Economic Growth Goes Negative (Updated)

The Bureau of Economic Analysis is reporting that the U.S. economy shrank at a 0.3% annual rate in the third quarter.

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — decreased at an annual rate of 0.3 percent in the third quarter of 2008, (that is, from the second quarter to the third quarter), according to advance estimates released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.8 percent.

Not that surprising with all that is going on.

What is driving the reduction in GDP? Reductions in personal consumption expenditures.

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Personal Consumption Expenditures (PCE) is the largest component of GDP coming in at about 70.6% of GDP. So, when consumers decide to stop spending money, or at least spend less it can be a problem in terms of economic growth.

This article points to a less than stellar outlook for the labor markets as well,

Separately, the Labor Department said weekly claims for new unemployment benefits were unchanged at a lofty 479,000 last week, a level that signals weak hiring prospects.

The U.S. economy has shed jobs in each of the last nine months, with about 750,000 lost so far. On Thursday, American Express said it would cut 7,000 jobs, while Motorola Inc said it would let 3,000 workers go.

Mass layoffs — involving 50 or more people — hit their highest level since September 2001 last month.

I think it is fair to say it will likely get worse before it gets better.

Update: Forgot to add, these are advanced estimates and are subject to revision over the coming months. It could turn out that growth will end up positive but equally low. It is unlikley however, that growth will be comparable to the second quarters 2.8% annual rate.

UPDATE (Dave Schuler)

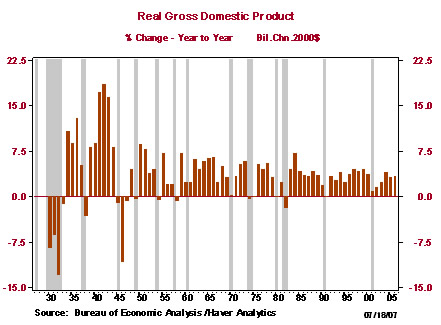

To place this degree of contraction in a little perspective here’s a chart of year-to-year GDP change from roughly 1930 to 2005:

Way over there at the left are the early years of the Great Depression of the 1930’s, during which the year-to-year contraction of the economy was in the vicinity of 6% to 12% per year, or 20 to 40 times the annualized decrease of which Steve appropriately takes note.

I don’t mean by this to disregard that some people have lost their jobs or deny that the economy has, indeed, contracted. I’d just like to stave off the comparisons to the 1930’s a bit.

Update (Steve Verdon): Quite agree with Dave’s point. This is not 1930. The economy is taking a beating, but anyone trying to argue we are heading into a depression at this juncture either has a really nice crystal ball or is being foolhardy.

I don’t worry about GDP shrinking. The GDP is not a good indicator of overall economic health. For example, if we fix our health care system to bring costs and outcomes in line with other wealthy nations, our GDP will shrink substantially because we will suddenly be spending much less on health care. That should not be cause for concern. It is a desirable thing. But if you just stare at the GDP all the time, you’ll panic.

The people who invented the GDP in the previous century understood that it was a bad, incomplete measure and warned strongly of paying attention to it. Some even warned against making the GDP figure public.

Thank you for posting the chart, because it provides perspective. (I’m still looking for that humongous downward bar in 1992, you know, Bill Clinton’s claim of the “worst economy in 50 years,” dutifully reported by the media? Snicker.)

I entered the workforce in 1981. And that 1982 downward bar IS significant. Paul Volcker was resolute in wringing out inflation, and Ronald Reagan had the vision and fortitude to say “stay the course.” Those were some difficult times. But the rest is history. Positive history.

To your point, let us not minimize the current situation. Real people’s futures are at stake. But the business cycle has not been repealed. Asset bubbles and bursts still occur. (Anyone remember the dot.com bust? The Wilshire falling by 35%?? Or did that get buried in the blather about the “Clinton economic miracle??)

This current easy credit blowoff may indeed have severe and protracted consequences. But let’s keep the politically driven hyperbole to at least a dull roar……..eh?

