Banks Roll Out New Fees for 2010

Faced with new regulations limiting some especially unpopular practices, many banks will introduce different practices, also sure to be unpopular but not yet illegal, to replace them.

Faced with new regulations limiting some especially unpopular practices, many banks will introduce different practices, also sure to be unpopular but not yet illegal, to replace them.

The nation’s banks will be bombarding customers with new fees and products in 2010 as they try to replace more than $50 billion in revenue wiped out by new rules that clamp down on certain business practices. So far, the changes are mostly concentrated in checking accounts and credit cards. In addition to attaching new fees to old products, banks are introducing new types of accounts that they hope will reel in new customers and reduce their funding costs.

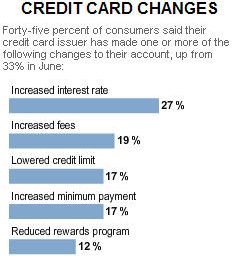

For plastic, the new rules go into effect in February as part of the Credit Card Act of 2009. The rules will limit some interest-rate increases, require more disclosure to customers and prohibit banks from raising interest rates on current balances unless a customer is at least 60 days behind in a payment. Credit-card issuers collected $22.9 billion in penalty fees—such as those assessed for late payments—in 2009, up from $19 billion in 2008, said [xxx], who runs a credit-card consulting firm in Thousand Oaks, Calif.

Credit-card companies already have been racing to slip new fees and practices into customer contracts ahead of the law. Issuers are closing accounts, switching cards with fixed interest rates to variable rates and introducing cards that have an annual fee.

[xxx], who regularly shops at sporting-goods chain, recently was notified that he will be charged a $1 “processing fee” each time he receives a printed statement of his Gander credit-card account rather than an electronic one. The 50-year-old paralegal said he is prepared to cut up the credit card even though he likes the loyalty rewards that come with it. “It’s not like I can’t afford it, but it’s another little stick in the consumer’s eye,” Mr. Moss said.

The Gander Mountain card is issued by World Financial Network National Bank, a unit of Corp., of Dallas. The company, which also issues credit cards for women’s clothing chain and lingerie maker Victoria’s Secret, says that the decision to charge the fee is partly tied to the costs that it will incur from the new rules. “One requirement of the Credit Card Act of 2009 is that monthly billing statements will now have to include significantly more information pertaining to the cardholder’s terms and conditions, thus increasing the amount of paper, production and postal expenses as well as having a greater environmental impact,” the company said in a written statement.

[…]

Other banks are expected to eliminate free checking completely, raise fees on safe-deposit boxes and charge customers more for issuing a stop-payment on a check.

“There may be some areas of opportunity that banks really haven’t focused on because they had the engine of overdraft fees,” said [xxx], who specializes in the community-banking industry at SNL Financial in Charlottesville, Va. [xxx], a consultant at marketing firm Haberfeld Associates in Lincoln, Neb., said such a strategy can backfire with customers. He is urging his community-bank clients to retain free checking and other services in order to differentiate themselves from big banks that are likely to increase fees.

Many of the fees being regulated away by the Credit Card Act of 2009 were indeed unconscionable and I have no real objection to the government’s intervention. Our modern economy virtually requires people to use credit cards and many of the practices are either industry-wide (and thus unavoidable) or sufficiently well hidden in the 30-page contracts that even educated consumers are unaware of them until hit.

At the same time, the financial industry has evolved into one that relies on low teaser rates to attract customers and then a myriad of complicated additional charges to make a profit. It was highly predictable that companies would find innovative ways to replace revenues taken away by the new law.

Because switching banks is a royal pain — most of us have direct deposit, a number of automatic transactions, and a multitude of other accounts tied to our primary bank account — a whole lot of people will put up with this. Many likely won’t even realize they’re being hit. But, so long as the practices don’t become universal, a significant number of people will indeed take their business to places that treat them fairly. Certainly, I’ve been known to cancel accounts and go through the aggravation of switching over the principle of the thing.

