About that No Tax Increase Thingy

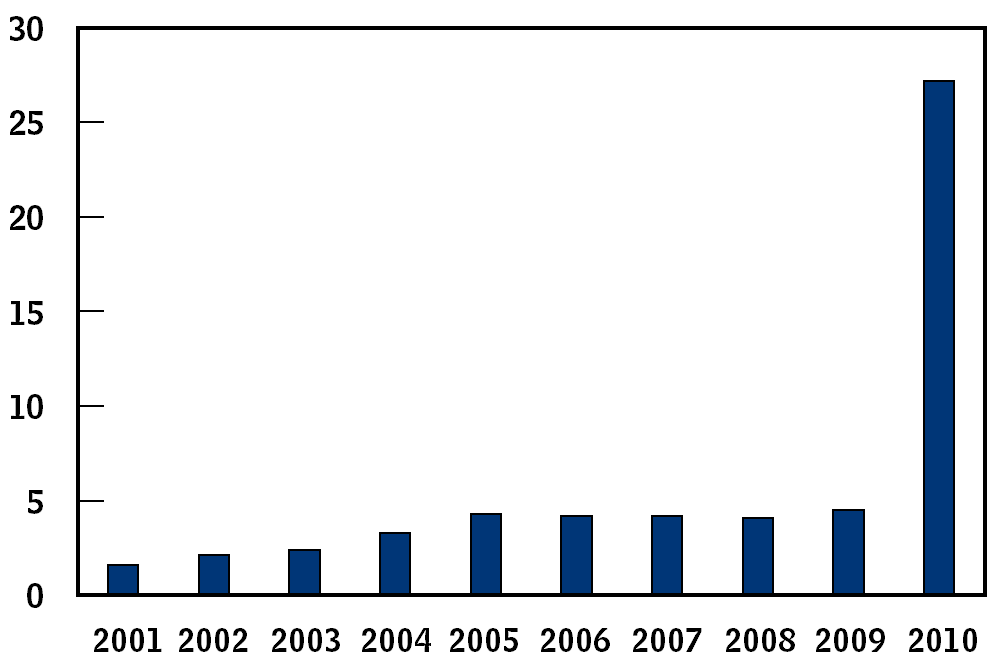

Once Again the CBO is bringing bad news to the Obama Administration. With the expiration of the AMT provisions at the end of 2009, an estimated 27 million people will be paying some amount of the AMT paying on average an additional $3,900 in taxes (granted the median tax increase is probably considerably less). Good news in terms of keeping the deficit low, probably bad news for the Democrats once people realize their taxes are going up solely due to inflation (i.e. you really aren’t richer, its just that inflation has pushed you into a higher tax bracket).

The number of people who will be subject to the alternative minimum tax (AMT) will increase dramatically in 2010 under current law. About 4.5 million taxpayers were affected by the AMT in 2009. That number has been kept relatively small by annual modifications to the AMT rules, but the most recent modifications expired at the end of calendar year 2009. Consequently, about 27 million taxpayers (see figure below)—one out of every six taxpayers—will be affected by the AMT in 2010, paying on average an additional $3,900 in tax. Nearly every married taxpayer with income between $100,000 and $500,000 will owe some alternative tax.

[…]

For the past four decades, the individual income tax has consisted of two parallel tax systems: the regular tax and an alternative tax, which was originally intended to impose taxes on high-income individuals who use tax preferences to greatly reduce or eliminate their liability under the regular income tax.

[…]

For most of its existence, the AMT has played a minor role in the tax system, accounting for less than 2 percent of individual income tax revenues (or 1 percent of total revenues) and affecting less than 1 percent of taxpayers in any year before 2000. Since then, the tax would have reached more and more taxpayers (because, unlike the parameters of the regular income tax, those of the AMT are not indexed for inflation), but lawmakers have intervened each year to slow that expansion. In addition, a series of reductions in the regular income tax enacted starting in 2001 would have caused even more returns to be subject to the AMT were it not for the series of temporary adjustments that lawmakers made to the alternative tax.

Complete CBO brief can be found here (pdf).