Uh..uh….er, Jeffrey?

If we don’t spend our disposable income on health care, we’ll spend it on other things. Ipods, cell phones, baseball tickets, Rolling Stone concert tickets, travel and entertainment, meals eaten out, cars, the daughter’s dance lessons, the son’s baseball mitt, the house renovation, stocks, bonds (egad!!! saving??? the horror !!), that new Ping G10 driver, a case of 2000 Pavie Decesse or 2005 Pontet Canet,………………..

Relax, zero sum dude.

Indeed Drew, ’82 was very tuff. I was eating popcorn and drinking thrice brewed coffee.

My girlfriends 401K has lost a third of its value in the last month or 2. The real crime here is that she CAN NOT pull it out of the stockmarket (you know, no treasuries, no gold) she has to ride the tiger… My union tells me my pension is all A-OK, but I am not buying that line of bull for a second, I know we took a hit, just a matter of how bad.

Personally, I think it is long overdue, and very necessary. Yes, it is going to be tough. I got laid off 3 weeks ago, and my chances of getting another job any time soon are slim to none (construction, commercial is still going but for how long? Residential is in the tank, that floods the market with carpenters, and commercial will retract soon enough)

A buddy of mine has been working for the same company (residential) for 20 years. He got laid off last week. Me? I been working commercial so long I know the drill: I never get on a job, I don’t know I am going to get laid off. I save 1/5th to 1/8th of every check. Between my savings and my unemployment, I’ll make it. I ain’t so sure about Dave and his savings… He’s been working steady too long.

I liked Reagan, and he did turn the economy around. But let’s not forget about the insane deficit spending that really took off under him and picked up steam under GW Bush. That’s part of history too, and we have to deal with it, somehow.

They haven’t fixed anything.

1. I have yet to find another country with a sustainable healthcare system.

2. Most other countries “save money” by denying services or extending wait times or shifting it to the private sector (e.g. Canada and Britain).

This idea that there is some magic cure for health care is really amusing and I don’t know where it comes from, but it certainly is based in fact. Even the mythical France is having problems and is talking about using more market oriented solutions. And oddly enough, France’s system is the most like America’s. Why people don’t seem to realize this, I just don’t know.

Every other wealthy country spends less (GDP fraction) than us and gets better outcomes (healthier people) than us. So you can have all the unfounded irrational objections over the form of health care that you want to have, but the plain fact is that on a cost/benefit ratio we’re the worst. If we bring our system in line with other nations we’ll spend less and be healthier. Doesn’t matter how we do it.

There are tremendous differences in reporting of statistics that alot of this is dubious. For example, the way other countries deal with live births vs. the U.S. Any signs of life in the U.S. and it is a live birth and heroic measures are taken if necessary. In many other countries, yes even in Europe, such births are not counted as live births. Search through the archives I’ve covered this before.

And the point still remains, no country’s system is sustainable. They are all financial black holes.

The issue of sustainability is not an irrational objection.

Post hoc ergo propter hoc. Your reasoning assumes that lower health care spending results in a healthier population. There is little or no reason to believe that.

Was that supposed to be serious? Okay, how about we set spending by half via government fiat. If we run out of money in 6 months we wont have health care for the remaining 6 months.

Still sure about the “how” not mattering?

Steve-

What would you propose to make our health care system more inclusive and cost effective while maintaining high standards? There must be ways to improve on what we are doing now.

Not really on topic, but Steve jumped in so I guess its ok.

But costs are 2/3s or less of ours and the growth in costs is considerably less as well. This means they are closer to sustainability than ours. So merely stating that there is a sustainability problem there to is not a real answer.

I’ve linked to the numbers before and can find the links again if you want them.

TYPO ALERT!!!

The GDP DECREASED by 0.3%, not grew.

“What would you propose to make our health care system more inclusive and cost effective while maintaining high standards? There must be ways to improve on what we are doing now.”

Re-introduce price in the consumer-provider equation.

