Unemployment Duration Record High

The median duration of unemployment is at levels not seen in decades. What do we do about it?

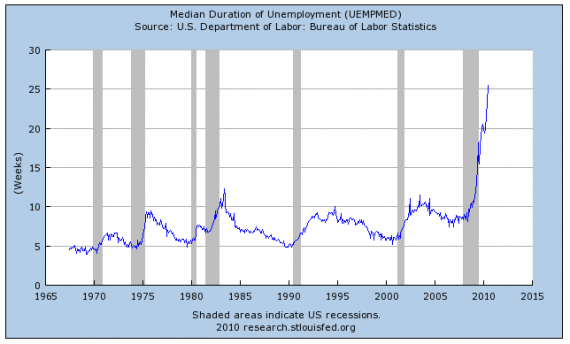

Derek Thompson produces what he terms “The Scariest Unemployment Graph I’ve Seen Yet.”

Basically, median unemployment duration (i.e., the length of time that people stay out of work) is not only higher than it has been in my lifetime, but twice as high as it has been during that span (which, incidentally, is less than 50 years). And he’s surely right about not only the scariness of the chart but the policy implications:

Does it mean we must increase the duration of unemployment benefits to protect this new class of unemployed, or does it mean we need to stop subsidizing joblessness? Does it mean we need to expand federal retraining programs, or does it mean federal retraining programs aren’t working? Does it mean we need more stimulus, more state aid, more infrastructure projects, more public works … or does it mean it’s time to stop everything, stand back and let business be business?

You’re going to find smart people make a case for all six of the above public policy directions. (I tend to side with the first of each coupling.) It’s hard to know for sure how to design public policy for historically unique crises precisely because they are historical orphans, without precedent to show us the right way from the wrong.

My gut tells me that we’ve got little choice but to expand the safety net. That is, to say the least, not my default position. But, while there are no doubt plenty of unpleasant people with poor work habits out there, as Ben Stein notes, most of these people are simply victims of the worst economy in decades. And, I fear, many of them will be unemployable for a very long time, in that their skills no longer match the job market.

By all means, let’s train as many people as we can for the new realities. That’s an investment in human capital worth going into debt for; indeed, it’ll likely more than pay for itself. But I’m not sure what we’re going to do with people in their 50s and 60s who’ve been displaced; no one is going to hire them for entry level jobs in new industries.

Yeah, well Ben Stein — if Holly wood didn’t have an enduring need for malignant dwarf trolls, he wouldn’t have a career.

I”m a fan of people finding training to suit them, and their local jobs environment, but very skeptical of programs to do the same. There are too many wrong incentives for the program-makers, as opposed to the jobs hunters.

As I understand it the success rates of “retraining programs” is very low.

(I guess that was a test, to see how many would follow the Ben Stein link.)

This is not principally about “training,” it’s about creating demand in the economy to boost the size of the workforce. There is of course the problem of what do you do in the meantime. I think we can forget the prognostications of Mr Stein. Barry Ritholz hasn’t christened Stein’s economic commentary BS-ery for nothing. As you say Jim, the minimum were going to be able to do is keep some sort of safety net in place unless you want guys selling apples on street corners. The challenge is how do you give the economy a booster shot. It’s clearly recovering (going from – 6% to +3% GDP April to April is a substantial shift), but not fast enough. The Fed’s options are limited because they are caught in what looks very like a liquidity trap and we have deflation as a real risk. Bernanke is on the hill this week and will be under pressure to “do something” but what can he do. I’m very sceptical that buying govt bonds to drive down interest rates further is going have much value when the yield on 10 year T bills is around 3% already and 30 year mortgages can be had for 4.6%. Demand is the key and you’re not going to pump that up more quickly without pump priming.

FWIW, I think an intellectual property overhaul could kick off some US growth, without new government funding. The tragedy of the anti-commons (too many areas blocked by meshes of independent patents) is real enough.

http://en.wikipedia.org/wiki/Tragedy_of_the_anticommons

I don’t think unemployment benefits should last forever, but in this case I think it is pretty clear unemployment is high because the economy is in the dumps. Another extension is probably needed.

