TurboTax Tricking Poor People into Paying for Free Filing

Those making under $66,000 aren't supposed to have to pay. But good luck figuring out how to avoid it.

Americans making less than $66,000 are supposed to be able to file their federal and state income tax returns for free. In exchange for the IRS not establishing their own competing services, commercial programs have agreed to provide it themselves. But, as ProPublica discovered, they’re intentionally making it extremely difficult.

Did you know that if you make less than $66,000 a year, you can prepare and file your taxes for free?

No? That’s no accident. Companies that make tax preparation software, like Intuit, the maker of TurboTax, would rather you didn’t know.

Intuit and other tax software companies have spent millions lobbying to make sure that the IRS doesn’t offer its own tax preparation and filing service. In exchange, the companies have entered into an agreement with the IRS to offer a “Free File” product to most Americans — but good luck finding it.

Here’s what happened when we went looking.

Our first stop was Google. We searched for “irs free file taxes.”

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word “free” five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasn’t going to be free at all. Turns out the house cleaner didn’t qualify because he is a independent contractor. The charge? $119.99.

— ProPublica, “Here’s How TurboTax Just Tricked You Into Paying to File Your Taxes”

They went through several scenarios and always wound up being directed to an “upgraded” version that was either $59.99 or $119.99.

How?

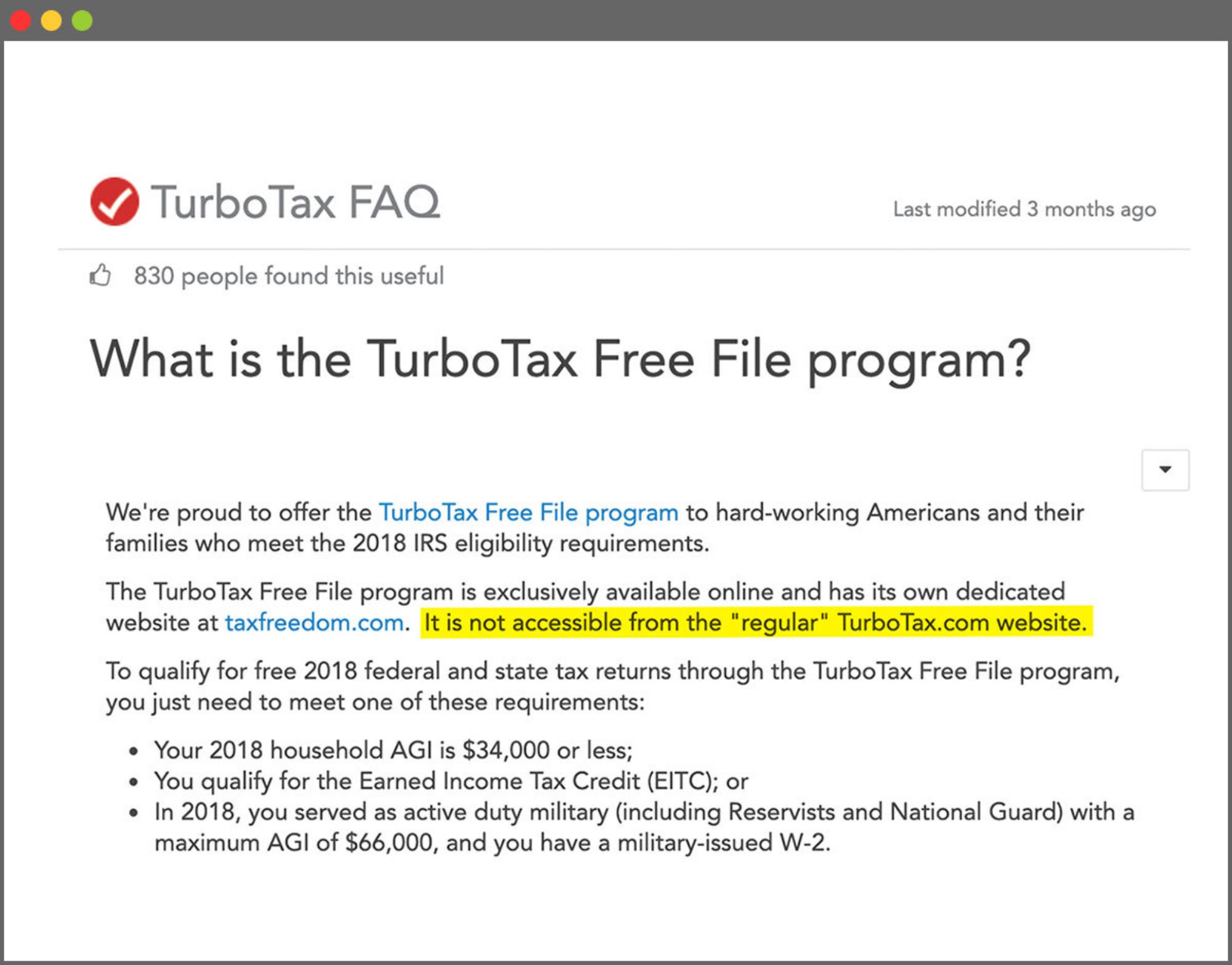

It turns out that it’s literally impossible to file from free starting at the TurboTax site!