Today, people consume health care services indiscriminately because its “free,” never understanding that their employer or some other entity are paying, and that they will not sit still forever.

Why must we maintain the high standards?

Well, not exactly. Most people don’t see healthcare is “free” because insurance takes a large portion of every pay check, even if it is partially employer provided. My employer covers 50% of my insurance premium, but 0% for my wife and 2 kids. I pay roughly $12,000 annually out of my pocket for the insurance, plus another couple thousand on co-pays and bills that exceed what insurance will pay. That isn’t “free” to me.

Now where your point makes a point is that I pretty much have the same cost whether I get unnecessary procedures or not. It costs me roughly $13,000 a year whether I am in the ER twice or twenty times, so your point about there being no incentive to forgo treatment remains.

Do either you, Steve V. or Dave S., think we’re in, or are falling into, a liquidity trap?

Sorry, should have provided a link: Liquidity Trap

I think that Bernanke is bound and determined to not let that happen. There’s still a little way to go and other tools that could be used.

I’m not sure it matters a great deal. We live in a very different, very wide economic world today and we’re not the only ones setting economic policy nor can we set the economic policy for the entire world.

While it’s barely possible that a Bretton Woods II could have a positive impact on things, I’m inclined to think that’s a long shot. Bretton Woods was decided by a handful of elites, mostly representatives of the WWII Allies, and there was more consensus among them than there is now. The institutions established then mostly still exist in one form or another and they’ve been sitting the current crisis out.

Additionally, I’m skeptical of attempts to plan the world economy, generally. Things move too fast, there’s too much that’s beyond the control of planners, and the planners have their own axes to grind. Alas, philosopher-kings are in short supply.

There has to be trade offs. You can’t have both, TANSTAFL, or health care for that matter.

Total costs aren’t that important in determining sustainability. What is important is growth rates and no country has a sustainable growth rate. Canada? No. The UK? No. France? No. The U.S.? No. That we might be driving over the cliff faster doesn’t mean the others are following along behind us.

In other words, move more towards the market. Oddly this was what sparked demonstrations in France when the French government suggested this very solution. And technically we already have France’s model here in the U.S. Not identical, but a mix of public and private health care.

Michael,

Part of the problem is the tax exempt status of employer provided health care. It creates a distortion against those that are self-employed. They have to purchase health care with after tax dollars while you are doing so with pre-tax dollars. Second it creates and incentive to move additional “income” into the health care benefit catagory.

For example, suppose you’d go out and purchase additional health care over and above what your employer provided. Suppose it it costs $100 dollars, and for arguments sake your tax rate is 20%. Now you’d have to earn $120 to purchase that $100. If your employer adds it to your existing benefits package and charges you only $100 you are ahead $20. This is the “gold plating” problem. This leads to an over-consumption of health care.

Now watch some dimwit will come along and say, “Nobody is going to get open heart surgery that they don’t need!!!” NFS, but they might add on coverage for things that aren’t technically “insurable” like glasses, lasik, child birth & pregnancy.

Sam,

No, I don’t think there is a liquidity trap problem. There could be, but not at the moment.

Technically we didn’t have a liquidity trap during the Depression, IMO. Once we went off the Gold Standard and the Fed was able to persue inflationary policies the economy started expanding again.

There is a very, very small portion of the population to which the pre-tax/post-tax difference matters. Usually employer-contributed insurance is all that is affordable, and in my case with an Autistic son, it is all that is available. Also, isn’t private health insurance already tax deductible?

Only a very, very small portion of the above-mentioned very, very small portion of the population would choose to move additional income into health care spending. Most can barely afford the minimum amount they must pay for health care, moving more into that category may save them on taxes, but it will more likely just give them less grocery money. As a tax shelter, health insurance premiums suck.

Hell Steve, most of what we need health insurance for is regular, predictable stuff. I’d be thrilled if that stuff was affordable without health insurance, but it isn’t for most Americans.

