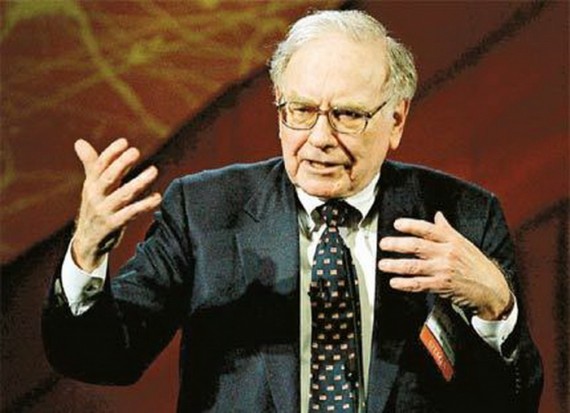

Warren Buffett’s “Super Rich” Tax Would Cover Seven Days Of Federal Spending

Herbert Grubel pours some cold water on Warren Buffett’s idea of taxing people like him to pay down the national debt:

Warren Buffett is known as the Sage of Omaha for a good reason: his outstanding ability to find profitable investments that took him from a small portfolio owner to one of the richest people in the world.

Recently, he used his formidable reputation to suggest in the New York Times, Financial Post and an interview with Charlie Rose on PBS that the U.S. government should raise taxes on the 400 super-rich, who in 2008 together earned $90.9 billion and paid only on average 21.5 percent of it in taxes. That is lower than the average percentage paid by most middle-income Americans.

Buffett justifies his proposal on the grounds that the present tax system is unfair, parroting the mantra of tax-addicted interventionists and socialists everywhere. He said “It will not be pretty” in response to Rose’s question about what he thinks would happen in the United States if the present unfairness continues and unemployment remains high. What does he mean? Will there be riots in the streets or the proletariat rising to shed its shackles?

Buffett correctly notes that the proposed tax increases will do little to alleviate the present fiscal problems of the United States. If taxes on the super-rich were raised so that they paid not the present 21.5 percent but 50 percent of their incomes, revenues from the top 400 earners would go up by $26 billion (one half of $90.9 billion minus the present $19.5 billion). Since this year alone, the U.S. federal deficit will be around $1.4 trillion, or $3.8 billion a day, the new revenue would cover less than seven days of deficits.

The numbers are even worse for total federal spending. In 2010, that amounted to $3.6 trillion or $9.7 billion a day. Buffett’s new taxes up against that would be gone in just 2.7 days.

So then what would be the purpose of adopting a policy idea like the one Buffett proposes? Outside of some desire to soak the rich, there really isn’t one. It’s not going to solve our fiscal problems. Only cutting spending and wholesale tax reform are going to accomplish that. More importantly, though, the truth behind the Buffett tax points out that no tax increase that concentrates merely on “the rich” is going to accomplish anything.

It’s actually worse than your headline suggests, Doug. Go back and look at the math. Taxing them at 100% (presumably a one-time proposition) would fund the federal government for just about two weeks. Taxing the top .1% (millionaires, roughly) at 100% would fund the federal government for just a bit longer.

Proponents of increasing taxes on the wealthy promote it because it would “fair,” not because it would have any significant impact on revenue.

I know GOP Congressmen who take a certain stance are considered, variously, intransigent, unrealistic, innumerate and other unsavory characterizations, but this point, that greatly increasing income taxes on the wealthy would be ineffective at balancing revenues and expenses, just goes to support their stand: only expenditure reductions will get the federal budget under control. Tax increases would have a negligible impact.

Of course, the biggest opportunities to reduce spending are pretty much limited to the sacred cows of government programs, so that’s really the barrier to finding a budget solution. Increasing taxes just ain’t gonna do it, as shown by the reasoning in this post.

@Dave Schuler:

It’s even worse than that: Buffet’s 50% proposal wouldn’t fund Federal spending for 7 days, as the headline suggests – just the deficit spending.