I haven’t had much experience with what the retraining for the unemployed looks like, but I can’t help but wonder if perhaps the retraining doesn’t target the right things and may be a program that is there to be there but may not be doing the job it says it is. I think creating a path to a more marketable skill would be a good use of funds, but if the skills they are training are in areas where there aren’t any jobs, then why spend the money?

I don’t want to see another massive stimulus package, or any kind of company bail outs. I am not convinced either was a good idea the first go around and I don’t see where there is money for it the second go around.

A lot of Stein criticism but no substance.

What to do? Stimulate small business, that’s where the jobs are going to come from. Unfortunately small business is running scared from the Obama agenda.

Health care taxes (even they admit it’s a tax now), cap and trade mandates, screwy energy policies, the list goes on. Until this amateur in the White House understands business comes before the public sector we will continue to see low confidence and little investment in people or equipment.

You could retrain some of the unemployed but that doesn’t create jobs for them. You could continue to prop up a dysfunctional public sector with make work projects and expand the public employee union rosters. You could pass a financial reform bill that may reform but doesn’t improve. So far we have endured nearly a year and a half of wrong moves. People laughed at the idea of a payroll tax holiday but now are wondering if it might not have been a worthwhile idea.

We’ve got an anti business, anti free market president who needs to wake up and see what made this economy great. It wasn’t government interference but government getting out of the way.

Good Lord! Steve wonders where the substance is in Stein criticism? Let’s quote Stein directly:

Does that actually work for you Steve?

Hey! Maybe small business is’t “running scared.” Maybe just have bosses “who have overbearing and unpleasant personalities and/or who do not know how to do a day’s work!”

***(I guess that was a test, to see how many would follow the Ben Stein link.)***

OMO!!!! lol…

I just did.The comment section was a true peace of work, I love the part where they vote comments down, Hahahaha……………….

***Hey! Maybe small business is’t “running scared.” Maybe just have bosses “who have overbearing and unpleasant personalities and/or who do not know how to do a day’s work!”***

lol,or a government with a President , congressmen,senators,judges,and czars with these same qualities…..

@Plunk

“It wasn’t government interference but government getting out of the way.”

Sure, like it gets out of the way with the Exim Bank:

You got any real objections to this, Steve?

Oh, and

“What to do? Stimulate small business, that’s where the jobs are going to come from.

Would you count that as trying to stimulate small business?

If my purpose was to fundamentally transform the economy of a nation like the United States from a free market economy to a more controlled economy. The first thing I would do is exactly what has taken place. Causing a crisis in the housing market goes a long way toward kick starting process. What better way to attack the economy than to force banks to make loans which cannot be repaid. Second, allow the mortgages from these bad loans to be bundled with good loans and sold to investors concealing the potential danger. That is just the start and is not made up BS but the real deal that is going on as we read this. Ben Stein said people are unemployed due to the worst economy is decades. Fact is, this economy was created. The job losses with the closure of thousands of auto dealerships was unnecessary as with the job losses in the gulf due to the moratorium on drilling. Those people do not need retraining, they need the government boot off the neck of the industry in which they work. How many people starved during 5 year plans Stalin instituted? Marxists are marxists no matter what their skin color or what political party they claim to represent. Men who have not experience in business are trying to control how business operates. The results will be disaster if allowed to continue. Most of the commenters here are blind to the truth by ideology wanting to blame the messager. It is the message we understand and reject.

“What to do? Stimulate small business, that’s where the jobs are going to come from. Unfortunately small business is running scared from the Obama agenda.”

Small business’s ability to bring us out of recession has been vastly overrated. As is the Obama’s administration “anti-business” bonafides.

@Zels

“Ben Stein said people are unemployed due to the worst economy is decades.”

Actually, JJ said that. What Stein said is:

“The people who have been laid off and cannot find work are generally people with poor work habits and poor personalities. ”

How long you been on unemployment, Zels?

