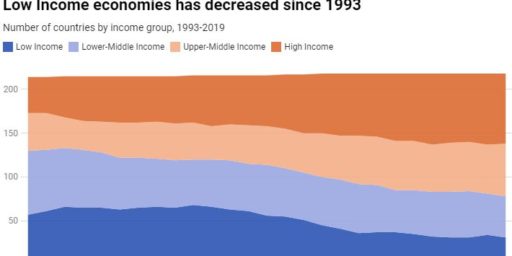

Bush expansion is over, and Brad DeLong describes it as “the first business cycle during which median household income in America falls from peak to peak.” And indeed it is. The closest we’ve come to such a dismal recovery in the postwar era was the dreaded stagflation-driven economic expansion of Jimmy Carter’s presidency.

DeLong provides a chart that Drum helpfully annotates with a red circle:

In both cases, the initial peak took place well before the president took office. In Carter’s case, the second peak was achieved and a new trough began during his tenure — which was only four years. In Bush’s case, household income has been trending steadily upward since 2003. Until the line starts trending down, we won’t know what the “peak” is.

It’s worth noting, too, that the chart is in increments of $5000. Even if we presume the 2007 numbers are the peak, we’re talking about what looks to be a difference of $500 a year. And, yes, these are inflation adjusted numbers.

Beyond that, while it’s a standard metric that makes sense for contemporaneous analysis of spending power, household income is rather dubious as a long-term comparative measure of the macroeconomy, let alone of presidential performance. During the 1970s and 1980s, we saw an explosion in the number of dual-income families. In recent years, we’ve seen a marked increase in single parent head of households.

That’s a huge factor, according to (2004) Census statistics:

Not surprisingly, households with two earners tend to have markedly higher incomes than those with one or, obviously, none. And that’s largely beyond the control of presidential management.

How much of the difference is due to external sources, such as oil manipulation, or attacks in southern Manhattan? Carter faced the oil thing, true, and I’ll remind you the result was 21% inflation, and high unemployment, despuite having a Rubber stamp Democrat run congress.

Bush faced the 9/11 attack, (And the resulting military commitments) the oil manipulation and a less than freindly Congress and came up with what is currently around 6.5% unemployment… a figure that most of the world would LOVE to have…(including the Europians we’re suppsoed to be emulating) and inflation of around 5.5%, or around one quater of what Carter produced, when Cater started in a far better position than Bush did.

If we’re going to, as Drum proposes, comare presidential performance between Bush and Carter, let’s tell the whole story, shall we? I can understand why Drum didn’t bring all this up; after all, it’s a little hard to sell…

…when you consider these additional factors I’ve mentioned… and Drum did not.

well as long we are taking things into consideration what would the Reagen \ Bush expansion have looked like without the collapse of oil prices? Hint: bad really bad …

Am I missing something here? The red circles seem to misrepresent the years each was in office. Carter was President from 77 to 81, which means he took office when the line was going up. Keep in mind it takes at least a year usually two after a President takes office for their economic policy to have an effect. In Carter’s case that would be 78 or 79 which is when the economy began to go down.

In Bush’s case, the economy was going down when he took office and started to flatten out after a year then started up after three years. Also Clinton took office in 93 when the economy was already greatly improving and left office in 2001 when it was sharply declining.

Of course!

Then again, that’s been true about EVERY expansion this country has had for the last 100 years or so. It’s altogether dependant on energy use. Energy is what make the economy run. Which is why it’s critical we get going on producing it.

And Wayne; quite correct.

On average since WW II real GDP growth has been 4.1% under a democratic president and 3.0% under a republican president.

Of course, it is very convient for republicans to claim that presidents can not influence the economy when presented with evidence like this and claim the opposite when they want to prove a different point.

Yes Bithead, Bush was the first president in recorded history to throw a war that failed to stimulate the economy. He just can not seem to get anything right, can he.

The Bush “boom” was basically a credit card binge, from the federal government down to Wal-Mart shoppers. The bills are coming due. We, our children and our grandchildren will have to pay them…

Wayne & Bithead: way to go! Excellent points, I could hardly have done better mysef!

I wish jap/vc boy would just go back to vietnam and live under communism instead of trying to get it here.

Sorry Chrissy, I am into capitalism. I need a new lawn boy, you might be up for the job….

It also appears the recession that we were in but wasn’t and the one that was unavoidable is once again on hold.

http://biz.yahoo.com/ap/080828/economy.html

It still doesn’t stop the MSM and the liberals from lying and claiming that we are in recession. Damn the facts, full speed ahead.

WASHINGTON — Prices may be rising unpleasantly fast, but what really worries the Federal Reserve is the weak economy, Fed Chairman Ben Bernanke said Friday.

At the same time, growth has slowed so much that most economists believe the economy is in a recession. U.S. payrolls have declined every month this year, pushing unemployment up to 5.7 percent.

Ken Beauchemin, an economist at forecasting firm Global Insight, described Bernanke’s outlook as pretty much on target.

Sure Wayne, all is well.

http://www.chicagotribune.com/business/chi-sat_bernankeaug23,0,7274661.story

“most economists believe the economy is in a recessionâ€

There is a definition of what a recession is. We have people telling us for years now that we have been in a recession but the fact remains just the opposite. It goes to show you that you can always find someone with an “opinion†that you want.