Note: I have no idea why the story redacted all the proper names; I replaced the blanks with [xxx].

The banking industry is sleazy.

Have you noticed how many times credit card due dates now fall on a Saturday or Sunday so they can nail you for a $39 late fee on Monday? I don’t know of other industries that try to trick customers into incurring charges.

It’s a shame how so many industries are only profitable if they’re screwing someone over. That’s not “trade.”

Along the lines of what Pug notes, I find it annoying that some of the companies I do business with build in a mutli-day “processing” period for online transactions, even though there is no reason that the transaction can’t be immediate (as it is, for example, with American Express and many others).

This is simply a way to try and make you late on your payment or to induce you to pay for their “express” processing service, which is cheaper than the late fee, but still ridiculously high considering there is no reason not to have an immediate payment option available.

Back in the Olde days my bank charged $5/mo for electronic banking. It worked out cheaper than stamps, so I paid it. My bank was subsumed into another … 18 months later I learned that I could have free electronic banking, if I asked. But you know, it was just their computers that kept charging me that $5. No, they checked with their managers, a refund was not possible.

Nickel and dime stuff … but in the long run it just undermines their customer relationship. Do they connect this with my accounts having largely moved away?

I’ve held a Citibank credit card for over 15 years and last month they informed me that my interest rate on the card will be raised to 29.99%. Their letter said it was a direct response to this new act. I am not canceling the card because it represents about 3/4 of my unsecured credit and doing so would put a big hit on my credit score, but I called and informed them that they would never receive a penny of interest from me as long as the rate remained that high and that I expected better.

While I don’t have a problem with Congress limiting some of the worst excesses of the financial industry, I think this legislation is counter-productive in the long run. The banks and credit card companies are already making changes (like my interest rate increase) that end up screwing consumers just as much or more. In my case – a consumer with excellent credit – this legislation is hurting me, not helping me.

Many banks make it a practice to collect pending transactions on an overdrawn account in order from the lowest charges to the highest, thereby maximizing the number of overdraft fees they collect.

For example, if you have $800 in your BOA checking account and you use your debit card seven times today, for $500, $200, $40, $30, $20, $10, and $5, and thereby overdraw your account by $5, you will pay $245 in fines.

Simply stated, Bank of America is out to screw you. Therefore, rather than pay the $500 charge last (which would only result in a $35 fee), they pay it first. Pretty sleazy, huh?

Aren’t credit cards at the root of lots of our financial woes? Today it’s so easy to …… in effect …… get a loan. No embarrassment, no hassle, no having to ask parents, relatives or friends for money.

Just simply put the purchase on the credit card, or get a cash advance. Before you know it, you’re beyond the point of no return on being able to ever pay it back. The only out is for those lucky enough to own a home to refinance and wipe out the credit card debt. But of course you still owe the money, perhaps at a lower interest rate.

But then you start using the cards again.

Cocaine and other highly addictive drugs are illegal. I personally (almost) think credit cards should be banned, or at least the amount of credit severely restricted. If you need a larger loan, you should have to go through the hoops to prove you’re able and responsible enough to pay it back.

And ….. debit cards can be used for those instances where you need plastic, usually, or if not ….. don’t do that or go there!

You make a great point, Andy. In practice, the credit card companies are so determined to keep ripping off their customers that any attempts by Congress to stop them is going to be, in a sense, futile.

But I don’t want Congress to sit back and do nothing either. I’m grateful that they’re willing to regulate some of these abusive practices.

After all, it’s unlikely that these practices would be less abusive if Congress took a hands-off approach.

“Aren’t credit cards at the root of lots of our financial woes?”

Yes they are. But look at how credit cards are marketed to our young people. Enroll in college, get a credit card app. Go to the college bookstore and make a purchase, get a credit card app.

Some T.V. commercials tell young that they are not successful unless they carry a certain prestigious credit card that is there for the taking.

