Another Month, Another Disappointing Jobs Report

The American jobs market continues to disappoint.

Going into today’s release of the August report from the Bureau of Labor Statistics, most analysts were actually expecting some fairly decent news. Based on the upward revisions to 2nd quarter GDP and signs that the auto industry was moving along quite nicely, the anticipation was that the job market was doing relatively well and that we’d see a health job creation number. Some analysts even expected we’d see as many as 200,000 jobs created in August. As it turns out, though, the August numbers weren’t nearly that good, and the underlying data raises real cause for concern:

The nation’s employers added 169,000 jobs in August, slightly below what economists were expecting. The unemployment rate ticked down to 7.3 percent from 7.4 percent, but it fell largely because people dropped out of the labor force and so were no longer counted as unemployed.

In fact, the share of working-age Americans who were either working or looking for work was at its lowest level since 1978, a time when women were less likely to be participating in the labor force.

The report also contained large downward revisions to job growth in July and June. August’s growth was about in line with the average hiring rate so far this year, which has been steady but mediocre. If the economy were to fill the jobs gap left by the recession within the next four years, around 300,000 jobs a month would need to be created, according to the Hamilton Project at the Brookings Institution.

The latest numbers leave in question whether the Federal Reserve will start scaling back its stimulus measures after it meets Sept. 17-18, as Wall Street seems to expect. The Fed has been buying long-term Treasury bonds and mortgage-backed securities in order to keep long-term interest rates low, and the Fed chairman, Ben S. Bernanke, has said that the central bank will reduce the rate of those purchases “later this year.”

Friday’s somewhat disappointing jobs report, released by the Labor Department, came on the heels of some positive economic reports that had helped reinforce Wall Street expectations that “tapering” would come in September.

“We still expect the Fed to go ahead with the taper later this month,” said Paul Ashworth, chief United States economist at Capital Economics. But he acknowledged that the latest jobs report was “mixed bag that can be used to support an immediate tapering of the Fed’s monthly asset purchases or delaying that move until later this year.”

Health care, retail and food services were among the industries that added jobs, while payrolls fell in the information industry. Government employers, which have generally been shrinking in the last few years, added workers in August.

Employment gains in the recovery have been disproportionately in lower-wage sectors like food service and retail, causing concern about not only the quantity of the new jobs but also their quality. The industries are more likely to hire part-time workers and operate on just-in-time schedules, making it difficult for employees to predict how many hours they will have from week to week.

(…)

As of August, there were 7.9 million Americans who wanted to work full time but could find only part-time work. When these workers and people who want a job but have stopped looking are included, the total underemployment rate rises to 13.7 percent.

When you look deeper into the BLS report, though, that 169,000 net job number, along with the drop in the unemployment rate, don’t look as good as they seem. First of all, there’s the fact that the jobs numbers for June and July were both revised downward by a net 74,000 jobs. June’s number went from +188,000 to +172,000, while July’s number was revised significantly downward, from +162,000 to +104,000. Secondly, the drop in the top line unemployment rate number is due almost entirely to the fact that 312,000 people left the job market in August, meaning that the the labor force participation rate fell from 63.4% to 63.2%, a level unseen since August 1978. To put that in perspective, if the participation rate were at the same level it was in January 2009 during the height of the recession, the unemployment rate for last month would have been 10.8%. A related number, the US employment rate stands at 58.6%, the same point it was at in January of this year which suggests that the labor market over the past eight months has been essentially flat.

Now, there are a number of factors that contribute to the drop in labor force participation, including the aging of the labor force and people retiring. However, even factoring that in, it seems fairly clear that there’s a large segment of the workforce that has quite simply given up looking for work. Those people, however, still have to support themselves somehow. Some of them are likely relying on other family members for help, others have sought out government assistance, and some may be lucky enough to have savings to fall back on. That’s not a situation that can last forever, though, and absent some real progress in job creation, which we’ve been waiting for over the past 4 and a half years or so, that population is going to be a problem going forward. Notwithstanding the spin that White House spokesmen are likely to put on these numbers, in other words, this was not a good jobs report.

That’s something that Neil Irwin agrees with:

If you only looked at the headlines on Friday’s August jobs numbers, you’d think “Not bad!”

