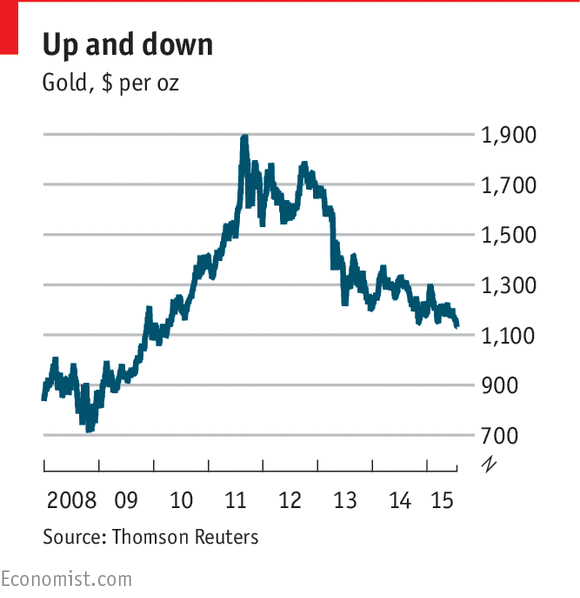

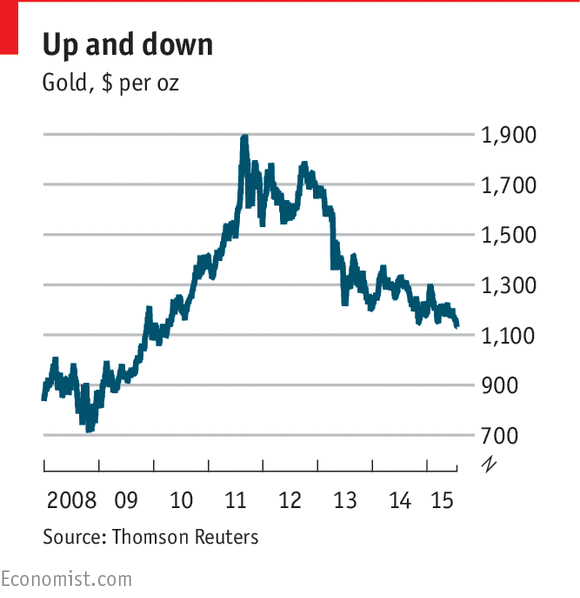

Gold Prices

But all those nice men on the tee-vee and radio told me that gold was where I should be putting my money. Oh dear.

(That and all the Austrian economists and their predictions of hyper-inflated doom).

But all those nice men on the tee-vee and radio told me that gold was where I should be putting my money. Oh dear.

(That and all the Austrian economists and their predictions of hyper-inflated doom).

Anybody who ran out and bought metals like silver and gold thinking they were suddenly going to make a ton of money due to skyrocketing prices was a fool and had no investment sense. I bought some silver when it was worth twice as much as it is now, but I never bought it intending to cash in on it in the near future. It’s a long term investment that I’ll hang onto for many more years to come and I’ll likely buy more at these lower prices. It’s still a sensible hedge given the amount of debt we’re taking on as well as the financial instability of many other western nations.

Since the beginning of 2015 the Chinese government has sold $150 billion of U. S. Treasuries, about 10% of its holdings, and bought gold. I’m open to explanations of that behavior including the possibility that the CCP is being foolish. However, they’re typically not faulted for being short-sighted.

@Dave Schuler: I think foolishness is possible. However, they have fantasies of turning the Yuan into a reserve currency and this is part of their behavior, yes? (Whether it is a good idea or not).

@Dave Schuler: It’s logical to sell Treasurys before the Fed’s rate hike in September. No one wants to be caught holdong lower yield second-hand securities.

But look, now is the time to BUY!!!

@Ben Wolf: We also do not know what the IMF is going to concerning the currency. If they change it (what in the world to), gold could skyrocket. Wait until October and we shall see.

Krugman is right again. I am shocked, shocked I tell you.

@OzarkHillbilly:

I’m starting to think Nobel prize-winning Paul Krugman is smarter than the average comment-writer.

@michael reynolds: He’s definitely smarter than I.

@Dave Schuler: I’ve been interested in the Shanghai Exchange near collapse and the PRC’s shoring it up. In the course of looking into that I picked up the idea (please don’t ask for citations, it was a couple weeks ago) that large numbers of Chinese had gold as a hedge and, having bought stocks on margin, had to sell their metal to meet their margin calls. The PRC’s financial leadership decided to prop the price of gold for the same reason they’re supporting the stock prices — to keep their investors from feeling impoverished and therefore to keep their economy on a pathway toward boosting internal demand, diminishing export demand.

Made sense to me at the time. I do not know enough to staunchly defend this point of view if anyone with more expertise has a contrary opinion.

Fear.

Gold has been sold on the premise of fear.

Fear that government will collapse.