Funny, we keep being told that we have to slash social security, and when it’s explained that doing so will have no effect on the deficit, those who push for the cutting insist that every little bit is necessary. We’ve got to eliminate unemployment benefits, and even though doing so will have only a small effect on the deficit, well, it’s one piece of a bigger plan.

But raises taxes on billionaires? If it doesn’t put us into surplus immediately, then we shouldn’t even think about doing that. But the rich are sacred, and they must keep ever cent that has ever crossed their fingers. If poor people have to die because they can’t get health insurance, that’s a small price to pay.

Oh, and maybe you think that a small tax increase on a tiny number of people who will never feel it and manages to cover almost one fiftieth of our annual budget is almost nothing, but it sounds pretty good to me!

Taxes won’t do it. But you cannot maintain any sense of shared sacrifice if you’re asking grandma to cut her pain meds while billionaires enjoy tax breaks.

This isn’t a negligible concern. If people are going to take a hit in benefits and higher taxes on the middle class, it is absolutely vital that our corporate overlords are seen to be in it with us. The alternative is genuine class warfare.

The rich need to realize that while “they” have the money, “we” have the votes. Populism can turn against them very quickly, and there is more to tax than income — there is wealth. Smarter to give way on income taxes now.

@michael reynolds:

I agree.

WR:

Social Security is a red herring. The real dog in the manger is Medicare and healthcare spending, generally. Too bad we didn’t get the healthcare reform we needed.

Is this a joke? You’re REALLY saying that the standard of a good idea to lower the deficit is that it lasts for months of the federal budget, or some other ridiculous idea?

There is no magic bullet. Buffet didn’t claim this was such. This is one of many things that needs to happen to balance the budget. None of the individual ideas that have been floated fix everything on their own, like raising retirement ages, cutting out tax loopholes and slowing entitlement spending growth, but pack them together and you get a plan that turns that upward line of debt to GDP and aims it downward.

*Sigh*. If there were a magic solution to the budget deficit, we already would have implemented the magic solution to the budget deficit. Cutting entitlements (only to people under 55 of course. Don’t fear voting population, we’d never make YOU uncomfortable in any way), doesn’t solve the problem immediately either. The solution must be some combination of increased taxes, fewer loopholes and deductions and decreased spending. That can’t be done until the nation is willing to have an adult discussion about what the proper role of the federal government government is and what cuts or tax increases will actually mean.

Of course cutting services is wildly unpopular, as are tax increases. The fact that politicians will tell people that they can somehow reduce taxes, reduce spending and increase or maintain levels of service ensures that both of these will remain so. Of course the fact that people are so innumerate as to compare government spending to balancing your checkbook or running a private business doesn’t really help.

Do you actually have any ideas that buy more than seven days?

I think as a single component, this is excellent.

@WR: Fact free, inaccurate, misleading, emotional strawman much?

@michael reynolds: Wouldn’t some form of flat tax (not necessarily The Flat Tax) or even a national sales tax with appropriate levels of tax credit for low income folks be the fairest way to do this, rather than trying to find a “fair” way to tax everyone at their own particular rate?

Be careful what you wish for, Michael. Your argument is: “if you don’t let me stab you with a knife, I’ll shoot you in the head. Pick one.”

Wealth taxes have had terribly destructive effects around the globe, and benefitted the poor or middle class not a whit.

The invective needs to be turned away from those most capable of creating wealth, and turned on the politicians who simply seek power by offering people the opportunity to rape the rich to give handouts for votes. Its always thinly cloaked as “caring,” but its just crass self interest by the political class.

And as the oh, so simple math shows, the practical benefit is next to nil. But the corrosiveness to society, and the inevitable encroachment on the vast volume of taxpayers – the middle to upper middle class is obvious.

But then again, Lucy got to pull the football away how many times??

