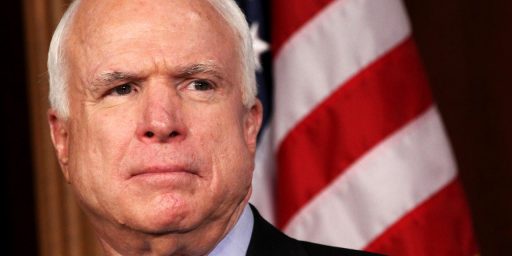

McCain the Interventionist

I’ve long thought that American politics and the fact that we have an activist/interventionist government when it comes to economic policy leads to a race to see who can pander the most to voters, or at least a sub-class of voters. John McCain’s new “plan” to bail out the greedy and stupid when it comes to mortgages is another data point supporting this theory.

NEW YORK — Amid widespread concerns about the nation’s mortgage crisis, John McCain outlined Thursday a proposal to help “well-meaning, deserving homeowners who are facing foreclosure” and called for a Justice Department investigation into possible “criminal wrongdoing” by unscrupulous lenders.

The proposals marked a shift in tone from McCain’s admonition two weeks ago against adopting a mortgage plan that would be “a multibillion-dollar bailout for big banks and speculators.” That set the Arizona senator apart from his Democratic rivals in the presidential contest, Sens. Hillary Rodham Clinton of New York and Barack Obama of Illinois, who have both said there is a need for government intervention to fight the nation’s wave of home mortgage foreclosures and overall economic slowdown.

I’m sorry, but this just completely turns me off to a candidate that I already see as having a nice authoritarian streak to him. Lets translate the phrase “well-meaning, deserving homeowners who are facing foreclosure”. To me I see that as a bailout for people who bought a house that was too expensive for them, or couldn’t resist the temptation of using their homes like ATM machines to tap into the equity (that is now gone, or substantially smaller) of their homes to promote a lifestyle they couldn’t actually afford. In short, Republicans, their presumptive nominee at least, doesn’t give a crap about personal responsibility and making wise financial choices. From there it is a few short steps to, “Well clearly we can’t let these people manage their own money since they make a mess of it anyways.”

The plan would retire old loans that homeowners no longer can pay and replace them with less expensive, 30-year, fixed-rate mortgages that are federally guaranteed.

Some political commentators look at things like that and wonder, “Do these candidates understand economics?” I’m more cynical, I’m sure the candidates understand economics, or at least some of their advisers do and are aware of the problem of moral hazard. However, the benefits of pandering to voters has far greater rewards for the candidates. Of course, this also exposes the fatal flaw to the view of “government would work great if we could just get the right person in there”. The wining candidate can never be the “right person” because to win the candidate must pander and that means policies that are, generally, not good policies. They end up promoting irresponsible behavior such as lowered savings rates, buying a house that is too expensive, and so forth.

About the best thing that can be said about McCain’s plan is that it isn’t as expensive as the Obama or Clinton plans.

Serious question, Steve. When is borrowing money trying to “promote a lifestyle they couldn’t actually afford” and when is it just another lifestyle decision? Is borrowing money to purchase a home living beyond your means? Should everyone pay cash for everything?

How is taking a mortgage to buy a house materially different than borrowing money on your house to purchase a boat?

Bailing out individual lenders may well be a bad idea. How about bailing out the billionaires own the companies that do the lending? Is that different somehow?

Bail outs some times are necessary, but not here. McCain is Democrap lite, nothing more nothing less. Were screwed.

anjin-san, I think that calling the controlled liquidation of Bear Stearns a “bail out” is a bit of a stretch. However, I do agree with the suggestion I’ve heard made that both J. P. Morgan and Bear Stearns (or any other company similarly assisted) should be prohibited from paying any salary or compensation plan greater than that received by a GS-15.

If you purchase a home that you can’t afford and you don’t factor in the risk of any possible financial setbacks it certainly is. Just because someone is willing to lend you the money and you want it doesn’t make it a good idea.

Look again carefully at the four sentences of this paragraph:

This is an amazing, and wholly unpersuasive, leap of reasoning with no logical underpinning, much less evidence. It’s a complete nonsequitur.

Use of a heavily loaded phrase like “doesn’t give a crap” is a dead give-away that we’re seeing the writer’s prejudices revealed, rather than a principled argument.

There’s been no shortage of greedy fools on both sides of these busted mortgage transactions. But that’s not logically inconsistent with the proposition that in some instances, there may also have been fraud, overreaching, or inadequate disclosure by particular lenders. Real estate speculation is nothing particularly new, and there’s a good reason why one of our most famous clichés — “If you believe that, there’s a bridge in Brooklyn I’d like to sell you” — involves real estate fraud. There are, however, at least two new features in the present crisis, both of which potentially could have been used to conceal wrongdoing: First, the growth in complicated variable-rate adjustable mortgages (which by their nature encourage gambling on back-end prosperity); and second, the “re-packaging” (i.e., securitizing) and international distribution of the loan obligations (divorcing decision-making on loans, as well as their management, from ownership of the debt). Given that, it would not surprise me at all if there is a substantial number of homeowners who genuinely are “well-meaning” and “deserving,” who were indeed victimized by scammers, and who, as a result, now face foreclosure.

I start by being keenly skeptical of government bailouts, too. But I don’t know enough of the details yet on what McCain has just proposed to compare it to the proposals that Clinton and Obama have already floated. Theirs, I’ve already concluded are less about the current turmoil in the mortgage lending marketplace than the normal (for Democrats) redistribution of wealth from haves (taxpayers) to have-nots.

In any event, you’re imputing to McCain an enormous amount of hypocrisy. I may not end up supporting his proposal. But something more than my disagreement, or yours, with its merits as a policy matter ought to be required before accusing someone of bad faith.

Color me emphatically unpersuaded by this post.

Since comments are closed….

This “defense” doesn’t work at all. Securitizing real estate maybe something new to you–i.e. you just learned about it–but it has been around for a long time. Since the 1970’s making it almost 40 years old. The first set of mortgages to be securitized was done by Ginnie Mae. As for the “non-disclosure” and what not, many borrowers were quite happy to take advantage of these practices when housing prices were going up with no end in sight. Like many Johnny-Come-Latelies to bubbles they didn’t know when to get out (timing the market has always been a stupid strategy).

Sure some people facing foreclosure might have done everything just right. Bought a modest home. Didn’t tap into the equity. Then suffered a financial set back (job loss, etc.). My problem is that this program, if McCain had been elected, would NOT have tried to seperate out these people. This pool would be very small, and such people even without government help often manage to get out of such financial hardships.

Its great to just say, “Well golly gee willickers I like this candidate, and he’ll be a straight up guy,” but in politics there ain’t no such candidate.

This is what you get when voters have no consequence for their demand for services. Half of all income earners pay no income tax.