Fear that the black man will take all your money once he was in office.

Fear that an economic collapse will have us moving to a barter system and gold will be king of the exchangeables.

Fear that the Bush collapse would continue. (Not that it was Bush’s fault anyway, amIrite?)

Fear that all the jobs will go away.

Fear is a powerful motivator.

Looks like it hasn’t worked out so well. Because you can only sell fear for so long when things keep improving.

I hope the same happens to the gun industry (whose production output has DOUBLED during the Obama administration, btw).

All we will have for hot buttons left for the ageing right will be:

* Abortion

* Immigration

* Benefits for the elderly

And… oops wait a minute! the right wants to get rid of that last one.

I guess Fox News only has two topics that it can talk about now.

That, and trying to smooth over the Trump focused infighting.

As they say:

You kno its hard out here for a

pimpRepublican when you tryna get this money for therentcampaign with thecalliacprivate jet andgasconsultant money spent would have a whole lot ofbitchestea partiers jumping shift(with regrets to Terrance Howard)

@Liberal Capitalist: Gold: It has always been that way. Now the IMF is talking about changing the currency. That will set people on edge for sure if they actually do that.

@JohnMcC: It’s possible. Central banks can also purchase gold to support bank capital levels, a form of financial bailout. I doubt very seriously the Chinese are dumb enough to think gold is key in establishing a reserve currency.

@Tyrell: OK, I’ll bite, what are you talking about? The IMF doesn’t have a currency.

@OzarkHillbilly: Yes, what are they going to replace it with? The Euro is already nearly on par with the dollar and still falling. The Yuan? The Chinese economy while still strong is sagging and there is no transparency. The Ruble? Not in this life time, The Russian economy is on life support. Not many options!

Yeah, those idiots who doubled their money in four years are stupid.

@Pinky: Indeed–those who bought low and sold high were smart. However, that not exactly what all the goldbugs were advocating, now was it?

It certainly wasn’t what your standard talk radio grifter was preaching back during the middle of the Great Recession.

All the folks I am criticizing here were preaching a coming hyperinflation and/or some other economic calamity and preached gold as a safe and smart haven.

I must admit I did buy some 3 9s silver but as a hedge not for a quick turn around. It has lost about a quarter of it’s value since I bought it but I’ still glad to have it.

@OzarkHillbilly:

It’s Tyrell. It’ll just be Ameros or Bitcoins or Rials or whatever conspiratorial nonsense he’s read recently on Infowars.

Question for the group…

And I’m totally asking for a friend.

If Clinton were to win in 2016, what goods and or services would

separate gullible right-wing rubes from their money, er…sorry, I meant what would right-thinking concerned Americans most likely purchase in that scenario?(I also don’t, sorry again, my friend doesn’t want to get in the buying gun or ammo manufacturer stock, because Ick.)

If HRC wins, what would be a big seller? Stormfront co-branded canned goods? Pasta, rice, beans – that type of thing? Prettied up in a fancy kit with appropriate slogans and tags? But that whole “Race War In A Bag” thing must be pretty well played out by now, don’t you think?

Maybe old-school Married With Children No Ma’am tee shirts?

I’m assuming the basic marketing strategy would revolve around talk radio and FOX News, but is my friend missing a new promotional channel?

Again, totally asking for a friend.

@de stijl:

K-Bars and Gerbers. And pup tents. Successful insurgents will have to rely on their knives after the despotic tyrannical gum’mint treacherously closes down the gun shows and padlocks all the ammo retailers.

Also mosquito repellent. And Depends, for those long weary unrelieved nights spent watching over the ramparts of liberty

It was pretty obvious this was going to happen. Gold was a classic bubble. When gold was at its peak, Warren Buffet pointed out that, at that price, you could have a massive block of gold … or:

Precious metals are useful insurance against bad but unlikely things. But if you’re playing them, they’re like any commodity.

The other day I read a blog post on the Forbes site discussing the impact of Greece’s current problems on the world economy. The

authoridiot advised buying gold and, get this, bitcoins.The stupid was strong with that blogger. Or perhaps he was sitting on a gold and bitcoins himself and was trying to not completely lose his shirt.

@de stijl:

Well, the

firearms manufacturing sales organizationNRA did well when Obama first won the Presidency…And all that ammo doesn’t stay fresh forever.@de stijl: Does your friend really believe the lame stream media story that gold is falling? There’s a web site, unskewedgoldprices.com, that has the truth.

@Dave Schuler:

Portfolio rebalancing and with a gold price collapse, not a bad deal for long-term holding.

@Ben Wolf:

Depending on what they sold.

@Tyrell:

This is simply a incomprehensible set of comments. IMF is going to ‘change the currency.’ is not a sensible statement for any currency.

@michael reynolds:

Yes he is an excellent macro-economist, and I am glad I studied my economics with his school. One would not be well-served in taking his operational political advice, but following his macro policy guidance would normally be a smart thing, although he does not have a solid sense of the market and political constraints that smaller and poor economies face.