I don’t have a solution, but I can certainly see the problem. It’s a shame that we have an industry that makes a huge profit from punishing it’s customers who have done nothing wrong.

The problem with bills like this is in the end the banks will just substitute one awful practice for another in order to maintain the profit margin.

Honestly-I am okay with banks having fees and rate hikes (for those who don’t pay their bills-although I think there should be an established habit before it happens, a couple of bills coming in on the 17th when it was due on the 15th shouldn’t count), but it would be nice if some of the rules were written in something other than legalese, and I think more than anything the practice I find most annoying and have been hit on is the shorter billing cycle (a card went from a 30 day to 20 day and trying to fit that bill into my bill paying sequence was a pain) and I think that due dates should always come with an “until the next business day” due date, so if the date falls on Saturday, the due date shifts until Monday. Even the IRS operates with this rule.

One thing I do like about online bill paying, is that the bill is paid that day and the mail can’t lose it-either the USPS or the mailroom at the company. I have a paper record that says payment was made on X date.

I suspect online or at least some form of electronic bill paying will be the direction all bill paying will move. I only have a few bills that I pay with a check-one of them I have to because my city doesn’t not take debit or credit-checks and cash only.

We seem to have left behind the classic argument, whether there is such a thing as “usury” and if it should be illegal. I guess that’s a triumph of the market, eh? We seem to have accepted the rational economist’s argument that people would only use a financial instrument if it was in their best interest.

Except at the same time, we know it’s not true … Frontline mentioned that there are more payday loan storefronts in the US than Starbucks.

That is a bit to many to support the rationally argued few who really need money at 450% APR or whatever.

Personally, I think we could pick some arbitrary rate (25%?), call anything above it usury and make it illegal. Those few who really need money above 25% would be better off seeing a charity.

Spare me your invective, people. If you don’t like credit card rates or terms, quit using them, quit running balances, or pay 2 days early. Please.

Ease of transaction, you say? Then do a protest -start using checks, or debit cards. If successful, the credit card terms will change. (The retailers will freak out at the lengthy time of check writing.) If not, the market has spoken, its worth the price.

You are whining like a bunch of old women.

Herb,

I’m not advocating a hands-off approach by Congress. Their problem is that instead of focusing on incentives they are attempting to ban specific practices which is unlikely to work.

Wow, Drew, I’m not sure what’s more offensive about your comment, your ignorance or your blithe smugness.

In your world, this is an intelligent statement:

And yet, this is closer to reality:

Rather than calling people names, maybe you could defend these practices instead? No? Didn’t think so…

Andy, do you have any ideas on what incentives Congress could focus on and how they would do that?

That’s a really stupid comment, Herb, really, really stupid, with no understanding of how business works… –

Nobody forces anyone to use a credit card. You can avoid all you bemoan by not using them, or paying immediately. And this comment: “Our modern economy virtually requires people to use credit cards…” is complete and total crap. I must have missed the “sign up or you sleep with the fishes” bank come ons…

People use these cards for convenience, and to live beyond their means, period. And now people like you whine like fools about the costs of those privileges. I don’t need to defend any practices. The (economically) voting public has ratified them…..voluntarily. Rather, you need to defend your assertions that these privileges are improperly priced.

My comment is spot on. If you don’t like the fees and expenses associated with credit card usage change your habits. Use checks. Use debit cards. If the economic pressure is such that the card issuers must change…….they will, in a heartbeat. In a New York minute.

If not, take your embarrassing juvenile whining and stick it.

Drew, did you read this article before you commented on it?

James Joyner wrote that comment. Direct your ire his way.

I happen to agree with Joyner on this one.

You say, “I must have missed the “sign up or you sleep with the fishes” bank come ons…” Which is real clever, until you consider that there are some things that most people cannot buy without credit. Important things. Cars, homes, big ticket items.