Yes it is Dave, but it is one too many conservatives keep talking about. As to healthcare spending… The ACA is a start. Maybe you don’t like it, but it is a start. Generally the GOP plan for less healthcare spending is “You people, over there, you have to spend more.”

Maybe Boyd, maybe, but the devil would be in the details. How about this for a start: End the Bush tax cuts, all of them.

This is the kind of libertarian nonsense that needs to end. They are not “creating” gold or diamonds or anything else, they are just moving money around, and the only “wealth” they are interested in is their own. If laying off 500 employees will improve their bottom line by 5%, guess what happens?

This is how I have always looked at it: I have one job and one job only: Make my boss money. In return I ask for one thing and one thing only: More work (at a decent wage, w/ benefits in a safe work environment).

Guess how that deal works out.

@Drew: I’m not wishing for a wealth tax, I’m saying that the rich need to understand that things can be a hell of a lot worse for them and it can turn a lot faster than they think. You should be thanking God Obama isn’t the socialist the far right claims he is — there is enormous hostility to the bankers and brokers and others who helped to get us into this fix and with little more than rhetoric this could be focused and made dangerous.

And please, I’m not a numbers guy, but even I know the rich are better off taking a hit on income rather than a tax directly on wealth. It’s not knife vs. gun, it’s a mild flu vs. cancer. What you and the rest of the Galtians need to figure out is that the middle class and working class have all the votes, and votes are all it takes to start coming after property and not just income. The control the rich exert over government is almost complete — but it can be shattered very quickly.

@OzarkHillbilly:

And that’s different from anything else…how?

The point behind my brand of tax reform is mostly eliminating the details. Each detail creates winners and losers anyway, so it seems to me just as useful to truly minimize the details (for an income tax, let’s say the details are the percentage and the amount of exemption, or preferably, credit), apply it to everyone and say “We’re done.”

I know, I know, pipe dream.

@Boyd:

A flat tax accomplishes what, exactly? Do you think it convinces a guy who makes 45K a year and pays a flat rate of 20% that he’s in the same boat with a guy who pays 20% of a billion dollars a year?

I don’t see it. A flat tax means the mom working at Wal-Mart gives up her lunch and doesn’t buy her kids clothes for school. For the billionaire it means he gives up the parsley garnish on his filet mignon.

I think Doug cut off an important paragraph:

The rich are different than you or me, they are not anywhere near as dependent on “income.”

@michael reynolds: That’s the whole “we have to make it fair!” approach, Michael, and that’s a position I just can’t abide.

Plus, you’re presuming that the dividing line is drawn in such a way as to produce the result you’re warning about. The solution to your dilemma is to move the line (or “a line”). My point is to limit the number of lines to, say, two.

Two lines is highly regressive. It only leads to more of the massive income inequality that is choking demand today.

@Boyd:

I think you’re missing Michael’s basic point, Boyd. It’s a prudential one.

For the billionaire it means he gives up the parsley garnish on his filet mignon.

Not really. He still gets that, while the poor kids starve.

@Hey Norm:

Why? Because you say so, Norm? And further, do you mean that the tax code must be complex to not be regressive? I’m gonna have to call BS on that one, if that’s what you’re saying. I can give you tons of examples of simple, progressive tax approaches (which is not to say I favor them).

@sam:

Your gonna hafta flesh that one out for me a bit, sam. I’m not sure what constitutes a “prudential point.” Or do you mean a “prudential approach?” Or something else entirely?

@Dave Schuler: Social Security may be a red herring in terms of budget debates, but there’s a big chunk of the Republican party that has been trying to eliminate it since its inception, and they’re using the budget battles as a way to do that now. They long for the good old days when we were morally pure and strong, which since to be R-speak for letting old people die in the street.

@PD Shaw: This is why we need to raise taxes on capital gains and inheritances, as well. Problem solved. Next?

@Drew:

This is the thinking that got us running a government on air (or more accurately, debt).