Zels — According to your theory, George W. Bush was a Stalinist out to destroy the American economy, since everything you described (except for not bailing out auto dealerships) happened under his watch.

Poor Ben Stein. Liberals don’t like him.

He has a point about some of the unemployed. I just fired a guy who cost me more money than he ever made me and he acted like I was tyrant for not keeping him employed. If you guys are going to throw out anecdotal evidence I sure can too.

I hardly see how small business is overrated as far as bringing us out of recession since so far small business has been ignored. Well maybe those crony capitalist firms with a congress critter in their pocket can get a sweet deal but those are few are far between.

I hear lots about loaning money to business but loans don’t make profits they just hold off creditors. Tax cuts keep money in the business and spur investment. I know the lefties don’t like tax cut talk but there it is raising it’s ugly head for you to take a whack at.

Face it, what they have done has failed so maybe the conservatives know the right way to get things back on track.

You know Steve, if you would do a minimum effing google search….instead of consulting your glands:

You are at a minimum moving the goalposts there Steve. Stein said “But in general, as I survey the ranks of those who are unemployed.” He did not say “some.”

But then that kind of twist seems typical for you now, as you look for any way to pretend that some new change since January 2009 made all this real.

Sam, I don’t think your links make it into Steve’s carefully constructed alternate reality.

Hiring tax credits don’t encourage businesses to expand. Hire for tax credit this year, get hit with a huge expense next year and every year there after. And neither do ever changing capital gain tax breaks (that only encourages the sale of small businesses unless it somehow attaches to a new business and remains with the investment until it is turned over.

What will encourage hiring is hope and optimism in the future of their market. A belief that sales will pick up and business will be permitted to flourish. Obama has gone so far in his rhetoric war on business that only a dramatic change will give any cause for the small business owner to hope. Maybe, a complete sacking of his economic team from Geithner on down but who on the Left hasn’t been shouting the same anti-business party line? A change in congress might help but we’ll probably have to wait until Obama is ousted from office or has a Clinton change of heart. In any case, things are going to get a lot worse before they get better.

Obama has the legislative and regulatory state running amok.

This substantially increases risk and uncertainty. It is risky for companies to hire or expand until they better understand the impact of obama’s policies on their business so they are not going to hire.

All My Business Problems Diagnosed

Clipped part of the quote, here it is with the missing part included.

I think that increasing aggregate demand is certainly part of the solution but I doubt it’s the entirety. How else can one explain the phlegmatic job creation over the last 10 years? There’s been no lack of demand but the demand hasn’t served to spark job growth, at least domestically.

As I’ve suggested over at my place, look at the graph above more critically. Rather than looking at the increases in the unemployment rate in the mid 1990s and the early 2000s as anomalies think of the decreases in unemployment of the late 1990s and the mid 2000s as the departures from trend. They were, after all, the consequence of two bubbles, the dot-com bubble and the housing bubble.

If that’s the case then we’ve been off the rails for the last twenty years rather than just the last two or three. I’m not trying to minimize in any way the pain of those who’ve been unemployed for extended periods over the last couple of years. I’m suggesting that the problems with our economy are much, much more basic.

“all my employees are retired, so they already have health care plans, but that does not affect the penalty”

That’s false, as I documented at the site you reference. He will be liable only in the event one or more of his employees purchase their health insurance via one of the state exchanges, and receive either a subsidy or a tax break in aid of the purchase. If they get their insurance via some other mechanism than an exchange, no liability. And since they are all retired and have insurance already, if they are on Medicare, no liability attaches, since Medicare does not now nor will then be connected with an HCR insurance exchange.

Dave Schuler is right to treat this as a long term issue. Policy changes play into that, of course, but this isn’t something that just sprang full force out of Obama socialism.

Sam,

You assert, based on one source, that the penalty does not apply to his company.

I think the business owner and his accountants are likely to have a better understanding of the policy since they are familiar with their circumstances and it impacts them directly.

Even if you are correct there is likely to be litigation before rules are finalized which means the uncertainty continues for years.