Now, there’s no Luca Brazzi saying you have to use a credit card, but if you want to fully participate in the economy…

As for this: “If you don’t like the fees and expenses associated with credit card usage change your habits. Use checks. Use debit cards.”

Let me revise it to state what you really mean.

“If you don’t like getting ripped off by the banks, don’t use banks.”

This is the limit of your wisdom???

Why is it unreasonable for people to expect NOT to get ripped off by banks?

Nobody forces anyone to use a credit card. You can avoid all you bemoan by not using them, or paying immediately. And this comment: “Our modern economy virtually requires people to use credit cards…” is complete and total crap. I must have missed the “sign up or you sleep with the fishes” bank come ons…

This actually isn’t entirely true. Back when my father was still alive, he loathed and hated credit cards and did not have one. He either had the money to buy something or he didn’t and he rarely bought anything on credit (even cars).

When he was in his 50’s he registered for an out of state optometry conference to get some CEU’s for his license and needed a car rental. He discovered that the company would not rent him a car unless he had a credit card-even if he was willing to pay the expected fee entirely in cash. He ended up applying for his first and only credit card in order to rent a car, and as far as I know he never charged anything to the card.

But for some things-simply renting a card or at this point making airline reservations requires a card.

One thing in the banking industry that has changed-the debit card now comes with a credit card company backing, but the reality is that some kind of credit card in hand is a requirement to do many things in our current society. So the “if you don’t like it don’t get one” argument only flies so far.

We have three credit cards – a Chase VISA, a Home Depot card, and an ExxonMobil card. We used to have five more but well before the peak of the housing market and the following collapse, we did away with them, canceling them over a period of two years.

Chase kept trying to raise our credit limit and we’d call them to complain, telling them to restore it to its previous limit and lock it there (and they finally did). Of course we kept hearing our actions would cause our credit rating to tank, and it did fall a bit. But after all that we saw our rating climb over the past couple of years. We use the credit cards just enough to keep them active and our credit rating good. Otherwise we use cash or debit (either our bank’s debit card or one of the pre-paid ‘green dot’ debit cards).

Has it been easy? Not always. But when the economy tanked we had little debt to service. Even with a pay cut (and loss of pay by one of us), we were able to pay out bills.

Are we unusual? Probably. Will we change how we are handling our finances, particularly our credit cards? Maybe, especially if Chase raises our interest rate above what we pay now.

Needless to say we see the upcoming changes as going the wrong way, fixing the wrong things. Congress has the propensity to make us deal with the unintended consequences of their attempts to ‘fix’ things. Unfortunately those unintended consequences usually entail us paying even more money and getting less for it.

Nice try, Herb –

When you can’t win the argument, change it, eh??

“until you consider that there are some things that most people cannot buy without credit. Important things. Cars, homes, big ticket items.”

Nobody has been talking about the two big time financed items: cars and homes. Are the issues we have been observing in effect here? NO! Unless I’ve been on opiates the last 5 years, the issue has been too easy credit!

Herb – you are publicly embarrassing yourself here. Best to just shut up and move on.

“Why is it unreasonable for people to expect NOT to get ripped off by banks?”

Oh, and because its an incredibly competitive business. WTFU.

If enough people cancel their higher rates credit cards, then maybe it will be a wake up call for the credit card companies that did hike up the fees. With enough people they will feel the impact.

Herb,

I’m not in the banking business, but I see no reason why Congress couldn’t create regulatory incentives that would make legitimate banking practices attractive and illegitimate ones unattractive. For an example off the top of my head, Congress could impose a tax penalty on banks that get too much income from fees and penalties. We also shouldn’t have banks that are “too big to fail” – unfortunately the present administration and Congress doesn’t agree.

Banks are like any other business. They are not collectively “evil” (though some individual bankers surely are) – they simply respond to the current regulatory and business climate in order to maximize profits.

And there are alternatives to banks – they’re called credit unions.

