Helping or Hurting Credit Card Customers

So the House gave final approval to the Credit Card Reform Bill which the President will sign before Memorial Day. But, will it really help people who use credit cards?

So the House gave final approval to the Credit Card Reform Bill which the President will sign before Memorial Day. But, will it really help people who use credit cards?

“This cements a victory for every American consumer who has ever suffered at the hands of the credit card industry,” [Senator] Dodd [D-Conn.] said. “Many Americans depend on credit cards to get by in this economy, and today they have won a giant victory that ensures they are protected from practices that would drive them further into debt, while also making our economy stronger.”

The landmark credit card legislation will force the $960 billion card industry to reinvent itself and consumers to rethink the way they use plastic.

The bill will prohibit card companies from raising interest rates on existing balances unless the borrower is at least 60 days late. If the cardholder pays on time for the following six months, the company would have to restore the original rate. On cards with more than one interest rate, issuers will have to apply payments first to the debts with the highest rates, which would help borrowers pay off their cards more quickly.

Treasury Secretary Timothy F. Geithner on Tuesday said the bill “will help create a more fair, transparent and simple consumer credit market.”

Card executives said the changes will force them to charge higher rates and annual fees to delinquent customers and those in good standing.

Really? Here is my thinking on this. It will reduce the amount of credit available to people who do not have good credit. Is this a good thing? I’m not so sure. People with poorer credit were still able to get credit by paying a higher price for it. Presumably they did this knowing full well that they were paying a premium and that they’d face higher interest rates. Thus, reducing their access to credit might make people worse off not better off.

I also don’t buy the argument for charging customers with good credit more, at least not totally. Sure credit card companies might try this strategy at first, but any company that resists that temptation can then “skim the cream” from those companies that don’t resist. That is they can lure away the higher quality customers by offering either lower interest rates, no annual fees, or both.

Credit would be reduced, but probably for those who have the poorest credit history. Is this a good thing? Hard to say without looking at the data, but unless your view is that people taking advantage of such credit are, as a general rule, less intelligent and are being taken advantage of, then the answer could very well be no.

To make up for the lost revenue, card issuers will turn to those customers who pay what they owe in full and on time every month, analysts said. Gone will be the days when creditworthy customers enjoyed the benefits of low interest rates and cards that offer rewards such as frequent flier miles and cash back, they said. Annual fees, which had been banished to cards with rewards programs, are likely to return. Offers for zero percent balance transfers are likely to become more rare.

Uhhhhmmm, no. While the idea that there is a revenue target is how many might think of how businesses work it ignores half of the equation so to speak. Yes, they could raise annual fees and interest rates on those who have good credit ratings, but there is the cream skimming problem noted above. Further, people with good credit ratings always have the option of getting rid of their credit cards if they become too burdensome. For example, suppose you have 3 credit cards and a good credit score. Currently you have no annual fees, and your interest rates are low. You get a letter informing you that you’ll have a $75 annual fee on all credit cards and the interest rates all went up by 20%. You could deactivate two of the cards. Thus, those two credit card companies are now out the annual fee revenues and there is nothing they can do about that. This is what happens when you look at just supply or demand and ignore the other half of the market. The individuals or firms on the other side are going to change their behavior too.

“This industry will start looking more like a one-size-fits-all pricing approach which dominated in the ’80s — 18 percent interest and a $20 annual fees,” said David Robertson, publisher of the Nilson Report, which covers the industry. Customers who pay in full each month will have “to start picking up the slack, to start pulling their weight.”

It is true because those with poorer credit histories will be leaving the market. Those still in the market will be more homogenous form a credit stand point. So yeah, this is probably right. But it isn’t about “pulling their weight” it is that some market participants will have been effectively shut out because the government has decided that those participants shouldn’t be in the market to begin with. Credit card companies may like to try and return to the old level of revenues and profits, but that will be limited by how competitive the market is and the responses by consumers.

Overall, I’m not convinced this is going to make consumers better off. Those with poor credit histories will be shut out of the market. Those with good credit histories might find that even they have less access to credit. Limiting people’s choices usually results in people being worse off in general.