@Tyrell: I too was somewhat mystified and, being quite fond of our Tyrell, wondered where he had been wandering. As close as I could come was discovering that the IMF has a program going back to the Bretton Woods Agreement of providing an international account of available funds distributed across the four principle currencies. This is called “Strategic Drawing Rights” and the currencies are the dollar, the pound, the euro and the yen. There seems to be some push-pull among the Davos set about whether to include the renminbi/yuan

http://www.blogs.wsj.com/economics/2015/04/28/how-the-yuan-could-win-reserve-currency-status-even-if-the-u-s-objects/

http://www.abcnews.go.com/Business/story?id=7168919

@OzarkHillbilly: headlines “IMF To Announce Alternative to Dollar October 2015”

See World News. wn.com

There are a lot of stories about this. You Tube also has a lot of videos

@Tyrell: Oh dog…. I thought so. Tyrell, Tyrell, Tyrell…. I googled it and got a bunch of heads up their a$$e$ conspiracists. First off, this rumor of the dollar no longer being the preferred ‘reserve currency’ has been going around since the beginnings of the Tri-Lateral Commission and the John Birch society. In over 50 years, it hasn’t happened. It may happen some day but it won’t be any time soon for the reasons Ron enumerated at @Ron Beasley:

“Yes, what are they going to replace it with? The Euro is already nearly on par with the dollar and still falling. The Yuan? The Chinese economy while still strong is sagging and there is no transparency. The Ruble? Not in this life time, The Russian economy is on life support. Not many options!”

and if it ever does happen, so what? America will survive just fine with that small blow to it’s exceptionalist pride.

@Tyrell: I just watched one of those YouTubes, my friend. I have to tell you that it seems to me that the change in the IMF ‘Special Drawing Rights’ market basket of currencies will probably NOT bring on the reign of the AntiChrist.

Please assure your fellow commenters here that you are not following these people’s investment advice.

I’m a little astounded that gold is down over the past few years as every time I walked into a Chinese bank, or fancy hotel lobby, or even trade shows there were very ornate kiosks selling gold.

@Tyrell:

In other words, silly conspiracy mongering tripe written by gits who do not understand either the IMF or macro-economics, let alone currency issues.

@MarkedMan: As noted in my previous comment, it seems to be that it is being sold by chinese investors to meet their margin calls.

Any asset acquired by a central bank effectively ceases to exist from a market perspective. Like monetary policy in general, increases in gold reserves should be regarded as largely immaterial.

@lounsbury: Changes in the Fed Funds rate directly alter short-term yields and long-term yields closely follow as a matter of observation. The entire maturity structure will be affected.

@lounsbury:

Told you:

@Ben Wolf:

Yes, I know. Basic bond maths.

However, China can not unload everything primarily exposed, they have too much. A selective portfolio tweak might be sensible however.

@de stijl:

Yes one rather did have to suspect.

I’m sure Glenn Beck will stand behind all of his claims…after all…he says these things for love of his audience. Not to get rich on their naivete.

https://www.goldline.com/d/index.html?id=1753&meng=e&keng=Glenn%20beck%20gold&medium=tsa&gclid=CjwKEAjw0NytBRD-1d3QsdHNpR0SJACGXqgRW8f9CiGU2mQFRxeIym2DrJAijpt3396I5Cdjne7mmBoCBvnw_wcB

@lounsbury: I didn’t realize that this country was no longer on the gold standard until someone, (I don’t remember who), told me on this site back a couple of years ago. Now I am wondering about Ft. Knox.

@Tyrell: You can sleep easy tonight, my dear little friend:

http://www.usmint.gov/about_the_mint/fun_facts/?action=fun_facts13

@Tyrell:

It is very hard to take such a statement seriously.

You must either be functionally retarded or a simple troll.

Or I suppose both.

What the USA has in its water that leads to quite so much idiotic gold-buggism does escape me.

@lounsbury: No one should be attacked for not knowing a thing, only for treating ignorance as a form of knowledge. The number of people worldwide with an adequate grasp of how modern monetary systems work is probably less than 5-6 thousand and belief the USD is backed by gold is in my experience quite common. It isn’t something we bother to teach about in our schools.

@lounsbury: I confess ignorance of the sophistication of the world’s hoi-polloi regarding bonds and currency. But here in the (by god!) U S there is a fairly reasonable belief among our great unwashed that a dollar is a dependable sort of thing like pounds and ounces, like feet and inches, und so weiter. The paper currency of my younger years plainly said on it’s face ‘redeemable’ in precious metal. Thinking that the dollar is ‘good as gold’ is widespread and intuitive.

And by the way, some of us are fond of Tyrell and sort of feel protective of him (altho other regular commenters have a different response — possibly because he reminds them of their family members?)