It’s not a tax hike if they did nothing to stop tax cut. Or that’s their line of thinking.

Every member of house and senate should have to pay the amt on top of the taxes they pay now. If its good enough for the rest of us, they can shoulder the burden as well. mpw

After WWII we worked the debt down when times were good and would temporarily run it up when times were bad. That changed in 1980. We finally need to become deficit conscious. This is going to be much harder to do now.

We have concentrated our wealth into the hands of relatively few people. They will be effective at avoiding tax hikes. The biggest parts of our budget are Medicare/Medicaid and Defense. Recent events have made these untouchable. If you need something to cheer you up after this, look at state budgets.

Steve

Hate to tell you steve that over half the wage earners in this country don’t pay taxes and most of the taxes paid are paid by just 10% of the people, so who is avoiding what again? How about the bottom 50% pay more taxes and everyone put their hands back in their pockets instead of holding them out for uncle sam to grease. mpw

steve, here’s the national debt by year from 1950 to 1999. I don’t see the pattern that you’ve suggested.

What I see is the debt mostly rising, under Democratic administrations and Republican administrations, during good times and during recessions. Yes, there have been a few years during which the debt went down. But mostly it’s just gone up.

Yeah, yeah. We run through this same song and dance every year. Expect another patch to be passed in a couple of weeks. The 2009 patch was passed in February 2009.

I meant as a percentage of GDP. Forgot to ad that.

Steve

Oh really? Care to provide some proof of that…

ah no this is flat wrong here let me fix it for you.

There fixed it for you with a mention that income tax is only 50% of the total revenue picture.

I don’t think the numbers support that, either, unless you just look at the post-war period. See here. To my eye the longer term view shows that spending goes up in a crisis and never, ever fully returns to the previous prevailing level. So, for example, the spending increase during WWII was never fully reversed; the spending increase during the recession of the early 1980’s has never been reversed. And so on.

Note that GDP has risen pretty monotonically throughout U. S. history so the trend can’t be explained by declines in GDP.

By now we are familiar with the game:

1) it was OK for Bush to pass unsustainable tax cuts

2) any reversal of unsustainable tax cuts is a tax increase

3) wait a sec, Bush wasn’t really a conservative so that wipes out the “unsustainable” part

With this neat emotional logic, cleaning up the mess Bush left is a crime.

1. Bush didn’t pass anything, Congress did. Bush did sign the legislation making it into law. But I see you have bought into the nonsense that the problem is that we aren’t taxed enough rather than that spending continues to increase at unsutainable levels, and it is picking up speed.

2. Again, tax revenue continued to rise even after these “unsustainable tax cuts”, it’s just that spending continues to rise even faster. But tautologically speaking, when the Bush tax cuts expire this year, my tax rates are going up next year, now matter which adjectives you choose to describe them. If my tax rates are going up, I would call that a tax increase.

3. Bush was definitely not a fiscal conservative, or even a fiscally responsible politician, nor were most Republicans or seemingly any Democrats. The wiping out of the “unsustainable” part would seem to be a non sequitur from the antecedent.

As to logic, emotional or otherwise, frankly, you don’t seem to understand the meaning of the word. Just curious, was that inductive or deductive reasoning you were trying to use? Or did you fancy that a syllogism? Please explain how the word crime is justified in this instance.

Well the fact is that no deficit cutting happens without tax increases … end of story. No amount of responsible spending cuts can do it, and tax cut simeply make the deficit worse.

Until tax increases are on the table rational discussion about deficit reduction is moot.

I do not accept your assumptions regarding rational discussion because there is no level of taxation that will meet the utopian schemes already on the table for health care reform, cap and trade, Stimulus I, Stimulus 2, TARP, not to mention Social Security and who knows whatever else we will hear proposed tonight to promote class warfare.

By the way, raising taxes was tried before to cut the deficit when George H. W. Bush was president, but then the promised spending cuts that were supposed to go along with them never materialized. Of course, we know what happened to Mr. Read My Lips, while the lying liars who lied about spending reductions continued on their merry way.