Economic Growth Slows But Shows No Signs Of Entering Recession Territory

The economy slowed somewhat during the second three months of 2019, but the economic recovery still looks strong as we head into the 122nd month of positive growth.

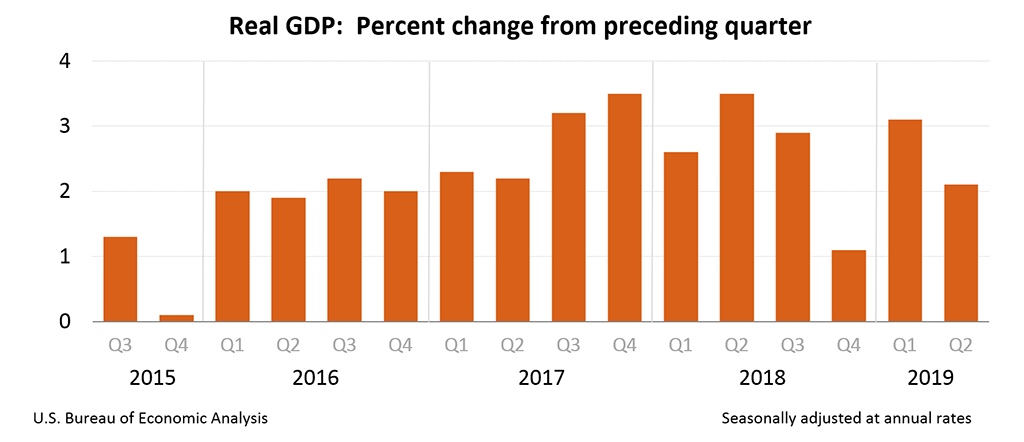

The first report on economic growth in the first quarter of 2019 shows that the economy slowed during the second quarter from what we had seen in the first quarter, although those numbers are largely consistent with what we saw in the final years of the Obama Administration:

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2019 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.

The Bureau’s second-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The “second” estimate for the second quarter, based on more complete data, will be released on August 29, 2019.

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The deceleration in real GDP in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.

Current-dollar GDP increased 4.6 percent, or $239.1 billion, in the second quarter to a level of $21.34 trillion. In the first quarter, current-dollar GDP increased 3.9 percent, or $201.0 billion (table 1 and table 3).

The price index for gross domestic purchases increased 2.2 percent in the second quarter, compared with an increase of 0.8 percent in the first quarter (table 4). The PCE price index increased 2.3 percent, compared with an increase of 0.4 percent. Excluding food and energy prices, the PCE price index increased 1.8 percent, compared with an increase of 1.1 percent.

As this chart from the Bureau of Economic Analysis shows, these numbers. while better than what analysts were expecting are largely consistent with the numbers we’ve seen going back three years now. which suggests that the economic recovery. while still going strong, is at a level of maturity such that we have settled into a period where economic growth is likely to stay within the same range for the time being:

It should be noted, of course, that the number released today is merely an initial estimate of economic growth in the second quarter and is based on incomplete data. We’ll get subsequent updates on the second quarter at the end of August and the end of September respectively, and at that point, we’ll have a clearer picture of where the economy may be headed for the rest of the year. It’s also worth noting that this report also included a final revision to growth numbers for the first quarter that places it somewhat below the 3.1% that was reported in April. That’s not to say that first quarter growth was not healthy, because it was, but it should be noted that we still are not seeing any signs of the explosive growth that President Trump and his fellow Republicans asserted we would see in the wake of the passage of the tax cut package that serves as the single legislative accomplishment of the President’s first term.

One good sign for the second quarter that we didn’t see in the first three months of the year are increases in both disposable income and consumer spending, both of which are responsible for the growth we did see to a large degree. This isn’t surprising since consumer spending tends to increase during periods of warmer weather, but it is positive in that it suggests that consumers are still inclined to spend notwithstanding the fact that the economy is not booming as promised.

Ben Casselman at The New York Times comments on the new report:

Economic growth slowed last spring, but don’t panic: The decade-long expansion has lost some momentum, but there’s little reason to think it is about to stall out.

Gross domestic product, the broadest measure of goods and services produced in the economy, rose at a 2.1 percent annual rate in the second quarter, according to preliminary data released by the Commerce Department on Friday. That represents a significant deceleration from the 3.1 percent growth rate in the first quarter.

But the big swings in the quarterly data are almost certainly exaggerated. The larger trend shows that the economy has cooled since last year, when tax cuts and government spending gave growth a temporary jolt. But the strong job market and robust consumer spending are keeping the recovery on track, even as trade tensions and a slowing global economy are threatening to knock it off course.

“It’s a good economy, but it’s got fragilities in it,” said Diane Swonk, chief economist for the accounting firm Grant Thornton. “You’d expect to feel more euphoria and more underlying strength, and instead what we’re seeing is fault lines.”

Growth in the first quarter looked good on the surface, but the underlying details were much weaker. The pattern reversed in the second quarter. Final demand — a measure of underlying growth that strips out some of the most volatile components — actually accelerated.