Photo by Flickr user doyoubleedlikeme under Creative Commons license.

Dropping a credit card for charging an annual fee can reduce your overall credit availability, thereby reducing your credit score, which can then affect other things like insurance rates,remaining card rates , etc.

Doesn’t this make the annual fee a form of extortion?

I don’t believe the law applies to debit cards (which are generally regulated as wire transactions, not credit transactions). If so, people using credit cards for convenience would have other options.

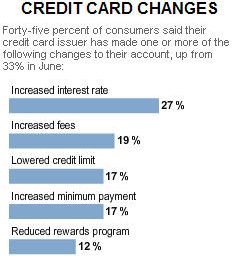

From the same article.

All this bill appears to do is end a specific of practices which they have been abusing. What we likely will see disappear are very low ‘introductory rates’ for people with poor credit. This could well mean fewer people with poor credit in the market or at least less deep in the credit market.

What is in the bill that prevents CC companies from doing anything other than suckering in college students and the desperate with low introductory rates that will almost certainly have the rate doubled or more within a year?

Freshly minted college students without jobs will not likely get the $15,000 in credit upon opening a bank account I was offered when I moved to LA jobless immediately after graduating college.

Will the cards no longer collect a % from every purchase?

Will they no be able to judge a person’s credit worthiness and assign an appropriate interest rate and/or annual fee?

If their business model relies on deceptive practices then their business model needs to change.

I posted on this one, too, Steve.

It seems to me that the fundamental problem is that banks are spoiled. They’ve become accustomed to a level of profit that just isn’t realistic any more.

One of the things that seems to be missing from the discussions I’ve seen is that the “good” customers benefit the credit card companies in a couple of ways.

First, the level of risk associated with them is lower. That’s a feature not a bug. Driving them away will raise the level of risk even if it succeeds in increasing their profit margins, about which I have some doubt. Second, they already make money in several ways other than fees and the putative interest charged from day of sale. There’s float and there’s what the vendor pays. If charges go down which they inevitably will if they start charging interest from day of sale, they’ll lose both of those.

The Fed won’t have a zero prime rate or interbank rate forever.

I was a bit surprised to find out that the credit card companies refer to me and my wife as “deadbeats” because we pay off our credit card (singular) every month.

lol Sam…apparently they don’t like anyone. I don’t know who they find desirable, honestly. My husband and I have too much credit card debt but, I’ve been actively trying to pay it all off and I’ve not charged a thing in at least a year. I pay on time every month, I should be who they do like because they’re making tons of money off of me but it’s never enough.

Two of my cards jacked up my interest rate above 25% earlier in the year and one of them raised my rate to like 28.9% last fall. I called to try and talk them out of it but all I got was, you either accept the new rate or cancel your account. So they probably knew this was coming and decided to stick it to people while they still could. This legislation is late and isn’t going to help anyone who’s already screwed.

Abuse and deceptive practices? I’m glad the government forced the credit card companies to send out all of those lending disclosures over the last forty years.

Apparently even the best and the brightest, the college students, are too stupid to know what a variable line of credit is.

I predict a lot of people-especially those who pay off every month will just move to using debit cards.

I also agree with Dave-it seems like banks are used to a certain level of profit, and rather than controlling what they issue to those who have poor credit, they want to make up the difference by charging those with good credit who pay on time and in full.

I am not a fan of some of the things banks do-I think the three week billing cycle, and late charges for bills that do not arrive on time (but were mailed in reasonable time) are absorbitant. I also don’t like the fee systems and interest rate hikes for the payment that was mailed timely, but arrives late.

But I also don’t think it is okay for banks to balance their checkbooks on the backs of those who have used their credit in good faith.

I think the word your looking for is naive and yes most are. Many are also short on cash and not very responsible. That, however, does not make the practices of the CC companies less deceptive or less designed to suck as much money as possible from those who can least afford it.

The limitations listed above are hardly onerous for a company whose goal is not to collect as many late fees and overlimit fees as possible.