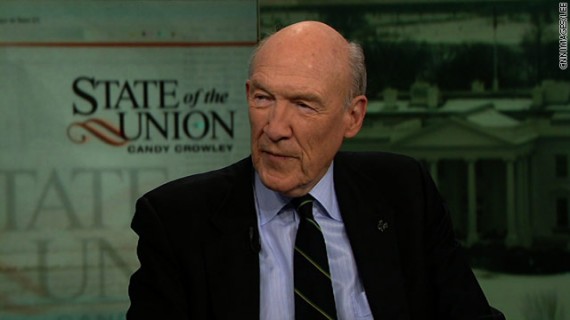

Alan Simpson Calls Out His Fellow Republicans

Alan Simpson is imparting wisdom to his fellow Republicans. I doubt they will listen.

Alan Simpson has always been the kind of guy who says what’s on his mind with little regard for what people might think about him, including his fellow Republicans. Quite honestly, that’s one of the reasons I always liked him when he was in the Senate, and why I’ve appreciated his role over the past two years in connection with the Bowles-Simpson Commission and the nation’s ongoing conversation about how to solve our obvious fiscal problems. Over the past two years, Simpson has fought back against those in the GOP who criticized him for suggesting that taxes should be on the table in any conversation about the budget, held his own quite nicely against those on the left who refuse to acknowledge that entitlements need to be on the table as well, taken on the critics of the plan he developed with Erskine Bowles, denounced the anti-gay rhetoric that seems pervasive in the Republican Party, and criticized those on the right who reject the idea of compromise.

Today, he was on CNN’s Fareed Zakaria GPS calling out his fellow Republicans for their adherence to a “no new taxes” orthodoxy that makes governing impossible in Washington:

In remarkably colorful terms, former Sen. Alan Simpson (R-WY) on Sunday lashed out at members of his party for their unyielding opposition to new tax revenues, whom he described as stymieing a debt reduction agreement.

“I guess I’m known as a RINO now, which means a Republican in name only, because, I guess, of social views, perhaps, or common sense would be another one, which seems to escape members of our party,” said Simpson, a co-chair of President Obama’s fiscal commission, on CNN’s “Fareed Zakaria GPS.”

“For heaven’s sake, you have Grover Norquist wandering the earth in his white robes saying that if you raise taxes one penny, he’ll defeat you,” he added. “He can’t murder you. He can’t burn your house. The only thing he can do to you, as an elected official, is defeat you for reelection. And if that means more to you than your country when we need patriots to come out in a situation when we’re in extremity, you shouldn’t even be in Congress.”

(…)

“You can’t cut spending your way out of this hole. You can’t grow your way out of this hole. And you can’t tax your way out of this hole. So put that in your pipe and smoke it, we tell these people. This is madness,” Simpson said. “If you want to be a purist, go somewhere on a mountaintop and praise the East or something. But if you want to be in politics, you learn to compromise. And you learn to compromise on the issue without compromising yourself. Show me a guy who won’t compromise and I’ll show you a guy with rock for brains.”

Referring to the criticism that President Obama has received from many observers, including yours truly, for his failure to embrace the Bowles-Simpson plan in 2010, Simpson made this argument:

“If he had embraced our plan, he would have been ripped to shreds,” the former senator said. “[H]e would have been ripped by the Democrats, say, why, you rotten — you’re digging into these precious, precious Medicare. And the Republicans would have rejected — if he’d have embraced it, the Republicans en masse in the House would have rejected it. So either way, he’s going to get hammered. So he is playing the waiting game.”

With regard to the tax issue, Simpson is, of course, completely correct.