The biggest factor: consumer spending, which accounts for more than two-thirds of the American economy. Stock market volatility, a prolonged government shutdown and harsh winter weather all contributed to weak spending early in the year. But consumer spending roared back in the spring, rising at a 4.3 percent rate. Government spending, which picked up in the second quarter after being depressed by the shutdown, also helped lift growth.

Unfortunately, other parts of the economy look much weaker. Business investment declined and exports slumped as manufacturers, in particular, were battered by tariffs and slowing demand from overseas.

If that continues, it could slow hiring or even lead to layoffs, which would hurt consumer spending as well.

“There’s nothing that I can point to about the consumer and say I’m worried,” said Ellen Zentner, chief United States economist for Morgan Stanley. “But how long can business investment remain this sluggish without spilling over into jobs and the consumer?”

The housing market continued its recent struggle. Residential fixed investment, which includes housing construction, declined for the sixth consecutive quarter.

As Casselman notes, there were also changes to the numbers for 2018 that appear to tell us that growth in that period was weaker than previously stated:

Last year was one of the best years of the recovery — but it wasn’t as good as it appeared initially.

The Commerce Department on Friday revised G.D.P. data back to 2014, an annual process that incorporates data not available when earlier estimates were released. One big change in the data: growth in the middle of 2018 was not quite as strong as it seemed at first.

The change robbed President Trump of a favorite talking point: Before the revisions, growth last year was 3 percent by one of two commonly used measures. (It fell just short by the other.) Now, by the White House’s preferred method, G.D.P. grew just 2.5 percent last year.

Mr. Trump’s 3 percent target matters for politics, not economics. But the slower growth last year does have real-world implications. It suggests that the economy came into this year in weaker shape than previously believed, and it could help explain why business investment has lagged.

The Washington Post, meanwhile notes the slowing by emphasizes that there are few signs we are headed for a recession:

The U.S. economy slowed in the spring but continues to grow at a healthy pace that shows little sign of a recession.

The economy expanded at a 2.1 percent annual rate from April through June, the Commerce Department said, a downgrade from the first quarter’s surprisingly strong 3.1 percent pace.

President Trump called it “not bad” growth in a tweet Friday morning and predicted the economy is “set to zoom” going forward, though many economists predict this year will be solid but not extraordinary.

“Last year was a fiscal sugar rush. This year it’s starting to fade,” said Michael Feroli, chief U.S. economist at J.P. Morgan.

Consumer and federal government spending accounted for the bulk of U.S. growth: Americans bought heavily again in the spring; and federal spending surged after the partial shutdown in the first quarter. Business spending dried up, however, turning negative for the first time since early 2016. Many executives blame uncertainty around Trump’s trade war for their hesitancy to spend as much as they did a year ago.

Trump has promised his policies will achieve more than 3 percent growth for years to come. Last year, he nearly achieved that goal, with an official growth rate of 2.9 percent. Trump has boosted the economy with an unprecedented amount of stimulus at a time when unemployment is very low.

He increased military and domestic spending, scaled back regulations and enacted the largest corporate tax cut in the country’s history.

The tax cut for businesses was supposed to spur companies to invest in new properties, equipment and products, but after a bounce early last year, businesses have pulled back on spending. Nonresidential fixed investment fell sharply to -0.6 percent during the quarter, and spending on new structures plummeted to -10.6 percent.

The White House argues that Trump’s policies have enabled millions more Americans to get jobs and receive higher pay through tax cuts and a strong labor market that has forced companies to boost wages. That, in turn, has helped raise consumer spending, said Larry Kudlow, Trump’s chief economic adviser.

Kudlow called consumers “heroes” on Friday and blamed the slowing economy momentum on the Federal Reserve, which raised interest rates four times last year and has been a near-constant target of Trump’s ire.

“We had to suffer through severe monetary tightening,” Kudlow said on CNBC. But he predicted a strong second half of the year. “We are the hottest economy in the world, and I expect us to stay that way.”

Kudlow’s remarks echoed Trump’s tweet that growth was “not bad considering we had the very heavy weight of the Federal Reserve anchor wrapped around our neck.”The Fed is almost certain to lower interest rates at the conclusion of its meeting next week, but the central bank has been hinting since early June that the cut is coming, which many say is a key reason that stocks hit record highs again and business sentiment has rebounded somewhat.

“In many ways, we’ve already reaped the benefits of a Fed cut,” said Diane Swonk, chief economist at Grant Thornton. She pointed to record stock prices, more mortgage refinancing and a rebound in spending as evidence the Fed’s more “dovish” stance has had an impact.

Few are predicting a recession anytime soon. The nation is in the midst of the longest expansion in U.S. history, growing for more than a decade and exceeding even the 1990s boom.

While some have questioned how much longer the expansion can last, it is showing little sign of weakness so far. Most experts say it will take a major event of some sort to knock the economy off course.

“Expansions don’t die of old age. I like to say they get murdered,” said Ben Bernanke, an economist and former Federal Reserve chair, earlier this year.

Newly released data from the Commerce Department shows it is likely that growth peaked in the middle of last year and then momentum cooled heading into 2019. The White House has discussed ways to potentially boost the economy further, including possibly trying to devalue the U.S. dollar to make American goods more competitive overseas. But Kudlow said that was ruled out.