You would also be completely wrong.

Yes, the unemployment rate fell a notch to 7.3 percent, from 7.4 percent in July. Yes, the nation added 169,000 jobs, broadly consistent with the pattern of recent months.

But in almost all the particulars, you can find signs that this job market is weaker than it appeared just a few months ago, and maybe getting worse. The drop in the unemployment rate was caused by 312,000 people dropping out of the labor force. The number of people actually reporting having a job actually fell by 112,000 in the survey on which the unemployment rate is based.

And while the overall August jobs number was okay, the Labor Department revised down its estimates of June and July job creation by a combined 74,000 positions. In other words, through the summer, hiring has been quite a bit shakier than it had appeared.

Jobs numbers ebb and jobs numbers flow, and as always, it would be unwise to make too much of one report. But this one has enough signs of weakness embedded in enough places that it has to make economy-watchers — including those at the Federal Reserve who meet in less than two weeks — reassess their confidence that a solid, steady jobs recovery is underway.

Consider this: The nation has averaged 148,000 new jobs a month for the last three months. The number was 160,000 for the last six months, and 184,000 a month over the last year. That looks to me like a downward trend, no two ways about it. It’s certainly not the gradual acceleration that most mainstream economists have forecast as 2013 advances and the impact of tighter fiscal policy fades.

Want another sign? The proportion of the U.S. population that had a job in August was 58.6 percent. Six months earlier, the number was a whopping — wait for it — 58.6 percent. The year is nearly three-quarters over, and the economy isn’t growing fast enough to put a higher proportion of its citizens back to work.

You don’t have to squint hard to see evidence that the “nice, steady improvement” theme that has been the conventional wisdom is missing part of the story.

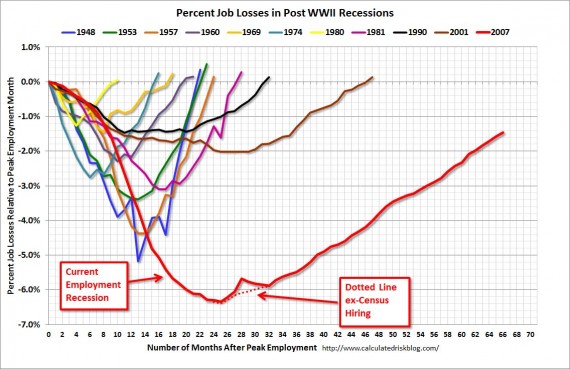

One policy impact of this report is likely to be that the Federal Reserve may end up delaying the “tapering off” of quantitative easing that it has been talking about for months now. The stock market will likely react positively to that given the fact that the only real impact of that particular Fed policy has been to boost stock prices on Wall Street. As these number attest, it seems to be having very little impact in the economy as a whole. At the very least, though, it’s clear that while the stock market has been doing quite well, the economy as a whole is another story. We’re in a recovery, but it’s one of the weakest ones we’ve seen in a long time, something amply demonstrated by what has been called the scariest jobs chart ever:

There’s not really any good news here folks, so there’s no use pretending otherwise.

You say there is no good news, but there is actually no news. After all, you close with the chart that has been my favorite for visualizing the recovery for the last two years. The slope of the recovery line is unchanged.

And as always it comes down to “what’s the plan?”

We know Obama offers jobs plans which are DOA in this Congress.

We know Congress is playing a “wait until 2016” game.

Nothing that another healthy tax cut for the rich, massive deregulation and slashing of government spending won’t fix. Wait until 2016 indeed.

My bet would be thought if the GOP does manage to get control of the government then all of a sudden it will be time to open the flood gates for new spending.

Declaring war on Syria with ineffective strikes guaranteed to kill civilians is unlikely to produce any more jobs.

@john personna:

Exactly this. The great muddling through continues. There is no change here. No momentum shift. And there will not be.

Doug, at this point I have to refer you to the words of The Man in Black:

Inigo: “Who are you?”

MIB: “No one of consequence.”

Inigo: “I must know.”

MIB: “Get used to disappointment.”

Why did the recessions of 1990, 2001, 2007 produce more flattening recoveries, than preceding recoveries?

@Kenny:

The economists have many answers, but I think globalization and automation are the big factors.