Even armed with the information that you need to go to taxfreedom.com rather than turbotax.com, though, the company steers people back to the paid version.

While the orange “See If You Qualify” link did take us to the real Free File program, the blue “Start for Free” link brought us back to the version of TurboTax where we ended up having to pay.

There’s a name for internet design tactics that get users to pay for products they don’t necessarily want: dark patterns.

[…]

The fifth link, a government site, looked like it would take us to the actual Free File program.

But not so fast! When we clicked, and then clicked through to a second page, we found a whole new set of choices and restrictions. Each of the 12 companies that have signed on to the deal with the IRS offer their own Free File product. But they all have different requirements based on age, income and location.

Finally! We clicked the “TurboTax Free File Program” link and found the actual homepage for TurboTax Freedom.

It’s not exactly a secret that this Free File program isn’t working well. The national taxpayer advocate recently said it “is failing to achieve its objectives and should be substantially improved or eliminated.” The IRS has been criticized for failing to oversee the program and the number of people using Free File has dropped by millions since it peaked in 2005.

The company will apparently refund the amount paid by those eligible to file for free. But only if they contact the company and request it! And I’m sure they make that easy.

This is obviously shameful behavior on the part of TurboTax but it’s hardly shocking.

Like the Richard Gere character in “Pretty Women,” I made it all the way through school. And, having run websites for two decades, I like to think of myself as more internet-savvy than average. And yet I run into this thing all the time. It can be incredibly difficult to get promised perquisites.

Reduced-price versions are typically hidden and use the sort of techniques Intuit used in this case to steer people to higher-priced versions. For example, as a university faculty member, I’m eligible for the University edition of Microsoft’s Office, which offers a four-year subscription to the suite and a gigabyte of storage on OneDrive for $80—a little less than a one-year subscription at full price. When it was time to renew, it was incredibly frustrating to do so.

Amazon offers “free one-day shipping” on a host of items. But it’s often actually quite difficult to get it. Ostensibly, all one needs to do is achieve a certain price threshold. But it turns out it only applies to items serviced directly by Amazon—which is a small subset of their offerings. Quite often, I’ll go to check out and find that I won’t get one-day shipping after all.

(Amazon has also taken to offering a wide price range on some items, notably clothing and shoes. The lower prices are invariably only available on one size or color. This makes comparison shopping quite frustrating.)

Less shady but still frustrating are sites that lure customers with multiple discounts only to find at check-out that they can’t be stacked. For example, the sports apparel site Fanatics almost always has some sort of discount code active that takes a significant percentage off the “regular” price, often with free shipping for orders over a set minimum. They also offer a 10% veterans discount. But it turns out that you can use one or the other. Effectively, then, they don’t have a veteran’s discount. Which is fine! But don’t pretend to offer one.

All of these practices are confusing, frustrating, and perhaps unethical. But they really don’t compare to bilking poor, uneducated people out of money. They’re not only less able to afford it but likely to have less awareness that they’re being tricked and to have less time to search for workarounds.

As noted in a recent post, it seems obvious to me that the IRS ought to be offering free filing. Objections that they lack the technical savvy to do it are easily overcome: they could simply contract out to Intuit or a competitor.

In the meantime, though, the Federal Trade Commission, Justice Department, or other appropriate entities should go after Intuit and others who have violated their agreement by bilking poor customers. It’s truly shameful conduct.

I worked for one of the biggest tax preparers years ago, and I won’t use their software or TurboTax. I use TaxACT to file, because they seem to be the least predatory, but that whole industry shouldn’t exist. It would be trivial for the IRS to contract out a front-end that 75% of taxpayers could use, and even that isn’t necessary, the IRS could simply send you a link to their prep of your taxes, which they’ve already done, and get you to sign off on them.

@Teve: For most salaried employees, yes. I’ve got a salary, some modest farm income (long story), and a side business (mostly just OTB at this point). I spend lots of hours and $600-700 on a CPA to file my taxes every year but don’t think the IRS could do it for me unless I wanted to forgo offsetting expenses.

Perhaps they don’t compare, but they add the insult to the injury. These kinds of practices may not meet the legal definition of fraud (or maybe they do), but they meet the moral definition.

