A Hatter as Thin as a Dime

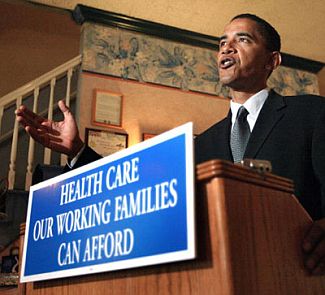

As anyone who’s paid even a modicum of attention over the last year knows, all Barack Obama promises come with an undisclosed sell-by date. So it comes as no surprise that one of the most frequently made of those promises, that those making less than $250,000 per year would not see their taxes increase “a single dime”, has officially expired:

As anyone who’s paid even a modicum of attention over the last year knows, all Barack Obama promises come with an undisclosed sell-by date. So it comes as no surprise that one of the most frequently made of those promises, that those making less than $250,000 per year would not see their taxes increase “a single dime”, has officially expired:

Over the weekend, Obama outlined his support for the Reid plan to impose a “Cadillac tax” on high-end health insurance policies. House lawmakers and unions oppose the fee.

Obama is expected to meet Monday with union leaders, but White House Council of Economic Advisers chief Christina Romer said Sunday the president is not willing to move very far on his position.

[…]

Romer was citing a Centers for Medicare and Medicaid Services report released Saturday that concluded that the tax on “Cadillac” health plans, as well as reductions in annual increases to Medicare providers, have the potential to hold down costs.

[…]

But for opponents of the Cadillac tax that means greater expenses. A proposed exemption up to $23,000 for some workers leaves one in four union employees — including some first responders — exposed to tax hikes, labor leaders say.

This was no casual, offhand proposal, either. It was a centerpiece promise of his campaign. He made the ” not one single dime” promise in multiple debates and reaffirmed it in his speech to a joint session of Congress after his inauguration.

Obviously, several other Obama initiatives impact middle class taxes, as well. But he’s managed to avoid this sort of open, unequivocal betrayal of this promise up to now. The article couches it in terms of its impact on union members, which makes sense since they will be the ones most vehemently opposed. But this proposal will hit plenty of other families making less than the infamous threshhold.

This isn’t a tax on income, it’s a tax on insurers. You may say that’s a distinction without a difference, since insurance companies will obviously pass that tax on to workers with expensive health plans. But those workers are free to purchase cheaper plans (creating that incentive is the whole point of the excise tax.) If they get hit with this tax, it’s their choice.

This isn’t any more a violation of the $250,000 pledge as is the tax on tanning beds or botox.

It is most certainly a distinction without a difference. This is a tax on a decidedly middle class construct that will either directly increase their insurance costs or just decrease their insurance choices when their employers drop the targeted plans. There’s no two ways about it.

It’s the latter effect that is most likely. The excise tax isn’t a violation of Obama’s $250,000 pledge, it’s a violation of his “if you like your insurance, you can keep it” pledge.

I, for one, am glad he broke that promise. The excise tax is good policy.

The GOP tried to say that with all his spending proposal he had to raise taxes directly or indirectly on the middle class. He repeating his unspecific campaign pledge and the MSM let him get away with it. He didn’t specify or seldom said income tax because he would have been called on it.

There are many ways to tax the middle class without touching the actual income tax. They can increase the gas, Social security, insurance, etc plus create new ones like a federal groceries tax, $50 per exemption tax that is not technically an income tax, etc.

End result is most people took his pledge as one that they would see no taxes increase not just income tax. That is what he intended them to believe but left room for political spin for when he breaks it.

Greetings:

Could it be that our current President is unsure about the difference between a “promise” and a “proposal”?

During my days in the bureaucracy, there was a bit if folk-wisdom that went, “You don’t have anything until you have it i writing and maybe not then either”.

Overly literal and silly, Dave.

Am I reading this right? Conservatives are now officially union-friendly?

Unions are, at best, tangential to the issue. That’s more or less explicitly stated in my piece.

Swing… and a miss.

They all lie but haven’t we let them get away with it? Until our outrage increases we will not see a change.

The article linked provides no support for the supposition that this will result in a tax increase for families making less than $250,000 per year–it merely asserts it. I admit that I have not been following the “Cadillac” tax debate that much so I was curious if you could you please provide evidence of same? And from the article linked, is this going to affect too many people not on the government teat already–seems like its mostly people in public service who have these plans.

Get your irony detector tuned, Doddfus.

Sounds almost like Stockholm Syndrome.

After-all the big zerO simply couldn’t be lying![L”O”L]

More confiscation by the least efficient and least competent is good policy???

The context would suggest that you mean sarcasm, not irony (whether you realize it or not). The attempt was not missed, it just failed.

