Fiscal Outlook: Grim

Via Menzie Chinn at Econbroswer comes this report from the GAO’s Comptroller General, David Walker. This completely rebuts any claims by President Bush in regards to fiscal restraint.

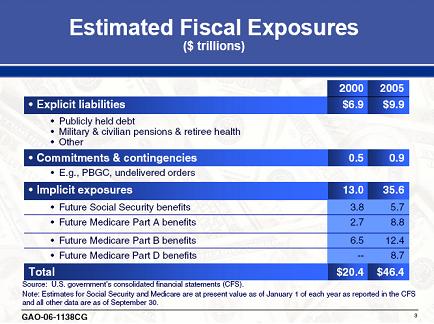

What is truly disappointing for those of us who are interested in fiscal restraint is the fourth line under Implicit Exposures. Medicare Part D is Bushes baby all the way, the Medicare Drug Benefit for Seniors. And yes, it is estimated to cost almost $9 Trillion dollars. In other words, just this program alone accounts for about one third of the increase of the fiscal exposure this country is facing. It is also the single largest component of the increased fiscal exposure as well.

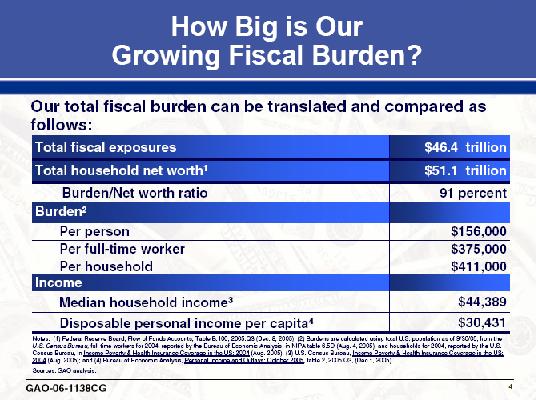

But how does all of this translate into fiscal burden? Well the GAO report gives us that information as well,

I can’t think of much to say other than, look at those numbers. And if you think Bush’s notion of making the tax cuts permanent will solve the problem via higher growth rates, you are in for a very nasty wake up call in decade or two down the road. Faster economic growth, while it will help, cannot solve this problem. The GAO report notes that for growth to solve this problem we’d need economic growth in the double digits for every year for the next 75 years. And given the spotty record of tax cuts spurring economic growth, the idea of making the tax cuts permanent is just nonsense.

The bottom line is that when Bush talks about fiscal restraint he is simply not being honest.

I find it hard to believe that you are just now realizing this. All of us “complaining, tax and spend democrats” have been screaming this for years and Mr. Walker has been saying this for years. How could you possibly not have known? We are now, and have been, taxing the future, WITH INTEREST. Yes, I’m sure the strategy is that the next admin will have to raise taxes and they might be democratic but the real burden lies with Bush, Norquist, the CEI, Heritage et al for believing (or saying) that the tax cuts would pay for themselves and we could fight a major war while cutting taxes.

Keep in mind that if the GOP retains control, the “death tax” is item 1 on the agenda. When will you wake up to the damage that is taking place?

Sorry for the rant, but it’s reports like this that really make me crazy.

It never made sense to throw money at a problem like high drug prices. Unfortunately when people look at health care costs in general they just want to put more money into the system through insurance and entitlements rather than look at cost of service and improved delivery methods.

While we could say this is Bush’s baby we can also say congress voted for it as well. Another example of government thinking they must provide a solution to every problem under the sun only to make things worse.

Mr. Gone,

I’ve been on this failure of the Bush Admin. for a long time.

So what else is new?

Steve,

“this failure”??? When I ask people to name me something they think that Bush has done well or good for the country, “tax cuts” is usually the only answer I get. What is it that you think hasn’t been a failure if I may ask?

The tax cuts and even there they should have been followed up with fiscal restraint. So partial credit at best.

I seem to recall that most Democrats felt that the Medicare Part D wasn’t enough. I wonder, has anyone put together a chart indicating the cost for Part D if the Dems got their way. Then you could also model the tax cuts being rescinded. I’m sure that would be a rosier picture.

Who cares, they didn’t so ultimately it is irrelevant when discussing our fiscal outlook and how Bush has made it worse.

Who said anything about rescinding the tax cuts? Geez talk about trying to obfuscate the issue. Next time try, “Look, over there! Something shiny!!”

Boy, Steve, you sure have it hard for the “drug relief plan for seniors”. It is roughly one part in twenty of the annual cost of the stupid war in Iraq, and it helps pay for research that will be beneficial to today’s younger people when they aren’t so young.

Oh, I see, your conclusion that

wasn’t a solution. I like your style Steve, always poking at Bush and his administration, but never providing solutions.

Fersboo,

The market based solutions are politically unappealing and hence will probably not be implemented…so look to Europe, that is what Bush as done for us.

Oh, and yes, I have offered some solutions, problem is I get it from both sides as being both market extremism and statist/fascist.

I know, I know, I’m just lacking in faith that tax revenues will soar once the tax cuts are made permanent.

RJN,

Really, the Iraq war costs $160 billion? Did I read you correctly?