For his part, the President called the numbers, which are basically the same as what we saw during President Obama’s final term, “Not bad” and blamed the Federal Reserve for the fact that they weren’t better:

The reality, of course, is that Federal Reserve policies likely had little to do with the fact that the economy cooled somewhat in the second quarter. Instead, this seems to be a natural and expected reaction from the better numbers we saw throughout 2018 and in the first quarter of the year, numbers that were achieved while the current interest rates were in effect. Indeed, if anything is responsible for the slower growth these numbers reflect it is most likely the impact that the President’s trade war is having on the economy. Nonetheless, this is yet another example of how the President continues to try to politicize the Federal Reserve and monetary policy. In any case, the Federal Reserve is expected to announce at least a slight interest rate cut after its meeting next week.

On the whole, these numbers are healthy for the late stages of what is now the longest economic recovery in American history. Whether it continues, or whether we continue to see a slowdown, is something we’ll have to wait until the future to find out.

My fear is that Trump’s idiot mangling of economic policy will result in a recession contemporaneous with Warren becoming Prez #46, then Mitch McPutin demands austerity, ostensibly for all the usual dumb reasons (“When times get tough you’ve gotta tighten your belt” and other phrases which appeal to beltway insiders and people with subnormal IQs.) but really to wreck the country further, so she gets the blame.

New Trump econ news just broke!

…except the Obama Administration was reducing the deficit, not exploding it.

The growth right now is mostly on consumer purchases made on credit. That’s not sustainable.

You know what’s really troubling? Boeing.

Or rather Boeing’s commercial aviation division. They’re down to pretty much three passenger aircraft models, and two of these, the 737 MAX and the 787, are having problems. ok, the issues with the 787 is with the engine manufacturer, but it doesn’t help Boeing’s case when airlines have to hustle to obtain short-term leases on older aircraft to replace their grounded 787s.

The 737 MAX, soon to be re-branded, is a horror show. First, two of them have crashed killing hundreds of people. Second, the known issues haven’t been fixed yet. Third, new issues have been uncovered.

Thus far Boeing keeps making the MAX, but they can’t deliver them to customers because the model is grounded. They’re running out of room to put them in, having had to use parts of the employee parking lot already. They may have to decrease production, or stop it altogether.

And for icing, there are issues now with the engine meant for the 777X follow-on to the 777. Ok, it’s the biggest engine ever made for a commercial plane, so you’d expect teething pains and such. But this delays flight testing, certification, entry into service, and sales.

The real worry remains the MAX. Wide bodies get more attention, but the staple diet of plane manufacturers is the narrow body workhorse. Many more narrow bodies are sold.

Except that we haven’t had the effect of Brexit yet, which could provide a horrible shock to the global finance system. The Oaf looks like he’s trying to push the U.K. out with a no deal Brexit, much to the EU’s disgust.

And it’s not that far away–end of October. Expect fireworks.

FROM WSJ:

U.S. Economy Grew at 2.1% Rate in Second Quarter

The U.S. economy grew at a healthy clip in the second quarter as higher consumer spending offset a decline in business investment, keeping the decade-long expansion on track despite trade tensions and cooling global activity.

Gross domestic product, a broad measure of goods and services produced across the economy, rose at a 2.1% annual rate in the second quarter, adjusted for seasonality and inflation, the Commerce Department said.

I love how now 2.1% is a healthy clip and “not bad” – I am sure under someone else it would be ripped as not good enough…just saying. Also love how for U.S. this is now good, but China growing at 6% is a crisis…

@Daryl and his brother Darryl:

It is way past time for every one to accept that Republican economic policy DOES NOT WORK!!!

Growth has slowed, and business investment is actually negative.

Republicans promised that their tax cut for corporations and the wealthy would deliver a boost to the economy…and while growth under Trump has continued pretty much the same as under Obama, there has been no discernible Trump acceleration. This in spite of $1T in deficit spending, increased inequality, the reversal of decades of progress on air pollution, and throwing people off their insurance. None of is has brought the faster growth we were promised.

But guess what? Government spending grew at 7.9% in Q2…the fastest pace since Q2 2009 — i.e., immediately after the Obama stimulus. Hello – small government Republicans…where are you?!?!?

We have saddled ourselves with failed Republican economic theories for decades. When are going to accept them for the failure that they are…and move on from there?

Manufacturing has contracted two quarters in a row. The 3m – 10y yield curve has been inverted for months. Neither of these things guarantee that a recession will happen in the next 6 months, but if I was a betting woman, my money would be on ‘recession soon.’

Something has my financial advisor spooked. He’s suggesting it would be a good idea to lock up about a quarter of my current net worth in an annuity.

@rachel: don’t

@Jc: There’s unsuitable ones and not so unsuitable ones.

What do you have against them?

I just feel they are generally a bad investment. Especially if your FA is advising you to buy one cuz of perceived market conditions. What firm are they with?

@Jc: They’re not an investment at all, and nobody should tell you they are. What they are is insurance.

Enjoy. I am sure the FA will