Cleanse the Code Project

I was invited to join a conference call featuring Senators Larry Craig (R-ID) and Ron Wyden (D-OR) in support of the “Cleanse The Code” project. It is backed by a coalition led by the National Taxpayers Union, Citizens for Tax Justice, the Heritage Foundation, and the Center for American Progress.

It’s a pretty wide ranging group ideologically and they certainly don’t agree on a lot of the details of how the tax code should look, including what the rate structure should be.

Their statement of principles:

1. Simplification, Transparency, and Certainty.

Filing taxes should be simple and fast for Americans, yet the plethora of tax credits, exemptions, deductions, special rates, and complicated rules can make filing a nightmare. According to the Government Accountability Office (GAO), 56 percent of Americans have someone else prepare their taxes. Most taxpayers should be able to calculate their taxes on a single form or no form at all, and in most cases by themselves, with a few hours or less of preparation.

Calculating one’s correct tax burden is further hampered by the ever-shifting compilation of rules that make up the tax code. The GAO recently tested 19 professional tax preparation firms, and found that not one prepared an error-free return and only two ended up with the correct refund amount.

A more transparent tax code would make it easier for individuals and businesses to pay the taxes that they owe, and for the IRS to help them comply with their obligations under the tax code.

2. Opportunity for All Americans to Get Ahead.

The tax code should provide opportunity for all Americans, through hard work, thrift, and ingenuity, to get ahead and enhance their economic security.

All Americans deserve a fair tax system that gives them a chance to get ahead in a marketplace economy. A tax code riddled with loopholes is not fair. Any reform effort needs to cleanse the code to ensure that special preferences are not given to the few at the expense of the many.

The tax code should not hold anyone back from the American ideal, but rather should allow hard-working Americans to plan and save for their individual needs.

3. Fiscal Responsibility.

The signatories to this letter have differing ideas on the appropriate size of the federal government, but agree that over the long-term the amount of revenue government collects and spends cannot be determined independently from each other. As a result of this interplay of revenue and spending, the goal of tax reform must be pursued in a fiscally responsible manner.

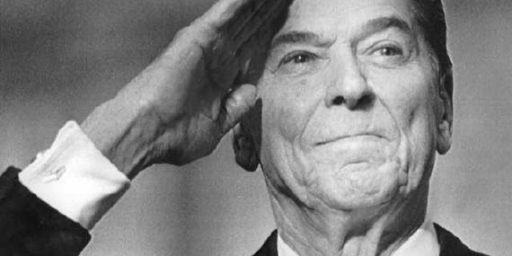

Wyden wants a “fair” flat tax that is simple yet progressive. His starting point is the bracket structure Ronald Reagan proposed in 1986. Wyden in particular believes that we should have a one-page 1040, an idea that has been bandied about since at least the Reagan administration.

I find little to object to in these principles. Then again, actually coming up with a replacement tax code that can gain wide consensus is much, much more complicated.

During the call, Ed Morrissey asked whether a consumption-based tax wouldn’t be better. That would be my preference as well. Sen. Craig said the main problem with that is that it would hurt the ability of state and local governments, who rely on sales taxes. But, of course, any taxes raised at one level of government makes it harder for other levels to take a bite of the apple. The advantage of sales taxes is that they are much more obvious than a withhold-and-file income tax system; that’s also the chief disadvantage from a legislative standpoint.

I’m more than a little skeptical that anything meaningful will be achieved. Indeed, I find it somewhat amusing that the 1986 tax reforms are being held out as an archetype. Not only, as Jon Henke noted during the call, has the tax code been sliced and diced to death since then but I certainly don’t recall it having been all that simple a code even in 1986.

I would expect any change away from the “hidden” income tax to breed discontent very quickly. Presently a refund of overpayment is looked upon as a gift from the government. Consumption taxes would have no “gift” every year and we would hurt a little with every trip to the store.

Consumption taxes could also hurt businesses like mine. I buy almost a million dollars worth of diesel fuel a year and would pay an additional tax whether I turn a profit or not. At least now I only pay in the profitable years. Businesses with high materials costs could really get hurt while professionals like attorneys and accountants along with low material usage service companies would make out like bandits.

Eventually equilibrium would be reached and adjustments in markets made but the transition period could disrupt the economy.

For now I would concentrate on taming the beast we have before introducing a new one.

Their “statement of principles” is meaningless. Its just a collection of buzzwords without any substance: “fairness” “fiscal responsbility,” “simplification,” etc….

Who ISN’T for these things? To show “principles” requires little more than endorsing platitutdes.

Maybe they did cover specifics, James, but it figures that the only thing coming close to specifics was the tax-and-spend Democrat Wyden’s endorsement of a tax hike through a flat tax.

Triumph: That’s sort of what I was getting at. The principles are broad enough to get buy-in from those far flung groups but actually turning them into a tax code will create strong disagreement.

Progressive is not fair. It always lends itself to raising rates on the ‘rich’.

I want the Bortz backed Fair Tax. Period. End of Tax Story.

The Fair Tax would have the advantage of making all the illegal aliens taxpayers. Also, drug dealers, foreign tourists, foreign diplomats, among others.

Form 1040ez is a simple one page form that the IRS estimates that around one half of all tax fillers will use this year.

We have a complex tax code because that is what people want despite the problems everyone protest about. No one believes or trust the system to actual deliver on promises that giving up a tax deduction will lead to lower taxes. In economics this is call revealed preference.

I recognized that, James.

What I wonder is why you bloggers don’t call BS on them? I don’t mean this to be directed at you, James, But the beauty of the blogosphere is that you guys can ask tough questions that, perhaps, the MSM won’t.

Triumph,

True enough. There wasn’t much time for Q&A in this one, unfortunately. And I hadn’t seen the statement of principles until late in the call, as it wasn’t circulated ahead of time.