As for funding research you’d think the monopoly profits that the drug companies enjoy would be incentive enough. Thanks for showing the evidence that not only to drug companies need monopoly profits, but government pork too.

The medicare drug bill is one that probably shouldn’t have happened, but it also was a compromise bill-one that compromised with the much more expensive one proposed by the democrats.

I don’t know too many republicans that liked it-but medicare drug bill was the “reach out across the aisle and make friends” attempt from the GOP, and it was a failure at that, because the democrats also hated it.

You can bet your boots that the social conservative leaders are going to tell the GOP that they saved the GOP as best they could with turnout, and that if they want their support in 2008, the GOP had better start really going after the gays.

Problem is the medicare drug bill is now a permanent line item on the budget-entitlements never get cut. While the defense budget is high, it isn’t one that will permanently remain high, so it isn’t a good comparison.

I’m not sure I agree with your final conclusion that making the tax cuts permanent is a bad idea. Heck, I’m not sure even that you agree with that since the rest of the post makes it rather clear that spending, not a lack of revenue is the real problem. If anything, additional taxation will only further aggravate the problem by slowing the economy even further.

Charles,

I don’t like high taxes and I’d like to see them lower. Not because of some idea that it will stimulate growth, I just don’t think the government should be doing nearly all the things it is doing.

But, it is, and most likely will continue to do these things. As such, cutting taxes to spur growth isn’t a solution. Cutting other spending doesn’t seem to be much of an option either. So we need to reform things like Medicare. But that isn’t an option either, at least not if the politicians suggesting it want to get re-elected. Maybe we can find a group of career suicidal politicians, but I doubt it.

We are in one heck of a mess that is our own making…well more likely the fault lies with the Baby Boomers as they had an opportunity to fix much of this back under Reagan, but they blew it.

So no, making the tax cuts permanent wont do anything at all, and will actually make matters worse from a fiscal standpoint as it will cost us more revenue than they will generate.

Just Me — show me one bit of evidence that the drug bill was a compromise from a more expensive

democratic plan.

Do you really believe this, or are you just another republican running around making up stuff?

As long as people like you continue to believe in your fantasies there is no hope for this country.

Hello again, Steve. When I was young my mother told me I wasn’t as dumb as I looked. Maybe that is still true. The war cost for the military is $5 billion per month, add $100 billion per year for reconstruction of a destroyed Iraq and we have $160 billion per year as the real cost of the odious fiasco.

Monopoly profits are the best kind of profits when you have earned your monopoly with research, and when you deliver a safe, and unique, life saving drug to those that need it. By the way, I am still holding Bristol Meyers Squibb stock at $25, that I had back in ’01 in the $50s. Some profits, some monopoly.

Well RJN, I’m looking at the total costs of the Medicare Senior Drug Benefit and it is in the trillions. So, Iraq, while expensive, it isn’t that expensive. Maybe is we plan on staying there for the next 5 years and costs stay the same or escalate, but somehow I doubt it.

Perhaps I am naive but I cannot believe that raising or re-instating former tax levels will ease this burden. The Bush Administration’s record on fiscal responsibility speaks for itself, but the increased revenues due to increased taxation will never be used to narrow the overall national debt. The data above suggest a collapse is a given at some point down the road. If that is truly the case, I would rather have money in the hands of people than in government coffers if it cannot be managed responsibly to ease the debt burden.

>And if you think Bush’s notion of making the

>tax cuts permanent will solve the problem via

>higher growth rates, you are in for a very

>nasty wake up call in decade or two down the

>road.

Especially since the tax cuts weren’t structured in a way likely to provide much supply side stimulus.

DaveD,

It is pretty much established that if taxes hadn’t been cut, we’d have a much smaller deficit and would have added less to the national debt. It might have resulted in a slightly longer recession, but taxes are at best a cumbersome tool for fiscal stimulus (same for spending).

As for the collapse, it will mean that the money in your hands will be worthless. Look at the Weimar Republic after WWI. One way for governments to get out of their debts is via an inflation tax–i.e. print a shit load of money and use that to pay off the debt. Either that or the government will tax the crap out of the people to get that money. Or the government will simply default point out that we have nukes and tell the Chinese and everybody else to go pound sand. Still, this would not be good either plunging financial markets into turmoil.

Collapse is imminent if something isn’t done, but my guess what will be done will be only slightly less worse than a collapse.

Steve,

You are a moron every day of the week to think that the tax cuts have not far exceeded even the wildest rosy expectations for the economy, through all it has been through-from the recession started while Clinton was in office, to 9/11, to the war on terrorism. Can you please take a day off? Please? Just one?

I see you and the facts are still strangers Christopher.

It seems to me we are already in a situation where inflation is the only way we can pay down our debt obligations to the world. We have two choices; inflation, or collapse.

Our present position, including momentum, is intransigent. We have no outs. There is no way we can pay off our outside debt in 2006 dollars.

Those aren’t the only two choices, although they may be the most politically feasible. We could reform both Social Security and Medicare that would greatly reduce the size of the problem at least. However, neither party will go this route. The Democrats will demogouge and the Republicans lack the spine.