Of course higher taxes work, and of course they can balance spending. They have in the past, ipso facto, they can again. In the face of that though, we have denial of the rational universe. What happened before is impossible, because it is (now) ideologically abhorrent. Never mind that olde time conservatives and Republicans signed on to those olde time tax rates.

(The idea that since X is not by itself a complete solution does not actually refute that X can, or should, be part of an integrated solution.)

@ Boyd…

I’m all for a simplified tax code.

If you can come up with a two line code that is not regressive, and does not continue the attack on the middle-class, then you have my vote.

@Hey Norm: There’s nothing new here, Norm. Set a percentage and rebate amount that works out. For instance, and for illustration only, a tax rate of 20% and a rebate amount of $10,000. Everybody gets the rebate amount (there may be a better term, but that’s not important), and everybody pays the percentage.

Someone who earns $0 pays no tax, but gets the rebate amount. So using my sample figures, someone who makes $25,000 pays $2,500 in taxes and receives $10,000, for a net income of $7,500. Someone who makes $50,000 pays $10,000 in taxes and receives $10,000, for a net of $0. Someone who makes $1,000,000 pays $200,000 in taxes and receives $10,000, for a net payment of $190,000.

The exact lines would need to be adjusted, but that illustrates the principle. It’s not regressive, and beyond the net income of whatever amount to those earning less than $50,000, it’s not progressive, either (meaning, I should point out, that it’s slightly progressive).

Now, I realize that this has no chance of ever being implemented, because everybody’s ox is getting gored, and there’s no way (or very few ways, more likely) to get ahead of the tax code by manipulation. But that’s why I think “simple” is a good idea, because it limits or eliminates the possibility of manipulation. And that’s why so many people dislike a simple tax code, because it can’t be manipulated to their advantage.

@Boyd:

It’s appealing. But then you’re catching me at a weak moment: I just got off the phone with the IRS who have “discovered” I owe them 30 grand. I’m somewhat suspicious of their discovery.

@michael reynolds: My point exactly. If you make a mistake on your taxes (not saying that you did), it doesn’t matter. You’re responsible for understanding the tax code.

IRS agents who miscalculate, however, can’t be expected to understand such a complex Hydra as our tax code. *shrug*

The problem with wealth taxes is that it punishes the repsonsible and reward the profligate. Any money you save gradually gets eaten away by compounded years of the wealth tax. To a lesser extent, the same thing happens with money spent on durable good or realestate. So you’re better off blowing it as quickly as possible so that at the end of the year there’s no wealth left to tax. You end up with a nation that has no savings, rings up tons of debt, and deliberately blows everything on hookers and beer.

@Boyd:

I was referring to this part of his comment, which I take to be his basic point (@ Friday, August 26, 2011 at 12:09)

I mean prudential in the sense that it would be politically prudent for the moneyed class to be seen sharing the sacrifice. It’s a matter of enlightened self-interest.

@sam: Exactly: prudential. As in, it would be prudent not to keeping provoking people who, in the aggregate, have a great deal of power.

Guys, I’m afraid the premise at the beginning of this whole discussion is just typical conservative slight of hand BS. Buffet didn’t propose raising taxes only on the top 400 earners. He proposed raising taxes on anyone earning over $1M. That’s a huge difference.

MarkedMan:

Thanks for making this important point. Doug’s article and the article he cited are both incredibly disingenuous. Grubel said this:

Doug said this:

Neither Grubel not Doug provided a link to what Buffett actually said:

So his suggestion is not just to “raise taxes on the 400 super-rich.” His suggestion is to raise taxes on the top 236,883 households. There’s a big difference there. Misrepresenting what he said in this manner is quite close to an outright lie, and you should run an update and correct your title.

Doug:

As long as you define “the rich” as only “the 400 super-rich,” then you’re right. But that’s an absurdly narrow definition of “the rich,” and it’s not the definition Buffett is using. It’s just the definition you’re pretending he’s using.