Furthermore, if you are correct, all that has to happen is for one of his employees to purchase insurance via a state exchange and he is liable for $800,000 penalty.

Since he has zero control over his employees decision to buy insurance the obama regulations represent a huge financial risk to his company.

This one small example shows obama’s regulations are huge disincentive to hiring and are hindering economic recovery.

“Furthermore, if you are correct, all that has to happen is for one of his employees to purchase insurance via a state exchange and he is liable for $800,000 penalty.”

True enough, but liability would attach only in the event he does not offer an insurance plan to his heretofore uninsured employees, that is, if he decides to throw his uninsured employees — if there are any — on the government’s tax-supported exchange. (BTW, you’ve got have more than 30 employees, I think the number is, to be liable under these provisions.) And note, he claimed all of his employees are retired, and this was the predicate of my counter-argument.

Ah, I stand corrected, the minimum number of employees is 50, with part-time employees (<30 hours/week) counting, though the employer is not required to offer insurance to part-timers.

It’s not my glands that I consult but rather news articles, fellow businessmen, and experience as an employer and business owner. If an “effing Google search” is where all the answers are at I would suggest Obama get on his laptop and fix this economy. What he’s done is not working. That’s the “effing” bottom line.

Where oh where to begin. I will give you a graph.

http://www.bsos.umd.edu/socy/vanneman/socy441/trends/unemp.html

In the 1970’s inflation, interest rates, and unemployment went up. That inflation was started by the LBJ “guns and butter” economics. Nixon tried dealing with inflation and failed with his ‘wage and price controls.” Ford failed with “WIN” buttons, and Carter did not know what to do. However, Carter did get Paul Volcker in as head of the fed in his last year and under Reagan, Paul Volcker raised interest rates to 21.5% to beat inflation and to make a long story short, we enjoyed some 25 years of economic recovery. Now, there have been hiccups along the way and you will have recessions. However, the trend line was lower unemployment for some 25 years.

And to make another long story short is that Bush created another “guns and butter” economics. You cannot spend, have tax cuts and a war at the same time without paying for it. So Bush created “deficits and debt.” And that alone has put our country into trouble for many years.

Even more dangerous was the Bush “stay the course” tickle down theory. While we had the tax cuts, our country (infrastructure) was ignored, we sent our money to Iraq, and we sent our jobs overseas as “free trade” took hold. So we had the tax cuts, but all these problems piled up negating what tax cuts were supposed to do. I cannot emphasize enough that 2 billion cheap laborers are willing to work for a dollar an hour and that we have lost some 2 million to 4 million jobs. Factories are closed and cities and states are going broke. Cities and states give tax credits for factories to stay, cities and states want dreamed up jobs as jobs leave the country, like casinos and cash for clunkers and bailouts.

Two other problems is that you have to ask yourself, can we have more tax cuts when we already had tax cuts? And can the fed lower interest rates when they have had low interest rates for a long time.

To me, this is an exact example of the roaring 20’s (although I did not live in this time). The stock market went up and everyone partied. Nobody during the Bush administration was concerned with all our problems. We sent our jobs overseas as we were told “free trade is good.” We sent our money to Iraq, and after all, we can take care of the whole world. And maybe this was the Military Industrial Complex that Eisenhower warned about. And we neglected the infrastructure, which is typical of laissez-faire economics. Just have tax cuts and all our problems are solved. But now we see, that relying on ideology are for fools and we will suffer many years for it.

I live in a small town and we lost some 2000 jobs. Three major factories closed. And many, many more factories closed throughout the Midwest. And with those loss of factory jobs, you cannot have a small business as you have no traffic and people are just unemployed. So, what we do know, is that small towns will be the most distressed areas and talking of small business is more or less useless. The larger cities can diversify, while small towns will wither away.

When we have unemployment down to 5%, the markets get overheated and it gets harder to maintain or sustain the good numbers. During the good times, it is advisable to cut spending, and I think, always we have to invest in our future. And especially in times of globalization.