My wife had 100% coverage when she gave birth to our first child, and we still came away with something like $20,000 in medical bills. If insurance didn’t cover anything, either the state would pay for it, or getting pregnant would give most women the choice between abortion and bankruptcy.

Until routine health care without insurance becomes affordable to the majority of the population, no amount of changes to insurance is going to keep us of from going over the cliff.

I’m really not trying to be a jerk or cruel here (just explaining the way insurance works), but your son is not insurable. If you have a medical condition then you cannot get insurance since insurance works for events that are costly and rare. Given that your son has a medical condition the rare part of the equation isn’t there. That being said, the issue is then one of does society subsidize health care for such people?

I disagree. Child birth/pregnancy is one example that probably accounts for billions of dollars every year. Lets go back to the concept of insurance: costly and rare. Child birth/pregnancy might be costly, but it isn’t rare and usually people go out and get pregnant on purpose, and they give birth absolutely on purpose. You don’t put car insurance on demolition derby cars, you shouldn’t insure child birth/pregnancy.

Yes, but look at many health care plans they cover the things I noted shouldn’t be covered. So this indicates that the issue isn’t so clear cut.

Again, insurance is for things that are costly and rare. If they are costly and common then it isn’t really insurance but merely cost sharing, NOT insurance. Cost sharing tends to result in over-consumption. Which is why the U.S., Canada, the U.K. and France are having issues with their health care spending.

Health care spending, last I heard, was growing at 6% per year. Even if we are generous and have GDP growth at 3% per year, you can see that eventually there will be a problem.

Or saving up until they could afford to have a child. When you get right down to it, what you are saying, in blunt harsh terms is: somebody else should pay for Mr. and Mrs. Jones’ baby’s birth.

See that part where I noted that health care expenditures are growing at twice the rate of GDP? We are going over a cliff right now. As the late Herb Stein said, “Unsustainable trends are not sustained.” We can try to do something about it now or we can let the things be and get yanked harshly off that trend. I’m thinking the latter will be by far the more painful choice, but maybe I’m wrong.

I’ve met people who are jerks about this, and believe me you’re far from that. You’re wrong, but for the right reasons. Autism is insurable because it doesn’t make a person more likely to get sick or hurt, and there’s no medical procedures that can do anything about it anyway. To date, my daughter has required more trips to the doctor than my son, and she’s a year younger than him.

Ideally, no. But ideally, we’d only insure what you call insurable events, costly and rare. But we don’t, we insure everything, which has the effect of making everything cost so much that it’s no longer affordable without insurance. Antibiotics and stitches shouldn’t require insurance, but you can’t get either without a doctor, and that alone can cost you a couple hundred dollars if you don’t have insurance.

Again, I agree that it shouldn’t be insured, but once again it shouldn’t require insurance to be affordable. In my case, it turned out to be both rare and costly, as both my children were born premature. My preference would be to have insurance cover the emergency cesarean and NICU expenses, since those fall into the “rare and costly” category, but for child birth without complications to be affordable out of pocket.

Cost sharing is essentially what we have in the US, is it not? If you are arguing against the current state of things, I’m with you, so long as your plan makes the common things affordable before you make them uncovered.

Procreation shouldn’t be a privilege obtained by money. I have serious ethical concerns about this proposal. I’m not saying somebody else should pay for anybody else’s baby’s birth, I’m saying that it shouldn’t cost as much as it currently does for the Jones’ to have their baby in the first place. I know a couple that had their baby at a mid-wife center instead of a hospital because they had no insurance. I don’t know what that was like, but from a financial stand point it makes more sense than insuring child birth as long as there are no complications.

I am against the current system of high-cost insurance for higher-cost health care, because the ubiquity of insurance is making it easier to raise the cost of the care, and the rising cost of care is forcing the rise in cost of the insurance. But don’t take that to mean I am in any way in favor of nationalized healthcare. I would much rather be able to pay for the health care I need out of my own pocket, with cheap insurance that only covered the rare and costly things that I will probably never need. But right now I can’t afford to not have insurance that covers everything, and neither can the vast majority of Americans.