Here’s the purpose: it could raise a ton of money. I did an analysis using a threshold of $353K, rather than a million, simply because the data was easier to find.

If your household income is above that threshold, that means you’re in the top 1%. Aggregate household income of this group is $2.2T. An income tax surcharge on this group could raise about a trillion dollars a year. That’s a hell of a lot more than the $26B you get from focusing just on the top 400.

Raising about a trillion dollars per year would be enough to completely eliminate the deficit within about two years. More details about these numbers can be found here.

So at what percentage does the rate of taxation on the rich become “rape”? 38.5%? 40%? 50%?

Just as many other people can’t abide by the position of everyone paying taxes at the same rate, no matter how many exemptions, credits, etc. are cooked into a plan…

By the way, having multiple rates doesn’t mean that filling out a tax form can’t be simplified…all those lines come from all the deductions and other gimmicks thrown into the tax code…

Warren Buffett is stupid and a hypocrite. I read a report that said his company was in trouble with the IRS because he hasn’t paid his taxes since 2002. If he has so much wealth guilt & thinks everyone should be taxed to death, he should go to pay.gov and make a few billion dollar donations to pay down the debt. If he can’t put his money where his mouth is, he should shut the hell up. Here’s a link to the IRS article

http://nation.foxnews.com/warren-buffett/2011/08/24/buffetts-berkshire-hathaway-trouble-irs

@Dave:

Boy, you have reading problems. That’s not what your link says. It says the IRS has conflict with Berkshire Hathaway about how much should be paid. It seems to be a Fox smear-up of note 15, pages 54-56 in the BH annual report.

I am not an accountant, but that note looks to me like normal corporate and IRS back-and-forth.

@Stormy Dragon: Taxes do not “reward the profligate.” An overwhelming amount of what our government does it to protect and subsidize corporate elites. In fact, many people consider that to be one of the major points of policy after national security and it’s two large insurance programs (social security and medicare.)

@lunaticllama:

… reminds me of how Walmart has gamed the system. They keep people part time and at low wages, and count on them to collect government assistance for the rest of their needs. Essentially, food stamps, etc. become a component of Walmart compensation. Without them, workers might have to decline those jobs.

Walmart has taken something that was supposed to be a path to full time employment, and leaving the assistance rolls, and made it a dead end.

Even if you don’t shop at Walmart you still pay their workers.

This assumes that one actually cares about the deficit as something other that a club to bash Obama with. That lets the tea party types out.

.

Poor Paris Hilton…

You’re right Doug. We’ll have to raise taxes on the middle class, as well. Time for you to pony up and see if you’re really sincere about paying down those deficits, or are merely using your soapbox to whine for spending cuts for programs that don’t affect you while keeping your own taxes low.

Deficits are caused by THOSE people. Never by responsible people with money.

I denounce Al Sharpton so Doug has to take me seriously

So it’s only one or the other? We either just raise taxes or we just cut spending? What about doing both? The 2.7 days is based on 2010 spending, not on what spending totals would be after future cuts are applied.

Tunnel vision is keeping people from seeing that we have to do both, increase taxes and make spending cuts. With this big of a problem, we have to use every option we have available. No more catering to special interest groups or the elite. We are in this together. Personally, I would like someone else to help me carry the fed income tax burden of 30+%. Especially when you consider 30% of my income is a helluva lot less than 30% of Mr. Buffet’s (my hero) income.

(BTW: Think about all the fraud that occurs at the hands of US citizens (including U.S. based businesses, primarily in the healthcare industry) when it comes to programs like Medicare, Medicaid, Unemployment… I think it’s fair to say that it’s not just the government’s responsibility to reduce the high costs of these valuable programs.)

I would like to see the current corporation tax breaks turned into incentives to get companies motivated to hire. Bush’s credits were handed out to send jobs overseas. I think we can make these current breaks contingent on getting our own citizens back to work for a change.