There is simply not enough jobs to go around. Not in our country as we gave our jobs away. And not for the 2 billion people who want jobs at a dollar an hour. We can no long run our country on an ideology. It will take many things to make it all work. And our country is behind some 20 years in enacting programs to advance our nation.

It was mentioned that we should support small business. I have no problem with that, however, small business cannot build in a town with the factories closed. Small business will hire a few people, but not the 500 or 1000 people that we employed in one facility. And small business will not pay as much as in the factory. We not only lost jobs for people on the line, but we also lost the jobs in the front office of draftsmen and engineers and other support people.

Other countries are bringing in their electric cars, more than likely subsidized by their governments to build a better battery. We are just starting to build a plant in Michigan for this purpose. McDonalds has experimented with a drive thru in which you order your hamburger by talking to someone in India. The internet has changed things for both good and bad. You no long need human resource people as companies want you to go on the internet and find things for yourself. I see no reason to have insurance adjusters, if you can send a picture of your car or house to China and someone can make an estimate there.

The pundits embrace “free trade” and say it is fine for you to lose your job. And there are lots of WalMarts to go to. And all they say is just have tax cuts and all will be fine. These are the nuts that are running our country.

Someone mentioned that we have an Oligarchy. I for one, believe that is what we have. A few elitists are running our country and we are losing the middle class.

We have a financial war with other countries. If we give up our jobs, then we need jobs to replace them. So what are those jobs? How many different ways can you make hamburgers. How many auto stores are necessary in a four block area? (O’rellys, Autozone, & Advanced Auto Parts) And if you drive one business into bankruptcy, where do the people go to?

And I have said all along, that you need to invest in your country, in your people, and in the future. And that should have been done 20 years ago as globalization took hold. We are behind the eight ball and it will take 10 to 20 years, if we get our act together, to rebuild our country. I don’t think Obama has done enough as he got boggled down with his healthcare. You need a president that is more articulate and forceful to understand the kind of shot in the arm our nation needs. As it is, we will see a generation of workers that will fall out of the workforce. It takes time to rebuild. But as I said before, 2 billion people control our jobs and wages. Cities and states cannot do much against such numbers. It has to be up to Washington and I am pessimistic about that.

Here is another example of how obama’s actions have worsened the unemployment situation.

IG report says Obama GM, Chrysler moves needlessly accelerated job losses

Duracomm says:

Wednesday, July 21, 2010 at 18:50

“President Obama’s push for General Motors and Chrysler to close thousands of dealerships across the country as part of their government bailouts”

Does the report ACTUALLY say this or is this an “addition” by you or someone else. Given that this whole operation was being run by the managements of GM and Chrysler (who have been trying to reduce the size of their dealer networks for years) and a govt task force I find it unpersuasive that President Obama pushed GM’s and Chryslers management to reduce their dealer networks. I’ll await your answer with interest.

Dave Schuler says:

Wednesday, July 21, 2010 at 13:22

This is not principally about “training,” it’s about creating demand in the economy to boost the size of the workforce.

“I think that increasing aggregate demand is certainly part of the solution but I doubt it’s the entirety”

I’m not disputing that the US has wider structural problems but in the short/medium term demand in the economy is the problem. There’s no doubt the expansion of the Bush years was much less effective at creating jobs than the eight years of Clinton (around 7 million jobs versus more than three times that number in 1993-2000) and of course all the Bush jobs were subsequently lost in the recession that started at the end of 2007. I could write a book about the reasons for this and our longer term structural problems but why add to the pile already out there. I’m sure your familiar with at least some of them!

Steve Plunk says:

Wednesday, July 21, 2010 at 16:51

“What he’s done is not working. That’s the “effing” bottom line.”

It’s working a hell of lot better than doing nothing or cutting payroll taxes which was all the opposition proposed. Or with your considerable business experience don’t you consider a GDP number that moves from -6% to +3 April over April not progress? Actually this recovery looks pretty much like every other recovery I’ve experienced (five of them) while managing small and medium sized businesses, a bit of a switchback, or have all your recoveries been straight lines?