Given the size of the Federal Government’s fiscal problems and the fact that the nation still remains closely divided on the whole issue of what the proper role of government ought to be, it is quite simply politically unrealistic to walk into negotiations about a long-term deal on the budget saying that one of the largest contributors to the problem is off the table. That’s true whether we’re talking about taxes, entitlements, or defense spending because without these three items all being part of the conversation, it’s going to be impossible to come up with a package that actually accomplishes anything. For confirmation of that one need only look back in time one year to the largely pointless negotiations that resulted from the need to raise the nation’s debt ceiling. Unwillingness by one side to put taxes on the table, and by the other to put real entitlement reform on the table, meant that we ended up wasting two months on non-negotiations only to end the whole process with a non-deal deal and the creation of a “super committee” that everyone knew would never accomplish anything. And now, we have to deal with not only a debt ceiling increase, but also the expiration of the Bush Tax Cuts, the expiration of the Payroll Tax Cut, the extension of unemployment benefits, and the extension of the Medicare “Doc Fix” by the end of this year. The odds that we’ll just get another round of pointless posturing is enhanced by the fact that we’re already in election season and any deal that a Lame Duck Congress makes will be largely influenced by posturing for the new terms to begin in January 2013.

I’m not sure I agree completely with Simpson essentially letting Obama slide on his failure to do anything in response to the Simpson-Bowles plan. To some extent, it is true, the President’s options were limited by the fact that the report came out just weeks after he and his party had suffered a rather large defeat in the mid-term elections. However, this was a Commission that he created, with members that he appointed, and which he sighted repeatedly as something that he supported in the months during which it was holding its hearings. The manner in which he, and everyone else in Washington, essentially took the plan that had been produced and threw it in the trash before the ink was even dry was an astounding act of political cowardice, especially considering that Obama could have used the plan as political ammunition in the battle with the GOP over the extension of the Bush Tax Cuts at the end of 2010. Perhaps something along the Bowles-Simpson framework will eventually be what all parties agree to in a year or two, but it won’t be because of any profile in political courage out of 1600 Pennsylvania Avenue.

I fully expect that Simpson will once again be denounced for speaking the truth. His fellow Republicans, however, would be better off actually listening to what he has to say.

“With regard to the tax issue, Simpson is, of course, completely correct.”

Actually, he is 100% wrong.

I love those Emperor’s New Clothes moments when someone just blurts out the truth.

(One of my favorites was when Reagan called the Soviet Bloc the “evil empire.” Many of my fellow liberals tut-tutted, but I loved it. It was true.)

Alan Simpson has spoken the truth on more than one occasion.

To effectively raise taxes and expect increased revenues, OVER A PERIOD OF TIME THAT WOULD HELP THE DEFICIT, you have to raise them on enterprises that can’t effectively find ways to avoid paying them. This silly mantra by the left to raise taxes on the rich is hollow political wealth envy flatulence. It doesn’t gain a thing as the rich won’t sit around and accede to it; at least not enough to make a difference.

So taxes have to be raised on enterprises large enough to be monitored for compliance. Or they have to be stealth taxes that the general public doesn’t see (VAT?). Politicians, and any of you, are morons if they think they can raise taxes willy nilly and see increased tax revenues longer than a year.

Now that I have opined about the fruitlessness of raising taxes on the rich, I do think it would be useful to do so; simply because the treasury would get a few extra dollars and all the rich liberals would be exposed to reality.

The problem in this country isn’t taxes. The problem is unsustainable promises by selfish people put in power by a dense and indifferent populace. The problem is a centrally planned economy by a secret central bank that has caused the dollar to devalue by 94% since 1913. Politicians make promises whose consequences will fall on future politicians and the Fed prints dollars to satisfy those promises. Bernie Madoff tried it for awhile.

Frankly, Simpson is pissing in the wind about the effect of raising taxes. I’ve always liked is candor, though.

Of course he will not be listened to. He will simply be excommunicated, like all those who violate the Republican liturgy.

Do you actually believe this tripe? I guess being a sock puppet is easier than actually doing some original thinking.

The problem(s) in this country are actually pretty complex. They won’t be solved by spouting right wing boilerplate. We need to increase revenues. We need to cut spending. If we do both, we can put an actual dent in the problem.

I love this nonsense. It’s become an article of faith for people who have never been in any danger of being taxed at the higher rates. God knows why the serfs are so anxious to save their liege lord’s money, but the boot-lick instinct runs strong in some people.

Let me tell you something, Pete: I am the 1%. And you know what happens when my income tax rate goes up? I pay more, that’s what happens.