Andy, if we wanted to do this, the trick would be to calculate fees as interest (as they truly are) and regulate them at the usury limit. That would force banks to suspend all cards which can’t be profitable at the max (I suggested a fairly high max, 25%). That might seem raw, but think about the kind of people they must be stringing along when 25% honest interest isn’t enough to cover defaults.

Moody’s reports that credit card charge-offs by financial firms hit 10.56% in November.

What a world.

“Unless I’ve been on opiates the last 5 years, the issue has been too easy credit!”

Then I think it’s safe to say….you’ve been on opiates the last 5 years.

Too easy credit? What’s “too easy credit?” Oh, giving credit to people who don’t deserve it? And why don’t they deserve it? Because they won’t pay it back. Why can’t they pay it back? Because of ten years of wage stagnation, zero job growth, and bubbles.

You’re going to sit there and tell me the issue is “too easy credit?”

As for this…”its an incredibly competitive business.”

Bah. What part of “many of the practices are either industry-wide (and thus unavoidable)” do you not understand?

If it was an industry-wide practice for a restaurant to spit in your food, what would your proposal be? Eat at home???

I mean, let’s not try and stop restaurants from spitting in your food. Let’s let the invisible hand and the magic of competition do it for us!

Andy,

“Congress could impose a tax penalty on banks that get too much income from fees and penalties. We also shouldn’t have banks that are “too big to fail” – unfortunately the present administration and Congress doesn’t agree.”

I’m with you on “too big to fail,” but I’m not sure your tax penalty would work. That sounds like an incentive to take advantage of a loophole.

And I don’t think banks are collectively evil. There’s nothing evil about making a profit. But there’s something wrong (wrong, not evil) with a bank that tried to squeeze more money out of people without an increase in service.

Hey, if the credit card companies want to raise my rates and then give me more identity theft protection (say) then go for it! You know, an exchange of goods for services. What we (used to) think of as trade.

But don’t raise my rates just because you need to put a little more profit in the ledger. Earn that profit.

I had a sudden thought. Outstanding consumer credit has been falling, though it has been unclear to me what part of that reduction has been by write-off and what part has been repaid.

What if a large part of it was through repayment? Wouldn’t it be sick if the banks kicked up rates to stop that?

That would be a legal strategy for them, right free marketeers?

As Toni and others note above, there are all manner of transactions requiring a credit card: car rentals, hotel stays, and many other. Or, heck, just simple things like starting a tab at a bar. We’re increasingly moving to an electronic economy.

I’m a convenience user of credit cards. I’ve never intentionally carried a balance in 25-plus years of using cards. But there are certainly a lot of trap fees built into the system.

Actually, businesses bury T&Cs that are unfavorable to consumers deep in their contracts every day of the week. My father was an attorney (a very good one, senior legal counsel for a large corporation). He was changing his life insurance, and came across a few clauses in the contract that he could not make heads or tales of. So he contacted a friend who specializes in insurance law. Well he could not make sense of it either. This is not all that unusual of a situation…

The unfortunate reality folks is that lending money comes with a cost. Salaries, benefits, facilities, utilities, technology, business materials, marketing and taxes…and that’s before the cost of the money itself or the percentage of customers who default, leading to higher costs for the rest of us.

While I certainly don’t support a $40 fee on a $5 overdraft or the penalties imposed by the credit card industry, I look at the way government has intruded into the consumer credit market and caused more harm than good.

We are now going to be paying more fees to cc companies, banks and credit unions, interest rates have been increased across the board and alternative products like cash advances and payday loans have been vilified, even though they are often significantly less costly to the consumers who use them.

In free, competitive markets, the consumer has a significant impact often driving costs to a lower level….When government steps in to “protect consumers” the consequences seem to always have the opposite impact!

Why does this matter? A better comparison would be that nationwide there are almost five times more banks than payday lenders — banks that charge overdraft and bounced check fees that can be more expensive than payday loans. Does that mean there are too many banks?