With each recession, US companies have looked for cost reductions via outsourcing, directly or down the chain, to Asia.

The one big point you missed (that is no change, but nevertheless does not bode well) is that the youth employment rate is falling while the older employment rate is rising.

Seems like that dream of early retirement is fast becoming a pipe-dream for me …

why would anyone think upward revisions to 2nd quarter GDP would influence August jobs… the contraction of our June trade deficit was the primary impetus to the upward revision in our second quarter GDP, and that was mostly due to unusually big jumps in exports of jewelry, gem diamonds, monetary gold & refinery products, and reductions in imports of much of the same…something’s going on there, but it aint about jobs..

@john personna:

I agree with this, but would like to add another possible answer to the mix:

– Household debt. The more people are leveraged, the harder it will be for consumer demand to rebound. Now the proximate cause(s) of all this household debt may be other things, like outsourcing good jobs, automating them away, shifting tax burdens, Fed policy, housing policy, etc. Whatever the causes, the debt overhang is a major issue. Especially this time around.

http://www.creditwritedowns.com/2012/10/us-household-debt-to-income-debt-servicing-cost-ratios.html

That chart only goes back to 1980. 1984-2006 saw rising debt-to-income levels. While debt service costs matter, I’m of the opinion that people also consider their total debt when they think about how rich they feel (and thus calibrate what they’re willing to spend).

I think off-shoring is a much, much bigger part of the picture. But I think this was in there.

it seems fairly clear that there’s a large segment of the workforce that has quite simply given up looking for work. Those people, however, still have to support themselves somehow. Some of them are likely relying on other family members for help, others have sought out government assistance, and some may be lucky enough to have savings to fall back on.

A lot of them are turning to oDesk.com and similar gig-based work websites. They’re not working in the Shadow Economy, as oDesk does 1099 its contractors, but they are not working in the traditional job-based economy. They have been absorbed into the Gig Economy.

oDesk recently surpassed one BILLION in billable work, and competing sites like Elance and Fiverr are growing exponentially.

@Teresa Rothaar:

Some tweet came through from an economic observer … something like “we need a new name for young people who work part time, make less than their parents, and manage a rich lifestyle.”

Of course, they won’t be filling up their retirement accounts, unless they are really frugal in their rich lifestyle.

Doug, at this point you should really just post the numbers when this report comes out each month. No matter what it actually says, we know that you’re going to view it as “disappointing”. It’s becoming redundant.

… oh yea, and of course the sequester (who’s hit you were “willing to take”) surely has absolutely nothing to do with these lower than ideal jobs numbers.

Neil Irwin also has something to say on why the jobs market is not performing better. Hint — it’s because Libertarians like Doug had their wish granted:

“A big part of the reason why the August jobs report was disappointing is that the Labor Department revised down June and July job growth estimates by 74,000 jobs. And more than half of that, 38,000, was due to government job losses.

Add it all up, and the picture for government employment is murkier. The total number of state and local government jobs is now below 3,000 below its April level. The federal government looks even worse; with the sequester spending cuts and an ongoing contraction by the U.S. Postal Service, federal government employment fell by 36,000 jobs since April.”

Yeah these blog posts are getting tedious in the extreme. These numbers are a direct and predictable outcome of there very policies that Republicans support. Why is it “disappointing” to you Doug? Government jobs are being shed at at rate not seen in my lifetime, taxes are lower then at any time in my life. Regulations are either being shed or simply not enforced. Companies are making money hand over fist. What exactly wold you like to see happen? What exactly do you think should be done? We know you don’t like Obama’s policies, we know you didn’t like the stimulus (even thought it was close to 40% tax cut.). You can’t put a gun to the head of corporations and tell them to give everyone raises from the piles of cash they are sitting on.

What do you think we should be doing exactly? My god we should be borrowing like a banshee and rebuilding infrastructure at the very least and extracting more tax revenue from those who have it, that would do the trick but you don’t support the only rational policy initiatives that would actually start addressing the problem.

After $18 trillion in wealth and asset value was lost in the 2008 crash, I’m not surprised that economic growth has been modest, I am surprised that we have been on this trajectory – a non recessionary path – for nearly 4 years now, and we will continue to be on this path unless Republicans put us on a path of cutbacks that will diminish our modest growth levels.