If the 1% doesn’t pay more at higher rates, why do you suppose we/they oppose the rate increases? Duh?

Now, is it enough? No. And NO ONE SAYS IT’S ENOUGH, least of all Alan Simpson. But it is part of a solution. Part.

Simpson and Bowles couldn’t get their own committee to embrace their plan — why would anyone expect the President to embrace it?

Always remember, whenever someone mentions Simpson-Bowles, it was a failure. There was no report from the comittee.

Republicans are probably less inclined than ever to compromise.

Republicans now believe that they’re going to take the Senate, that Romney is going to defeat Obama, after which they will be better positioned than ever to make the kind of spending reductions and program changes that they dreamed of for decades – begin to privatize MediCare, private retirement accounts for Social Security, Medicaid reductions, rollback the top income tax bracket from 34% to 25%.

The 2012 election has more at stake for Americans than any election since the Great Depression.

@al-Ameda:

I’ve heard that about every election since I started voting almost four decades ago. Maybe its even true, in the same sense at its true as your most important meal is your next one …

Well, as the last Republican President left office, our economy was on the verge of collapse. Romney seems eager to pursue the policies that led us to the edge of the cliff – so maybe this time there really is something to it.

The problem is reality: taxes are going to be increased, spending is going to be cut(Including in things like Medicare and Defense). If not now, when interest rates begins to increase. Believe me, if interest rates goes up it will be fair more damaging than the effects of higher taxes and lower spending.

The problem is that the American Public was pampered by politicians that are afraid of telling the truth.

@michael reynolds: Tell that to Eduardo Saverin.

@anjin-san: How do you increase revenues, oh Great Master? Do you increase rates or do you find ways to put more people in the position of owing taxes(expand the base of tax payers)? Why do you suppose people suggest increasing the taxes on cigarettes to discourage smoking? Or do you tax gasoline to the point where people will begin to not be able to afford it and choose an alternative? The same goes for taxation. If Reynolds is willing to pay more, good for him. Guess he thinks of himself as some sort of martyr.

You are the one who lives in a leftist cocoon where anything that doesn’t conform to your view is “right wing tripe” or any other derogatory slogan you hear from your fellow cocoon dwellers. Reynolds is original and witty in his attempts at take down; you are childish and boring.

Sure the problems in this country are complex. But the basis for our economic problems are just as I stated. I wouldn’t expect you to understand.

@michael reynolds: Michael, you will begin to change your tone and willingness to pay when your rate gets high enough. When the rate on your dividend income and capital gains income gets high enough. Many of you who can “out earn” the tax increases are simply earning more in a liability of diminishing value: the dollar. The reason you are earning more is because the more the Fed puts money into the economy, the higher prices go because there are more dollars bidding up the price of your work. More dollars just means they are worth less. That is the grand illusion under which we live.

The higher the price of everything, the more the government needs to tax to pay for its borrowing and spending. This ugly cycle will end at some point when you realize the dollars you receive for your talent don’t provide you with the value you deserve. So why agree to send more of your hard earned value to a place that is deliberately devaluing your talent?

@anjin-san: @anjin-san:

Who had the purse strings from 2006 until 2008? Bush was a lousy President when it came to expanding government, but the dems had a hand in this mess as well. As a matter of fact, both parties, for 60 years have spent us into the mess in which we live now. So why don’t you do some original thinking and break out of your cocoon to expand your mind?

@Pete: “Michael, you will begin to change your tone and willingness to pay when your rate gets high enough.”

Is that what happened after the Clinton tax increases? Did people stop paying taxes, thereby rendering the tax increases pointless? Or did they pay the tax increases, thereby increasing government revenue and contributing greatly to government surpluses?

@Pete: Please tell us what steps you would recommend to solve the country’s fiscal problems.

@Spartacus: Try this for some perspective: http://www.politifact.com/truth-o-meter/statements/2011/jul/07/barack-obama/obama-claims-job-rate-soared-after-clinton-raised-/

@Pete:

Thank you for the link, but I’m not sure why you think it’s responsive to the questions I asked you. Nor do I understand what perspective you think it provides that would suggest that raising taxes would be either harmful to the economy or ineffective at increasing federal revenue.