It’s not just an image problem, it’s also a trust problem. Think of how those who favor free markets want to hand over more responsibilities to private businesses, and then think of how these companies go and morally defraud millions of people routinely. Think of the building backlash, too.

In the mid-2000s oil hit peaks of high prices. Airlines instituted a fuel surcharge, which most people understood as necessary given the higher cost of fuel. Since then oil prices have come down to more normal levels, yet the fuel surcharges are still there. What does that look like?

And I’m sure you can find more examples like that.

I used Turbo-Tax myself for the first time this year (in previous years I had someone do it…and they used Turbo-Tax) and it was generally a good experience.

I was not pleased, however, when they sprung the extra fee for doing my State Tax on me.

A legitimate charge, I suppose, but really slimy.

Free tax preparation should rank up there with clean coal.

The IRS itself has similar problems. Have you ever had issues with your filling and tried to reach an agent? Good luck. Here’s the process:

Call the IRS: (1-800-829-1040)

When calling the IRS do NOT choose the first option re: “Refund”, or it will send you to an automated phone line. Note: this remains true even if you are calling about a refund.

Choose your language.

Then when a second voice menu asks if it’s about a refund, do NOT choose the ‘refund’ option. Choose option 2 for “personal income tax” instead.

Then press 1 for “form, tax history, or payment”.

Then press 3 “for all other questions.”

Then press 2 “for all other questions.”

It will ask you for your SSN or EIN to access your account information. If you enter it, it takes you back to the refund menu (which, remember, you don’t want, even if you are calling about a refund). Just wait, for awhile. Between 30 seconds and a minute.

It will ask again for your SSN or EIN. Again, do not enter this information or you will be taken to the refund menu. Another 30 second- 1 minute pause.

Then a new easter egg menu is available.

Then press 2 for personal or individual tax questions.

It will inform you the wait time is hours long, and ask if you want to go to the refund menu. That’s how they get you. Hold tight.

Another 30 second to 1 minute pause. Then you’ll be connected to an agent. Success, right? Not so fast. Most agents I’ve encountered will just read back to you the letter you’ve received in the mail. (I received a one-sentence letter informing me my return was ‘on hold.’ The agent read it back verbatim and told me he couldn’t help with any more information). Ask for a manager. The manager will then tell you that you that they will make a note in your file, and to call back in 3 months to see if anything has changed.

After 4 periods of calls in 3-month intervals (so a year)*, you are allowed to access a taxpayer advocate.

After that you can receive information about why your return is held up. (The answer I received? “Oh, that’s weird. I don’t know why it’s been held up.” It’s 2019 and I’m still waiting on my 2017 return to be processed.)

*I don’t know if a year wait is standard. My whole process was reset because of the shut down.

@Teve:

That sounds so much like me too. LOL

I stopped using Turbo Tax when I discovered they automatically didn’t do a tax credit my wife gets while Tax Act does. That was about 5 years ago. I also use TaxAct for my S Corp/Ebook publishing business.

Companies cheating poor people. What’s new? I was suffering some tough financial times and had to move into a LIHTC apartment. The property manager is a hoot for many reasons. One of which- She starts charging late fees to tenants as early as the 2nd of the month even though the lease says they don’t kick in till the 6th. She puts it in writing too, in a community newsletter every month. Unless you ask, a tenant isn’t given a copy of the lease after signing.

Good news- I just got away from that evil woman on April 1st. She refused to renew our lease because of my complaints (Like her entering my apartment without knocking). Me and the wife found a great place (55+ older resident condo which we hope to maybe buy one day especially if my ebook business continues to prosper), for less rent, and with free television. So the Property Manager did us a favor. I hope the new tenant she gets runs over her BMW SUV (Not with her in it) with their moving truck!

@Neil J Hudelson: Don’t get us started on the IRS!

But regarding Amazon, we’ve got Prime and it’s always advertising a digital reward ($1) or some WholeFoods coupon ($5, IIRC) when I’m looking for stuff. The problem is, you can only get it once. Or maybe once per quarter or something. They don’t mention that until you actually check out, so any decision you made based on that has to be reconsidered. Everything’s a sham.

And what’s with Amazon’s search function? Someday, I pray they come to their senses and just pay Google to do it right. Or even halfway right would be good; if they can get a good deal for Yahoo or Bing search, go for it. Anything would be better.

I use freefillableforms – Allows you to do your taxes yourself online and will do many of the calcs after you plug in your info, and supports pretty much all the forms you need. It’s free online filing and available for state as well, and available to everyone (no income restrictions/minimums). Most should use it and do their own taxes. Majority of Americans taxes are not so complex as to require paid preparation and/or pricey software.

Regulatory capture and rent-seeking at its finest.