@Todd:

This is why I think the site would benefit from an economics blogger. Doug is (I think) only mildly interested in the subject.

@Rick DeMent:

“Why is it “disappointing” to you Doug? Government jobs are being shed at at rate not seen in my lifetime, taxes are lower then at any time in my life. Regulations are either being shed or simply not enforced. Companies are making money hand over fist.”

I suspect the (true but unstated) answer is that, contrary to Libertarian dogma, the economy is not taking off even though Libertarian policies are being implemented. It’s just Exhibit #47,294,308 of how Libertarian theory does not predict what happens in the real world.

@Ben Wolf:

Are you volunteering?

Serioulsy though, I’m not sure that wouldn’t cause more trouble than it’s worth. Some of the most ignorant (at least in relation to my own POV .. I’m fairly well persuaded by MMR) comments that I’ve seen since I started reading this blog have been on economics related topics.

… and even a talented economics blogger probably wouldn’t change many minds. Most people are only slight less dogmatic about their economic views than they are about their religion.

@Todd:

No. There’s an innate arrogance required to blog which I don’t possess: the belief someone gives a damn what I think.

The jobs report above would have been a good place for an economics blogger to post the data, then dig a little deeper to tell us more about what it means rather than just putting “disappointing” in the title of the post. I suspect a lot of readers here actually do have an interest in developing a greater understanding of economics, they simply don’t have the time to to do it themselves. A good blogger can get people thinking and leave them more informed at the same time.

@Ben Wolf:

When it comes to the majority of readers of this blog, you may very well have a point. Generally a good crowd here.

there is a discrepancy of almost a million jobs between the unadjusted employment change data from the two BLS surveys, as the seasonal adjustment subtracted more than 200,000 jobs from the establishment survey and added nearly 500,000 to the household survey…the unadjusted data from the establishment survey shows payrolls jobs increased by 378,000 from 135,583,000 in July to 135,961,000 in August; after which the BLS seasonal adjustment increased the payroll jobs to 135,964,000 in July and 136,133,000 in August which thereby reduced the jobs change from July to 169,000; meanwhile, the raw, not seasonally adjusted household data shows employment dropped 604,000, from 145,113,000 in July to 144,509,000 in August…however, the action of the seasonal adjustment on the household survey was in the opposite direction, in that it reduced the negative change of employment loss to 115,000, changing the monthly change from 144,285,000 in July to 144,170,000 in August….thus the seasonal adjustment subtracted 209,000 from job gains in the establishment survey, but it added to 489.000 those counted as employed in the household survey…the establishment survey is more accurate, but there is no reason that would have the seasonal adjustments on employment move in opposite directions in the same month…

Doug, what in the heck did you expect? If that curve were bouncing all over the place, I’d be far more worried. We have a very long recovery in sight.

And yes, if the government had put a heck of a lot of $$$ into more actual job stimulus stuff we would have recovered much earlier.

How libertarians assume that you’re going to generate demand when nothing is moving is beyond me.

I voted for POTUS twice and am generally a strong supporter but facts are facts and under his presidency the rich has got way richer and the middle class and poor have gotten disgustingly poorer…and I don’t see him taking any concrete actions to change things. It’s ironic that under the first black president who is a former community organizer in a mostly disadvantaged area in Chicago, the state of middle class and poor Americans have been so negatively affected. His presidency is in danger with leaving this awful legacy that he cared more about the rich and much less about the poor and middle class while POTUS. Very sad and in fact disgusting, Pres Obama.

The feds should give each American making less than $250K each year a check for $100K and our country and economy would be in much better shape. Instead of spending so much money fighting wars overseas let us help Americans and our economy…with our enormous wealth.

POTUS has been a disaster for poor and middle class Americans. As a former community organizer you would think he and Michelle would understand the plight of these folks and do something concrete to help them. After 5 years we keep waiting while the super rich and rich get richer and other Americans get poorer and poorer. Yes he is not soley to blame but Pres Obama and DNC have done an awful job of telling Americans about GOP and TP obstructions and support for Wall Street and the rich while fighting any tax increases on the fortunate to benefit our country. By the way, the DNC needs some major changes now. If they are made, Dems will take back the house next year.