I quoted the article’s discussion of how they’re proposing exemptions for workers making up to $23k (the piece goes on to say $27k is too high). How does that not show that this will impact people below $250k…? Anyway, here’s some more:

But those workers are free to purchase cheaper plans

Elaborate. I don’t have the option to switch plans through my employer. Or I didn’t when I had an employer. Do organizations that offer a Cadillac Plan traditionally offer a cheaper option, as well?

Or maybe they don’t currently but will when this legislation passes. If so, that will cut into the proposed revenue. It incentivizes getting cheaper health care plans. Is this a good thing or a bad thing? I would say “good”, but I’m open to being convinced.

I quoted the article’s discussion of how they’re proposing exemptions for workers making up to $23k (the piece goes on to say $27k is too high). How does that not show that this will impact people below $250k…?

I thought that the article was saying the exemption was for (family) insurance plans costing that much annually, not employees making more than that annually.

A Cadillac Plan is currently defined as $21k. So if they were proposing to raise that threshold, $23k or $27k sounds like numbers they would consider.

The PoliticsDaily article Dodd links to confirms my impression. The $23k is the cost of the insurance plan. That’s a family plan that costs almost $2k a month, all told, which seems like quite a bit. I know that my personal plans have cost my employer and I combined somewhere between $300-500 a month, all of which well under the $8.5k threshold for individuals. And these weren’t bad plans.

Dodd,

In order for the tax to hit, the total cost of premiums has to be greater than $23K per year, and the first $23K is exempted, so the only tax is $0.40 on every dollar OVER $23K. And that amount is paid by employers, not taxed to employees directly.

What are the statistics on how many families making less than $250,000/year will actually see any kind of tax hike? The articles assert “millions”, but I’m with Trumwill–I’m a comfortable, middle-class professional and my premiums, counting both my and my employer’s contributions, don’t even come remotely close to hitting the ceiling.

What are the numbers?

Trumwill, one of the items in the Senate bill was a provision making it illegal for companies to offer different levels of insurance based on affordability. I think the purpose of this was to discourage high value plans for highly compensated employees, but I did wonder when I read this whether it would also preclude more cost-effective plans.

My wife’s employer offers various types of coverage with different deductibles and co-pays. The biggest difference might be between those that offer coverage for childbirth and those that do not. Without any numbers, I would think selection bias would increase the premiums by several thousands.

Alex, the labor unions around here are complaining about this, they are starting to organize and prepare ads based upon the concept that union employees “chose” higher value healthcare plans in lieu of wages and they’re upset that they are getting hit.

Is it true? I think union benefits are probably deserving of some scrutiny here. Are they really negotiating for union-friendly legislation? Do unions force their employees into plans with providers preferred for union-friendliness, and not cost-effectiveness?

PD, if the purpose is to discourage gold-plated plans for executives and whatnot, wouldn’t this tax serve the same purpose? So maybe they can take that (extraordinarily stupid) provision out.

Trumwill, I don’t have a problem taxing healthcare insurance benefits; I’d prefer they tax all such benefits as income.

But I don’t see how the excise tax would discourage healthcare spending if it was directed only at the wealthy. The wealthy are going to spend, what they are going to spend.

The only stats I’ve found is the CBO report that estimates 19% of workers will be subject to the excise tax, assuming that nobody drops or reduces coverage to avoid it. PDF at Page 9 The CBO assumes that many will drop, but doesn’t quantify. In any event, the top quintile of households in the USA currently have incomes of $90,000. (NOTE: CBO report is looking at 2016; my household income data is from last year)

I found this discussion at Wikipedia on Cadillac Plans interesting:

I’ve always assumed that the higher price plans were due to state/region issues, age of enrollees, and pre-existing health conditions. Also, I assume a lot of wealthier individuals might opt for a low-cost plan, coupled with an HSA.

19% of the public is on a health care plan costing more than $8.5/23k per year? Seriously? No wonder we spend so much of our GDP on health care.

I don’t think that it would discourage healthcare spending so much as it would discourage specific plans. I would expect much of the slack to be picked up by people putting the money that they were putting into the health care plan and instead putting them in HSAs. As a fan of HSAs, I don’t consider that a bad thing. As a plan to generate revenue, though, I am doubtful that it will be very successful.

Okay, so apparently they can’t put them in HSA’s without getting similarly taxed. I guess, then, that they will either set the taxed-income aside (maybe a booming supplemental insurance industry will fill the gap) or pay the insurance tax depending on whichever is cheaper. If the latter is cheaper, then I guess it could generate some revenue.

That’s 19% of plans in 2016. Healthcare insurance premiums continue to rise quicker than anything. In ten years,: the average family health care plan in this country is projected to be $23,842.