In fact, the link you provided includes the following statement: “I think he (Obama) is making the point that higher tax rates, at least at the levels under President Clinton, are compatible with strong economic growth, and the evidence is clear on that.”

Again, my questions to you are: (1) After the Clinton tax increases, did people stop paying taxes, thereby rendering the tax increases pointless? and (2) Or, did they pay the tax increases, thereby increasing government revenue and contributing greatly to government surpluses?

@Jeremy: The majority of people are going to live where they want to live and pay the commensurate tax rates. Plenty of rich people want to live in Manhattan. New Jersey could cut its rates by 25% and it probably wouldn’t be enough motivation for most of them.

Yes. And they are strongly focused on these big changes because they believe, correctly, that this is probably their last chance to make these big changes. Because they know that the long-term demographic tide is very much against them. They tend to be old and white; the old people are going to die, and the country is becoming much less white. Their last hurrah is now.

This is really what they’re getting at when they say things like this: ‘this is our last chance to save the country from complete disaster.’ That idea comes up a lot in their comments in various places.

@Pete:

Sure, but the rate increases being discussed aren’t even close to being high enough to matter. No one’s talking about going back to the 90% rate that was in place when Kennedy took office, or the 70% rate that held through the 60s and 70s, or even the 50% rate that was the top rate during Reagan’s administration. The discussions I’ve heard are of increasing the top tax rate back to the 39.5% of the Clinton administration and increasing capital gains rates to something around 30%. These are hardly increases that are hardly confiscatory levels.

And seriously, you’re worrying about inflation? It’s been under 2% for quite some time now, so inflation isn’t hurting or helping anyone.

@ Pete

I am a little curious about the “leftist cocoon” you think I inhabit. At the moment, I am consulting for three startups. Many of my business associates are directors, VPs, principals, and C level types. OTB is the only political blog I spend any time on, and my daily news reading consists of WSJ and the Economist. I don’t watch cable news. Your assumption that I live in some sort of neo-Soviet bubble is sort of childish and boring. As is your nonsense about wealth envy. Sorry, but it is simply dogmatic garbage.

I am a 10%er who makes a very good living working for 1%er’s (as does my wife). I am very invested in rich folks, working for them allows me to have a standard of living that is far beyond that of almost everyone who has lived in the history of the world. And to be blunt, I probably pay a hell of a lot more taxes than you do. Yet I manage not to whine about it. It’s my buy in for being part of a stable, advanced society that has allowed me to have a wonderful life. I am not going to cry about paying my share, nor helping those less fortunate than I am.

Well, that is a nice bromide, but you have to actually do it in the real world, which is more difficult than talking about it on a blog. Do some reading about an emerging technology – 3D printing. It is potentially a disruptive technology that should help bring manufacturing back to the US. The problem is, the technology does most of the work that assembly line folks used to do. So what you will have is manufacturing plants in industrial parks with most of the jobs (and there won’t be that many) going to mid/low-level IT people and folks working on the supply and fufillment chains. Look at the number of jobs created by Apple’s new data center, the second largest in the world, it’s not a big number. Now why don/t you provide some specifics on how we put folks back to work – specifics please, not slogans or vague ramblings about cutting red tape and deregulation.

And consider that the Bush administration gave business everything it wanted. Look where that led us. Your nonsense about the 2006 congressional class being a causal factor in that train wreck goes in the garbage where it belongs. If you want to peddle that go have a slumber party with Jenos.

Our taxes are at historic lows. Please note that the Bush tax cuts did not ignite growth, but they did ignite deficits. Rich people are not going to flee if taxes go up. For one thing, we are a low taxed nation even with an increase, for another this is the best place in the world to live. You know what rich people will do if taxes go up? They will buy one less vacation home, and skip the McLaren and make due with the Ferrari & the Bentley, and they will be just fine.

@Spartacus:

We’re talking about the possibility of returning to Clinton-era rates. As you may recall, we were doing much better as a country under the higher Clinton rates than we did (and are doing) under the Bush rates.