Brummagem Joe said (in blockquotes with italics),

If you had bothered to click the link and look at the information I provided you would have discovered it was the report said that.

Once again If you had bothered to click the link and look at the information I provided you would have found

Next time click the link and you won’t have to wait with either interest or boredom.

TARP Audit Questions Rush to Close Auto Dealers

Sure. We’re in a recovery and Obama’s policies have helped the economy. Somehow….. errrr, right? I know, he’s increased the public sector employment tremendously. More folks in the wagon, fewer folks pulling. Health care was ever so much more important, you see. Got that legacy to think about, ya’ know?

Duracomm says:

Wednesday, July 21, 2010 at 20:13

As I suspected you distorted. Your original version of what was in that IG’s report :

“President Obama’s push for General Motors and Chrysler to close thousands of dealerships across the country as part of their government bailouts”

By your own account what it actually said was:

“President Obama’s auto task force pressed General Motors and Chrysler to close scores of dealerships”

There’s a substantial difference even if you don’t comprehend it. The qualified people not Obama took this decision. And the last para confirmed what I said about manufacturers desire to close dealerships. Not surprising really since GM and Toyota were selling about the same number of cars and GM had almost twice as many dealers which has huge ramifications for auto distribution economics. Barofsky is arguing against a sound business decision essentially on social grounds.

“President Obama’s push for General Motors and Chrysler to close thousands of dealerships across the country as part of their government bailouts”

Um. I hope this wasn’t said by someone who opposed “bailouts,” and by extension wanted them all closed.

(We only have the remaining dealers we do because we taxpayers are subsidizing them.)

Brummagem Joe said,

By your standard Bush has no responsibility for the katrina response or iraq because the qualified people not bush made the decisions.

Maybe not

Obama Car Dealer Closures

The bankruptcy courts have decades of experience and expertise handling situations like the financial crisis at chrysler and gm.

Obama decided to bypass the courts in a political ploy. Obama now owns the job losses an negative economic consequences his political decision caused.

Brummagem Joe said,

You might want to look up the definition of qualified. I’m not sure it is an accurate description of the people on obama’s task force.

The 31-Year-Old in Charge of Dismantling G.M.

Duracomm says:

Thursday, July 22, 2010 at 09:03

“Barofsky says the administration insisted on the closings even though a GM official told him”

And who was this mysterious GM official because it certainly wasn’t the CEO and board of GM who made reduction of the size of their network a major element of their restructuring plan and as you pointed out Barofsky himself acknowledged that reductions were necessary:

“Barofsky…. said both carmakers needed to shut down some underperforming dealerships.”

Having worked in the industry for about 15 years, if this guy actually said reducing the size of their dealer network was not going to affect the economics of GM’s distribution and their cost of managing the network, he’s a complete idiot. And it’s very clear you yourself have not much understanding of how managing a distribution network of thousands of dealers works.

” The 31-Year-Old in Charge of Dismantling G.M.”

And I’d add that if you think one person (of 31 or 90) was sitting there making all the decisions about how GM was going to be restructured legally and operationally this rather confirms my comment above. In fact the entire restructuring has worked out better than most people expected or hoped. GM has been saved (although many on the right wanted to let it go out of business). It has massively cut capacity and is succeeding in the market place. Later this year there is going to be a public offering and since the business is estimated to be worth around 70 billion at the moment the country looks set to recover its entire investment.

Duracomm says:

Thursday, July 22, 2010 at 09:03

“Obama decided to bypass the courts in a political ploy. Obama now owns the job losses an negative economic consequences his political decision caused.”

And something else you obviously don’t understand. No courts were bypassed and politics were not involved. GM went through an expedited chapter 11 proceeding to which all the interested parties had to agree beforehand. I’m bound to say you have a very strange idea of how the world works. Do you honestly believe Obama was actually involved in the minutiae of how all this was managed?.

Brummagem Joe said,

Needs cite

And that cite needs to account for the tens of thousands of job losses caused by actions the obama administration.

In fact you need to provide a lot more cites. All you have done so far is rhetorically wave off the information from the inspector generals reports.