You are correct; I misread that in formulating my reply. Nevertheless, it will hit a lot of people Obama promised repeatedly would not see a tax increase:

The numbers have changed a little since that article was written, but not enough to dramatically change the results. Whether it’s “good” policy or not is an issue for another discussion. The fact remains, this is a clear violation of Obama’s promise. It was, of course, just as inevitable as the breaking of the “if you like you plan you can keep it” promise, it just came in a different form than expected.

I guess the obvious answer everyone missed is that Obama is embracing the Republican definition of taxes, ie, only income taxes count. Payroll taxes never count in Republican discussions about percentages of taxes being paid.

More seriously, it is intended that this tax will encourage people to move to cheaper plans. If people do this, they will not pay more tax. Anyway, the promise thing is unimportant in this case IMHO. The promise was started before the economy collapsed. When circumstances change, plans change.

Steve

Dodd,

If this only affects 10% of the population, what percentage of that 10% are families making under $250k?

More seriously, it is intended that this tax will encourage people to move to cheaper plans. If people do this, they will not pay more tax.

But then won’t the government lose funds its counting on to bankroll other aspects of the package?

Beyond that, is it a good idea to encourage people to have less health insurance? Why or why not? I thought so until I realized that HSA’s were considered a part of the figure. Now I’m not sure. At the very least, it’s not like taxing cigarettes or something else that is an unmitigated social ill.

If this only affects 10% of the population, what percentage of that 10% are families making under $250k?

As of 2005, $250k comprised of only 1.5% of US Households. So somewhere around or north of 85%.

According to the JCT:

There you go.

Dodd,

Doesn’t that presume that their health benefits stay status quo or that their employers don’t absorb the tax (most likely in lieu of raises)? Presumably there’s going to be some cost cutting in light of the tax.

I’m not sure how thrilled I am about this as policy, but it strikes me that the effects seem pretty limited.

Seems markedly unlikely that employers are going to absorb the tax. Much more likely that they’re going to either (a) pass it on to the employee or (b) find a cheaper health care plan.

Whether it hurts employees or not, (b) is not really a tax. Even (a) could be said to be taxing the employer (and/or insurance company) and not the employee. It may be a technicality, but I don’t think it runs entirely afoul of the pledge. I’m not sure that the people who are suddenly having to shell out more money or are getting inferior plans are going to see it that way, though.

I agree with Alex that it’s pretty limited in scope, however PD has a good point about the rapidly increasing costs of health care plans. Additionally, while perhaps serving a greater good, it seems likely that insurance rates are going to increase independent of this as insurance companies have to compensate for their inability to disqualify people for pre-existing conditions and rescind policies on technicalities. The number of health care plans affected by this tax are likely to grow considerably in the coming years, if this passes.

You are forgetting the game strategy McCain and Obama both had in the campaign. Both pretended no decline in receipts from the looming recession. Both pretended no automatic expansion of spending (food stamps, etc.) from the looming recession. Both published budget projections based on happy fantasies.

And … in a sense of the game, they were right to do so. The American people wouldn’t have wanted to hear it. They would not have elected a candidate so “pessimistic.”

Heck, when Obama got in, and started being more realistic, some idiots argued that he was “talking down” the economy.

How does this relate to “promises?” Well, obviously those two politicians were playing a game. We’d be better served now by them being real.

I guess what I’m saying is that we can criticize politicians for lying, but it’s kind of hypocritical when we don’t want to hear the truth.

What does it matter? Liberals will find 10 ways to give Obama glory and republicans will find 10 ways to show what liars they are…and in the end it’s still just politics that serve politicians first. Splitting hairs and having each camp declare win-win is proof of that.

That’s a dodge, and an ineffective one. 12 million people under $200k is a huge number to have be affected by this. And I’m sorry, Trumwill, but whether it’s directly applied or not, the direct effect (as you note yourself) of this tax will be to raise premiums or reduce choices for those people. Indirect or not, it’s a tax increase for those people. Looking at it any other way is a license to tax us every which way but loose at one remove – our wallets will still feel the effect.

As policy, it’s terrible, as it will directly reduce use of FSAs. The upward spiral in health care costs is perfectly correlated with the steady reduction of the percentage paid out of our own pockets. FSAs keep more costs in the individual’s hands, creating an incentive to conserve – and retarding the increase in costs. We should be encouraging such plans if we’re going touse the tax code to tweak HC policy, not smother them in the crib.

Looking at it any other way is a license to tax us every which way but loose at one remove – our wallets will still feel the effect.

Just because something isn’t a tax doesn’t mean that it’s not a bad thing or that it doesn’t screw the people that have to pay the tax. It just means that it’s not a tax. Technically.

The Republican governor of my old home state did something similar. Promised not to raise taxes, then the early-decade recession hit and there was a shortfall. He raised fees, fines, and all manner of other things… but not taxes. The effect was the same as far as money out of our pockets, but he remained popular in an anti-tax, red state — especially among conservatives.