This belief in low tax rates is quasi-religious. It’s faith-based. There’s no evidence that somewhat higher rates harm economic activity or cost jobs. There’s no evidence that lower rates create jobs or magically generate more revenue. Again: Clinton v. Bush.

This has all long-since been adjudicated. But the brainwashing goes deep. The forelock-tugging of the middle classes is bizarre, but hey, there are a lot of suckers in this world. I suppose I should appreciate the desire of people who don’t make what I make to save me money, but I’m actually a patriot and I want my country to do well. Even when it costs me. Shocking idea in the GOP’s era of greed as the only virtue.

You know when George W. Bush lost me? It’s when he told me after 9-11 to go shopping, and gave me a tax break. My reaction then and now was: f*ck you, I’m an American, and I’m too old to enlist, but I can contribute something. Go shopping? Drop dead.

Yea dude, don’t you know that all you are doing is providing the sanction of the victim?

Damn, that was supposed to be a reply to PETE not SPARTACUS.

Curse you, absent edit button.

@michael reynolds: Yeah, I see your point, but really, you are just an OPINO–one percenter in name only. Why should those on the right pay any attention to you?

“If he had embraced our plan, he would have been ripped to shreds,” the former senator said. “[H]e would have been ripped by the Democrats, say, why, you rotten — you’re digging into these precious, precious Medicare. And the Republicans would have rejected — if he’d have embraced it, the Republicans en masse in the House would have rejected it. So either way, he’s going to get hammered. So he is playing the waiting game.”

Oh come on. The Democrats were no more ready to embrace the findings of this commission than the Republicans were…and it was their commission.

I do agree with Simpson sometimes, but he is just pandering to the media when he makes a point of going after his own party while he lets Obama off the hook. Obama is the president, it his the responsibility of the president to lead…..and that means taking positions that are not always popular with either party.

The problem is that people like Alan Simpson and David Stockman, that do not expect to play any role in partisan politics, are the only people telling the truth. Maybe(Only maybe) a retiring Senator like Kent Conrad or Judd Gregg may say something like the truth. The point is that both taxes are going to go up and spending is going to be cut. Deficits that are as large as the GDP or Mexico are unsustainable.

But, no one, no one, is going to face reality. You know, the last tax increase destroyed dozens of political careers, Medicare cuts are toxic(Remember the Death Panels?)

I’ve noticed a trend here at OTB featuring numerous posts about Republicans bashing other Republicans and the party in general.

So when will we be treated to a post about Meghan McCain’s recent appearance on Al Sharpton’s show bashing the GOP as “extremists”?

lol

Oh yeah, and how about a post about Richard Lugar’s appearance on a Sunday show whining about how the GOP has gotten just too darned rigid?

I mean, just because their senator hasn’t lived in Indiania since the 70s and votes with his DC homies rather than support the interests and wishes of his state, why should he have been kicked to the curb?

And what’s this nonsense about only being allowed SIX terms?

It ain’t right and it ain’t fair!

The GOP according to Lugar: Radical! Extremist! Uncompromising! LOL!

America needs tax reform badly and the Bowles-Simpson plan is the most sensible place to start.

If Congress had implemented the Bowles-Simpson plan when it was first proposed then the tax code would already be simpler, fairer, and better suited to support economic growth. http://bit.ly/GVrWuY

A Bowles-Simpson type “grand bargain,” which leaves no sacred cows untouched, is the best way to get our economy back on track. http://bit.ly/noTDPF

” I guess I;m a RINO now”…

Ummm Alan… when were you NOT a RINO?

Quit wasting our time.

Eric,

You are being ridiculous. When he was in the Senate, Alan Simpson was one of the most conservative members and his record as a deficit hawk during those years is unparalleled. He almost became GHWB’s Vice-Presidential nominee — and I wish he had instead of that non-entity Dan Quayle. It’s not his fault the GOP has taken a long trip on the crazy train.

@Doug Mataconis:

It’s not his fault the GOP has taken a long trip on the crazy train.

Eric had an early seat on that train. You think you’re going to convince him of anything?