That probably makes you feel better but it does not make that information go away.

Brummagem Joe,

Here is some more information for you to wave away.

Obama and the democrats just keep throwing anchors at the drowning economy. Which is why the unemployment situation is a mess.

Unintended consequences Joe, learn the concept, learn to love it…

And so it begins…

You do know, Duracomm, that the ratings agencies are considered by many, many people to have been deeply complicit in the financial meltdown owing to their uncritical rating of what are now called toxic assets of the banks. You know that right? Right? From the WSJ story:

Boo fvcking hoo. The SOBs are just lucky the DOJ didn’t file conspiracy and fraud charges against them.

Sam,

Read the quotes before getting all indignant on me.

Consumers ability to get loans is likely to be reduced because the democrats in congress passed another bloated bill that is having negative consequences they did not think about.

The democrats have thrown another anchor at a sinking economy, damaging prospects for improving employment.

Boo hoo indeed.

Bullshit. This is always, always, the claim of corporate fellators like yourself — Ooooo, the little guy will get hurt. Funny how that’s never thought about when these big companies are engaging in behavior that genuinely crushes people, as happened in the credit meltdown. In any event, the SEC suspended the rule that new bond offerings have to include ratings from the credit agencies for six months, and the bond (which makes one wonder just what the purpose of the rating is beyond PR). The world ain’t coming to an end:

Sam,

Your article says no problem.

My article says potential problem and cites no bond sales as evidence for it.

That means there is uncertainty which slows risk taking and economic growth.

Well, potential problems…possible problems…possible no problems. This move by the ratings agencies is purely political anyway, an attempt to get the rule overturned or modified. As the article says, the info is still available, as it would have to be, right? I mean if the ratings agencies didn’t publish their ratings, what’s the rationale for being in business? There just huffin’ and puffin’ to get scrutiny off of themselves. And I’m not that taken with the uncertainty thing–businesses always operate in an environment of uncertainty, always. Nothing new here. (Was your article published before the 6-month moratorium as announced?)

BTW, I apologize for the ‘corporate fellator’ remark. That was uncalled for. I really, really shouldn’t post before I’ve had my first cup of coffee in the morning.

sam said wednesday, July 21, 2010 at 14:17

20 minutes later

sam said wednesday, July 21, 2010 at 14:37

This illustrates another part of the problem. If you have the policy wrong you get to correct yourself 20 minutes later.

If the business owner has the regulations wrong he is potentially facing bankruptcy. Not surprisingly business owners are reluctant to do anything until the regulatory uncertainty is reduced.

Yet obama and the democrats continue to increase regulatory uncertainty which slows economic recovery.

One more example of how regulation (by the state this time) kills business growth.

All My Business Problems Diagnosed

“If the business owner has the regulations wrong he is potentially facing bankruptcy. Not surprisingly business owners are reluctant to do anything until the regulatory uncertainty is reduced.”

Ah c’mon, these things don’t go into effect until 2014. Jesus, if he can’t have had it figured out by then, he doesn’t deserve to be in business.

And look, you’re not going to get me to argue that some regulations aren’t counterproductive. But I would certainly argue that what appears to be your position, that allregulations are counterproductive, is false. If you think businesses suffer from uncertainty in a regulated environment, imagine the bowel-dissolving uncertainty they’d suffer in unregulated one. The regulatory regime is something business wants, even if this or that business has a problem with a particular aspect of the regime. (See, Articles of Confederation, failure of, and the economy.)

Sam said,

True but regulatory uncertainty is a completely different form of uncertainty.

Other forms of uncertainty and risk can’t seize your assets and put you in jail. Being wrong on government regulations can result in both of those things.

sam said,

And if the penalty applies what is going to be the result?

He is going to cut employment as much as possible and he is going to start cutting employment long before the regulations start.

Automation might not have been cost effective otherwise but a $2,000 per employee penalty buys a lot of automation.

More jobs killed by obama and the democrats.

Update on the Arizona Minimum Wage