@Eric Florack:

Alan Simpson a RINO? By that standard, Reagan was a RINO.

Ironically, it is Tea Party avatar Michele Bachmann who deserves the appellation RINO, her family virtually lives off the government: Michele’s salary and benefits, her husband’s “counseling” practice receives fee revenue from the federal government, and her family’s farm received farm subsidy support from the federal government.

Quite true. If Reagan, the real guy, not the cartoon figure they have deified, was alive today, guys like Eric would probably despise him. And I have no doubt the genial and pragmatic Reagan would loathe today’s “conservatives” and punk slap their asses down the road…

Exactly. But he was. An honest evaluation of his actions indicates that he would not be welcome in today’s GOP.

But if you read the op-ed sections of newspapers in the 80´s you´ll note that most conservatives despised or had a cold relation with Reagan. George Will had a real issue with Reagan´s deficits(He was pretty warm to Dukakis in 1988 because of that), some months before the fall of the Berlin Wall people like Safire still insisted that the Soviet Union was threat. People like Jesse Helms had real issues with him over his policies toward the Soviet Union.

That he was one of the most conservative members of the senate that time, is indisputable. However that’s only a measurement of how far to the left the senate had gone through those years. Which, in turn, is precisely why we’re in the position we’re in today.

But let’s consider this for a moment. If he really was a conservative, he certainly wouldn’t be on any of Obama’s commissions. Obama would have nothing to do with him. And Simpson, for his part, would have dumped the idea back in the Bamster’s lap on principle alone,

@David @ Engage America:

How?

Related:

Probably true. Because the guiding principal for today’s conservatives is “party before country”…

@anjin-san:

The spending cuts never come. If you raise taxes during bad times, then when the recovery actually occurs, the government gets a windfall of new money to spend on new entitlements and new programs. After a couple of times of this cycle, the government will run trillion dollar deficits during a bad time.

Tax increases now for spending cuts later just means that the U.S. gets to being a one party state faster than the course it is already on.

Why not discuss what is the maximum percentage of the GDP that government at all levels can consume and what level of spending is sustainable in the long term.

@michael reynolds:

M.R.

The is a difference between long term and short term. Tax increases raise revenue in the short term but, in the long term, the rich find ways to avoid the.

You live in California. Does having very high tax rates really create balanced budgets and long term fiscal sanity or does high taxes cause shifts in income out of the state?

If we wanted to create federal taxes that would be very difficult for the rich to avoid paying, we could do so. We just choose not to. It has to do with the way the law is constructed. We have the best government money can buy.

1-) It´s much more difficult to do that when taxes are increased in a federal, not a state level.

2-) That´s usually happens when taxes are concentrated among the rich. That´s why taxes are going to be increased to anyone.

@Eric Florack:

Wait… I thought your prevailing logic is that Government has been moving steadily Leftward since Reagan or at least the “Contract with America.” Or are you saying that the 2010 elections moved the Government significantly to the right?

Simpson Bowles will never get anywhere if it eliminates the home mortgage interest deduction.

If you are single, have zero kids, and make over $100 grand, you will absolutely get hammered in taxes as you have little deductions.

I live in LA, so this skews things a bit compared to the rest of the U.S., but it behooves people like me in a high income bracket to buy an expensive house to take advantage of this deduction as these tax advantages also weigh heavily on married couples with no kids when calculating whether to rent or buy.

The only other big deductions for the vast middle class who makes $50k – $100k with no kids ( a big deduction) is the home mortgage deduction and any bill that eliminates this is DOA.

@brad hamilton:

The only way to do it is to reduce the cap (currently it’s capped at interest on the firstr $1 million in debt) then slowly lower it more over time (or simply hold it steady and let inflation do its thing). Just removing the deduction overnight would be terrible policy. Removing deductions would have to be coupled with rate rebalancing in order to prevent a spike in effective taxes on the middle class.

I’m not really sure it’s smart policy to provide a tax incentive for people to go out and get a big mortgage, so I think the deduction should be reduced or possibly done away with entirely, but over time. People have made big decisions based (in part) on this and can’t easily just change course.

But you’re almost certainly correct: DOA.